The Vanishing First-Time Homebuyer: Burson Home Advisors Expands Access to Lease-to-Own Solutions to Reverse the Trend

Burson Home Advisors expands Lease-to-Own solutions, helping first-time buyers secure a home with just 2% down and build equity—faster than a mortgage.

This solution comes at a time when homeownership remains out of reach for many, with affordability challenges intensifying due to economic conditions. The Lease-to-Own approach is designed to mitigate these barriers, offering an alternative to traditional mortgage financing and providing a financially sound entry point into homeownership.

Affordability Barriers Are Preventing First-Time Buyers from Entering the Market

A range of financial hurdles has made it increasingly difficult for first-time buyers to purchase a home. Key obstacles include:

- Higher Down Payments: The typical down payment for a first-time buyer has risen to 9%, the highest since 1997.

- Skyrocketing Home Prices: Median home prices have quadrupled in the past 30 years, making it more difficult for buyers to save.

- Mortgage Rates Have Doubled: Interest rates now exceed 7%, significantly increasing monthly housing costs.

- Rising Cost of Living: Student loans, inflation, and stagnant wages have made it challenging for buyers to accumulate savings for homeownership.

- Closing Costs and Buyer’s Agent Fees: Many first-time buyers underestimate the thousands of dollars in closing costs and commissions required in a traditional home purchase.

These factors have led to a shrinking pool of first-time homebuyers, despite strong demand for homeownership.

Lease-to-Own as a Solution to Housing Affordability

Burson Home Advisors, in partnership with innovative homeownership platforms, is working to address these challenges by expanding access to Lease-to-Own programs. These programs eliminate many of the upfront costs associated with buying a home, while allowing homebuyers to build equity from their first payment.

“For too long, first-time homebuyers have been priced out of the market,” said Tamera Nielsen, Broker at Pinnacle Realty Advisors and Co-Owner of Burson Home Advisors. “The Lease-to-Own model creates an opportunity for aspiring homeowners to enter the market sooner, with lower upfront costs, while building wealth more rapidly than a traditional mortgage allows. Homeownership is not out of reach—it simply requires a smarter approach.”

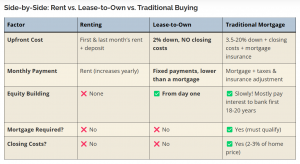

Lease-to-Own vs. Traditional Buying: A Financially Sound Alternative

Traditional homeownership often requires high upfront costs and years of interest payments before buyers begin to accumulate real equity. Lease-to-Own programs, by contrast, enable homebuyers to start earning equity immediately while avoiding many of the financial burdens associated with conventional home purchases.

The benefits of Lease-to-Own compared to traditional mortgage financing include:

- Lower Upfront Costs: Lease-to-Own programs typically require a lower down payment than a conventional mortgage.

- Immediate Equity Building: Unlike traditional mortgages, where the majority of initial payments go toward interest, Lease-to-Own models prioritize equity accumulation from day one.

- Fixed Monthly Payments: While mortgage rates fluctuate and rent often increases annually, Lease-to-Own programs provide stable monthly payments over time.

- No Closing Costs or Buyer’s Agent Commission: Buyers using Lease-to-Own programs avoid costly closing fees, reducing the overall financial burden.

A Path to Homeownership for a Wider Audience

This alternative pathway to homeownership is designed not only for first-time buyers but also for self-employed professionals, current homeowners who are relocating, and those struggling with traditional financing barriers. By providing flexibility, affordability, and financial benefits, Lease-to-Own programs are redefining access to homeownership in an era where affordability remains a top concern.

“These programs are not just for first-time homebuyers. They offer financially sound solutions for anyone seeking a strategic and cost-effective path to homeownership,” added Nielsen. “Eliminating outdated lease-to-own models and bypassing the interest-heavy burden of traditional mortgages allows buyers to move in, build equity, and achieve financial stability faster than ever before.”

For More Information

Burson Home Advisors offers consultations to help first-time buyers, relocating professionals, current homeowners, and self-employed individuals explore their homeownership options.

About Burson Home Advisors:

Burson Home Advisors has facilitated Lease-to-Own home purchases for more than 100 families, including its founders. With active real estate licenses in Florida and North Carolina, the firm specializes in helping first-time buyers, self-employed professionals, and relocating families navigate the home-buying process through innovative Lease-to-Own programs. Operating from Pinnacle Realty Advisors in Sanford, NC, Burson Home Advisors serves the Raleigh/Durham, Greensboro, and Charlotte markets, providing expert consultation, strategic negotiation, and long-term support. By offering a financially sound alternative to traditional mortgages, the firm empowers buyers to achieve homeownership faster, more affordably, and with greater wealth-building potential.

Tamera Nielsen

Burson Home Advisors

+1 941-241-1632

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Burson Home Advisors' Lease-to-Own Programs: The Wealthier Path to Building Home Equity

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.