Brio360 Releases Q3 2024 Restructuring Analysis Report Highlighting Key Trends in Corporate Transformation

Independent business advisory firm Brio360 has published its inaugural quarterly report on transformation activities among publicly traded companies

NEW YORK, NY, UNITED STATES, October 15, 2024 /EINPresswire.com/ -- Brio360, an independent business advisory firm dedicated to creating long-term shareholder value, today announced the release of its inaugural quarterly report analyzing corporate transformation activities among publicly traded companies. The report provides a detailed breakdown of restructuring trends across various industries and company sizes, offering insights into how companies are adapting to a challenging macroeconomic environment and changing competitive landscapes.“Our restructuring analysis reveals a significant shift in how companies are approaching these initiatives. In 2024, we see businesses taking a more proactive stance, not just reacting to immediate challenges, but positioning themselves for long-term growth and operational efficiency,” said Peter Ho, Managing Partner at Brio360. “While cost reduction remains important, companies are increasingly focused on aligning their resources with strategic goals, optimizing their portfolios, and investing in areas of high growth potential. This shift underscores a more forward-thinking mindset, even in the face of continued economic uncertainty.”

The analysis draws from SEC public filings from 2023Q1 to 2024Q3. The data showcases strategic pivots from reactive cost-cutting measures to proactive, growth-oriented initiatives.

Key Findings from the Report:

1. Shift from Reactive to Proactive Restructuring: The report highlights a shift in restructuring motivations. In 2023, many companies were forced to react to unforeseen challenges such as regulatory setbacks and economic turbulence. By contrast, 2024 has seen companies adopting a more forward-looking stance, initiating restructuring programs designed to streamline operations, optimize supply chains, and invest in new technologies. This shift demonstrates a broader focus on future-proofing operations and achieving long-term strategic objectives.

2. Focus on Profitable Growth Amid Economic Uncertainty: While cost reduction remains a primary driver of restructuring in 2024, the report notes a growing trend of companies reinvesting savings into growth initiatives. In contrast to 2023, where survival dominated the narrative, businesses in 2024 are showing a renewed focus on profitable growth, despite ongoing economic uncertainties. This reflects a strategic mindset focused not just on managing costs but on reinvigorating core business areas for sustainable expansion.

3. Strategic Portfolio Management: Another major theme identified in the analysis is the rise in portfolio rationalization efforts. Companies in 2024 are taking more targeted steps to evaluate their operations, divesting non-core assets, and discontinuing less profitable product lines. This trend underscores a greater emphasis on focusing resources on high-growth areas and improving overall business efficiency.

4. Supporting Data Trends:

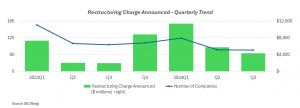

o Decrease in the Number of Restructuring Announcements: The report indicates a 25% decline in the number of companies announcing restructuring plans in 2024 compared to 2023, with mid-cap companies experiencing the sharpest drop. The total charges announced in 2024Q3 are down 24% vs. prior quarter but still represent a significant increase versus same period last year.

o Surge in Restructuring Charges: Despite the decrease in announcements, the total value of restructuring charges on year-to-date basis increased by almost 90%, driven primarily by large-cap companies. This signals that while fewer companies are restructuring, those that are undertaking it are executing larger and more complex initiatives.

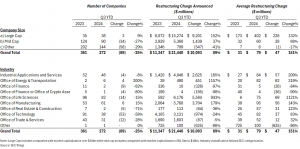

Restructuring Trends Across Company Sizes:

The report highlights contrasting trends between different company sizes. Large-cap companies (with market caps over $10 billion) saw a modest increase in restructuring announcements, with the total value of announced restructuring charges rising by 152%. On average, restructuring charges for large-cap companies increased by 132%, reflecting the complexity and ambition of the initiatives.

Meanwhile, mid-cap companies experienced a 27% decline in the number of restructuring announcements, although the total value of their restructuring charges still rose by 37%. This points to a continued focus on substantial restructuring, even amid fewer announcements.

Industry-Specific Trends:

The report also delves into industry-specific restructuring trends, noting that sectors such as healthcare and manufacturing have seen significant restructuring activities. Some companies also disclose savings expectations and reveal strategic rationale which are particularly useful for executives and investors. For instance, the technology industry has been adjusting to shifting market conditions, while healthcare companies have been facing regulatory challenges and evolving patient demands.

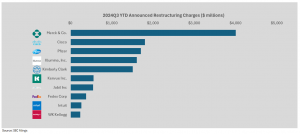

Examples include major restructuring programs by companies like Merck, Cisco, Illumina, and Kimberly Clark., all of which have undertaken substantial operational overhauls and incurred significant restructuring charges.

Conclusion:

Brio360’s quarterly restructuring analysis reveals that companies are increasingly taking a proactive approach to restructuring, focusing not only on cost reduction but also on strategic growth and portfolio optimization. As the economic environment remains volatile, businesses are positioning themselves to thrive by realigning resources, investing in core areas, and preparing for future challenges.

This report serves as a vital resource for executives, investors, and stakeholders seeking to understand the latest trends in corporate restructuring and their long-term implications.

For more information about Brio360’s restructuring analysis or to download the full report, please contact media@brio360.com

About Brio360

Brio360 is an independent business advisory firm dedicated to serving CFO offices in the middle market and emerging growth firms. By collaborating closely with clients across industries, Brio360 aims to create long-term shareholder value through the development of robust financial analytics and by asking the tough strategic questions.

https://brio360.com

Media Relations

Brio360

media@brio360.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.