U.S. Cannabis Industry Requires Up to $130B to Grow, Offering Massive Revenue Potential for Financial Institutions

Whitney Economics Collaborates with CTrust and Green Check to Identify Lending Needs and Opportunities in Cannabis Sector

This report should pave the way for conversations with financial institutions to develop more informed lending partnerships with the cannabis industry.”

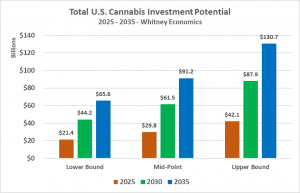

DALLAS, TX, UNITED STATES, October 15, 2024 /EINPresswire.com/ -- A first-of-its-kind report released today projects that the U.S. cannabis industry will need between $65.6B and $130.7B in sustainable growth capital to support new cannabis businesses and help refinance existing ones over the next decade, generating approximately $1.0 billion to $2.4 billion in potential interest revenue for financial institutions willing to lend to cannabis businesses. — Dotan Y. Melech, CEO and Co-founder of CTrust

Whitney Economics (WE), a global leader in cannabis and hemp business consulting, data and economic research, published the report with support from CTrust, the cannabis industry’s first “FICO-like” business credit scoring and monitoring agency, and Green Check, the leading fintech connector and technology and insights provider in the emerging cannabis market.

The report also shows that U.S. cannabis retail sales are forecasted to grow from $28.8 billion in 2023 to $87.0 billion by 2035. To support that growth, the U.S. cannabis industry could add 25,000 to 30,000 licenses to roughly 40,000 current licensees—a near doubling of potential lending and interest revenue opportunities for banks.

“The funding needed to realize this growth cannot be supported solely by friends and families,” said Beau Whitney, WE founder and chief economist. “By demonstrating regional opportunities and broader market potential, the report aims to empower financial institution lending departments to help educate their boards on risks, rewards and opportunities—all in the hopes of accelerating the industry’s growth by encouraging more financial institutions to participate”

This report stands out among the first to apply a forward-looking analysis to finance-related data associated with the cannabis industry, with the goal of supporting the sustainable expansion of the U.S. cannabis industry. California, Florida, Illinois, New York, Pennsylvania and Texas are among the top states for financial funding opportunities over the next decade according to the report.

"Banks have long been cautious about entering the cannabis industry due to regulatory and financial risks, though when they do, they have to rely on non-cannabis specific underwriting and due diligence,” said Dotan Y. Melech, CEO and co-founder of CTrust. “This report should pave the way for conversations with financial institutions to develop more informed lending partnerships with the cannabis industry."

"With a network of over 170 banks and credit unions serving the cannabis industry today, we're dedicated to furthering the discussion on responsible banking and lending practices,” Kevin Hart, founder and CEO of Green Check Verified. “Our clients today have over $750+ million in loans written. This report is crucial for our customers, as an integrated platform of compliant deposits, account monitoring and portfolio management opens the entire industry up nationally. Connected data, visibility, opportunity and managed risk are essential for building a robust financial ecosystem that supports sustainable growth in cannabis lending."

To request the executive summary of the report, visit https://ctrust.io/request-market-report/

###

About Whitney Economics

Portland, Oregon based Whitney Economics is a global leader in cannabis and hemp business consulting, data, and economic research, supporting hemp and cannabis operators, investors and regulators. Whitney Economics does not take a position on the legalization of cannabis, nor does it take positions on proposed legislation. Visit whitneyeconomics.com.

About CTrust

CTrust is the cannabis industry’s first credit rating and risk monitoring agency. We provide a free score and report to cannabis-related businesses that is used by lenders to evaluate creditworthiness, enabling a transparent credit risk environment for operators & financial institutions. At CTrust, our mission is to provide objective, trusted and data-driven solutions for cannabis businesses, financial institutions, and investors that fosters transparency and trust throughout our industry. We are the next generation of cannabis business intelligence. To learn more about CTrust, visit www.ctrust.io and follow CTrust on LinkedIn.

About Green Check:

Green Check (GC) is modernizing the way cannabis businesses and financial institutions work together. Founded in 2017 by a team of technology, banking, and regulatory experts, GC provides industry-leading technology and advisory services to more than 170 financial institutions and over 11,000 cannabis-related businesses. Green Check was included in the 2024 CNBC World’s Top Fintech Companies, 2024 Forbes Cannabis 42.0 and named one of 50 game-changers in the cannabis industry in the 4th annual The Cannabis 50. It has been repeatedly recognized as Top Compliance Company and Top Compliance Leader at the PBC Awards, the premier cannabis industry honors. In addition, it has been recognized as the Top Financial Technology by the Green Market Report and was also named as one of top Best Places to Work in Fintech three years running ( 2022 -2024) by American Banker. To learn more about Green Check, visit greencheckverified.com and follow GC on LinkedIn.

Leland Radovanovic

Grasslands: A Journalism Minded Agency

Leland@MyGrasslands.com

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.