ESG Shareholder Resolutions

Key Observations

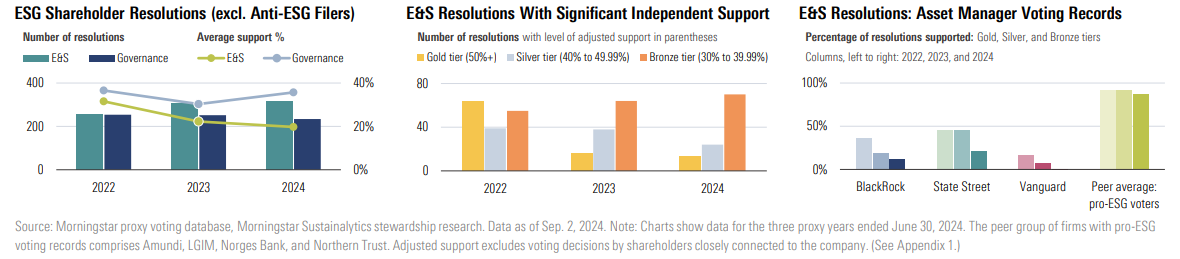

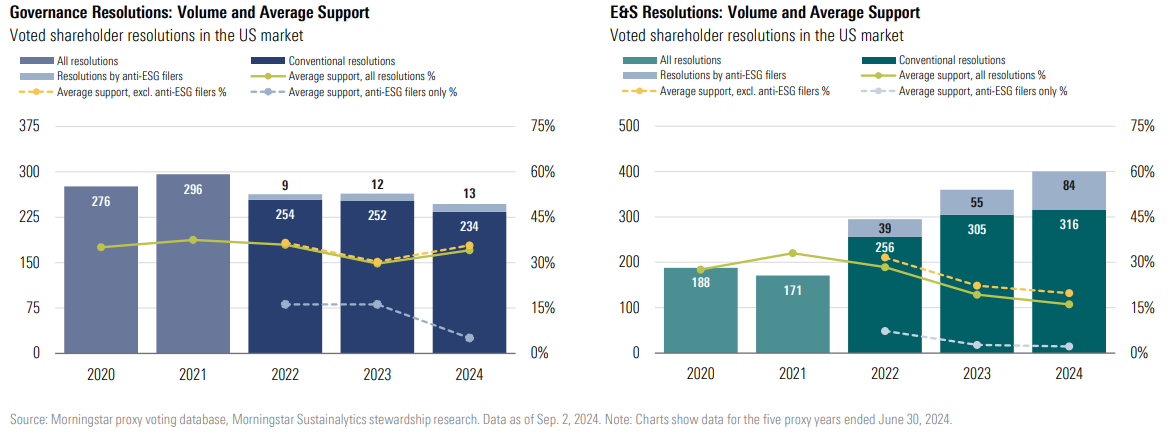

- Average support for ESG-focused shareholder resolutions in the US stabilized at 23% in the 2024 proxy year, after a steep decline in 2023. Excluding a growing cohort of resolutions by anti-ESG filers, the 2024 average is 27% (2023: 26%).

- Support for governance resolutions rebounded in 2024 to 36% from a low of 30% in 2023 (excl. anti-ESG filers), amid a growing focus on shareholder rights.

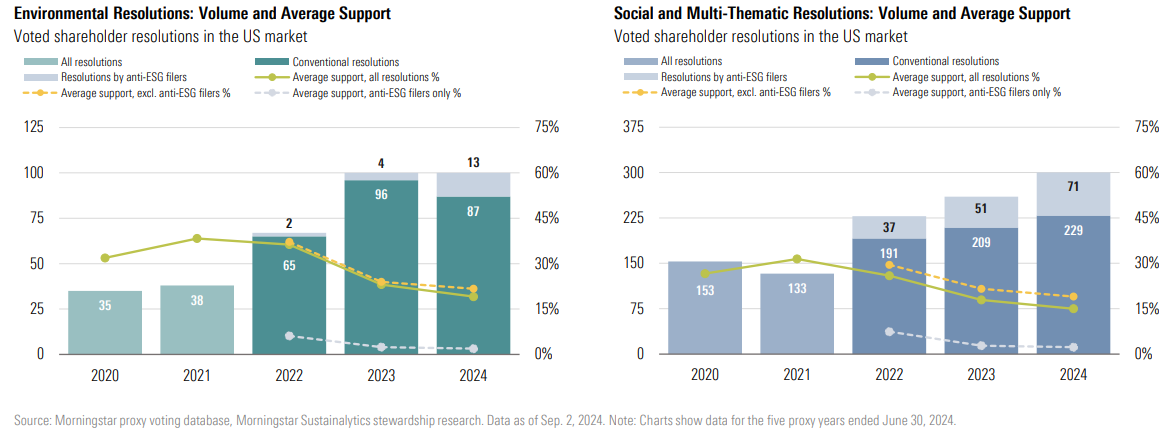

- Over the same period, support for environmental and social resolutions fell further to 19% from 22% (excl. anti-ESG filers). The declining trend slowed in 2024.

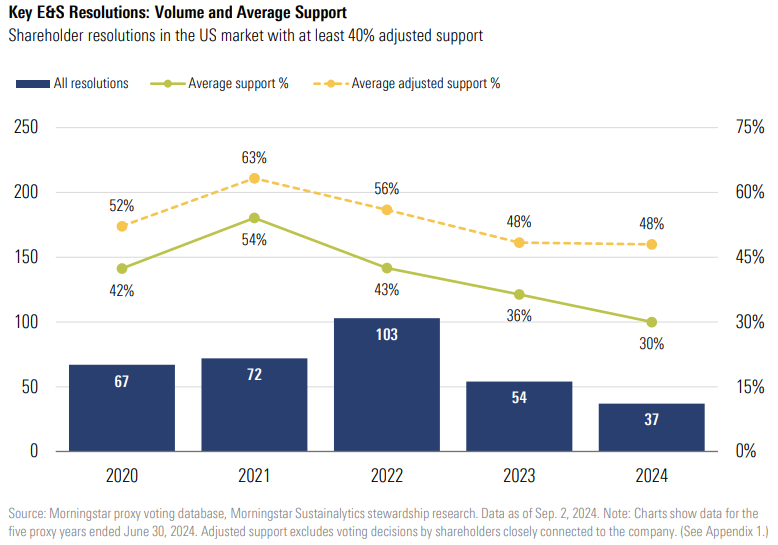

- The number of well-backed key resolutions hit a five-year low in 2024: just 37 – down from a peak of 103 in 2022. Key resolutions are those backed by at least 40% of a company’s independent shareholders.

- This contraction is driven by large asset managers’ votes, as they increasingly question the merit of many environmental and social (E&S) proposals.

- By extending our analysis to proposals with at least 30% adjusted support, we see greater stability, even growth, among bronze-tier resolutions that are more consistently backed by other asset managers.

- The two largest managers, BlackRock and Vanguard, further cut their support for E&S proposals, seeing many as “prescriptive,” “redundant,” or “not material.”

- State Street – third of the Big Three index fund managers – significantly reduced its E&S support in 2024, breaking the firm’s prior moderate-but-stable support trend. The firm has so far not reported on this.

- Managers with a pro-ESG voting history did not mimic the steep decline in support by the Big Three. There was a slight drop in the average of four managers we reviewed, but their support remained high overall.

ESG Shareholder Resolutions in 2024

Shareholder support for governance resolutions increased significantly. Support for E&S resolutions declined further, but not as sharply as in 2023.

ESG Shareholder Resolutions: A Change in the Tide

Following the 2021 proxy year, two key trends emerged that would dominate through to 2023:

1. A steep rise in the number of ESG-focused shareholder resolutions at US companies, after the SEC lifted restrictions on what proposals could be filed, and

2. A steady fall in average support for those resolutions, as asset manager skepticism on the merits of many resolutions increased, while a cohort of poorly supported resolutions by anti-ESG filers grew.

In the 2024 proxy year, those trends changed significantly. The number of shareholder resolutions grew at a slower rate than in the previous two years and, for the first time, resolutions by anti-ESG filers accounted for all of the growth in volume.

Furthermore, average support for shareholder resolutions seeking to advance ESG topics stabilized for the first time in three years at 27% – still some way down from the peak of 37% seen in the 2021 proxy year.

Support for Governance Resolutions Rebounded While E&S Support Slid Further

Stable average support for ESG resolutions overall in the 2024 proxy year masked diverging support for two very distinct kinds of proposals. Average support for governance resolutions jumped to 36% (excl. anti-ESG filers) in the 2024 proxy year from 30% in 2023. Many such proposals focused on fundamental issues of shareholder rights that tend to enjoy greater consensus among institutional investors. Yet, support for E&S resolutions fell from 22% to 20% over the same period (excl. anti-ESG filers), indicating continuing skepticism from larger asset managers.

Social Resolutions Are Now the Only Group of ESG Resolutions Still Growing in Number

Shareholder resolutions focused on social outcomes have long dominated the E&S category in volume terms. But as the charts below and on page 6 show, resolutions focused on social outcomes are the only group of ESG shareholder resolutions still growing in number in 2024, with that growth mostly driven by resolutions by anti-ESG proponents. Although environmental resolutions once enjoyed a significant lead in support over social proposals in the 2022 proxy year, this lead has narrowed somewhat in later years.

Analyzing E&S Resolutions With Significant Support

Analyzing E&S resolutions with significant support from independent shareholders reveals important underlying trends.

Strongly Supported Key Resolutions Become Increasingly Rare

For years, Morningstar’s proxy voting analysis has revealed important trends beneath the headline numbers for an important group of key resolutions: environmental and social shareholder proposals with at least 40% adjusted support. We pay close attention to key resolutions because they give a clearer signal of how institutional investors are voting on higher-quality resolutions addressing material issues, reflecting the market’s perception.

In 2023, the pullback in support for E&S resolutions by several of the largest asset managers caused the number of key E&S resolutions to almost halve, from 103 to 54. In the 2024 proxy year, the number of key resolutions contracted still further to 37.

Key resolutions tend to be supported by at least one of the very largest managers. So, the pullback in support for environmental and social shareholder proposals last year by several large asset managers, including Vanguard, BlackRock, and Capital Group, presents a particular problem for key resolution analysis.

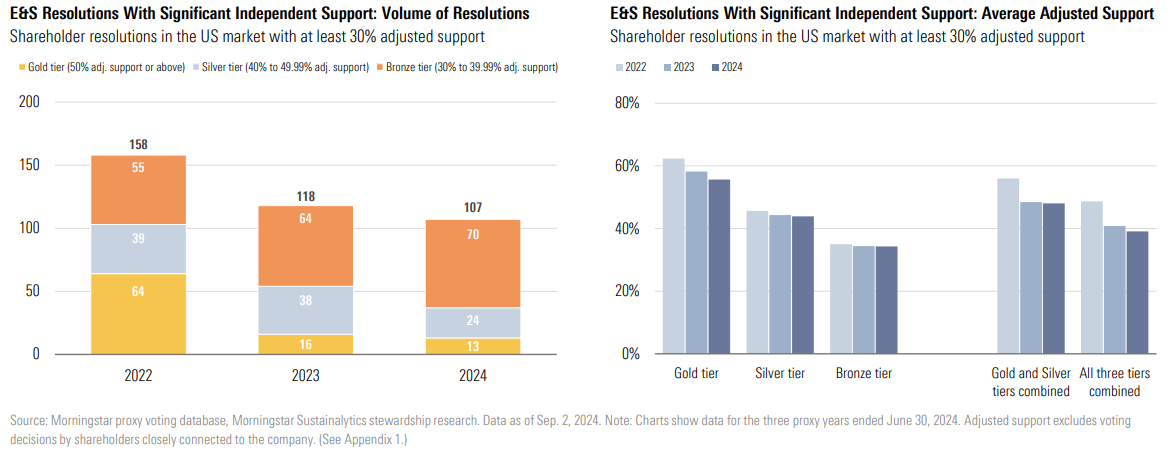

From Key Resolutions to Gold, Silver, and Bronze Tiers

In response, we created an analysis this year that covers the entire US market, under a new three-tier model we’ve named E&S Resolutions With Significant Independent Support (ERSIS), extending coverage to resolutions with at least 30% adjusted support. Over the last three years the size of the gold tier (with majority adjusted support) has shrunk by 80%, while the silver tier (40 to 49.99% adjusted support) has shrunk by 40%. However, the bronze tier has actually grown over the last three years, expanding from 55 resolutions in 2022 to 70 in 2024.

Questions Over Quality Persist

In the last two proxy years, several of the largest managers have questioned the quality of many of the resolutions on the ballot. The chart below left illustrates why. The number of resolutions without significant independent support (i.e., those opposed by company boards whose voting result placed them outside the three tiers) more than doubled in two years, from 128 in the 2022 proxy year to 293 in 2024. Resolutions in the three tiers as a percentage of the whole – a proxy for high quality, in our view – fell from 54% to 27% over that period.

Resolutions With Significant Support Increasingly Focus on Three E&S Themes

Over the last three years, the topics addressed by proposals in the three ERSIS tiers have become less diverse and are now dominated by three core topics: climate change, political influence and activity, and workplace fairness and safety. The number of ERSIS proposals addressing environmental issues other than climate has more than halved from nine to four since the 2022 proxy year. Well supported resolutions on civil rights and racial equity, and human rights and societal impacts, have also become much rarer over the same period.

Big Three Support for E&S Resolutions Continues to Shrink

In 2023, BlackRock and Vanguard steeply cut their support for E&S resolutions. This continued in 2024, with State Street joining them.

Big Three Firms Continue to Trim Their Support for E&S Resolutions

In 2024, and for the second year in a row, both BlackRock and Vanguard backed fewer E&S resolutions – even those with significant support from other institutional shareholders. Both attributed the continued decline in support to the quality of proposals they describe as “prescriptive,” “poor-quality,” or “redundant.”

BlackRock: “Consistent with last year, we found the majority of proposals addressing these topics [climate and natural capital or company impacts on people-related issues] were overreaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term shareholder value. A significant percentage were focused on business risks that companies already had processes in place to address, making them redundant.” – 2024 Global Voting Spotlight, August 2024, page 53

Vanguard: “The lack of support for environmental and/or social proposals this year does not reflect a change in our team’s application of the funds’ voting policies. Rather, it can be attributed to our assessment that, in each of these cases, the proposals did not address financially material risks to shareholders at the companies in question or were overly prescriptive in their requests.” – U.S. Regional Brief, August 2024, page 4

State Street – previously a consistent supporter of around 45% of the resolutions in the three tiers of significant support – halved their support to 23% in the 2024 proxy year. At the time of writing, the firm has not commented on this development.

Yet, relative to other firms – particularly those with a more pro-ESG voting record – the Big Three’s decline in E&S support is steep, as the charts opposite illustrate.

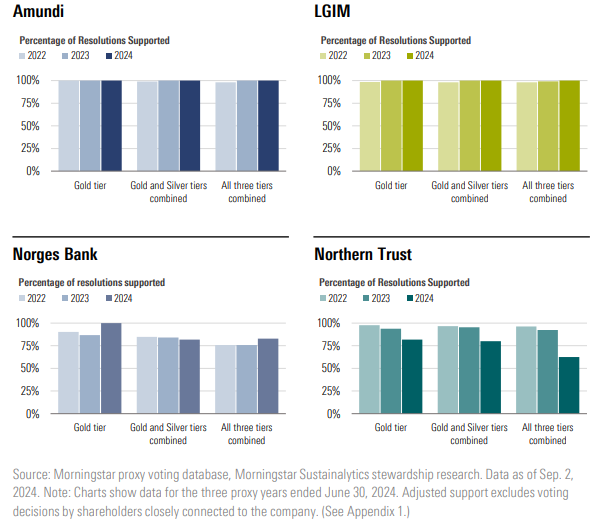

Support for E&S Resolutions More Stable Among Sustainability-Conscious Firms

Average support for gold, silver, and bronze tier resolutions by four peers with a history of strong backing for E&S proposals reveals an alternative perspective: this group largely believes there has been no meaningful decline in quality among resolutions with significant support.

Average support for the majority-supported gold-tier resolutions by these four institutions – Amundi, Legal & General Investment Management, Norges Bank, and Northern Trust – is steady at around 95% over each of the last three proxy years. Well above that of the Big Three firms, with their equivalent three-year average of 85%, which falls to only 54% in the 2024 proxy year.

For resolutions across all three tiers, the pro-ESG peer group’s average support fell from 92% in the 2022 and 2023 proxy years to a still very high 87% in 2024. Equivalent averages for the Big Three are 60% in the 2022 proxy year, 53% in 2023, and falling to just 25% in 2024.

Our research from January highlighted a growing divide between US and European firms’ voting patterns, with the latter showing much stronger support for E&S proposals. It is interesting to see this play out among this pro-ESG peer group too. Northern Trust, one of the strongest supporters of E&S proposals among US firms, appears to cut their support for these proposals (although not nearly as drastically as the Big Three) while the other three European institutions in the group maintained or increased their support.

Link to full report can be found here.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.