Jack Henry Collaborates with Swaystack to Personalize Onboarding and Engagement for Banks and Credit Unions

Jack Henry collaborates with Swaystack to personalize onboarding and engagement for banks and credit unions

Community and regional financial institutions can now personalize onboarding and engagement in digital banking to win primary financial institution status.

Swaystack leveraged the Banno Digital Toolkit™, the same set of APIs the Banno Digital Platform™ is built on, to embed its technology into the digital experiences offered by community and regional financial institutions. Access to Jack Henry’s API, design, and authenticated frameworks has enabled Swaystack to directly integrate into the digital banking platform providing a seamless banking experience. This integration contributes to Jack Henry’s growing ecosystem of over 1,000 fintechs, providing approximately 7,500 financial institutions with relevant financial products and services for their accountholders.

46% of newly opened accounts go inactive within the first year (Jim Marous, The Financial Brand). With the cost of acquisition for new accounts well over $200, banks and credit unions face a dual strain: coming out of pocket to acquire account holders, while nearly half of those accounts go inactive.

What are the primary reasons new accounts go inactive?

● Funding never happens

● Direct deposit never gets set up

● Debit cards are seldom used

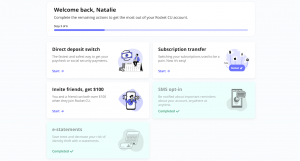

Swaystack’s gamified onboarding switch kit tackles the most common challenges that financial institutions face when onboarding new customers:

● Funding: Facilitate immediate funding with Instant Account Verification (IAV)

● Direct Deposit: Switch direct deposit seamlessly by connecting with payroll providers

● Debit Card Usage: Update card-on-file with APIs to popular merchants

“Swaystack’s revolutionary onboarding switch kit helps banks and credit unions re-engage their new account holders with home screen widgets in digital banking. To establish primary financial institution and top of wallet status, we must win the direct deposit relationship and help consumers put their card-on file with popular merchants,” said Har Rai Khalsa, Swaystack’s CEO, Co-founder. “With our new Jack Henry partnership, Swaystack can fulfill its mission to help banks and credit unions compete with neobank and megabank personalized onboarding and engagement.”

About Jack Henry & Associates, Inc. ®

Jack Henry™ (Nasdaq: JKHY) is a well-rounded financial technology company that strengthens connections between financial institutions and the people and businesses they serve. We are an S&P 500 company that prioritizes openness, collaboration, and user centricity – offering banks and credit unions a vibrant ecosystem of internally developed modern capabilities as well as the ability to integrate with leading fintechs. For more than 48 years, Jack Henry has provided technology solutions to enable clients to innovate faster, strategically differentiate, and successfully compete while serving the evolving needs of their accountholders. We empower approximately 7,500 clients with people-inspired innovation, personal service, and insight-driven solutions that help reduce the barriers to financial health. Additional information is available at http://www.jackhenry.com

About Swaystack, Inc.

Swaystack, a personalized onboarding and engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.6 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built. To learn more, schedule a discovery call: https://calendly.com/swaystack/discovery-call

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

LinkedIn

Overcoming Onboarding Blind Spots for Banks and Credit Unions

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.