2024 Proxy Roundup: ESG Metrics in Incentive Compensation Plans

In this year’s proxy roundup, we have analyzed the use of environmental, social and governance (“ESG”) metrics in cash and equity incentive plans among the largest 100 public companies.[1]

Incentive compensation plans, such as annual bonus and long-term equity awards, generally pay out on the basis of achievement of objective financial goals. However, incentive plans can also pay out in part or in full on the basis of nonfinancial metrics, including ESG metrics. In recent years, companies have increasingly linked ESG objectives to incentive compensation to support and advance their broader ESG strategies. Despite the growing politicization of ESG issues in the United States, ESG goals aimed at promoting environmental stewardship, social responsibility and robust governance frameworks remain important to many companies’ long-term strategic goals and value creation. By embedding ESG targets into compensation plans, companies reinforce their commitment to these goals and ensure that executive leadership remains accountable for achieving progress in these areas.

The proxy statements filed in 2024 by the companies in our sample generally disclose 2023 compensation plans and decisions. As discussed below, in light of the U.S. Supreme Court’s decision invalidating race-conscious admissions practices in higher education and the ongoing anti-ESG political backlash in the United States, the use of ESG metrics in incentive compensation plans in the 2024 compensation season may look quite different.

Key takeaways from our analysis of the 100 largest public companies include:

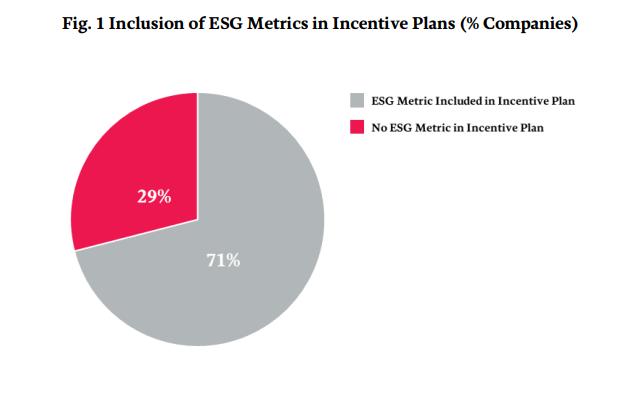

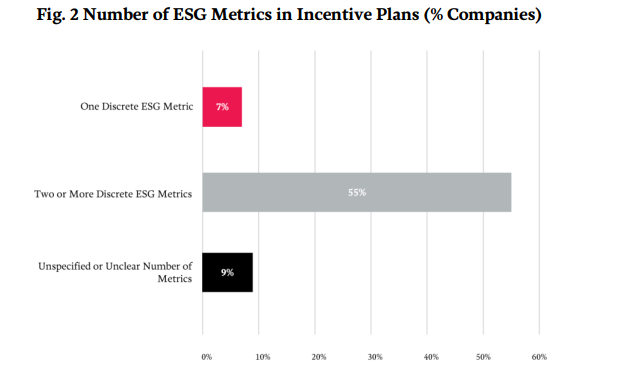

- 71% included one or more ESG metrics in incentive compensation plans. Most companies that included an ESG metric in their incentive compensation plans included more than one.

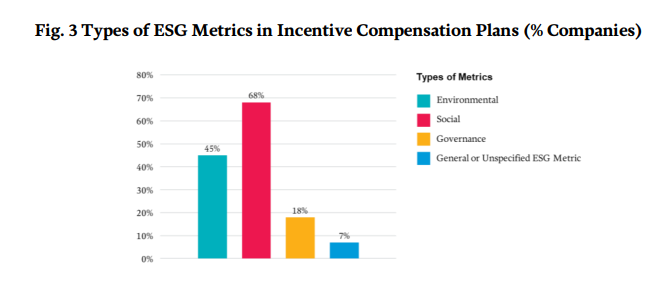

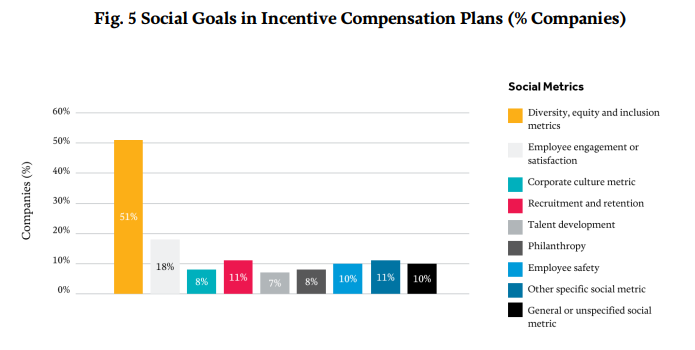

- Social goals remained the most common ESG metrics in incentive compensation plans, with 68% of companies using a social metric. The most common social metrics were related to diversity, equity and inclusion (“DEI”), with 51% of the companies in our data set using a DEI metric.

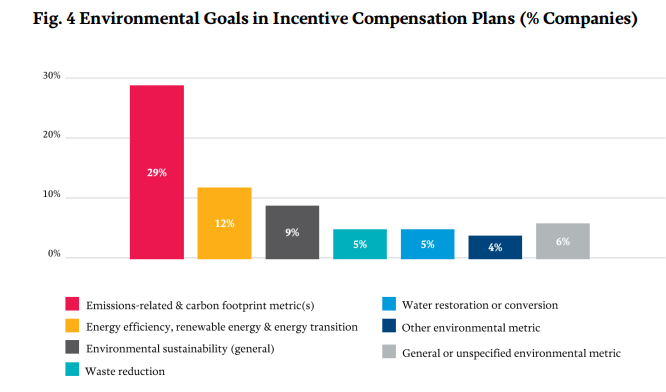

- 45% included environmental goals in their incentive compensation plans. Emissions and carbon footprint-related metrics were the most common environmental metrics, followed by energy efficiency and renewable energy metrics.

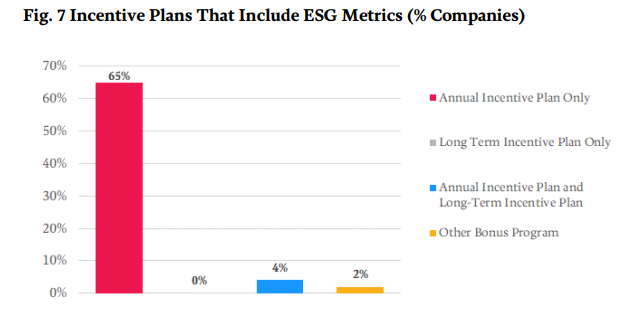

- 55% included ESG metrics only in their annual incentive plans, and another 4% included ESG metrics in both their annual and long-term incentive plans. No companies in our data set included ESG metrics only in their long-term incentive plan.

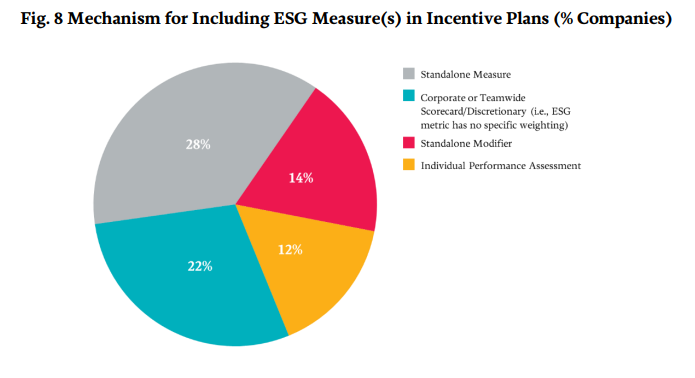

- 25% included ESG metrics as standalone weighted measures, while 22% included ESG metrics as part of a corporate or teamwide scorecard. ESG metrics were typically measured based on corporate, business unit or teamwide performance rather than individual performance.

- 31% included quantitative goals (with 22% disclosing numerical target metrics). 15% of companies included qualitative goals, and another 23% did not disclose, or had unclear disclosure, regarding how ESG metrics were measured.

Inclusion of ESG Metrics in Incentive Plans

Of the 100 largest public companies, 71% included one or more ESG metrics in their incentive plans, and 29% did not include any ESG metrics in their incentive plans.[2] A small number of companies (7%) that did not include an ESG metric in the incentive plan took ESG factors into account in some other way in determining compensation, such as determining the size of an executive’s target equity grant based on prior year contributions to diversity, equity and inclusion, or including other ESG metrics in overall discretionary compensation decisions.

Number of ESG Metrics Included in Incentive Plans

Of the companies in our sample, 7% used one discrete ESG metric, but most (55%) incorporated two or more specific ESG metrics in their incentive plans. Nine percent of the companies in our sample had an unspecified or unclear number of specific ESG metrics.

Prevalence of Environmental, Social and Governance Goals

The largest 100 companies continued to use a variety of ESG metrics, with social metrics being most common. Of the companies we analyzed, 45% incorporated environmental goals, 68% incorporated social goals, 18% incorporated governance goals and 7% incorporated general or unspecified ESG goals. The denominator adds up to more than 100% because, as noted above, most companies in our data set used more than one ESG metric in their incentive plans.

In each of these categories, we see a variety of goals. Some common ESG measures include, but are not limited to, the following:

| Environmental | Social | Governance |

|

|

|

For purposes of our analysis, we focused on human capital and workforce “social” metrics rather than other measures that may be considered social metrics, such as product quality and safety or customer/client satisfaction.

E – Categories of “Environmental” Goals

Of the 100 largest public companies, 29% included an emissions reduction or carbon footprint goal in their incentive compensation plans, and 12% included an energy efficiency, renewable energy or energy transition goal. Figure 4 below shows the prevalence of these and other types of environmental goals in incentive compensation plans.

S – Categories of “Social” Goals

Social goals were the most common type of ESG metric included in incentive plans, with DEI goals being the most prevalent type of social goal.[3] Figure 5 below shows the prevalence of various social goals in incentive compensation plans.

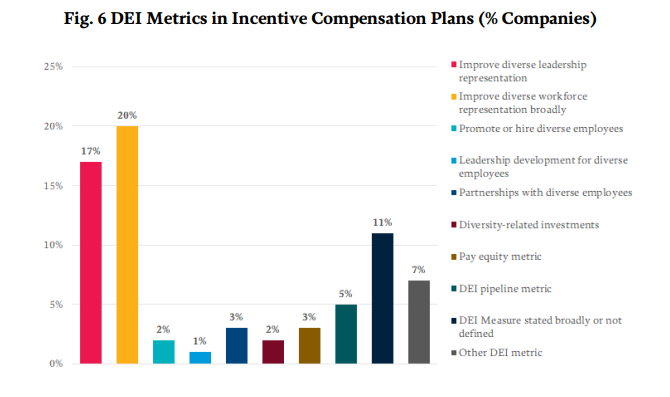

Spotlight on DEI

As noted above, the most common “social” goals included as metrics in incentive compensation plans in our data set were related to DEI.

There are a number of subcategories of DEI goals, including representation goals (such as the promotion or hiring of women or BIPOC[4] employees in leadership positions or improvement in the representation of women or BIPOC employees in the workforce more broadly); leadership development or training for BIPOC employees; DEI trainings for other employees; partnerships with diverse suppliers; goals relating to donating to and volunteering with DEI organizations; diverse investment goals; gender pay equity improvement metrics; and DEI pipeline goals. Figure 5 below shows the prevalence of these different types of DEI metrics in the 100 largest public companies.

On June 29, 2023, the U.S. Supreme Court invalidated race-conscious admissions practices in higher education in Students for Fair Admissions, Inc. v. President and Fellows of Harvard College and Students for Fair Admissions, Inc. v. University of North Carolina, holding that the interests in promoting diversity cited by Harvard and UNC were insufficient to justify such practices. Although the Supreme Court’s decision has no formal impact on private sector employers, the opinion has cast a spotlight on DEI initiatives in the workplace.

Our analysis in this Debevoise In Depth does not show the ultimate impact of the Students for Fair Admissions decision on the use of DEI metrics in incentive plans. The opinion was issued in June 2023, which was after the time period in which most companies established performance goals for the 2023 compensation season. Our observations and predictions for the 2024 compensation season are below under the heading “Predictions for the 2025 Proxy Season.”

G – Categories of “Governance” Goals

As noted above, of the companies in our data set, only 18% included governance-related goals in their incentive compensation plans. The following governance goals were most prevalent: compliance (6%), risk management (5%), cybersecurity (5%), succession planning (4%), ethics (3%), data governance and privacy (1%). In addition, 3% of companies in our data set used other governance metrics in their incentive compensation plans, and another 3% used general or unspecified governance-related metrics. It is difficult to determine from the proxy disclosures how these governance-related metrics were measured or considered, as they are typically included as part of corporate or teamwide scorecards (as discussed below). In addition, governance metrics such as risk management, compliance and ethics are regularly considered by boards and compensation committees in connection with compensation decisions, even if not included specifically as metrics in an incentive compensation plan.

Types of Incentive Compensation Plans That Include ESG Metrics Companies incorporate ESG goals into incentive plans in a variety of ways. Some include these metrics in their short-term incentive plans, or annual bonus plans, which are generally paid in cash and based on a performance period of one year or less. Others incorporate ESG metrics in their long-term incentive plans, which can include equity or cash-based awards, which are based on performance periods longer than one year (with a three-year performance period being most common).

Sixty-five percent of the companies in our sample included the ESG measures in only the annual incentive plan (or cash bonus plan), 4% included the ESG measures in both the annual incentive plan and long-term incentive plan and 2% included the ESG measures in a separate special bonus program. No companies in our sample included ESG measures in only the long-term incentive plan.

Incorporating ESG goals into short-term or annual incentive plans provides flexibility in setting goals each year based on changing business priorities and objectives. On the other hand, including them in long-term incentive plans reflects the reality that many of these goals are long-term in nature rather than true short-term goals.

Mechanisms for Inclusion of ESG Goals

There are a variety of approaches through which ESG metrics are taken into account in incentive compensation plans. One method—the most common method among the largest 100 public companies—is the implementation of a standalone measure, which assigns a specific weight to the ESG metric as a distinct component in the overall determination of incentive payouts. For example, 5% of the total bonus payout is earned on the basis of achievement of an ESG measure.

Another approach is the standalone modifier or multiplier. This mechanism adjusts the overall incentive payout based on the achievement of predetermined ESG performance goals. For example, the final bonus payout could be increased or decreased by a set percentage, such as +/- 10% impact, depending on the level of achievement of ESG performance goals. (We can think of a standalone ESG measure as being one slice of the incentive pie, while an ESG modifier or multiplier increases or decreases the size of the entire incentive pie.)

Additionally, an ESG goal can be integrated into a scorecard approach, where it represents one of many objectives used to evaluate performance. The scorecard assesses the achievement of multiple objectives by a team of executives or employees to determine their incentive payout; the scorecard may be used to determine the entire payout or one portion of the payout (e.g., a strategic goals scorecard that determines 25% of the bonus payout, which includes both ESG metrics and other nonfinancial goals). ESG goals can also be included in individual performance assessments, serving as one or more specific metrics by which an executive’s performance is evaluated for purposes of determining their incentive payout.

Finally, although not frequently used by public companies, ESG metrics may be included as a “threshold” measure; if the ESG metric is not satisfied, no bonus amounts are payable.

Figure 8 below shows the prevalence of these mechanisms for inclusion of ESG metrics in incentive plans in the 100 largest public companies. Where a group or bundle of ESG metrics had a separate standalone weighting, we counted each individual ESG metric as a standalone measure even if it did not have a separate weighting.

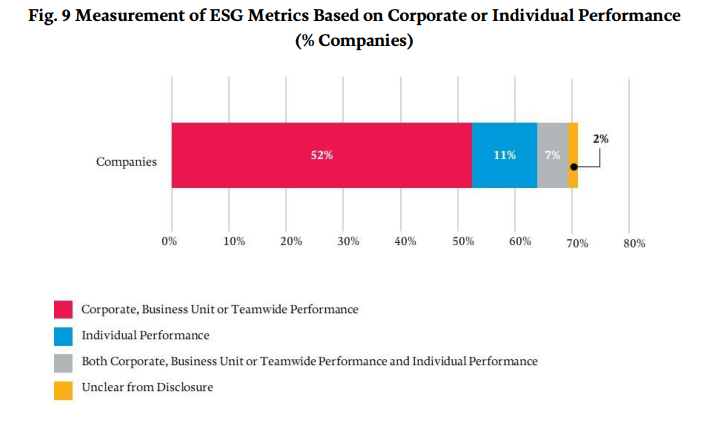

Measurement of ESG: Corporate versus Individual Performance

ESG metrics may be assessed on the basis of corporate, business unit or teamwide performance; individual executive performance; or both. In our sample, a majority of the companies (52%) assessed ESG performance on the basis of corporate or teamwide performance.

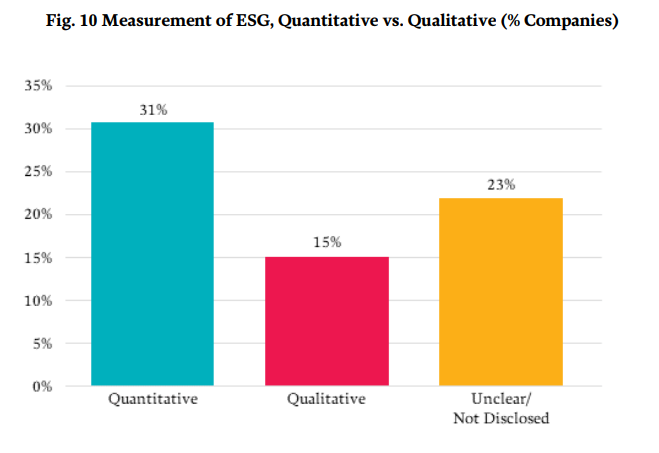

Measurement of ESG: Quantitative vs. Qualitative Metrics

ESG metrics can be assessed on a quantitative or qualitative basis. A quantitative metric involves measuring outcomes with numerical values, such as absolute amounts or percentage growth, providing a clear, data-driven assessment. Conversely, a qualitative metric relies on discretion and judgment, evaluating outcomes based on subjective criteria. Often, the specifics of these assessments are not disclosed in the proxy statement.

In recent years, institutional investors and proxy advisors have increasingly demanded rigorous, quantifiable measures for ESG goals in incentive plans, responding to complaints that “fluffy” ESG metrics are being used to unjustifiably boost bonus payouts. Investors also seek clear disclosure and transparency regarding performance achievements and their impact on company value, insisting on a strong alignment with long-term strategy. These investor expectations often clash with companies’ difficulties in setting quantifiable ESG goals and/or their reluctance to make detailed public disclosures due to potential legal or social risks. This tension is particularly evident with respect to DEI—where numerical goals related to workforce or leadership representation may result in a higher “reverse discrimination” litigation risk—and other ESG metrics where companies may not want to highlight underperformance against stated goals.

Of the 100 largest public companies, 31% used quantitative goals, 15% used qualitative goals and another 23% did not specify how the ESG goals included in the incentive compensation plan were measured.

Of the 31 companies that used quantitative measures, 22 companies disclosed numerical targets and 11 did not disclose numerical targets.

Public companies took a close look at the use of ESG measures in incentive compensation plans during the 2024 compensation season. Despite the growing politicization of ESG issues in the United States, companies continue to incorporate ESG goals in incentive plans where there is a clear link to the company’s long-term strategy and value creation.

Companies have revisited DEI metrics after the U.S. Supreme Court’s opinion last year in the Students for Fair Admissions cases. We have seen some companies making changes to DEI goals or the disclosure related to such goals, especially where such goals are quantitative representation goals that may result in a higher litigation risk. We have seen other companies remove DEI goals from their incentive compensation plans. However, we have not seen and do not expect to see most companies walking away from DEI goals altogether given the importance of these goals to workforce strategies and long-term business performance.

With respect to other ESG-related metrics, we expect companies will continue moving toward quantitative goals and away from qualitative or discretionary measures in the face of investor and institutional shareholder demands.

We expect to see more specificity around ESG goals in incentive plans, rather than broad or general measures. We also expect that even more companies will use standaloneweighted ESG metrics rather than scorecards where ESG measures have no defined weighting.

Finally, we anticipate that more companies will begin to include ESG goals in their longterm incentive plans to align with the inherently long-term nature of their ESG strategy, recognizing that some of these metrics are less suited for short-term objectives.

1Our data set included the 100 largest companies by market capitalization as of June 7, 2024. The authors would like to thank Flora Li, Samuel Pittman and Ivy Wysong for their contributions to this Debevoise In Depth.(go back)

2Where a company incorporated an ESG metric in an incentive compensation plan but only for one or more executives on an individual basis, we have counted this as including an ESG metric only if the goal was established at the beginning of the relevant performance period. We have not included ESG metrics that were incorporated or considered at the end of the performance period on an individual basis.(go back)

3This is the case even though, as noted above, our analysis focused on human capital and workforce “social” metrics rather than other measures that may be considered social metrics.(go back)

4“BIPOC” means Black, Indigenous, and people of color(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.