Significant Drop in SEC Enforcement Actions, Financial Remedies Reach Historic High

SEC Enforcement Results for Fiscal Year 2024 Show Significant Drop in Enforcement Actions Although Financial Remedies Reach Historic High

Summary

On November 22, 2024, the Securities and Exchange Commission (“SEC” or “Commission”) announced its “Enforcement Results for Fiscal Year 2024.”[i] The results reflect some of the lowest activity levels across numerous metrics in nearly a decade, although financial remedies reached a record high.

Numbers of course only tell part of the story. But these numbers come as something of a surprise given the consistently forceful language from Chair Gary Gensler and Enforcement Division leadership regarding enforcement, the Commission’s pursuit of novel legal theories in various of its cases, and the increased headcount in the SEC’s Enforcement Division. Below we review the announced results and consider possible reasons for the muted enforcement activity and discuss what may lie ahead.

Enforcement Results for Fiscal Year 2024

A. Key Metrics

The Enforcement Division results for Fiscal Year 2024 reflect sharp drop-offs in overall activity.

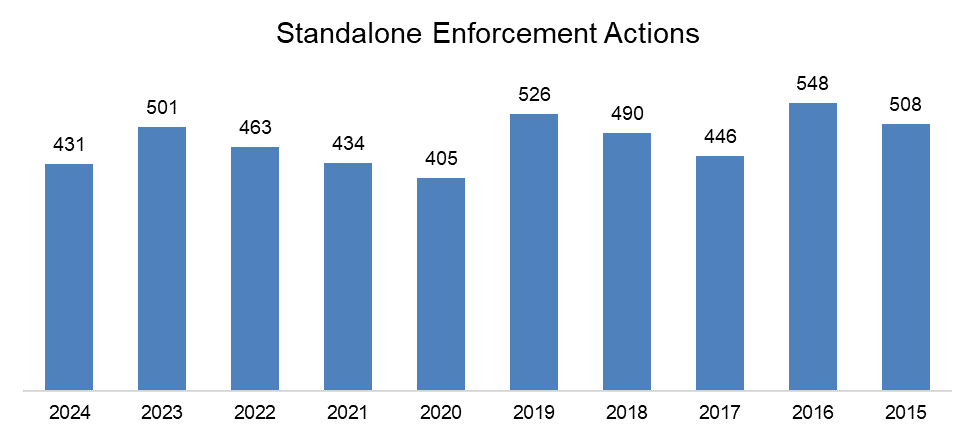

Standalone Enforcement Actions. The most significant measure of activity—so-called “Standalone Enforcement Actions,” i.e., independently-charged cases—fell to 431 cases. This was the lowest number reported in the last decade, with the exception of the pandemic years of 2020-2021.

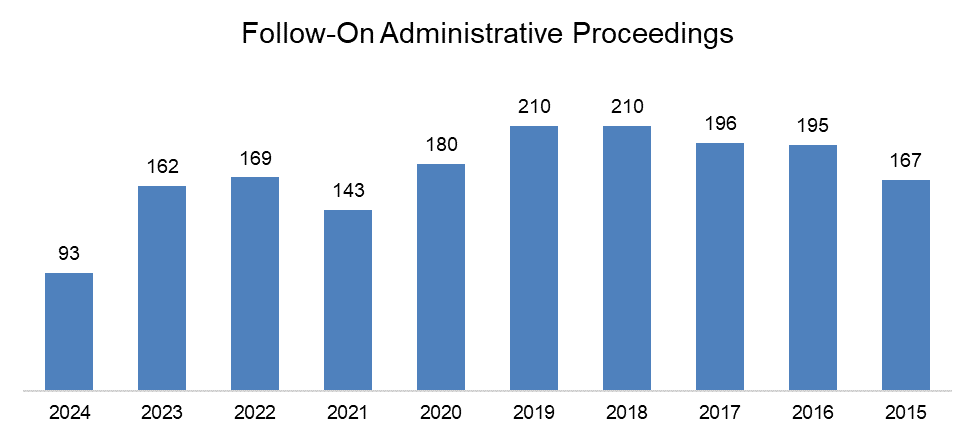

Follow-On Administrative Proceedings. Other activity metrics also fell significantly. So-called “Follow-On Administrative Proceedings,” which are intended to exclude wrongdoers from the markets by seeking associational or other bars based on Commission actions or actions by criminal authorities or other regulators, fell to their lowest level in a decade.

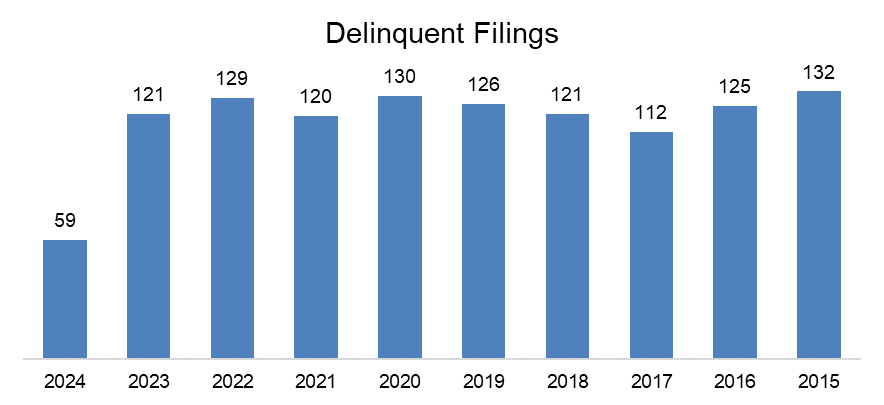

Delinquent Filings. Similar results are reflected in the number of “Delinquent Filings.” These are important proceedings to rid the markets of shell companies, often used by microcap fraudsters, by deregistering public companies that are delinquent in their public filings. Fiscal Year 2024’s 59 proceedings were approximately half of the number typically pursued—again the lowest number in a decade.

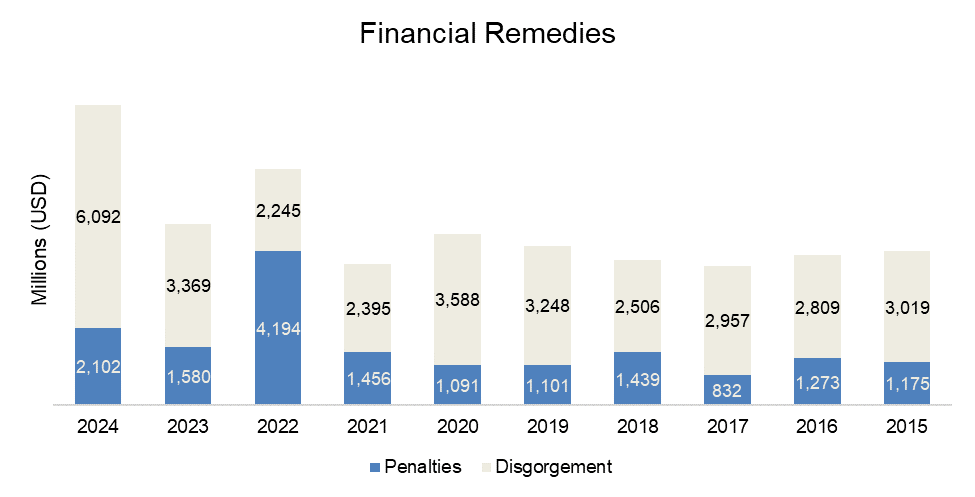

Financial Remedies. The only reported numbers that increased were financial remedies ordered by the Commission, which were reported at an historic high of approximately $8.2 billion. Sanjay Wadhwa, Acting Director of the SEC’s Division of Enforcement, explained that “[i]n fiscal year 2024, the Division continued to vigorously enforce the federal securities laws by recommending to the Commission high-impact enforcement actions addressing noncompliance throughout the securities industry and resulting in robust financial remedies.”[ii]

The numbers are consistent with messaging from former Director Gurbir Grewal that penalties, in particular, should be sufficiently large to punish and deter misconduct and to prevent market participants from viewing penalties as “priced into the cost of doing business.”[iii]

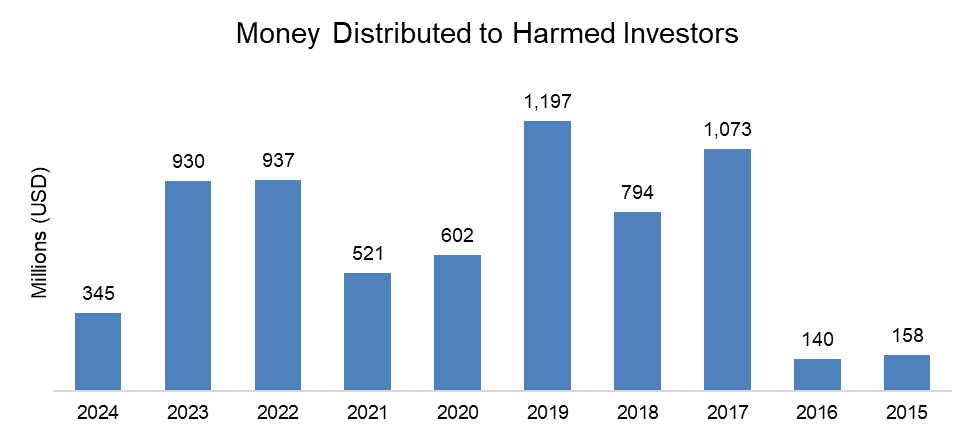

Money Distributed to Harmed Investors. Finally, another important investor protection metric—funds distributed to harmed investors—also slid.

B. Observations

The above-described drop in activity levels is unexpected for several reasons.

First, the Commission and Enforcement Division leadership consistently have used aggressive language in describing the SEC’s enforcement efforts. Chair Gensler has long emphasized the importance of sweeping enforcement, explaining that “[i]t is critical that [the SEC’s] enforcement program have tremendous breadth, be nimble, and penalize bad actors” and that the SEC “continue to pursue misconduct wherever we find it.”[iv] Indeed, in the press release announcing the Fiscal Year 2024 enforcement results, Chair Gensler resorted to his oft-used metaphor for the Enforcement Division: “a steadfast cop on the beat” engaged in a constant search for wrongdoers.[v] Although the SEC has been aggressive in pursuing increased financial remedies, the same cannot be said of some other key metrics reported in the enforcement results.

Second, the Commission has not shied away from pursuing aggressive legal theories and, as noted above, seeking substantial civil penalties. For example, in SEC v. SolarWinds Corp., the Commission pursued fraud and internal controls charges against SolarWinds and its Chief Information Security Officer in the wake of a significant cyber attack on the company by a nation-state actor. As discussed in our earlier Memorandum to Clients, the case was the first time the Commission had charged a CISO individually and represented a significant effort to expand the SEC’s authority to regulate cybersecurity controls as internal accounting controls.[vi] The district court roundly rejected most of the SEC’s claims, allowing only a limited category of them to proceed.[vii] Observers might have expected that the SEC’s application of novel theories such as these in settled actions would have contributed to a greater number of enforcement actions in total.[viii]

Third, the headcount in the Division of Enforcement has increased from that of recent years. In Fiscal Year 2024, the Enforcement Division had 1,512 positions.[ix] This reflects a more than 10 percent increase from 1,352 positions in Fiscal Year 2020.[x] Moreover, some of these additional positions were intended to facilitate the enforcement priorities of Commission leadership.[xi] For example, in 2022 when the SEC announced the allocation of 20 additional positions to the Crypto Assets and Cyber Unit—which has been an area of focus for the recent administration—Chair Gensler noted that the Unit had “successfully brought dozens of cases,” and that “[b]y nearly doubling the size of this key unit, the SEC [would] be better equipped to police wrongdoing in the crypto markets while continuing to identify disclosure and controls issues with respect to cybersecurity.”[xii] Given the additional staffing intended to support enforcement, the decline in enforcement actions is surprising.

Implications

A. Possible Reasons for Enforcement Statistics

The reason for the drop in activity levels is difficult to discern. Some of it may be due to an increase in the number of litigated matters as the Commission pursues aggressive theories that respondents choose to challenge in court.[xiii] And some of it may be due to a reallocation of resources to numerous investigations of digital asset matters, off-channel communications matters, and enforcement efforts directed at alleged whistleblower impedance in violation of SEC Rule 21F-17—all significant priorities of Chair Gensler.

The record-high $8.2 billion in disgorgement and penalties also requires closer analysis. Approximately 56% of the $8.2 billion is attributable to a single case, SEC v. Terraform Labs, which resulted in a total of $4.47 billion in disgorgement, prejudgment interest and civil penalties—the highest remedies ever obtained by the SEC following a trial.[xiv] And given that those payments will be “deemed satisfied” by payments to investors and creditors in Terraform’s pending bankruptcy proceeding, it is not clear that any of that money will actually be paid to the Commission.[xv] For these reasons, the $8.2 billion is not, on its own, a particularly useful metric for assessing enforcement trends, because without the one-off judgment in Terraform Labs, Fiscal Year 2024’s total financial remedies would be in line with historic numbers. But the fact that the penalty and disgorgement total absent Terraform Labs is consistent with that of recent years, despite the decrease in enforcement activity in Fiscal Year 2024, shows that the Commission has taken aggressive positions with respect to financial remedies in the relatively fewer cases that it has resolved.

B. What Lies Ahead?

If history is a guide, the transition year of Fiscal Year 2025 is likely to also see lower activity levels. This is common in ordinary years of transition, as the Commission typically operates with an Acting Chair and then undergoes an adjustment period as new personnel take leadership positions in the Commission and the various Divisions. This year, that may be more pronounced, as the Commission will operate for at least some period of time with a 2-1 majority of Commissioners Pierce and Uyeda before they are joined by a new Republican-appointed Chair.

As leadership of the Commission changes, we are likely to see its resources allocated away from some of Chair Gensler’s priorities and back to more traditional areas of SEC focus including issuer accounting and disclosure matters, offering fraud, market manipulation and insider trading, and the like.

The reduced activity levels of Fiscal Year 2024 may also result in appropriation and personnel cuts. President Trump and his newly created Department of Government Efficiency have identified reducing the size of the federal government as a significant policy objective, and with a Republican-controlled White House, Senate, and House, the SEC may see the size of its footprint reduced.

[i] Press Release, SEC, SEC Announces Enforcement Results for Fiscal Year 2024 (Nov. 22, 2024) available at https://www.sec.gov/newsroom/press-releases/2024-186.

[iii] Former Director, Division of Enforcement, Gurbir S. Grewal, Remarks at Securities Enforcement Forum (Nov. 15, 2022), available at https://www.sec.gov/newsroom/speeches-statements/grewal-speech-securities-enforcement-forum-111522.

[iv] Chair Gary Gensler, Prepared Remarks at the Securities Enforcement Forum (Nov. 4, 2021), available at https://www.sec.gov/newsroom/speeches-statements/gensler-securities-enforcement-forum-20211104.

[v] Press Release, SEC, SEC Announces Enforcement Results for Fiscal Year 2024 (Nov. 22, 2024) available at https://www.sec.gov/newsroom/press-releases/2024-186.

[vi] See Amended Complaint, SEC v. SolarWinds Corp., 1:23-CV-09518 (S.D.N.Y. July 18, 2024).

[vii] SEC v. SolarWinds Corp., 1:23-CV-09518 (S.D.N.Y. July 18, 2024).

[viii] See Press Release, SEC, SEC Charges R.R. Donnelley & Sons Co. with Cybersecurity-Related Controls Violations (June 18, 2024), available at https://www.sec.gov/newsroom/press-releases/2024-75.

[ix] SEC, Fiscal Year 2025 Congressional Budget Justification and Annual Performance Plan at 12, available at https://www.sec.gov/files/fy-2025-congressional-budget-justification.pdf.

[x] See SEC, Fiscal Year 2022 Congressional Budget Justification and Annual Performance Plan at 14, available at https://www.sec.gov/files/fy-2022-congressional-budget-justification-annual-performance-plan_final.pdf.

[xi] See SEC, Fiscal Year 2023 Congressional Budget Justification and Annual Performance Plan at 6, available at https://www.sec.gov/files/fy-2023-congressional-budget-justification-annual-performance-plan_final.pdf.

[xii] Press Release, SEC, SEC Nearly Doubles Size of Enforcement’s Crypto Assets and Cyber Unit (May 3, 2022), available at https://www.sec.gov/newsroom/press-releases/2022-78.

[xiii] See, e.g., SEC v. SolarWinds Corp., 1:23-CV-09518 (S.D.N.Y. July 18, 2024).

[xiv] Final Judgment, SEC v. Terraform Labs Pte Ltd., 1:23-CV-01346 (S.D.N.Y. June 12, 2024); Press Release, SEC, SEC Announces Enforcement Results for Fiscal Year 2024 (Nov. 22, 2024), available at https://www.sec.gov/newsroom/press-releases/2024-186.

[xv] Final Judgment at 7, SEC v. Terraform Labs Pte Ltd., 1:23-CV-01346 (S.D.N.Y. June 12, 2024).

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.