Spotlighting The Reason Behind Surging Demand for DSCR Loans in 2024

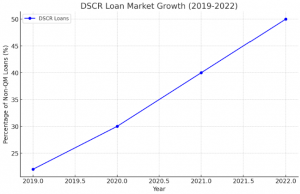

DSCR collateral represented 50% (by balance) of the non-QM transactions rated by S&P Global Ratings, up from 22% in 2019.

Rising interest rates boost the DSCR lending market. Truss Financial Group's analysis shows growing interest from real estate investors.

LADERA RANCH, CALIFORNIA, USA, July 26, 2024 /EINPresswire.com/ -- With rising interest rates making traditional borrowing more expensive, the Debt Service Coverage Ratio (DSCR) lending market is experiencing a significant resurgence.We at Truss Financial Group, delved into relevant data provided by S&P Global and Google Search Trends to find out the trend over the past few years. Based on this data, Jason Nichols, co-founder and Chief Marketing Officer of Truss Financial Group, underscores the growing appeal and advantages of DSCR loans amidst the current economic landscape.

The DSCR Loan Market Size:

Over the past few years, the DSCR loan market size has been on an upward trajectory. This growth is driven by real estate investors seeking alternatives to traditional loans. "The market size of DSCR loans may be low by mortgage industry standards, but the growth trajectory is promising," Nichols added. "Lenders and brokers should consider participating in this expanding market to diversify their portfolios and capitalize on the rising demand."

Impact of COVID-19 on DSCR Lending:

The onset of COVID-19 marked a significant turning point for DSCR lending. As people moved away from urban areas, the demand for rental properties in suburban regions surged. DSCR lending saw rapid growth post-COVID. The shift towards suburban living and the increased need for rental spaces have driven the market. This graph shows Google search interest for DSCR over the years:

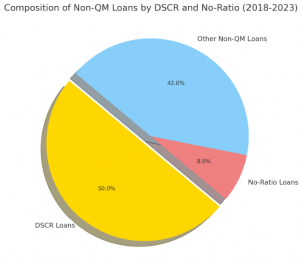

Growing Presence in Non-QM Market:

Debt service coverage ratio (DSCR) loans are residential investor property loans underwritten with reference to the cash flows generated by a property's rental income. Although they are exempt from qualified mortgage (QM) and ability-to-repay (ATR) rules, DSCR loans are generally considered part of the non-QM loan market due to their growing presence in non-QM residential mortgage-backed security (RMBS) transactions. In 2022, DSCR collateral represented 50% (by balance) of the non-QM transactions rated by S&P Global Ratings, up from 22% in 2019. Source: S&P Global Website.

Economic Context and Future Projections:

With the Federal Reserve indicating that interest rates may continue to rise, the attractiveness of DSCR loans is expected to increase. Industry analysts predict the DSCR loan market could grow by 20% over the next five years as more investors turn to this financing option. The growing popularity of DSCR loans among originators and issuers, as well as the increase in sellers and originators is partly due to the general interest in investor property ownership and management as a viable business.

Conclusion:

The DSCR loan market, though still a small segment compared to traditional mortgages, is on a promising growth trajectory. With ongoing housing affordability issues and a shortage of inventory, DSCR loans offer a viable alternative for real estate investors looking to expand their portfolios. The future of DSCR lending looks bright, driven by economic factors, housing market dynamics, and the adaptability of originators to market conditions.

#END#

Jason Nichols

Truss Financial Group

+1 888-878-7715

hello@trussfinancialgroup.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.