Global Business Travel Industry Spending Expected to Hit Record $1.48 Trillion in 2024

Boosted by economic stability, pent-up demand & recovery momentum, spending projected to surpass $2 trillion by 2028 according to the latest BTI Report

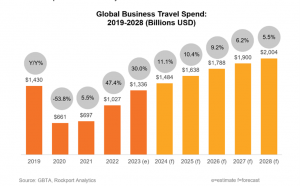

ATLANTA, GEORGIA, USA, July 22, 2024 /EINPresswire.com/ -- The business travel industry has proven itself resilient as it leaves the global pandemic behind and moves into a new era of post-pandemic stabilization. The forecast for 2024 predicts global business travel spending will reach $1.48 trillion USD by the end of the year, an increase on 2019 spending which was a previous record at $1.43 trillion. Additionally, by 2028, it is projected to exceed $2.0 trillion, highlighting a robust path ahead for the business travel sector in terms of spending.

Relative stability in the global economy has continued to drive growth which, along with lingering pent-up demand, has provided reassurance for CEOs and CFOs to get their people back on the road for business meetings. Many top business travel markets around the world have returned to or are nearing pre-pandemic levels, reinforcing the momentum of the recovery and boosting spending. However, the outlook for economic and business travel growth presents a balance of both potential upside factors and downside risks.

These are the top-level findings from the latest 2024 GBTA Business Travel Index Outlook – Annual Global Report and Forecast (“GBTA BTI™”) published by the Global Business Travel Association (GBTA) and made possible by Visa.

Unveiled onstage today at the GBTA Convention 2024 in Atlanta in front of more than 5,000 attendees, the 16th edition of the GBTA BTI™ is an annual exhaustive forecast of business travel spending and growth covering 72 countries and 44 industries. The GBTA BTI™ also includes survey data and analysis this year from 4,100 business travelers across five global regions, representing insights from employee travelers regarding their business travel preferences, behaviors and spending.

Global business travel spending is anticipated to increase 11.1% in 2024, after significant years in 2022 and 2023 of 30%-47% growth year over year. Growth is expected to continue to gradually moderate, resulting in an annual compound growth rate of 6.95% from 2025 to 2028.

In 2023, the business travel industry had recovered approximately $675 billion of the $770 billion lost in 2020, according to GBTA BTI™ analysis, achieving 93% of the pre-pandemic peak of $1.43 trillion by the end of 2023. The sector experienced a significant resurgence in 2023, with spending growing by 30% compared to 2022, reaching $1.3 trillion.

Highlights from the 2024 GBTA BTI™ Outlook (figures in US dollars):

• Global business travel spending is expected to recover to its pre-pandemic total of $1.48 trillion in 2024, fueled by more favorable economic conditions than expected in 2022 and 2023. (While recovery has been impressive, it is important to note that when adjusted for inflation, spending levels are anticipated to lag pre-pandemic highs over the coming years, implying that business travel volumes will remain below pre-pandemic levels as well.)

• Recovery in business travel continues to vary by region. Asia Pacific emerged as the fastest-growing region in 2023 (36%), followed by Western Europe (33%) and North America (25%). The recovery bounce back was led in 2023 by the U.S, Middle East and Africa, and Latin America, all achieving 100% or more of 2019 spending numbers. For 2024, China and the U.S. are forecast to continue to lead as the top two markets, respectively, for overall business travel spending.

• GBTA’s survey of 4,100 business travelers across 28 countries and four regions (North America, Europe, Asia Pacific, and Latin America), revealed an increase in overall business travel, with international travel remaining below average. Sixty-four percent of business travelers globally report increased spending on business travel compared to 2023. However, over one-third (37%) say they have experienced more restrictive travel policies since pre-COVID.

The “Executive Summary" for the 2024 Business Travel Index Outlook report contains more information and insights, and is available to download.

About GBTA

The Global Business Travel Association (GBTA) is the world’s premier business travel and meetings trade organization headquartered in the Washington, D.C. area serving stakeholders across six continents. GBTA and its 8,000+ members represent and advocate for the $1.48 trillion global business travel and meetings industry. GBTA and the GBTA Foundation deliver world-class education, events, research, advocacy, and media to a growing global network of more than 28,000 travel professionals and 125,000 active contacts.

Debbie Iannaci

Global Business Travel Association | PR & Communications

press@gbta.org

Visit us on social media:

Facebook

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.