The Flat Rate: Italian Tax Benefit for Foreign Freelancers and New Residents

Let's discover the advantages of the flat-rate tax regime for those who decide to move to Italy to work there from abroad, enjoying numerous tax benefits.

FIRENZE, FLORENCE, ITALIA, January 10, 2024 /EINPresswire.com/ -- The Flat Rate: Italian Tax Benefit for Foreign Freelancers and New ResidentsDoes Italy tax US social security benefits?

What are tax benefits for expats in the Belpaese?

In this article, we will attempt to address some of these common questions.

Before going on, everyone interested in moving to Italy can have a look at the Agenzia delle Entrate website. The Agenzia delle Entrate is the Italian Revenue Agency responsible for administering taxes and enforcing tax laws. It offers several services to assist foreign citizens living and working in Italy. Regarding tax incentives for example, attractive tax benefits are offered to certain individuals who move to Italy for work, such as professors, researchers, graduates, managers and high-net-worth individuals. On the other hand, investors can get an advance opinion from the Revenue Agency on the tax implications of a planned investment in Italy.

Many are interested in the Double Taxation Relief, that means Bilateral existing agreements with many countries to prevent double taxation of income and capital for Italian residents.

The tax benefit of Regime forfettario and Partita Iva in Italy

Since 2015, Italy has introduced a special tax regime in place for the self-employed and professionals who charge up to 85,000 euros per year. Called the "Regime Forfettario," it represents a tax framework designed to encourage entrepreneurship and attract new residents.

Tailored to provide favorable conditions for freelancers and small businesses, this tax benefit has gained popularity because of its simplicity and advantageous tax rates. For seasoned freelancers or new residents seeking financial incentives, the Regime Forfettario offers a simplified approach to managing tax obligations, promoting economic growth and fostering a vibrant business environment in Italy.

In this introduction, we will delve into the main features and benefits of this special tax regime, exploring how it has become a coveted choice for those seeking to establish or expand their business in Italy. From tax rates and eligibility criteria to the benefits of choosing this regime, we will uncover the reasons for the growing popularity of the Regime Forfettario among freelancers and new residents.

The flat-rate scheme appeals to many: 15% tax rate and tax simplifications of various kinds can guarantee very substantial annual savings. To be among the lucky ones who can access this regime, however, the applicants have to meet certain requirements and make sure they don't run into one of the statutory grounds for exclusion.

The flat-rate regime was introduced in Italy by Law No. 190/2014 (2015 Budget) effective January 1, 2015. With its entry into force, it caused the repeal of all facilitated regimes that previously existed:

• the regime of new productive initiatives,

• the advantageous regime for young entrepreneurs and mobile workers, known as the new minimums regime,

• the facilitated accounting regime for "former minimums."

The current access and permanence requirements are set by the 2020 and 2023 budget laws. Specifically, Budget Law 2023 raises the income and compensation limit to €85,000.

The requirements for entering the flat-rate scheme

To enter the flat-rate scheme, applicants only have to meet one subjective and two objective requirements. Let's find out about them in detail.

1. Personal requirement: who can access the flat-rate scheme?

First of all, a new resident must open a self-employment position. First step is obtaining the Italian Fiscal Code. Now people can then access the flat-rate scheme for an individual and engage in a business, art or profession (including family businesses). What does this mean? Simple: this is valid for a freelancer or a sole proprietor, only they can enjoy the benefits. Companies and professional associations, on the other hand, are excluded.

2. Business requirements: limit of the flat-rate scheme for turnover and expenses

The limit on fees and revenues.

The first objective requirement to access the flat-rate scheme, concerns the revenues and fees of the business: the total of these sums must not exceed €85,000 per year. If, for example, during 2023 the sums exceed this threshold, in 2024 the freelance will be forced to adopt the ordinary (or simplified) regime.

For those who have opened a new business, the €85,000 limit should be reduced in proportion to the months of operation. That is, freelancer and 'imprese individuali' will have to divide 85,000 by 365 (the days in a full year) and multiply the result by the days of actual activity. Assuming the new business has been started on December 1, 2023, the compensation limit to be met in 2023 will be 7,219, or (65,000/365)*31.

The new revenue/compensation limit of €85,000 was established by the Budget Law 2023 (previously it was €65,000) and is effective January 1, 2023.

How are revenues and fees calculated?

Be careful: we talked about "revenues and fees" and not "income." This means that the tax payer has to find out, if the incomes are under the €85,000 limit, and add up all the income from his business, without subtracting any expenses (rent, equipment, employees, etc.). As we will see later (in the chapter on taxation of the flat-rate regime), expenses incurred are not relevant in this regime.

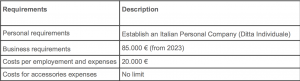

Summary of requirements --> attached table (images)

Lorenzo Mazza

ILF Law Firm

+39 055 098 1586

info@italylawfirms.com

Visit us on social media:

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.