Finally Italian banks open to mortgages for non-residents

With proper documentation provided by real estate attorneys, non-residents have access to transparent financing options from Italian banks and lenders

FLORENCE, TUSCANY, ITALY, October 16, 2023 /EINPresswire.com/ -- An Overview of the Italian Banking LandscapeThe Italian banking system is made up of a variety of institutions that can be broadly categorized into commercial banks, cooperative banks, and branches of foreign banks. According to data from the Bank of Italy, in total, the Italian banking system comprises over 25,000 institutions. Through consolidation over recent decades, the system has shifted toward larger commercial banking groups.

There are 19,452 incorporated banks (S.p.A.) operating in the country. These commercial banks are set up as joint-stock companies and make up the majority of banks in Italy. In addition, there are 1,559 popular banks (banche popolari cooperative), which are mutually-owned by their members. An even larger segment is made up of 4,236 cooperative credit banks (banche di credito cooperativo) that provide localized service, especially in rural areas.

What about foreign banks operating in the Belpaese?

Only 162 are the branches of foreign banks, that means a very little percentage (0,64%).

Non-resident Entrepreneurs in Italy and Loans

Over recent decades, the number of non-resident entrepreneurs operating businesses in Italy has grown exponentially. According to data from Unioncamere and InfoCamere, as of 2012 there were nearly 480,000 enterprises in Italy led by foreign citizens.

Then years later, at the end of March 2022, foreign entrepreneurship confirmed itself as a structural component with 650.000 companies, 10.7% of the total. 39% of the entire increase in foreign-owned businesses is related to the construction sector (+20,974 units).

These non-resident entrepreneurs have various financing options when looking to start or grow a business in Italy. Like Italian citizens, they can qualify for personal loans and payroll-deducted loans based on their income and employment status.

To obtain any type of loans and mortgages, non-resident entrepreneurs need either Italian citizenship or a valid work permit. But what if the request is coming from a non-resident and is just related to the possibility of obtaining money to buy a house?

Non-resident individuals willing to buy a house in Italy

Ideally, Italian banks have always been open to the possibility of giving mortgages to foreigners. In reality, many requests have been refused due to a very cautious approach. Italian banks' reluctance to provide mortgages to non-Italian residents highlights the challenges and risks associated with such lending practices.

One of the key challenges faced by Italian banks when considering mortgage applications from foreigners was the complexity and costliness of pursuing legal remedies in case of default. While foreigners may present all the necessary guarantees and qualifications, the prospect of recovering outstanding payments became considerably more burdensome for banks operating abroad.

How can a non-resident obtain a mortgage in Italy?

So, what is going to change?

During the Pandemic years, with interest rates at their lowest, granting mortgages to domestic borrowers was the thing to do for several factors, including familiarity with the local market and legal frameworks. The Italian banking sector has developed robust systems and procedures for handling default cases domestically, which may not be as readily applicable when dealing with foreign borrowers.

But, with higher interest rates, mortgage applications from Italians decrease. At the same time, banks realize that foreigners looking to buy a vacation home or open an agriturismo in Italy have significant economic power.

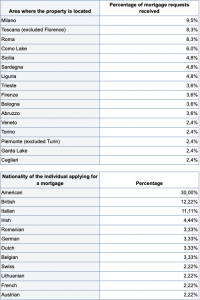

According to data compiled by ILF in 2023 - Italy Law Firm, mortgage applications from non-residents are more substantial:

ILF OVERVIEW NON-RESIDENTS HOUSE MORTGAGE REQUESTS IN 2023

Average loan amount requested:

217.506€

Average property price

327.183€

No-resident applicants nationality

American

30,00%

British

12,22%

Italian

11,11%

Irish

4,44%

Romanian

3,33%

German

3,33%

Dutch

3,33%

Belgian

3,33%

Swiss

2,22%

Lithuanian

2,22%

French

2,22%

Austrian

2,22%

The role of Italian attorneys in this process

Dealing with legal proceedings and debt recovery in foreign jurisdictions can involve time-consuming processes, language barriers, and additional costs. These challenges are the bread and butter of Italian attorneys. Italian law firms have tools and experience to carefully evaluate the potential risks related to regulatory and compliance factors.

With proper documentation provided by Italian law firms, non-resident entrepreneurs have access to transparent financing options from mainstream Italian banks and lenders. Payroll-deducted loans allow qualifying borrowers to access credit while building their house in Italy. Carefully evaluating loan terms and lenders can help non-residents avoid problems and obtain fair financing.

Final Thoughts

Securing a mortgage in Italy as a non-resident might seem daunting, but it can be straightforward with the correct information and preparation. Remember to stay informed about the latest Italian mortgage rates, understand the difference between various mortgage and loan types, and explore the best Italian banks for mortgages to ensure a successful property acquisition in this beautiful country.

For more information and expert advice on mortgages in Italy, feel free to explore ILF pages to guide you through every step of your property-buying journey in Italy.

Michele Ambrogio

ILF Law Firm

+39 055 098 1585

info@italylawfirms.com

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.