JD Euroway Finex (JDEFINEX) Unveils Web3 Mobile Wallet and Announces Pilot e-Money & Deposit Token Program Launch

JD Euroway revolutionizes the global financial landscape with its groundbreaking Web3 Mobile Wallet and Pilot e-Money & Deposit token program launch.

Our solution will be on par with JP Morgan's ONYX, Citibank's initiative with Baton Systems. We will also leverage the newly launched PAPSS infrastructure from Afreximbank and SIX Group's SDX”

MONTREAL, QUEBEC, CANADA, July 21, 2023/EINPresswire.com/ -- JD Euroway Finex (JDEFINEX), a regulated money service business and digital bank, is set to revolutionize the global financial landscape with the introduction of its groundbreaking Web3 Mobile Wallet and an upcoming Pilot e-Money & Deposit token program launch. — Dr Fritz Gerald Zephir, crm PhD

The launch of the Web3 Mobile Wallet forms part of JD Euroway's strategic partnership with DaffiOne Payment Services ehf, an Iceland-based innovator in digital payment solutions, MBS Global Investments, is a UAE-based initiative from EMEA Royal Families led by Private Office of Sheikh Nayef Bin Eid Al Thani and the Queen of Sheba Investment Authority (QSIA), a sovereign wealth fund. As part of its commitment to innovation and efficiency, JDEFINEX is addressing the shortcomings of legacy payment systems by pioneering payment rail innovation within the cross-border payment landscape. The JDEuroway wallet offers next-level, digital-first financial solutions to JD Euroway's institutional clients and partners, facilitating the streamlined tokenization of traditional assets on blockchain ledgers.

In addition, JDEFINEX is preparing for a Pilot e-Money and Deposit program launch in collaboration with its network of financial institutions. This move aligns with the increasing global trend towards tokenized deposits, which combine the stability of traditional banking with the efficiency and transparency of blockchain technology.

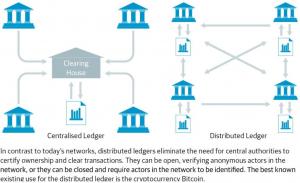

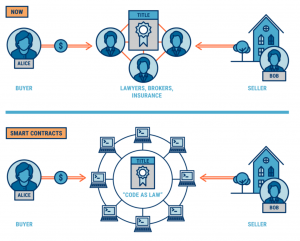

The Pilot e-Money and Deposit token program, underpinned by the power of Distributed Ledger Technology (DLT), is set to transform the way value is transferred across borders. The tokenization of deposits will enable real-time, secure, and efficient movement of assets between institutional stakeholders. This is achieved through the creation of digital tokens that represent existing bank deposits, thereby bypassing the traditional complexities and inefficiencies associated with cross-border transfers.

Moreover, the Pilot will provide the ability for clients of different banks and financial institutions to directly transfer value to each other using authorized digital currencies, akin to conventional bank payments. The tokens can be minted onto third-party DLT networks such as a consortium blockchain, initially targeting financial institutions that are members of the consortium. The e-Money tokens in this scenario are acting as digital representations of Account balances held under a correspondent banking relationship, making the process more efficient by leveraging the transparency, security, and speed of DLT. This is a significant innovation as it overcomes some of the challenges associated with correspondent banking, such as the need for liquidity to be locked up in these accounts and the time it takes to reconcile and settle transactions.

JDEFINEX's approach significantly enhances the speed, transparency, and security of cross-border transactions, while simultaneously reducing costs. By making the cross-border transfer of value as seamless as domestic transactions, JDEFINEX is paving the way for a new era of global financial interoperability.

In the realm of cross-border payments, JDEFINEX foresees significant benefits to arise from the convergence of information and value on shared ledgers. In 2020 alone, to move US$23.5 trillion across borders, settlement costs represented US$120 billion and took an average of 2-3 days. As many Central Banks are now exploring the launch of Central Bank Digital Currency (CBDC), estimates suggest that a multi-currency CBDC could slash these costs by a staggering 80%, down to approximately US$20billion. The advent of deposit tokens, such as those in our Pilot e-Money and Deposit token program, can unlock similar, if not greater, benefits. They drastically reduce fees, settlement times, and counterparty risks, while enabling more direct, efficient, and transparent transfers. Deposit tokens with their sophisticated payment operations features that operate 24/7, are poised to revolutionize the cross-border settlements landscape, bringing us one step closer to a fully digitized global financial ecosystem.

Mr. FritzGerald Zephir, President of JD Euroway said, "Our JD Euroway Web3 Mobile Wallet and forthcoming Pilot e-Money & Deposit token program are integral to our robust and regulated Digital Payments Financial Market Infrastructure (DPFMI). This infrastructure, which will be operational through JD Euroway's network of International Financial Centers (IFC) located in strategic Free Trade Zones, is a significant step towards realizing our vision of a fully digitized global financial ecosystem. The DLT-based Consortium Network and Wallet solutions, as part of this infrastructure, are set to serve a market of over 430 million people, with over 20 banks and 3 central banks already in the process of onboarding our technology. This technology will be the cornerstone for the deployment of our IFC network in the 2nd quarter of 2023. By harnessing the power of Distributed Ledger Technology (DLT), we are empowering our clients with the tools they need to succeed in an increasingly digital global economy and ensuring that our clients can enjoy secure, private, efficient, and seamless cross-border transactions.”

As part of our mandate to continuously support our banking and institutional clients, shortly after the imminent launch of our Pilot program, we are to release our web-based institutional grade wallet. This blockchain agnostic wallet, designed with enhanced security features and functionalities, demonstrates our commitment to interoperability and flexibility of choices in the digital finance space.

Beyond the pilot, we are also looking forward to integrating the Bantu Blockchain infrastructure. Chosen for its advanced secure token issuance and management capabilities, Bantu offers features like token minting and burning, and regulatory compliant features supporting KYC/AML/CFT requirements. This mirrors real-life currency circulation, making it ideal for e-money tokens and other regulatory compliant digital assets or currencies. In addition, Bantu aligns with our commitment to environmental responsibility, by providing a low carbon DLT network infrastructure and consensus mechanism. This integration enhances our offerings, providing a flexible, realistic approach to digital currency management while upholding our dedication to cutting-edge, secure, and environmentally conscious solutions

As the digital finance space continues to transform, JDEFINEX remains at the forefront, consistently delivering unrivaled, client-centered solutions.

About JD Euroway

JD Euroway Finex is part of the JD Euroway Financial Group part of the JD Euroway Financial Group, JD Euroway. This multinational group of private financial institutions is headquartered in Montreal, Canada, with operations spread across five continents and operating in 28 countries across the globe.

Gerald ZEPHIR

JD EUROWAY

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.