Diversified Portfolio Construction: A Case for Active Responsible Investment Strategies

DropShot Capital utilizes artificial intelligence to guide market strategy and outperform competitors.

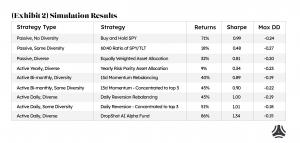

DropShot Capital Management has performed a simulation showing the benefits of active and diversified investment management.

SP500 ETF (NYSE:SPY)

HOBOKEN, NEW JERSEY, UNITED STATES, March 21, 2023 /EINPresswire.com/ -- DropShot is an AI-Driven Fund that aims to generate superior returns with lower risk through automated investments. Their approach to portfolio management is active, long-only and leverage-free, trading in highly liquid ETFs. In this article, DropShot wishes to make the case that diversifying one’s portfolio while maintaining active and adaptive trading methods is the most efficient way to mitigate risk while still participating in market returns.The experiment is to compare the risk profile of various popular passive and active portfolio management strategies with varying degrees of activeness and diversification. For the test, DropShot used the post-Corona pandemic timeframe, starting on 3/24/2020 and ending on 3/10/2023, a total of 745 trading days. The three years simulated encompasses a variety of market regimes as a continuous stream of unprecedented events weighed continuously on markets.

The portfolio consists of the ETFs that represent a wide cross asset exposure (Exhibit 1A).

The simulation uses several portfolio management techniques to trade these ETFs, long only. The gross performance of DropShot's AI Alpha Fund was also included which uses machine learning to trade an even more diversified basket of assets (Exhibit 1B).

The simulation results (Exhibit 2) conclude that even in various unique market climates, best results are driven by an active, diverse trading strategy.

Simply put, passive strategies vastly underperformed during this time. With both stocks and bonds suffering during the back end of the simulation, 60:40 and risk parity portfolios were unable to keep up. The best passive strategy was to simply diversify by equally weighting the universe.

Active management outperforms Passive management.

Momentum and reversion, two opposing market investment philosophies, are used in the simulation and are almost equal in post pandemic performance. This means that whether you bet the losers will win, or the winners will win, you are still better off than a long term, non-dynamic bet.

Diversification of one’s portfolio is a concept that should be embraced diligently as a method of offsetting the risk of any one sector, country or instrument melting down. Risky propositions such as unknown crypto coins belong only as a small part of a portfolio. By picking from highly liquid ETFs, one can gain access to a wide variety of market exposures. By allocating to a wide range of safe assets, and applying advanced quantitative methods, strategies become much more robust particularly in difficult market conditions.

This is why DropShot’s proprietary trading algorithm achieved double the performance of the simplistic but active methods. The research process goes to extraordinary lengths to achieve favorable rewards for diminished risk in turbulent markets. Using machine learning is just one part of the approach, the most important point is that it is operated with common sense. The algorithms are continuously learning and adapting to new market conditions, which allows DropShot Capital to stay ahead of the curve and identify opportunities that other investors may overlook.

Happy trading!

DropShot Capital

--

Christopher Kramvis

DropShot Capital

+1 630-728-6747

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

TikTok

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.