Being Prepared to Combat Fraud Attempts

Protect your company against fraud with risk-based suspicious transaction monitoring and the latest technology solutions like Sanction Scanner.

LONDON, UK, February 14, 2023 /EINPresswire.com/ -- Financial crimes are increasingly damaging the reputation of institutions, causing a loss of customers, financial loss, and legal liabilities. Fraud, a term we have been hearing more about lately in 2023 and gaining momentum in parallel with technological developments, will be one of the most critical topics on companies' agendas.Protect Your Company with Fraud & Suspicious Transaction Monitoring

Fraud is a broad term that covers activities such as making financial transactions for illegal purposes or stealing/misusing financial assets. The most common types of fraud for organizations include identity theft, credit card fraud, online fraud, debt collection fraud, insurance fraud, money laundering, and terrorism financing. Companies use several methods to detect and prevent fraud attempts with these crimes. The most basic and effective of these are the suspicious transaction monitoring procedures implemented by companies for compliance against money laundering.

Suspicious transaction monitoring procedures help organizations meet regulatory compliance requirements, while also playing a critical role in preventing fraud. These procedures enable institutions to automatically monitor the transactions taking place in their customers' accounts and analyze them to detect potential fraud activities. It is not possible for institutions to manually control hundreds of thousands or even millions of transactions to detect fraud activities. With suspicious transaction monitoring, organizations can detect fraud activities in a time and resource-efficient way.

Risk-Based Approach to Fraud

Suspicious transaction monitoring enables organizations to use a risk-based approach. The risk level of customers is calculated based on many factors such as trading volume, trading frequency, account history, customer ID, and other parameters. In this way, institutions can identify high-risk customers and monitor their transactions more closely. However, this process is not sufficient to detect fraud activities. Financial institutions need to take a comprehensive approach to detect and prevent these activities using risk analysis, customer verification, fraud detection software, and other fraud detection and prevention technologies.

Latest Technology Solutions

Today, with increasing data and digitalization, fraud detection is no longer a process to be followed manually. At this point, technology companies take the stage and develop solutions supported by AI and machine learning for financial institutions.

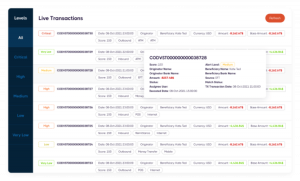

Sanction Scanner, with its software developed entirely by Turkish engineers, offers financial institutions a suspicious transaction monitoring product for fraud detection. With this autonomous, artificial intelligence, and API-supported, modular and competitive product, companies can monitor in real-time all financial activities carried out by their customers or the users they serve. Thanks to the algorithm that the product runs, an anomaly detected during this follow-up is marked as a suspicious transaction, and authorized users are notified of these transactions. Considering the threat posed by suspicious transactions, the product stops the process during the inspection and prevents any illegal attempt.

Distinguishing from its counterparts in the industry, Sanction Scanner Suspicious Transaction Monitoring product is prepared in accordance with the company using it. Firms determine their risk appetites according to their sector, location, and currency, and company size and can adapt the product accordingly.

An Enhanced Test Ground for Simulation

The Sanction Scanner Suspicious Transaction Monitoring product has been developed so that each company can determine its rules in line with its own needs and create rule sets from these rules specific to customers or segments. It also provides a simulation environment where customers can test the rules they create before they go live. Here, the prepared rules are applied to previous processes, and the results are compared. Thus, companies can determine the most optimized rules on transactions mediated by their companies.

While it is not possible for companies to detect threats manually among countless data and prevent these transactions in today's conditions, these technology-based products can reach solutions without the need for large teams and manual processes. After a fast integration process, are you ready to combat fraud and other illegal transactions with Sanction Scanner?

Digital Marketing Team

Sanction Scanner LTD

+44 20 4577 0427

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.