How are EU electricity prices formed and why have they soared?

EU energy prices have followed a marked increase from July 2021. But why ?

BRUSSELS, BELGIUM, October 25, 2022 /EINPresswire.com/ -- EU energy prices have followed a marked increase from July 2021. As the economy recovered from COVID-19, the growing energy demand started to push prices on an upward trend last year. Moreover, Russia’s invasion of Ukraine followed by its decision to cut natural gas supplies to Europe have then considerably shaken the energy system and triggered a sharp rise in inflation. The cost of natural gas imports continues to have severe impact on the customers, and the overall economy. Why do European electricity consumers feel the pinch? To find out the answer, it is important to understand the electricity value chain, as well as the basics of power markets.

What is the electricity value chain?

The value chain is all the companies or entities that play a role in the electric ecosystem. Traditionally, it includes:

Generators - companies with generation assets, namely power plants running on wind, solar, hydro, coal, gas, nuclear and any other kinds of fuel. They produce electricity and sell it on the wholesale market

Transmission system operators or TSOs – entities which manage the transmission networks, i.e., high-voltage power lines linking generation assets and transformers. A non-exhaustive list of their responsibilities includes among others: assessing demand, informing generators about short-term (day ahead, for instance) and long-term needs for electricity (both baseload and peak demand); manage the flows on interconnectors.

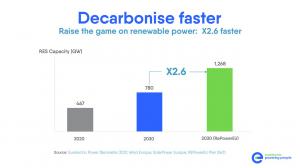

Distribution system operators or DSOs – entities which operate the distribution network typically medium and low-voltage lines, bringing electricity to customers. They make sure there are no congestions, re-establish the connection in case of power cuts, and cooperate with TSOs to enable the effective participation of those connected to the grid in retail, wholesale and balancing markets. Their role becomes ever more critical to the functioning of growing numbers of heat pumps and electric vehicles, to the connection of renewable plants, and the further decentralisation of the energy system. It is expected that by 2030, 70% of the additional renewable capacity to be connected at distribution level.

Suppliers – companies that sell electricity to consumers, providing competitive rates. Since the liberalisation of the electricity market, customers can freely choose their supplier and change should a better offer or service be made available.

The system is now becoming more complex, as many more participants emerge. For instance, prosumers – i.e. consumers who have installed generation capacities, such as solar panels on rooftops at home or in commercial buildings - are now able to inject electricity into the network. This is transforming the traditional functioning of the grid, which is shifting to bi-directional flows.

How does the EU electricity market function?

The electricity market follows the economic principles of demand and supply, aiming at ensuring that demand is served at any moment in time in the most cost-effective way. In very basic terms, electricity generators sell their production on the wholesale market. This is further sold by suppliers to consumers via the retail market.

What are the frameworks that govern the EU electricity markets?

Between 1996 and 2009, three packages containing Electricity Directives and Regulations have established a set of common rules for internal energy market. EU Member States intended to put an end to the traditional monopolies by organising competitive power exchanges, both within the countries and across their borders. This would offer customers, be they citizens or businesses, competitive prices; give efficient investment signals and higher standards of service; help maintain security of supply and contribute to sustainability goals.

Electricity wholesale prices – explained

Wholesale electricity prices are the formed as a result of the competition between generators who bid in the intraday, day-ahead and forward markets, striving to sell their production and meet the demand forecasted by transmission operators (TSOs).

The day ahead delivery, TSOs make provisions for every single hour of the following day, assessing how much generation capacity will need to produce and serve demand. Based on this forecast, generators inform if they are able to produce electricity for the various slots and at which price.

As the system is built to serve demand at the lowest price, generators are dispatched from the cheapest to the most expensive, until the supply and demand curves meet. Generators will bid, and the wholesale price will settle at the rate proposed by the last power plant (i.e. the marginal plant) activated to serve demand. The wholesale power price will thus be equal to the variable marginal cost of the last power plant needed. Each generator who supplies during that time frame will be paid at the same level as the last activated producer. This is called inframarginal rent and it is used to ensure a return on fixed investment costs.

Why are electricity prices so high?

The spike in electricity rates initially resulted from a higher energy demand than what was planned for a COVID-19 recovering economy. Yet, this further accelerated as it soon became clear that the main cause were the supply disruptions in the gas market, as well as the high volatility this commodity is exposed to when trading.

Retail electricity prices

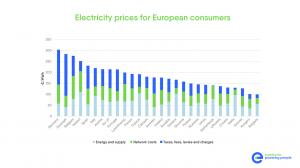

The retail electricity price is the amount that a customers pay per kwh of electricity used during a certain period of time. The bill includes the electricity price - reflecting the consumption-, the transmission and distribution network tariffs, as well as taxes and levies.

In Europe, the electricity component represents 31% of the electricity bill, while network tariffs account for 28% and taxes and levies reach 41%.

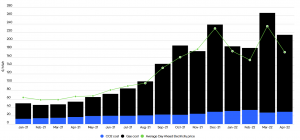

Changes in the wholesale rates have a direct impact on the retail price. Latest data presented in the Power Barometer shows that wholesale raised by 532% between January 2021 and August 2022. As a result, retail price offers made to customers living in capital cities jumped by 84% .

The network tariffs

The network cost encompasses the expenses associated with transmission and distribution.

Read Eurelectric's "Electricity Prices Explained" for a deep dive into the price formation of the electricity bill

Ioana Petcu

Eurelectric

+32 470 45 35 89

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.