HULT Private Capital Takes A Look Into The Future of Crypto and NFTs

Crypto has long been on the lips of many investors, here HULT explores it’s offerings and potential

HULT Private Capital sees 2022 as another banner year for digital assets”

JLT, DUBAI, UNITED ARAB EMIRATES, March 18, 2022 /EINPresswire.com/ -- 2021 was a massive year for crypto, having what HULT Private Capital calls its “breakout” year. The broad strokes saw the price of Bitcoin go from $34,622, reaching its all-time high of $68,990, before ending 2021 at $37,928, a modest 9.5% gain for the year. Vitalik Buterin’s Ethereum climbed from $1,385 to $2,614, a jump of 89%. Memecoins, like Dogecoin and Shiba Inu , saw rises in the thousands or, the rare case, millions of percent, and NFTs became both hot and controversial items. The market size grew from $758 billion at the beginning of last year, reaching nearly $3 trillion before dropping back to about $2.6 trillion. Though 2021 saw some profound changes, crypto is just barely a teen, with more growth to come leading us to ask:— HULT Private Capital

What Does HULT Private Capital Expect To See Through 2022?

Regulation:

The parents are starting to pull crypto back in, with more regulation, particularly in stablecoins. Lawmakers worldwide are trying to regulate an industry, with few borders at best, by creating guidelines for safe crypto investing and fighting cybercriminals. For most, regulation is wanted, but crypto’s decentralized nature makes it challenging to monitor and enforce. The US Fed announced it has no plans to ban Crypto as China has, but they may restrict the industry further.

Crypto ETFs:

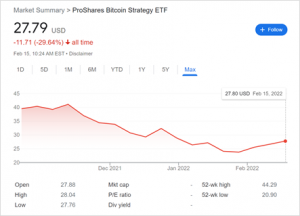

BITO the first Bitcoin ETF hit the NYSE listings in October; with more almost certainly on their way. BITO holds no Bitcoin, only purchasing futures contracts, which usually follow the trend of the coin, but not its price directly. Several ETFs are seeking SEC approval, but BITO was the first to gain it. HULT Private Capital sees 2022 bringing several Crypto ETFs to the table, including those with direct crypto holdings.

Investors have largely avoided BITO, with the price falling from its listing. HULT Private Capital believes that the more accessible crypto are via traditional investing products, the larger the market grows. Expanding out from crypto exchanges allows those who would never invest in crypto to

adopt them as part of their retirement account. As a burgeoning industry, all crypto remain risky. For 2022, HULT Private Capital warns crypto will remain speculative and volatile investments no matter what format they are packaged, keeping them as a small proportion of a diverse portfolio is warranted.

Institutional Adoption:

The finance industry is now the most developed; payment services like Square and Paypal now allow users to buy crypto on their platforms. Mainstream companies have a growing interest in blockchain technology and cryptocurrency. Tesla is leading in a number of manufacturers who keep altering their acceptance of Bitcoin, and both Tesla and Elon Musk already hold billions in different crypto assets.

HULT Private Capital sees more global corporations considering crypto later in 2022. This move would jumpstart the broader adoption process if Amazon or any large bank went in for crypto. The chain reaction of crypto acceptance by Amazon adds credibility; however, the volatility of Bitcoin and other cryptos is such that this remains unlikely in the short term. As crypto volatility reduces, acceptance will increase, investors see the writing on the wall. Amazon and leading US retailer, Walmart have both made job postings for crypto and blockchain experts; they see a future in these technologies; it is just a matter of time.

HULT Private Capital on Bitcoin’s Future:

One of the best indicators of the crypto market is to use Bitcoin. Being the cryptocurrency with the largest market cap, the rest of the market usually follows Bitcoin’s movements.

Bitcoin’s price still had a wild ride in 2021, reaching its all-time high of over $68,000 in November, superseding earlier highs in both April and October. Between these records, Bitcoin saw a July fall below $30K. Continued volatility is why HULT Private Capital recommends only keeping a maximum of around 5% of your portfolio in crypto.

Like many experts, HULT sees Bitcoin eventually hitting $100,000, and with history as a guide, Bitcoin has seen plenty of huge spikes before pullbacks since its inception. Most should not worry about spikes and dips, emotional trading can hurt overall returns. Volatility in the short-term but continued growth in the long-term is the trend Bitcoin follows, making the long game the easiest move.

NFT’s and Other Crypto Futures:

NFTs (non-fungible tokens) garnered lots of fame and popularity in 2021, and HULT Private Capital sees this continuing into 2022. Whilst you will hear many speculate on the values of different tokens and NFTs throughout 2022, the reality is that they are mainly speculative investments, and experience high levels of volatility. A single tweet from a billionaire, Instagram influencer, or a move by a ‘whale’ can have huge effects on NFT collections and crypto tokens, and so too, does any governmental scrutiny or the decisions of a country’s regulating body. HULT Private Capital sees keeping a small, diversified portfolio of cryptocurrencies and digital assets that have the best potential for future use as the soundest investment strategy.

HULT’s Summary:

HULT Private Capital sees 2022 as another banner year for digital assets. We will see several all-time highs for some and crashes for others. In the long run, we want to see the volatility reduce, and the acceptance grow. If this broadens in 2022, it will undoubtedly be a positive move for the space and investors involved.

Press Team

HULT Private Capital

+971 4 566 4052

press@hultprivatecapital.com

Visit us on social media:

Twitter

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.