DPM Mining Inc. Discusses some of the ESG SMART benefits considered during the evaluation of the AZM Taylor deposit

SMART creates a range of practical solutions that improve Environmental, Social and Governance of the Hermosa project while enhancing Taylor profitability.

TORONTO, ONTARIO, CANADA, November 16, 2021 /EINPresswire.com/ -- DPM 10 –– AZM SMART ESG Discussion.

DPM SMART mining inventor C. Gryba P.Eng. has independently evaluated the South32 owned Taylor deposit. The SMART study was done totally independent of South32, funded 100% by DPM mining and based on AZM information posted on Sedar. The AZM PEA 20 year financial model was rebuilt to evaluate the financial effect of SMART’s 10% reduction in dilution plus SMART recovers the 5% ore tonnage that is lost during the mucking of blasthole stopes. The SMART Base Case generates a 50% IRR and an after tax NPV@8% of US$1.76b vs the AZM PEA 42% IRR and NPV $1.27b. The SMART design is production scalable. Doubling the mine mill rate to 20,000tpd would increase the Taylor SMART NPV to US$3.52b or 277% . See EIN press releases DPM#1 to #9 for background SMART technical and financial analysis.

The ESG approval of a new mine has 3 main stakeholder groups. The 1st group includes Board of Directors, bankers and senior management, whose focus is governance plus minimizing mining and Capex costs to maximize the IRR-NPV of the project. The 2nd group includes the local public, environmentalists, government, and now ESG focused investors. The 3rd ESG group is the mine staff whose focus is safer and improved work conditions for both male, female miners whose jobs depend on the mine being a long term sustainable business.

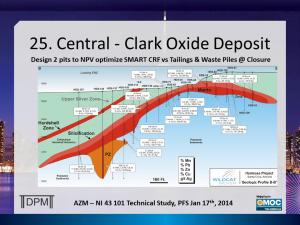

Environmental, permitting and social opposition organized via the 2nd ESG group can now prevent a mine from being permitted in a timely fashion. This group “mandates” that a minesite must minimize the carbon and environmental footprint which includes elimination surface tailings storage, waste rock piles, unfilled pits plus prior to closure, contouring the minesite back to original topography then replanted with native vegetation. SMART’s unique technical advantages combined with the Central oxide orebody can create a modern ESG mine design that neutralizes many permitting hurdles. See Image 25, the Clark Deposit in 2014 had a M&I Resource of 181mt grading 1.29opt Ag and 5.67% Manganese.

The SMART ESG approach is to contract mine the oxidized Manganese deposit via several open pits. Assuming a 2:1 W:O ratio, an initial 100mt pit would generate 33m of ore to feed a Manganese metallurgical circuit plus stockpile 67m tons of SMART CRF aggregate. Backfilling the 1st pit would store 10 years of mixed sulphide - oxide tailings. At $2.50t mining cost, the Capex would be $250m. Design a 2nd pit to match the SMART LOM requirements. Whittle Consulting specializes in NPV optimization of complex matrix type mine plans to minimize preproduction and future Capex.

Governance focus, post Bre-X, has resulted in the mining industry adopting the PEA to FS approach to protect shareholders. An unfortunate side effect is that several PEA rules can legally keep SMART mining out of a FS. Secondly, ESG permitting starts as soon as an ore body appears economic. SMART uses CRF, not paste fill thus is offside with current AZM permitting. Thirdly a SMART trade off study via the PEA shaft design would make SMART appear to be uneconomic, hence the redesign to a triple ramp system to optimize SMART mining costs.

Taylor as per the PEA design would be a typical blasthole mine; hot, wet with relatively poor ground that requires stopes to be backfilled. Paste fill drains over time creating up to .5m high voids along the top of stopes. SMART jams CRF thus eliminating subsidence risk to mill foundations, oxide pit walls or creation of new pathways for water. NA blasthole mine productivity in 2021 is only 10 to 15tpms using the same equipment and paste fill as the Taylor PEA. Miner productivity has dropped 3% per year over the past 15 years. Blasthole mining is a poor platform for introducing Smart technology as all improvements introduced over the same time period could not improve ESG or profitability.

SMART is an ideal ESG mining platform. The SMART spreadsheet of 1,240t stopes is simply better suited to mine a complex, flat dipping orebody. SMART panel mining under concrete roofs provides a safer work environment, neutralizes poor wall rock, plus for example, separates sulphide and oxide ore on a round by round basis. The kriged geological model that generates the SMART LOM plan can be rerun daily or monthly by entering updated exploration, mine mill and cost data. With each rerun, the NSR value of every unmined SMART cell becomes more and more accurate, thus adjacent indicated and inferred SMART cells continuously convert to mineable ore maximizing Taylor sustainability. See Image 26 for SMART sustainability factors.

In effect, the SMART platform is a undercut and fill mining method that was redesigned to eliminates falls of ground, dilution and be more productive. SMART was mine proved by Penoles thus qualifies for feasibility studies. The SMART spreadsheet platform adds multiple ESG checks and balances to traditional mining methods. Risks due to cut factors, dilution, ore grade or complex metallurgy are accurately identified to specific SMART cells. Also, SMART can visually audit the sustainability of blasthole or UC&F mine plans. Simply plot the planned stope perimeters on all color coded SMART 6m lift plans; this instantly shows that blasthole feasibitity studies on average only recover 75% of an orebody tonnage vs SMART's +90% .

The 2 ESG elephants in the room for underground mining is the large carbon foot generated by cement usage plus the energy required to run the mine and mill circuit. SMART eliminates the power required to grind a minimum of 10% dilution plus SMART's mill revenue is 10% higher but at the same energy cost. Solar power to is more feasible as SMART eliminates the large power swings due to hoist motors. Energy requirements are reduced, for example by pumping water from sumps located closer to surface and multiple ramps reduce the overall ventilation resistance. See Image 27 for energy and cement reduction options.

Rather than keeping the SMART technology confidential 15 EIN press releases will be issued to explain SMART to both the financial and mining communities.

Charles Gryba

DPM Mining

+1 416-801-6366

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.