Retail investors are no longer the dumb money

With advanced analytics tools and new datasets, professional retail investors are now tapping into new realms of investment research for a differentiated view

SINGAPORE, SINGAPORE, July 23, 2021 /EINPresswire.com/ -- With advanced analytics tools and new datasets, professional retail investors are now getting a differentiated view on the market and tapping into new realms of investment research. Some are new areas that traditional fund managers are not even aware of and we are not talking about Reddit.In May, Gareth (not his real name) creamed a 6-digit profit from his NYSE:AMC position. A short-term trade where he held his position for just 2 days, a 22% pop added meaningfully to his personal trading account. Back when he used to run the London equities S&T desk for a European Investment Bank, discretionary fast-money accounts he used to cover would execute trades like this once a quarter at best. No doubt, increased market volatility has contributed to more of such short term opportunities but the real juice is in the way such trade ideas are being generated.

Enter the realm of alternative market and fundamental data – everything from short interest, telegram chat signals, brand level search volume to real time retail footfall. “US Funds have had a clear lead in this domain and there are many Chinese tech players and robo-investing firms that are tapping into these as well. Europe still lags. The biggest change however is the way prosumers or retail investors are now getting access as well. In Asia, they [family offices and traditional funds] haven’t even got their head around how to get or use such data.” said Gareth.

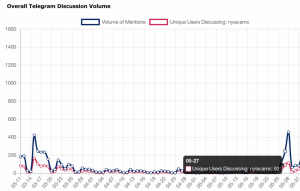

What prompted Gareth’s trade, was a buy signal across a consolidation of Wallstreet Trading groups on Telegram. Between the 25th of May and 27th of May, the volume of unique individuals discussing AMC registered 3 consecutive days of increase and surpassed the trailing 3-mth peak. At the same time, sentiment tracked through natural language processing of chat conversations on these groups suggested that the retail trading community was going long. What followed after, was history as the retail trader community moved on with their short squeeze that drove AMC’s share price to double between the 28th of May and 2nd of June.

AMC’s share price gained through this period and ultimately spiked on 2nd June. “In some discretionary funds today, you will have teams of data scientist analyzing such data to find trade opportunities. But these are not rocket science and the tech folks out there have made these into SaaS platforms accessible to practically everyone.” Gareth shared. (Example: https://market.operatingdata.com/telegram-equities-data/)

While many fund managers are still spending tens of thousands buying seats on Factset, Bloomberg and spending thousands hiring research analyst; there have been a realization of late that financial analyses tend to be backwards looking. Even for fundamental investors, there is recognition among US and Chinese funds that sources of Alpha reside in being able to uncover a differentiated view on individual stocks through unique datasets that either tracks capital market sentiments (e.g. telegram conversations, 13F filings of hedge fund trades) or operating fundamentals (e.g. retail mall footfall for commercial REITs, brand level search volume)

Yet, it is not straight forward and access to such data doesn’t always mean funds know how to make full use of them. In Gareth’s words “if it was all that easy, money managers won’t exist anymore. You can’t just look at a bunch of Telegram datapoints and decide on a trade. The critical point is using such data to identify situations that are emerging, and then forming a view on whether you want to ride the squeeze or get out of your position”.

The new smart money retail investor weighs corporate fundamentals alongside capital market moves. When institutional funds are still fighting for data engineering and data science talent, professional retail investors like Gareth are increasingly tapping on free / low cost web analytics platform that are now targeting individual traders/investors and not just the large quant funds. These platforms help address questions such as: Which telecom service providers are gaining share of online search volume? If institutional fund managers have progressively reduced position in a counter, is there a reason to follow the flow and similarly derisk? If negative news in a company has been bubbling, is there cause for concern and time to reconsider a position?

Perhaps, the consumerization of data analytics is starting to level the playing field between institutional and retail investors. As data and analytics vendors grapple with long sales cycles to institutional funds and the hefty cost of account management, the budding community of retail investors naturally become an attractive new pool of customers. Afterall, recent events have showed that retired professional traders like Gareth and young traders who have gotten a taste of beating large hedge funds at their own game – well, they are not quite the dumb money of yesteryears anymore.

Alexis

Operatingdata.com

admin@operatingdata.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.