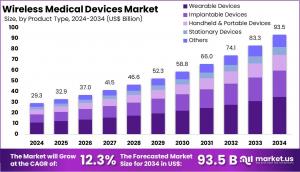

Wireless Medical Devices Market Expands at 12.3% CAGR, Reaching US$ 93.5 Billion by 2034

Wireless Medical Devices Market Size is expected to reach US$ 93.5 billion by 2034 from US$ 29.31 billion in 2024, at a CAGR of 12.3%.

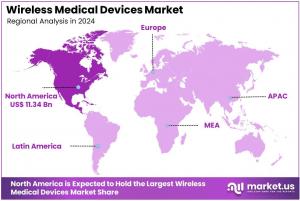

NEW YORK, NY, UNITED STATES, March 6, 2025 /EINPresswire.com/ -- The Wireless Medical Devices Market is projected to grow from US$ 29.31 billion in 2024 to US$ 93.5 billion by 2034, registering a CAGR of 12.3% during 2025–2034. North America dominates the market, holding a 38.7% share, valued at US$ 11.34 billion in 2024. This growth is fueled by advancements in digital healthcare, increasing chronic diseases, and the rising demand for remote patient monitoring. Organizations such as the World Health Organization (WHO) and U.S. Food and Drug Administration (FDA) highlight that wireless medical devices are transforming healthcare by enabling continuous health monitoring for conditions like diabetes and cardiovascular diseases.Wireless medical devices like glucose monitors, ECG patches, and wearable sensors facilitate real-time data transmission, improving patient outcomes. The Centers for Medicare & Medicaid Services (CMS) reports that these technologies help reduce hospital visits and lower medical costs, making them attractive to both patients and healthcare providers. Additionally, telemedicine adoption is rising, further driving the demand for wireless health solutions. According to the U.S. Department of Health & Human Services (HHS), 5G-enabled devices and the Internet of Medical Things (IoMT) are improving healthcare accessibility, particularly for elderly and rural populations with limited access to traditional care.

The integration of artificial intelligence (AI) and machine learning (ML) is enhancing wireless medical devices. The National Center for Biotechnology Information (NCBI) states that AI-powered wearables can analyze patient data in real-time and detect early signs of complications, reducing emergency cases. The FDA has also approved AI-integrated wireless devices for chronic disease management, allowing personalized treatment plans. Moreover, cybersecurity improvements in healthcare ensure better patient data protection, increasing trust in these technologies.

Government initiatives and funding are accelerating market expansion. The U.S. National Institutes of Health (NIH) and European Medicines Agency (EMA) are investing in research and development for remote health technologies. Programs supporting 5G-enabled medical devices are enhancing the efficiency and accuracy of wireless health monitoring. Additionally, partnerships between government health agencies and technology companies are streamlining regulatory approvals for new innovations. The Centers for Disease Control and Prevention (CDC) highlights that improved interoperability between wireless devices and electronic health records (EHRs) is allowing faster decision-making by healthcare providers.

Wireless medical devices are revolutionizing healthcare. Key drivers include rising chronic disease cases, AI advancements, government funding, and regulatory improvements. Organizations such as WHO, FDA, NIH, and CDC are actively promoting these technologies to enhance patient care and reduce healthcare costs. As 5G, AI, and cybersecurity advancements continue, wireless medical devices are expected to become an essential part of modern healthcare, improving efficiency and patient outcomes.

KEY TAKEAWAYS

• In 2024, the Wireless Medical Devices market earned $31 billion in revenue, growing at a CAGR of 12.3%, and is expected to reach $93.50 billion by 2034.

• The product type segment includes wearable, implantable, handheld, portable, and stationary devices, with wearable devices leading in 2024, holding 37.4% of the market share.

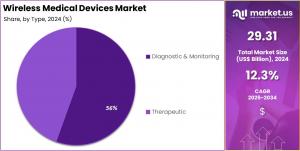

• By type, the market is divided into Diagnostic & Monitoring and Therapeutic, with Diagnostic & Monitoring holding a dominant 55.5% share in 2024.

• In terms of technology, the market includes Bluetooth, Wi-Fi, NFC, Zigbee, RFID, UWB, and others, with Bluetooth leading at 29.7% market share.

• Based on application, Point of Care emerged as the top segment, holding the largest market share of 32.2% in 2024.

• The end-user segment includes hospitals, home healthcare, ambulatory surgical centers, diagnostics, long-term care, and others, with hospitals & clinics leading at 31.7%.

• North America dominated the market in 2023, securing the largest regional share of 38.7% in the Wireless Medical Devices market.

Get Sample PDF Report: https://market.us/report/wireless-medical-devices-market/request-sample/

COMPREHENSIVE ANALYSIS

The primary goal of this report is to deliver factual, actionable data about the Wireless Medical Devices market. It equips readers with the necessary information to formulate and execute informed strategies based on the extensive data provided. The report includes detailed market statistics that offer insights into the current market status, future projections, and classifications based on various criteria such as product type, end-use, and region.

The report thoroughly covers the classification of the Wireless Medical Devices market, highlighting significant aspects like product types and the main industries associated with the Wireless Medical Devices Market. It also delves into critical industry dynamics such as development trends, supply, and demand conditions. This analysis provides a deep understanding of the market's current landscape and growth trajectory over the years.

Furthermore, the report extensively analyzes business plans, sales, and profitability to enhance readers' understanding of the Wireless Medical Devices market. It discusses essential elements like production volumes, sales data, key raw material suppliers, and buyers in the industry. These details are crucial for understanding the informational needs and distribution rates within the market.

MARKET INSIGHT AND COMPETITIVE OUTLOOK

The Competitive Landscape section of the Wireless Medical Devices market report meticulously examines the dominant players shaping the industry. This analysis underscores the strategic initiatives and relentless efforts these firms undertake to secure competitive advantages. Through detailed evaluations, the section offers insights into the strategies deployed by these key influencers, enhancing stakeholders' understanding of the market dynamics.

This segment features comprehensive profiles of each leading company, providing essential details such as company history, business focus, and market position. These profiles help readers visualize the major forces sculpting the market landscape, offering a snapshot of each entity's influence and strategic direction.

The report also delves into company overviews and financial highlights, presenting a clear picture of the economic health and investment priorities of these entities. This financial analysis is crucial for stakeholders, as it elucidates the funding dynamics and revenue streams that drive these companies toward market leadership.

Furthermore, the section elaborates on product portfolios, SWOT analyses, key strategies, and developments. This compilation not only highlights the strengths, weaknesses, opportunities, and threats each company encounters but also showcases their strategic maneuvers and product innovations. Such comprehensive details provide a well-rounded understanding of their market presence and growth tactics.

The Primary Entities Identified In This Report Are:

• Medtronic plc

• Koninklijke Philips N.V.

• GE Healthcare

• Abbott

• Boston Scientific Corporation

• Siemens Healthineers

• Omron Healthcare, Inc.

• Dexcom, Inc.

• Fitbit Health Solutions

• Samsung Electronics Co. Ltd.

• Digi International Inc.

• Baxter

• Biotronik SE & Co. KG

• Other Prominent Players

SEGMENTATION PERSPECTIVE

The Wireless Medical Devices Market is segmented by product type into wearable devices, implantable devices, handheld & portable devices, stationary devices, and others. Wearable devices dominated the market in 2024, holding a 37.4% share due to their role in continuous health monitoring and fitness tracking. Devices like smartwatches, fitness bands, and wireless ECG monitors provide convenience, real-time data access, and non-invasive monitoring. Implantable devices, including wireless pacemakers and neurostimulators, are gaining traction for chronic disease management but face regulatory challenges. Handheld devices, such as wireless glucose meters, offer mobility, while stationary devices remain essential for clinical use.

The diagnostic & monitoring segment held the largest market share at 55.5% in 2024. This dominance is due to its scalability, cost-effectiveness, and ability to provide real-time data access. Cloud-based solutions enable secure storage and analysis of patient data, enhancing remote patient monitoring and telemedicine. On-premise solutions offer better data control but face scalability limitations and high costs. The growing focus on interoperability and cloud security continues to drive cloud adoption in healthcare. AI and IoT advancements further support the demand for diagnostic & monitoring wireless solutions.

Bluetooth led the market with a 29.7% share in 2024 due to its low power consumption, ease of use, and compatibility with wearable devices. Fitness trackers, smartwatches, and wireless glucose monitors widely use Bluetooth for seamless connectivity. Wi-Fi is essential for high-data transmission applications like remote monitoring but faces adoption barriers due to high power consumption. NFC and RFID are commonly used in healthcare asset tracking, while Zigbee and UWB serve niche applications. Bluetooth’s cost-effectiveness and versatility ensure its leading position in wireless medical device connectivity.

The Point of Care segment held a 32.2% market share in 2024, driven by the rising demand for remote patient monitoring and home-based care. Wearable ECG monitors, glucose meters, and pulse oximeters enable continuous health tracking, reducing hospital visits. Cardiology applications, including wireless pacemakers, play a crucial role due to the increasing prevalence of cardiovascular diseases. Wireless neurostimulators and smart inhalers support neurology and respiratory applications. Diabetes management remains significant, with wireless insulin pumps and glucose monitors improving patient outcomes, aligning with the shift toward decentralized healthcare.

Hospitals & clinics led the end-user segment, holding a 31.7% share in 2024. These facilities adopt advanced wireless technologies for diagnostics, monitoring, and treatment. Wearable monitors, wireless imaging systems, and connected infusion pumps improve patient care and operational efficiency. However, home healthcare is the fastest-growing segment, driven by remote monitoring and chronic disease prevalence. Ambulatory surgical centers and diagnostic centers use wireless devices for enhanced workflow efficiency. Long-term care facilities are adopting wireless solutions to improve elderly care, yet hospitals remain dominant due to high patient volume.

Key Segments Covered In This Report Are:

By Product Type

• Wearable Devices

• Implantable Devices

• Handheld & Portable Devices

• Stationary Devices

• Others

By Type

• Diagnostic & Monitoring

• Therapeutic

By Technology

• Bluetooth

• Wi-Fi

• Near Field Communication (NFC)

• Zigbee

• RFID (Radio Frequency Identification)

• Ultra-wideband (UWB)

• Others

By Application

• Cardiology

• Neurology

• Respiratory

• Diabetes Management

• Point of Care

• Others

By End-User

• Hospitals & Clinics

• Home Healthcare

• Ambulatory Surgical Centers

• Diagnostic Centers

• Long-Term Care & Assisted Living Facilities

• Others

Buy Directly: https://market.us/purchase-report/?report_id=141096

REGIONAL ANALYSIS

North America dominates the Wireless Medical Devices Market due to the strong presence of key industry players like Medtronic, Philips, and GE Healthcare. These companies focus on continuous innovation, launching advanced wireless medical devices. The rising prevalence of chronic diseases, including diabetes and cardiovascular disorders, drives demand for wireless monitoring and diagnostic solutions. Additionally, the aging population further fuels market growth, as wireless healthcare solutions enable better disease management and real-time patient monitoring. This trend ensures sustained demand for wireless medical devices in the region.

Government policies support the market expansion in North America, especially in the U.S. The FDA actively promotes digital health solutions, creating a favorable regulatory environment. Additionally, the integration of IoT and AI into healthcare systems enhances efficiency, enabling early diagnosis and remote monitoring. The U.S. accounts for the largest revenue share in the region, while Canada experiences steady growth due to increasing healthcare investments and rapid technological advancements in wireless medical technologies.

A key factor driving growth is North America’s focus on improving patient outcomes while reducing healthcare costs. The adoption of wireless medical devices improves patient care efficiency and minimizes hospital visits. Remote monitoring solutions enable early detection of health complications, reducing emergency admissions. With growing investments in wireless healthcare infrastructure, the market is expected to expand further. These developments position North America as a leader in the wireless medical devices industry, attracting major players to strengthen their presence in the region.

Companies continue to introduce new innovations and strategic partnerships, fostering market growth. For example, in May 2023, DeviceLab (Tustin, CA) and Nouslogic Telehealth, Inc. (Irvine, CA) announced a strategic partnership. The collaboration aims to develop next-generation wireless medical devices and remote patient monitoring systems. By combining expertise in engineering excellence, these companies are driving cutting-edge healthcare solutions, advancing the wireless medical technology market in North America.

What to Expect in Our Wireless Medical Devices Market Report?

1. Market Growth and Industry Dynamics

○ The report examines market drivers, challenges, and opportunities shaping the Wireless Medical Devices industry.

○ It identifies key trends influencing industry growth and technological advancements.

2. Regional and Country-Level Market Insights

○ The report provides an in-depth analysis of market share, consumption patterns, and growth potential across key regions.

○ It highlights countries driving industry expansion and emerging market opportunities.

3. Competitive Landscape and Key Players

○ The report analyzes leading market players, their revenue performance, and strategic initiatives.

○ It evaluates competition intensity, highlighting key challenges and market positioning.

4. Mergers, Acquisitions, and Expansion Strategies

○ The study covers major industry mergers, acquisitions, and business expansions shaping the market.

○ It provides insights into market concentration levels and top players' shares.

5. Opportunities for New Market Entrants

○ The report identifies potential market gaps and investment opportunities for new entrants.

○ It examines market entry strategies and factors influencing business success.

6. Strategic Business Expansion Plans

○ It details how companies are expanding their market presence and strengthening their competitive edge.

○ It explores partnerships, collaborations, and technological advancements driving growth.

7. Impact of Competitive Strategies on Market Trends

○ The report assesses how competition influences product innovation and pricing strategies.

○ It evaluates competitive advantages and challenges shaping industry development.

8. Emerging Trends Impacting Future Growth

○ The study highlights innovations, automation, and evolving regulatory landscapes shaping market growth.

○ It forecasts new technological advancements in Wireless Medical Devices.

9. Fastest-Growing Product Types and Market Segments

○ The report identifies product categories with the highest projected compound annual growth rate (CAGR).

○ It examines demand trends across different product segments.

10. Dominant Application Segments in the Industry

○ The study outlines key application areas driving demand in the Wireless Medical Devices market.

○ It evaluates sector-wise market penetration and revenue contributions.

11. Lucrative Geographical Markets for Manufacturers

○ The report highlights the most profitable regions for manufacturing and market expansion.

○ It provides insights into regional demand, regulatory frameworks, and investment opportunities.

This report provides well-researched conclusions and actionable insights, helping businesses navigate the evolving Wireless Medical Devices industry effectively.

CONCLUSION

The Wireless Medical Devices market is growing rapidly, driven by advancements in digital healthcare, the increasing need for remote monitoring, and the integration of AI and 5G. These devices enhance patient care by providing real-time health data, improving diagnosis, and reducing hospital visits. Government initiatives, regulatory approvals, and funding are further accelerating adoption. North America leads due to strong healthcare infrastructure and key industry players. Wearable and diagnostic devices dominate, with Bluetooth as the preferred connectivity option. As technology advances, wireless medical solutions will become essential in modern healthcare, ensuring better accessibility, improved patient outcomes, and reduced medical costs. The future holds continuous innovation, making healthcare more efficient and connected.

*Note: We offer customized market research reports tailored to meet your specific business needs and requirements.

GET MORE TRENDING REPORTS

• Medical Device Cleaning Market: https://market.us/report/medical-device-cleaning-market/

• Medical Device Cybersecurity Market: https://marketresearch.biz/report/medical-device-cybersecurity-market/

• Medical Device Enclosure Market: https://marketresearch.biz/report/medical-device-enclosure-market/

• Medical Device Gaskets and Seals Market: https://market.us/report/medical-device-gaskets-and-seals-market/

• Medical Device Outsourcing Market: https://market.us/report/medical-device-outsourcing-market/

• Medical Device Packaging Market: https://market.us/report/medical-device-packaging-market/

• Medical Devices Market: https://market.us/report/medical-devices-market/

• Medical Devices Vigilance Market: https://market.us/report/medical-devices-vigilance-market/

• Pediatric Medical Devices Market: https://market.us/report/pediatric-medical-devices-market/

• Plastic Injection Molding for Medical Device Market: https://market.us/report/plastic-injection-molding-for-medical-device-market/

• Smart Medical Devices Market: https://market.us/report/smart-medical-devices-market/

• Software as a Medical Device (SaMD) Market: https://market.us/report/software-as-a-medical-device-samd-market/

• Wearable Medical Devices Market: https://market.us/report/wearable-medical-devices-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.