Rigid Foam Market to Reach USD 155.2 Billion by 2032, Propelled by Growth in Insulation & Packaging Sectors

Advancements in thermal insulation and energy-efficient materials propel the adoption of rigid foam across industries, enhancing sustainability and performance.

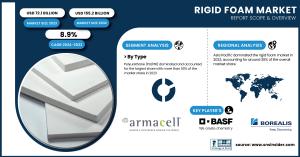

AUSTIN, TX, UNITED STATES, February 24, 2025 /EINPresswire.com/ -- The Rigid Foam Market Size was valued at 72.1 Billion in 2023 and is expected to reach USD 155.2 Billion by 2032, growing at a CAGR of 8.9% over the forecast period of 2024-2032.Rigid foam is witnessing significant demand due to its superior insulation properties, lightweight nature, and durability. Increasing construction activities, growing adoption of energy-efficient buildings, and stringent regulations promoting sustainable insulation materials are key growth drivers. According to the U.S. Department of Energy (2023), buildings account for approximately 40% of total energy consumption in the U.S., driving the demand for efficient insulation solutions like rigid foam. Additionally, the European Commission's Green Deal aims to renovate 35 million buildings by 2030, further boosting market growth. The automotive sector also contributes to demand, with manufacturers integrating rigid foam for lightweighting and improved fuel efficiency. In 2024, BASF launched an advanced polyurethane rigid foam designed for high-performance insulation in construction and refrigeration applications. Similarly, Dow announced its expansion plans to enhance rigid polyurethane foam production in response to increasing demand. With industries shifting towards sustainable and high-performance materials, the rigid foam market is set to grow substantially over the next decade.

Get a Sample Report of Rigid Foam Market @ https://www.snsinsider.com/sample-request/5734

Key Players:

• Armacell International S.A. (ArmaFlex, ArmaPET)

• BASF SE (Styropor, Elastopor)

• Borealis AG (BorECO, BorSafe)

• Covestro AG (Baytherm, Bayfoam)

• Elliott Co. of Indianapolis, Inc. (Polyurethane Foam, Polyisocyanurate Foam)

• Foamcraft, Inc. (Polyurethane Foam, Polystyrene Foam)

• Future Foam, Inc. (Flexible Polyurethane Foam, Rigid Polyurethane Foam)

• Huntsman Corporation (Insulfoam, Polyurethane Foam)

• Kaneka Corporation (Kaneka Foam, Kaneka Polyurethane Foam)

• Nitto Denko Corporation (Nitto Thermal Insulation Foam, Nitto Rigid Foam)

• Recticel S.A. (Europur, Eurothane)

• Rogers Corporation (Rogers Foam, PORON)

• Sealed Air Corporation (Instapak, Bubble Wrap)

• Sekisui Chemical Co., Ltd. (Styrofoam, Ekoflex)

• Saint-Gobain S.A. (Isover, Placo)

• Trelleborg AG (Trelleborg Foam, Trelleborg Insulation Foam)

• The Dow Chemical Company (Styrofoam, Great Stuff)

• Wanhua Chemical Group Co., Ltd. (Polyurethane Foam, Isocyanate Foam)

• Woodbridge Foam Corporation (Polyurethane Foam, Rigid Foam)

• Zotefoams Plc (Zotefoam, Zotek)

By Type

Polyurethane (PU/PIR) dominated the rigid foam market in 2023, holding a 50% market share due to its excellent thermal insulation, moisture resistance, and structural strength. Widely used in building insulation, refrigeration, and industrial applications, PU foam contributes significantly to energy savings. The U.S. Environmental Protection Agency (EPA) states that polyurethane foam insulation can reduce energy costs by up to 30%. With increasing green building initiatives and stringent energy regulations worldwide, the demand for PU-based rigid foam continues to expand. Innovations in bio-based PU foams are further fueling market growth, making it the preferred choice among industries.

By Density

Low-density rigid foam accounted for 30% of the market share in 2023, driven by its versatility and cost-effectiveness. This segment is widely used in packaging, thermal insulation, and lightweight automotive applications. The growing e-commerce sector has increased the demand for protective packaging solutions using low-density foam. Additionally, construction firms are integrating low-density foam in walls and roofing to enhance energy efficiency. Companies like Owens Corning and Kingspan have developed low-density rigid foams with improved fire resistance and thermal performance, making them a preferred choice across multiple industries.

By Application

Thermal insulation dominated the rigid foam market in 2023, accounting for 40% of total demand. The rapid expansion of the construction industry and rising concerns over energy conservation are key drivers for this segment. According to the International Energy Agency (IEA), improving insulation in buildings can reduce energy consumption by up to 50%. With increasing government initiatives for sustainable buildings, such as the European Union’s Energy Performance of Buildings Directive, the adoption of rigid foam for insulation applications is expected to surge.

By End-use Industry

The building & construction sector held a 39% share of the rigid foam market in 2023, making it the largest end-use industry. The sector's growth is driven by rising infrastructure projects, urbanization, and strict energy efficiency regulations. Rigid foam is extensively used in walls, roofs, and flooring for insulation purposes. The U.S. Green Building Council (USGBC) reported that demand for sustainable construction materials, including rigid foam, grew by 20% in 2023. As energy efficiency becomes a priority, the construction sector will continue to drive demand for rigid foam solutions.

Buy Full Research Report on Rigid Foam Market 2024-2032 @ https://www.snsinsider.com/checkout/5734

Asia Pacific dominated the rigid foam market in 2023, holding a 38% market share.

The region's growth is fueled by rapid urbanization, infrastructure development, and increasing demand for energy-efficient buildings. China, India, and Japan are major contributors, with government initiatives promoting sustainable construction. The Indian Green Building Council (IGBC) reported a 30% increase in green building certifications in 2023, boosting the demand for rigid foam insulation. Additionally, expanding cold storage facilities in the food and pharmaceutical industries are further driving the regional market.

Europe emerged as the fastest-growing region in the rigid foam market, with a significant CAGR during the forecast period.

The European Green Deal and initiatives to enhance building energy efficiency are key drivers. Countries like Germany, France, and the UK are investing heavily in energy-efficient insulation solutions. The European Insulation Manufacturers Association (EURIMA) reports that demand for rigid foam in insulation applications increased by 18% in 2023. The region's stringent environmental regulations and focus on sustainable construction materials contribute to rapid market expansion.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Jagney Dave

SNS Insider Pvt. Ltd

+1 315 636 4242

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.