Alamos Gold Announces Development Plan for High-Return Burnt Timber and Linkwood Satellite Deposits

Burnt Timber and Linkwood to significantly extend mine life of Lynn Lake project and enhance economics given low-capital and high after-tax Internal Rate of Return of 54%

All amounts are in United States dollars, unless otherwise stated.

TORONTO, Feb. 13, 2025 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported positive results of an internal economic study completed on its Burnt Timber and Linkwood satellite deposits located in proximity to the Lynn Lake project in Manitoba, Canada. In August 2023, an Updated Feasibility Study (“2023 Study”) was released on the Lynn Lake project outlining a long-life, low-cost project in Canada with attractive economics. The 2023 Study was based only on the Gordon and MacLellan deposits which are to be mined over the first 11 years, with the processing of lower-grade stockpiled ore for the remainder of the 17-year mine life.

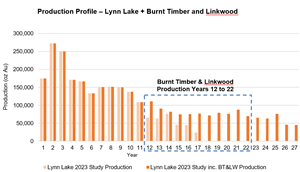

The Burnt Timber and Linkwood deposits are expected to provide a source of additional mill feed to the Lynn Lake project starting in year 12, deferring the lower grade stockpiles until later in the mine plan. This is expected to extend the mine life of the combined Lynn Lake project to 27 years, increase longer term production rates, and enhance its economics as a low-capital, high-return satellite project.

Burnt Timber & Linkwood Study Highlights:

- Average annual gold production of 83,000 ounces over a 10 year mine life

- Higher margin production: total cash costs of $1,140 per ounce and mine-site all-in sustaining costs of $1,164 per ounce, providing lower costs and higher margins than stockpiles from Lynn Lake

-

Low initial capital of $67 million with mining equipment and planned processing infrastructure at Lynn Lake to be utilized. Life of mine capital, including sustaining capital and reclamation, is expected to total $88 million

- Low initial capital intensity of $77 per ounce produced, or $101 per ounce based on total life of mine capital including sustaining capital and reclamation

- Low total all-in cost of $1,241 per ounce, including life of mine capital

- Lower execution risk with key infrastructure from the Lynn Lake project to be utilized

-

High-return project with additional upside potential

- After-tax Internal Rate of Return (“IRR”) of 54% and after-tax Net Present Value (“NPV”) (5%) of $177 million (base case gold price assumption of $2,200 per ounce, and CAD/USD foreign exchange rate of $0.75:1, discounted to 2025); after-tax NPV (5%) of $317 million discounted to the start of construction

- After-tax IRR of 83% and after-tax NPV (5%) of $292 million at closer to spot prices of approximately $2,800 per ounce of gold, and CAD/USD foreign exchange rate of $0.70:1; after-tax NPV (5%) of $524 million discounted to the start of construction

- Payback of less than one year at the base case gold price of $2,200 per ounce

Lynn Lake + Burnt Timber and Linkwood Highlights:

-

40% increase in combined Mineral Reserves to 3.3 million ounces of gold, including:

- Initial Mineral Reserve of 940,000 ounces of gold at Burnt Timber and Linkwood (31 million tonnes (“mt”) grading 0.95 grams per tonne of gold (“g/t Au”)

- Lynn Lake Mineral Reserve of 2.3 million ounces (48 mt grading 1.52 g/t Au) as of the end of 2023

- 40% increase in combined life of mine production to 3.1 million ounces

-

Longer mine life, with higher longer-term average production rate

- Lynn Lake mine life extended to 27 years, from 17 years in the 2023 Study

- Average annual production of 176,000 ounces over the initial 10 years, unchanged from 2023 Study

- Higher average annual production of 85,000 ounces years 12 to 17, up 60% from 53,000 ounces in the 2023 Study

-

Significant near-mine and regional exploration upside

- Burnt Timber and Linkwood deposits remain open to the west and at depth with the 2025 drill program focused on expanding mineralization beyond existing Mineral Reserves

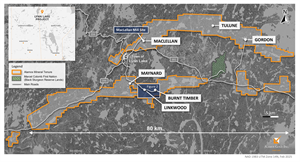

- Multiple regional targets across most of the east-west trending Lynn Lake Greenstone Belt, of which Alamos has a total of 58,000 hectares of mineral tenure covering 80 kilometres (“km”) of strike length. This includes the Maynard and Tulune targets where broad zones of near surface gold mineralization have been intersected. Both targets are within trucking distance of the planned MacLellan mill.

“Lynn Lake is an attractive, long-life, low-cost stand alone project. The addition of Burnt Timber and Linkwood has enhanced the overall project and already strong economics by leveraging existing infrastructure to extend the mine life, and increase longer term production rates, at a low capital cost. The high returns within the Burnt Timber and Linkwood study highlight the significant upside potential across the larger, underexplored Lynn Lake greenstone belt. With a number of targets already identified across the Lynn Lake District, we see excellent opportunities to define and develop additional satellite deposits to feed the centralized mill well beyond the currently defined 27 year mine life,” said John A. McCluskey, President and Chief Executive Officer.

| Burnt Timber & Linkwood Project Highlights | |||

| Production | |||

| Mine life – starting year 12 of the Lynn Lake mine plan (years) | 10.5 | ||

| Total gold production (000 ounces) | 871 | ||

| Average annual gold production (000 ounces) | 83 | ||

| Total ore mined (000 tonnes) | 30,667 | ||

| Total waste mined (000 tonnes) | 85,348 | ||

| Total material mined (000 tonnes) | 116,015 | ||

| Total waste-to-ore ratio | 2.8 | ||

| Average gold grade mined (grams per tonne) | 0.95 | ||

| Average mill throughput (tonnes per day (“tpd”)) | 8,000 | ||

| Gold recovery (%) | 92.7 | % | |

| Operating Costs | |||

| Total cost per tonne of ore (C$)1 | $ | 43.27 | |

| Total cash cost (per ounce)2 | $ | 1,140 | |

| Mine-site all-in sustaining cost (per ounce)2 | $ | 1,164 | |

| Capital Costs | |||

| Initial capital expenditure (millions) | $ | 67 | |

| Sustaining capital expenditure and reclamation costs (millions) | $ | 21 | |

| Total capital expenditure (millions) | $ | 88 | |

| Total capital expenditure (per ounce) | $ | 101 | |

| Total all-in cost (per ounce)2,3 | $ | 1,241 | |

| Base Case Economic Analysis at $2,200 per ounce Gold Price | |||

| IRR (after-tax) | 54 | % | |

| NPV @ 0% discount rate (millions, after-tax) | $ | 549 | |

| NPV @ 5% discount rate (millions, after-tax) – discounted to start of construction | $ | 317 | |

| NPV @ 5% discount rate (millions, after-tax) – discounted to start of 2025 | $ | 177 | |

| Gold price assumption (per ounce) | $ | 2,200 | |

| Exchange Rate (CAD/USD) | $ | 0.75:1 | |

| Economic Analysis at $2,800 per ounce Gold Price | |||

| IRR (after-tax) | 83 | % | |

| NPV @ 0% discount rate (millions, after-tax) | $ | 886 | |

| NPV @ 5% discount rate (millions, after-tax) – discounted to start of construction | $ | 524 | |

| NPV @ 5% discount rate (millions, after-tax) – discounted to start of 2025 | $ | 292 | |

| Gold price assumption (per ounce) | $ | 2,800 | |

| Exchange Rate (CAD/USD) | $ | 0.70:1 | |

- Total unit cost per tonne of ore includes mining, processing, ore haulage, G&A, royalties and refining costs

- Please refer to the Cautionary Notes on non-GAAP Measures and Additional GAAP Measures

- Total all-in cost per ounce produced is calculated as total cash cost per ounce plus total capital per ounce produced over the life of mine

Mineral Reserves and Resources

An initial Mineral Reserve totaling 940,000 ounces grading 0.95 g/t Au (31 mt) has been declared at Burnt Timber and Linkwood reflecting the successful conversion of Inferred Mineral Resources. Additionally, the two deposits host 287,000 ounces in Measured & Indicated (10.6 mt grading 0.84 g/t). Only Mineral Reserves were included in the mine plan and economic analysis, with Mineral Resources representing potential upside.

Mineral Reserves – Effective as of December 31, 2024

| Classification | Tonnage (000’s) | Grade (g/t Au) | Contained oz (000’s Au) |

| Proven | 2,902 | 1.33 | 124 |

| Probable | 27,769 | 0.91 | 816 |

| Total Proven & Probable | 30,670 | 0.95 | 940 |

- Mineral Reserves reported are consistent with the CIM Definition Standards for Mineral Resources and Mineral Reserves.

- Mineral Reserves are reported to a cut-off grade of 0.39 g/t Au.

- The cut-off grades are based on a gold price of $1,600/oz Au.

- Metallurgical Au recovery is 93%.

- Totals may not add up due to rounding.

- Chris Bostwick, FAusIMM, Senior Vice President, Technical Services is the Qualified Person for the Mineral Reserve estimate. Mr. Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator's National Instrument 43-101 ("NI 43-101").

Mineral Resources – Effective as of December 31, 2024

| Category | Tonnage (000’s) | Grade (g/t Au) | Contained oz (000’s Au) |

| Measured | 114 | 3.14 | 11 |

| Indicated | 10,459 | 0.82 | 276 |

| Measured & Indicated | 10,573 | 0.84 | 287 |

| Inferred | 926 | 1.04 | 31 |

- Mineral Resources reported are consistent with the CIM Definition Standards for Mineral Resources and Mineral Reserves.

- The Mineral Resources are reported at an assumed gold price of US$1,800/oz.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- Contained Au ounces are in-situ and do not include metallurgical recovery losses.

- Mineral Resources are exclusive of Mineral Reserves.

- Totals may not add up due to rounding.

- Jeff Volk, CPG, FAusIMM, Director Reserves and Resources, is the Qualified Person for the Mineral Resource estimate. Mr. Volk is a Qualified Person within the meaning of Canadian Securities Administrator's National Instrument 43-101 ("NI 43-101").

Economic Analysis

Burnt Timber and Linkwood’s estimated after-tax IRR is 54% and after-tax NPV (5%) is $177 million, discounted to the start of 2025, assuming a gold price of $2,200 per ounce and CAD/USD foreign exchange rate of $0.75:1. Assuming closer to spot gold prices of approximately $2,800 per ounce and CAD/USD foreign exchange rate of $0.70:1, the after-tax IRR increases to 83% and after-tax NPV (5%) increases to $292 million. These economics represent upside to the 2023 Study prepared for the Lynn Lake project which only included the Gordon and MacLellan deposits. The payback on the Burnt Timber and Linkwood project is less than a year under the base case scenario.

The mine plan, operating parameters, and capital estimates incorporated in the study are based on operating experience and benchmarking against Alamos’ current operations.

The project economics are sensitive to metal price assumptions, foreign exchange rates, and input costs as detailed in the tables below.

Burnt Timber and Linkwood After-Tax NPV1 (5%) Sensitivity ($ Millions)

| -10% | -5% | Base Case | 5% | 10% | ||||||

| Gold Price | $ | 142 | $ | 160 | $ | 177 | $ | 194 | $ | 214 |

| Canadian Dollar | $ | 196 | $ | 185 | $ | 177 | $ | 169 | $ | 160 |

| Operating Costs | $ | 195 | $ | 185 | $ | 177 | $ | 168 | $ | 159 |

| Capital Costs | $ | 178 | $ | 178 | $ | 177 | $ | 176 | $ | 175 |

Burnt Timber and Linkwood After-Tax NPV1 (5%) Sensitivity to Gold Price and CAD/USD ($ Millions)

| Canadian Dollar | ||||||||||||

|

Gold Price US$/oz |

$0.700 | $0.725 | $0.750 | $0.775 | $0.800 | |||||||

| $ | 2,000 | $ | 157 | $ | 151 | $ | 145 | $ | 138 | $ | 131 | |

| $ | 2,200 | $ | 189 | $ | 182 | $ | 177 | $ | 171 | $ | 165 | |

| $ | 2,400 | $ | 224 | $ | 218 | $ | 210 | $ | 203 | $ | 197 | |

| $ | 2,600 | $ | 257 | $ | 252 | $ | 245 | $ | 239 | $ | 232 | |

| $ | 2,800 | $ | 292 | $ | 285 | $ | 278 | $ | 273 | $ | 266 | |

Burnt Timber and Linkwood After-Tax IRR1 Sensitivity to Gold Price and CAD/USD (%)

| Canadian Dollar | |||||||||||||||||

|

Gold Price US$/oz |

$0.700 | $0.725 | $0.750 | $0.775 | $0.800 | ||||||||||||

| $ | 2,000 | 51.4 | % | 48.9 | % | 46.3 | % | 43.8 | % | 41.7 | % | ||||||

| $ | 2,200 | 59.6 | % | 56.3 | % | 53.6 | % | 51.3 | % | 48.9 | % | ||||||

| $ | 2,400 | 67.9 | % | 64.5 | % | 61.3 | % | 58.7 | % | 55.6 | % | ||||||

| $ | 2,600 | 75.4 | % | 72.3 | % | 69.1 | % | 66.0 | % | 63.0 | % | ||||||

| $ | 2,800 | 83.4 | % | 79.6 | % | 76.1 | % | 73.2 | % | 70.3 | % | ||||||

- Discounted to start of 2025

Project Overview

The Burnt Timber and Linkwood deposits are accessible by an all-season gravel road from Highway 397, approximately 28 km from the planned MacLellan mill. The two deposits will be mined using conventional open pit mining methods with mining equipment from the Lynn Lake project to be utilized once the MacLellan deposit has been depleted. Ore will be hauled to and processed through the MacLellan mill to be constructed as part of the Lynn Lake project.

The 2023 Study for the Lynn Lake project outlined a 17-year mine life based on the Gordon and MacLellan deposits. The two deposits are expected to be mined and depleted over the first 11 years, with lower-grade stockpiled ore to be processed over the final six years.

With the incorporation of Burnt Timber and Linkwood, these relatively higher grade deposits will be mined and processed starting in year 12, deferring lower-grade stockpiled ore from Lynn Lake until year 22. This is expected to extend the mine life of the combined project to 27 years, from 17, and provide higher average annual rates of production from year 12 onward.

Mining

The Burnt Timber and Linkwood deposits will be mined using conventional shovel/truck open pit mining methods, with owner mining to be employed. The Burnt Timber deposit will be mined over a seven-year period and the Linkwood deposit will be mined over an eight-year period. Mining activities at both deposits will overlap, for a combined mine-life of 10 years, including pre-stripping activities.

Total mining rates (ore + waste) will vary between 13,000 and 35,000 tonnes per day (“tpd”) at an average life of mine waste to ore strip ratio of 2.8:1. The majority of the mining fleet from the Lynn Lake project will be utilized once the MacLellan deposit has been depleted. Ore from Burnt Timber and Linkwood will be transported approximately 28 kilometres to the MacLellan mill.

Processing (MacLellan Mill)

Ore from Burnt Timber and Linkwood will be processed at a rate of 8,000 tpd through the MacLellan mill to be built as part of the Lynn Lake project, therefore no processing capital is expected to be required to process ore from these deposits. No changes to the mill are anticipated.

The mill being constructed for the Lynn Lake project is a conventional milling operation with a nominal capacity of 8,000 tpd. The plant design is based on leach/carbon in pulp (“CIP”), and will consist of crushing, grinding, thickening, pre-aeration and leaching, CIP, cyanide detoxification, carbon elution and regeneration, and gold smelting.

Mill recoveries from Burnt Timber and Linkwood ore are expected to average 92.7% for gold over the life of mine, consistent with the Lynn Lake project. Power to the MacLellan site, which will host all the process facilities and major infrastructure, will be supplied from Manitoba Hydro through the commercial electricity grid.

The tailings management facility (“TMF”) to be built as part of the Lynn Lake project will have sufficient capacity, with additional lifts required to accommodate current Mineral Reserves at Burnt Timber and Linkwood.

Operating Costs

Total cash costs are expected to average $1,140 per ounce of gold and mine-site all-in sustaining costs $1,164 per ounce of gold over the life of the operation. Total unit operating costs are expected to average C$43.27 per tonne of ore processed. This includes average mining costs of C$4.25 per tonne of material mined across the Burnt Timber and Linkwood deposits, and processing and haulage costs of C$19.15 per tonne of ore.

The breakdown of unit costs is summarized as follows.

| Operating Costs | C$/t | LOM US$M | |||

| Mining1 | C$/t mined | $ | 4.25 | $ | 353.8 |

| Mining1 | C$/t ore | $ | 15.38 | $ | 353.8 |

| Processing & Ore Haulage | C$/t ore | $ | 19.15 | $ | 440.5 |

| G&A | C$/t ore | $ | 8.35 | $ | 192.0 |

| Refining, Transport, Royalties | C$/t ore | $ | 0.39 | $ | 8.9 |

| Total Operating Costs | C$/t ore | $ | 43.27 | $ | 995.1 |

| Total Cash Costs2 | US$/oz | $ | 1,140 | ||

| Mine-site All-in Sustaining Costs2 | US$/oz | $ | 1,164 | ||

- Average mining cost per tonne is for the production years

- Please refer to the Cautionary Notes on non-GAAP Measures and Additional GAAP Measures

Royalties

There is a capped third-party royalty on a portion of production at Linkwood. Based on a $2,200 per ounce gold price, the cap is expected to be reached in the first two years, and will total approximately $6 million in royalty payments over that period. Burnt Timber and Linkwood are not expected to be subject to any other third-party royalties for the remainder of their mine life.

Capital Costs

Initial capital of $67 million will be spent over a two-year period starting year 10. This will include haul road upgrades, truck shop relocation, pit dewatering, and pre-stripping activities, with mobile equipment from the Lynn Lake project to be utilized for mining activities.

The mill, tailings management facility, and permanent camp, to be constructed as part of the Lynn Lake project, will be utilized for Burnt Timber and Linkwood keeping initial capital costs low.

A breakdown of the initial and total capital requirements is detailed as follows.

| Capital Costs (US$ millions) | ||

| Infrastructure | $ | 26.8 |

| Pre-production mining | $ | 12.9 |

| Owner Costs & Indirects | $ | 12.7 |

| TMF (additional lifts) | $ | 9.1 |

| Contingency | $ | 5.7 |

| Total Initial Capital | $ | 67.3 |

| Sustaining capital | $ | 5.8 |

| Reclamation and Closure Costs | $ | 15.0 |

| Total Capital | $ | 88.1 |

Taxes

Burnt Timber and Linkwood will be subject to provincial, federal, and mining taxes. Assuming a gold price of $2,200 per ounce and CAD/USD foreign exchange rate of 0.75:1, taxes paid are expected to total $284 million over the 10-year mine life for an effective tax rate of approximately 34%.

Environment & Permitting

The mining and processing of ore from Burnt Timber and Linkwood deposits through the MacLellan mill will require amendments to existing authorizations for the Lynn Lake Project (the federal Decision Statement and the provincial Environment Act License). Additional federal and provincial authorizations, specific to the development of the Burnt Timber and Linkwood deposits, will also be required.

Additional Upside Opportunities

In-pit tailings

Utilizing the MacLellan open pit as a tailing storage facility once the deposit has been depleted will be evaluated as a longer term opportunity. This could provide capital and operating cost savings relative to completing additional lifts on the Lynn Lake TMF. This could also provide additional longer term capacity to accommodate the development of additional satellite deposits across the Lynn Lake District.

Exploration upside at Burnt Timber and Linkwood

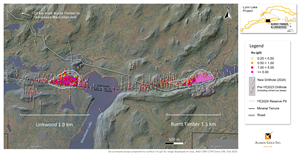

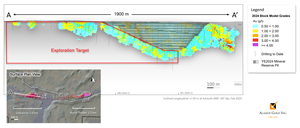

There is significant potential to continue expanding mineralization beyond the currently defined Mineral Reserve pits at Burnt Timber and Linkwood. The 2025 drill program includes over 7,000 metres of drilling focused on expanding mineralization to the west of both Mineral Reserve pits. At Burnt Timber, drilling is also planned below the eastern portion of the previously mined-pit where there has been limited historical drilling. At Linkwood, drilling is also planned immediately below the main portion of the 2024 Mineral Reserve pit where no drilling has been completed and mineralization remains open, as well as following up on near-surface mineralization to the west (see Figures 2 to 4).

Exploration upside underground at MacLellan and Gordon

The MacLellan and Gordon deposits remain open at depth with potential for higher-grade mineralization below the current Mineral Reserve pits. This represents a longer-term opportunity as a source of additional higher-grade mill feed for the Lynn Lake project. MacLellan previously operated as an underground mine with a total of 969,680 tonnes, grading 5.36g/t Au mined between 1986 and 1989.

Significant regional exploration potential

The Lynn Lake project encompasses most of the east-west trending Lynn Lake Greenstone Belt in northwestern Manitoba, of which Alamos has a total of 58,000 hectares of mineral tenure covering 80 km of strike length, representing significant exploration potential including the Maynard and Tulune regional targets.

The Maynard target is located 8 km northwest of the Burnt Timber deposit, and 20 km by road from the proposed MacLellan mill. Through additional drilling and exploration, Maynard has the potential to become an additional satellite deposit, and future source of mill feed, similar to Burnt Timber and Linkwood. Significant gold mineralization has been extended over a 750 m strike length and to a depth of 330 m. To date, all 23 holes drilled by Alamos within the Maynard target have intersected gold mineralization including higher grade intercepts such as 5.87 g/t Au over 11.88 m, including 13.81 g/t Au over 2.80 m, and 20.29 g/t Au over 1.22 m (23LLX066)1.

Tulune is a greenfields discovery made in 2020, and is located between the Gordon and MacLellan deposits. Drilling has extended broad zones of near surface gold mineralization over a 2 km strike length. All 29 holes drilled within the granite and granodiorite have intersected gold mineralization.

1Gold grades reported as uncut, composite intervals reported as core length, true width is unknown at this time.

Technical Disclosure

Chris Bostwick, FAusIMM, Alamos Gold's Senior Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Mr. Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator's National Instrument 43-101 ("NI 43-101").

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Island Gold District and Young-Davidson mine in northern Ontario, Canada, and the Mulatos District in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 2,400 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Senior Vice President, Corporate Development & Investor Relations

(416) 368-9932 x 5439

Khalid Elhaj

Vice President, Business Development & Investor Relations

(416) 368-9932 x 5427

ir@alamosgold.com

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note

This news release contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities laws. All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward-looking statements and are generally, but not always, identified by the use of forward-looking terminology such as “future”, "expect", “assume”, “anticipate”, “potential”, “proposed”, “plan”, “estimate”, “continue”, “evaluating”, “target”, “opportunity” or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may", “could”, “would”, "might" or "will" be taken, occur or be achieved or the negative connotation of such terms. Forward-looking statements contained in this news release are based on information, expectations, estimates and projections as of the date of this news release.

Forward-looking statements in this news release include, but may not be limited to, information as to strategy, plans, expectations or future financial or operating performance pertaining to, or anticipated to result from, the Lynn Lake Project and the Burnt Timber and Linkwood Deposits, such as expectations, assumptions and estimations regarding: gold production; production potential; mining, processing, milling and production rates; gold grades; gold prices; foreign exchange rates; total cash costs, all-in sustaining costs, mine-site all-in sustaining costs, capital expenditures, total sustaining and growth capital, life of mine capital, reclamation capital, taxes, IRR, NPV; returns to stakeholders; mine plans; mine life; Mineral Reserve life; Mineral Reserves and Resources; exploration potential, budgets, focuses, programs, targets and projected results; execution risk; construction activities, capital spending, planned infrastructure, intended method of mining the deposits and production with respect to the Lynn Lake project and the Burnt Timber and Linkwood deposits near the Lynn Lake project; additional upside opportunities; as well as other general information as to strategy, plans or future financial or operating performance, such as the Company’s expansion plans, project timelines, production plans and expected sustainable productivity increases, expected increases in mining activities and corresponding cost efficiencies, cost estimates, sufficiency of working capital for future commitments and other statements that express management’s expectations or estimates of future plans and performance.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of Mineral Resource. A Mineral Resource that is classified as "Inferred" or "Indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "Indicated Mineral Resource" or "Inferred Mineral Resource" will ever be upgraded to a higher category of Mineral Resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Proven and Probable Mineral Reserves.

The Company cautions that forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable by management at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political, and competitive uncertainties, and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements, and undue reliance should not be placed on such statements and information.

Such factors include (without limitation): the actual results of current and future exploration activities; changes to current estimates of mineral reserves and mineral resources; conclusions of economic and geological evaluations; changes in project parameters as plans continue to be refined; the speculative nature of mineral exploration and development; risks in obtaining and maintaining necessary licenses, permits and authorizations for the Company’s development stage and operating assets; risk that required amendments to existing permits for the Lynn Lake project to accommodate the Burnt Timber and Linkwood Deposits may not be obtained; operations may be exposed to new illnesses, diseases, epidemics and pandemics, including any ongoing or future effects of COVID-19 (and any related ongoing or future regulatory or government responses) and its impact on the broader market and the trading price of the Company's shares; provincial and federal orders or mandates (including with respect to mining operations generally or auxiliary businesses or services required for operations) in Canada, Mexico, the United States and Türkiye, all of which may affect many aspects of the Company's operations including the ability to transport personnel to and from site, contractor and supply availability and the ability to sell or deliver gold doré bars; changes in national and local government legislation, controls or regulations; failure to comply with environmental and health and safety laws and regulations; labour and contractor availability (and being able to secure the same on favourable terms); disruptions in the maintenance or provision of required infrastructure and information technology systems; fluctuations in the price of gold or certain other commodities such as, diesel fuel, natural gas, and electricity; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges and changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates and may be impacted by unscheduled maintenance); changes in foreign exchange rates (particularly the Canadian dollar, U.S. dollar, Mexican peso and Turkish Lira); the impact of inflation; the potential impact of the implementation of any tariffs, trade barriers and/or regulatory costs; employee and community relations; the impact of litigation and administrative proceedings (including but not limited to the application for judicial review of the positive Decision Statement issued by the Ministry of Environment and Climate Change Canada commenced by the Mathias Colomb Cree Nation (MCCN) in respect of the Lynn Lake Project and the MCCN’s corresponding internal appeal of the Environment Act Licences issued by the Province of Manitoba for the Project) and any interim or final court, arbitral and/or administrative decisions; disruptions affecting operations; availability of and increased costs associated with mining inputs and labour; delays in the Phase 3+ Expansion at Island Gold; delays in the construction and development of the Lynn Lake Project; changes with respect to the intended method of mining and processing ore from the Lynn Lake Project and the Burnt Timber and Linkwood Deposits; inherent risks and hazards associated with mining and mineral processing including environmental hazards, industrial accidents, unusual or unexpected formations, pressures and cave-ins; the risk that the Company’s mines may not perform as planned; uncertainty with the Company's ability to secure additional capital to execute its business plans; contests over title to properties; expropriation or nationalization of property; political or economic developments in Canada, Mexico, the United States, Türkiye and other jurisdictions in which the Company may carry on business in the future; increased costs and risks related to the potential impact of climate change; the costs and timing of exploration, construction and development of new deposits; risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; risks arising from holding derivative instruments; and business opportunities that may be pursued by the Company.

For a more detailed discussion of such risks and other risk factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this news release, see the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors” available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Cautionary Note to U.S. Investors

Alamos prepares its disclosure in accordance with the requirements of securities laws in effect in Canada. Unless otherwise indicated, all Mineral Resource and Mineral Reserve estimates included in this document have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) has adopted final rules, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under Regulation S-K 1300 and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under Regulation S-K 1300. U.S. investors are also cautioned that while the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under Regulation S-K 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater degree of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable.

Cautionary non-GAAP Measures and Additional GAAP Measures

Note that for purposes of this section, GAAP refers to IFRS. The Company believes that investors use certain non-GAAP and additional GAAP measures as indicators to assess gold mining companies. They are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared with GAAP.

“Cash flow from operating activities before changes in non-cash working capital” is a non-GAAP performance measure that could provide an indication of the Company’s ability to generate cash flows from operations and is calculated by adding back the change in non-cash working capital to “cash provided by (used in) operating activities” as presented on the Company’s consolidated statements of cash flows. “Cash flow per share” is calculated by dividing “cash flow from operations before changes in working capital” by the weighted average number of shares outstanding for the period. “Free cash flow” is a non-GAAP performance measure that is calculated as cash flows from operations net of cash flows invested in mineral property, plant and equipment and exploration and evaluation assets as presented on the Company’s consolidated statements of cash flows and that would provide an indication of the Company’s ability to generate cash flows from its mineral projects. “Mine site free cash flow” is a non-GAAP measure which includes cash flow from operating activities at, less capital expenditures at each mine site. “Return on equity” is defined as earnings from continuing operations divided by the average total equity for the current and previous year. “Mining cost per tonne of ore” and “cost per tonne of ore” are non-GAAP performance measures that could provide an indication of the mining and processing efficiency and effectiveness of the mine. These measures are calculated by dividing the relevant mining and processing costs and total costs by the tonnes of ore processed in the period. “Cost per tonne of ore” is usually affected by operating efficiencies and waste-to-ore ratios in the period. “Total capital expenditures per ounce produced” is a non-GAAP term used to assess the level of capital intensity of a project and is calculated by taking the total growth and sustaining capital of a project divided by ounces produced life of mine. “Growth capital” are expenditures primarily incurred at development projects and costs related to major projects at existing operations, where the projects will materially benefit the mine site. “Sustaining capital” are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects. “Total cash costs per ounce”, “all-in sustaining costs per ounce”, “mine-site all-in sustaining costs”, and “all-in costs per ounce” as used in this analysis are non-GAAP terms typically used by gold mining companies to assess the level of gross margin available to the Company by subtracting these costs from the unit price realized during the period. These non-GAAP terms are also used to assess the ability of a mining company to generate cash flow from operations. There may be some variation in the method of computation of these metrics as determined by the Company compared with other mining companies. In this context, “total cash costs” reflects mining and processing costs allocated from in-process and doré inventory and associated royalties with ounces of gold sold in the period. Total cash costs per ounce are exclusive of exploration costs. “All-in sustaining costs per ounce” include total cash costs, exploration, corporate and administrative, share based compensation and sustaining capital costs. “Mine-site all-in sustaining costs” include total cash costs, exploration, and sustaining capital costs for the mine-site, but exclude an allocation of corporate and administrative and share based compensation. “Adjusted net earnings” and “adjusted earnings per share” are non-GAAP financial measures with no standard meaning under IFRS. “Adjusted net earnings” excludes the following from net earnings: foreign exchange gain (loss), items included in other loss, certain non-reoccurring items, and foreign exchange gain (loss) recorded in deferred tax expense. “Adjusted earnings per share” is calculated by dividing “adjusted net earnings” by the weighted average number of shares outstanding for the period.

Additional GAAP measures that are presented on the face of the Company’s consolidated statements of comprehensive income and are not meant to be a substitute for other subtotals or totals presented in accordance with IFRS, but rather should be evaluated in conjunction with such IFRS measures. This includes “Earnings from operations”, which is intended to provide an indication of the Company’s operating performance and represents the amount of earnings before net finance income/expense, foreign exchange gain/loss, other income/loss, and income tax expense. Non-GAAP and additional GAAP measures do not have a standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other companies. A reconciliation of historical non-GAAP and additional GAAP measures are detailed in the Company’s latest Management’s Discussion and Analysis available online on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov and at www.alamosgold.com.

Figure 1: Lynn Lake District Map

Figure 2: Plan View of Burnt Timber and Linkwood 2024 Reserve Pits and Drilling

Figure 3: Linkwood Reserve Pit and Exploration Upside

Figure 4: Burnt Timber Reserve Pit and Exploration Upside

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/a4eb9919-fc67-4528-8564-3fd2de9aa234

https://www.globenewswire.com/NewsRoom/AttachmentNg/9ac3a9dd-15d4-4b67-8e55-6d44e73f1075

https://www.globenewswire.com/NewsRoom/AttachmentNg/15a71220-aafa-44be-9f51-17d23a7a7ec1

https://www.globenewswire.com/NewsRoom/AttachmentNg/43e0c5cb-67e8-4023-ab14-01056d51b4f8

https://www.globenewswire.com/NewsRoom/AttachmentNg/46422c14-86fc-4436-be0d-a5d1b2af8a2a

Production Profile – Lynn Lake + Burnt Timber and Linkwood

Production Profile – Lynn Lake + Burnt Timber and Linkwood

Figure 1 Lynn Lake District Map

Figure 1 Lynn Lake District Map

Figure 2 Plan View of Burnt Timber and Linkwood 2024 Reserve Pits and Drilling

Figure 2 Plan View of Burnt Timber and Linkwood 2024 Reserve Pits and Drilling

Figure 3 Linkwood Reserve Pit and Exploration Upside

Figure 3 Linkwood Reserve Pit and Exploration Upside

Figure 4 Burnt Timber Reserve Pit and Exploration Upside

Figure 4 Burnt Timber Reserve Pit and Exploration Upside

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.