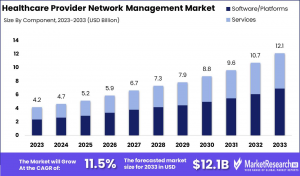

Healthcare Provider Network Management Market Grows from USD 4.2 Bn To USD 12.1 Bn by 2033

The Healthcare Provider Network Management Market was valued at USD 4.2 billion in 2023. It is expected to reach USD 12.1 billion by 2033, with a CAGR of 11.5%

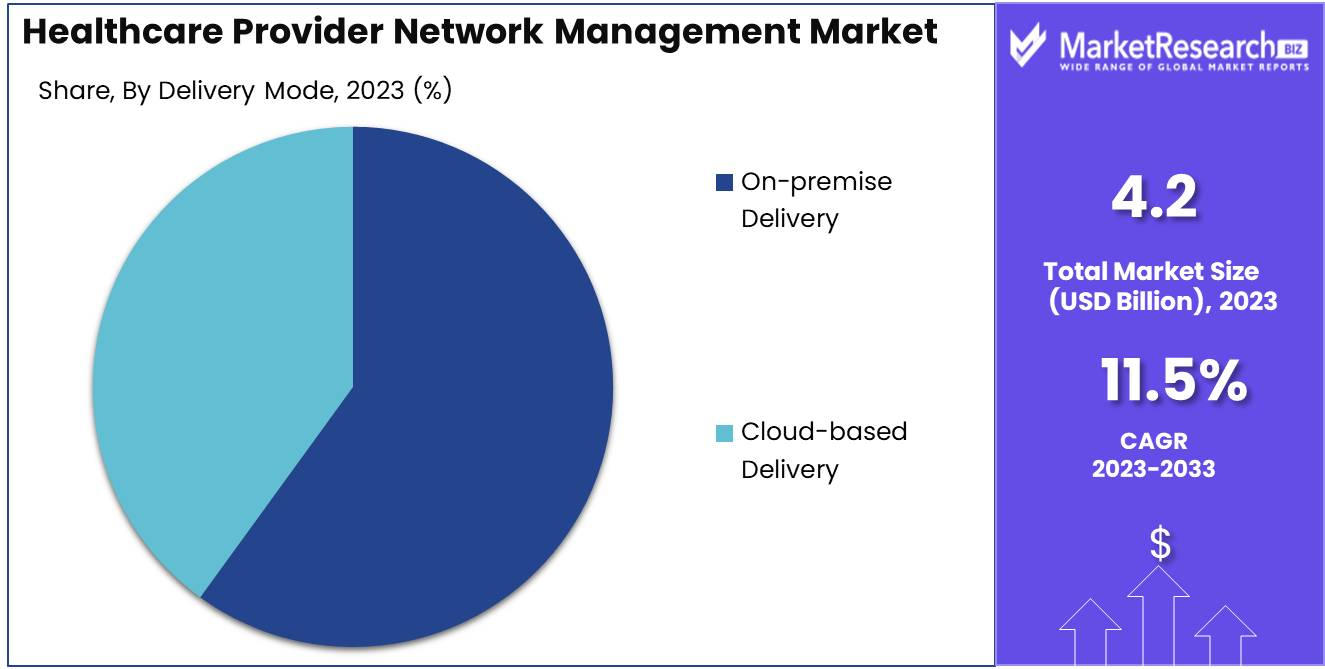

In 2023, On-premise Delivery held a dominant market position in the By Delivery Mode segment of the Healthcare Provider Network Management Market.”

NEW YORK, NY, UNITED STATES, February 12, 2025 /EINPresswire.com/ -- Overview— Tajammul Pangarkar

The Healthcare Provider Network Management Market was valued at USD 4.2 billion in 2023. It is expected to reach USD 12.1 billion by 2033, with a CAGR of 11.5% during the forecast period from 2024 to 2033.

Healthcare Provider Network Management is revolutionizing how healthcare organizations coordinate services, optimize provider networks, and improve patient outcomes. This system enables healthcare payers, hospitals, and insurance providers to efficiently manage provider credentials, contract negotiations, and compliance requirements. By streamlining administrative processes, network management enhances operational efficiency and reduces costs.

With the growing adoption of digital solutions, advanced analytics and AI-driven platforms are playing a crucial role in network optimization. These technologies improve provider data accuracy, ensure seamless claims processing, and enhance care delivery. Additionally, regulatory compliance and data security remain top priorities as organizations integrate automated solutions to maintain transparency and efficiency.

The increasing focus on value-based care is further driving the demand for robust provider network management. By facilitating better provider-patient interactions and ensuring service accessibility, healthcare organizations can improve care coordination and patient satisfaction.

As the healthcare industry continues its digital transformation, efficient network management solutions will be essential in creating a streamlined, cost-effective, and patient-centered healthcare ecosystem. The future of healthcare provider network management lies in innovation, ensuring quality care while maintaining financial sustainability for healthcare institutions and insurers.

Click here to get a Sample report copy @ https://marketresearch.biz/report/healthcare-provider-network-management-market/

Key Takeaways

•Market Growth: The Healthcare Provider Network Management Market was valued at USD 4.2 billion in 2023 and is projected to reach USD 12.1 billion by 2033, growing at a CAGR of 11.5% from 2024 to 2033.

•By Component: Software/Platforms lead the market, with increasing demand for services that enhance network efficiency and provider management.

•By Delivery Mode: On-premise solutions continue to dominate over cloud-based delivery, although cloud adoption is gaining momentum due to flexibility and scalability.

•By End User: Payers remain the primary end users, leveraging advanced technologies and strategic initiatives to optimize network management.

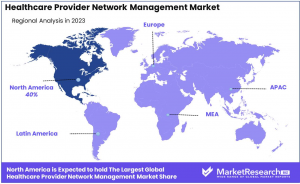

•Regional Dominance: North America holds a 40% market share, driven by advanced healthcare infrastructure, regulatory frameworks, and digital transformation initiatives.

•Growth Opportunity: The market is set for significant expansion with the integration of AI-powered solutions and strategic technology partnerships, enhancing efficiency and automation in provider network management.

Segmentation Analysis

••By Component Analysis

Software/Platforms Lead, Supported by Growing Service Demand

In 2023, Software/Platforms dominated the Healthcare Provider Network Management Market, driven by automation, real-time data processing, and analytics. These solutions enhance credentialing, provider data management, and compliance tracking, ensuring accurate and reliable networks. AI and machine learning integration further optimize resource allocation. Meanwhile, the Services segment is expanding, offering consulting, implementation, and regulatory guidance. As healthcare organizations seek efficiency, the combination of software and specialized services strengthens overall network management.

••By Delivery Mode Analysis

On-Premise Solutions Dominate, Cloud Adoption Rising

On-premise delivery led the market in 2023, as healthcare providers prioritized data security, regulatory compliance, and seamless integration with existing IT systems. This approach is preferred by large institutions with significant IT resources. However, Cloud-based delivery is gaining traction due to its scalability, lower costs, and ease of implementation. The rise of telehealth and remote monitoring is driving demand for cloud-based solutions, marking a shift toward digital transformation and operational flexibility in healthcare.

••By End User Analysis

Payers Lead Market with Technology-Driven Strategies

Payers, including private and public health insurers, held a dominant position in 2023, leveraging advanced analytics and technology to optimize provider networks. Private insurers used AI-driven tools to reduce costs and improve efficiency, while public health insurance providers benefited from government support and large-scale enrollment programs. Their focus on accessibility and affordability strengthened their role in network management, ensuring streamlined operations and compliance with evolving regulatory standards.

Market Segments

By Component

•Software/Platforms

•Services

By Delivery Mode

•On-premise Delivery

•Cloud-based Delivery

By End User

•Payers

•Private Health Insurance

•Public Health Insurance

To Purchase this Premium Report @ https://marketresearch.biz/purchase-report/?report_id=48431

Market Dynamics

•Driver: Digital Transformation in Healthcare

The healthcare sector is undergoing a significant digital transformation, integrating advanced technologies to enhance service delivery. This shift includes the adoption of electronic health records, telemedicine, and mobile health applications, making healthcare services more accessible and efficient. The COVID-19 pandemic has further accelerated this trend, highlighting the need for remote healthcare solutions and boosting the adoption of e-commerce in healthcare.

•Trend: Growth of Telemedicine and Online Pharmacies

There is a notable increase in the use of telemedicine and online pharmacies, driven by the demand for convenient and accessible healthcare services. Patients are increasingly opting for virtual consultations and online medication purchases, reducing the need for physical visits to healthcare facilities. This trend is supported by advancements in digital platforms and changing consumer preferences towards online healthcare solutions.

•Restraint: Data Privacy and Security Concerns

The expansion of healthcare e-commerce raises significant concerns regarding data privacy and security. Handling sensitive patient information requires stringent measures to prevent data breaches and unauthorized access. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe imposes challenges for healthcare providers and e-commerce platforms in managing and protecting patient data.

•Opportunity: Expansion of Personalized Healthcare Services

The integration of e-commerce in healthcare presents opportunities for personalized healthcare services. By leveraging data analytics and digital tools, healthcare providers can offer tailored health and wellness products, customized treatment plans, and targeted health interventions. This personalized approach enhances patient engagement and satisfaction, leading to better health outcomes and opening new avenues for service providers in the healthcare e-commerce market.

Market Key Players

•Infosys Limited

•Appian

•Artivatic AI

•Atos SE (Syntel Inc.)

•Centene Corporation (Envolve Health)

•Change Healthcare

•McKesson Corporation

•Mphasis Limited

•Optum Inc.

•OSPLabs

•RELX Group (LexisNexis Risk Solutions)

•Skygen USA LLC

•Virtusa Corporation

•Others

Regional Analysis

••North America Leads with 40% Market Share

North America remains the dominant region in the healthcare provider network management market, holding 40% of the global share. This leadership is driven by advanced healthcare infrastructure, widespread adoption of IT solutions, and strong government support for digital health initiatives. The United States plays a crucial role, benefiting from substantial healthcare spending, which reached $4.1 trillion in 2020. The region’s strong technological ecosystem and focus on healthcare automation further support market growth.

••Europe Holds 25% Share, Driven by Healthcare IT Investments

Europe follows closely, accounting for 25% of the market. The region benefits from a well-established healthcare system, significant healthcare IT investments, and patient-centric care models. Germany, the UK, and France lead in market expansion, leveraging continuous advancements in healthcare technology and regulatory support for digital health innovations. The region’s emphasis on data security and interoperability further strengthens adoption.

••Asia Pacific Expands Rapidly with 20% Market Share

Asia Pacific is experiencing rapid market growth, capturing 20% of the global share. Increasing healthcare expenditures, large patient populations, and government-driven healthcare modernization initiatives are key growth drivers. China, Japan, and India are leading contributors, with China’s healthcare market projected to surpass $1 trillion by 2025. Rising demand for cloud-based solutions, telehealth services, and AI-driven provider management systems is further propelling the market.

••Middle East & Africa and Latin America Account for 15%

Middle East & Africa and Latin America collectively hold 15% of the market share, with growing investments in health IT and healthcare infrastructure improvements. Countries like Brazil, South Africa, and the UAE are making significant strides, driven by government healthcare reforms and digital transformation initiatives. The increasing demand for efficient provider network management and technology-driven healthcare solutions is expected to boost market expansion in these regions.

Emerging Trends in Healthcare Provider Network Management

•Integration of Advanced Technologies: Healthcare provider network management is increasingly adopting advanced technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT). AI enhances data analysis and decision-making, while blockchain ensures secure and transparent data transactions. IoT devices, such as wearable health monitors, provide real-time patient data, improving care coordination. These technologies collectively aim to create a more efficient and personalized healthcare system.

•Emphasis on Data Security and Privacy: With the digitization of healthcare records, there's a heightened focus on data security and privacy. Ensuring compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) is crucial. Implementing robust cybersecurity measures protects sensitive patient information from breaches and unauthorized access, maintaining trust between patients and providers.

•Growth of Telemedicine and Remote Monitoring: The rise of telemedicine and remote patient monitoring is transforming provider network management. These services offer patients access to care without the need for physical visits, expanding reach to underserved areas. Integrating telehealth into provider networks enhances flexibility and responsiveness in patient care.

Use Cases of Healthcare Provider Network Management

•Streamlining Provider Credentialing: Efficient provider network management systems streamline the credentialing process. By maintaining up-to-date records of over 4.8 million providers, organizations can ensure accurate and timely verification of credentials, reducing administrative burdens and enhancing network reliability.

•Enhancing Care Coordination: Advanced network management facilitates better care coordination among providers. By leveraging electronic health records (EHRs) and health information exchanges, providers can access comprehensive patient information, leading to improved treatment outcomes and reduced duplication of services.

•Addressing 'Ghost Networks': Effective provider network management addresses issues like 'ghost networks,' where listed providers are unavailable or non-existent. By regularly updating provider directories and verifying information, organizations can ensure patients have access to accurate and reliable provider options, enhancing trust and satisfaction.

Lawrence John

Prudour

+91 91308 55334

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.