Shareholder Democracy and the Challenge of Dual Class Share Structures

One share, one vote is a basic principle of shareholder democracy. It protects minority shareholder voices in markets with dispersed ownership. Multi-class share structures violate this principle. They give subsets of a company’s equity owners superior voting rights, so that their influence outweighs their economic interest.

Our 2024 post-proxy season analysis shows that, for companies with differential share voting rights, reported vote results often deviate significantly from estimated broad market shareholder sentiment on resolutions that shape important aspects of corporate governance. Multi-class structures can distort key governance signals, limiting the influence of minority shareholders on issues ranging from executive compensation to environmental, social, and governance (ESG) resolutions. Systemic risks may also arise as a growing number of companies, particularly in the tech sector, adopt this share structure at their initial public offering. [1]

As a minimum safeguard, companies should be required to disclose their vote outcomes by share class, to better represent the market signal conveyed via proxy voting, and to ward off weaker market-wide governance practices. [2]

Conflicting Views on Dual Class Share Structures

Multi-class share structures typically take the form of two classes of shares within a company’s equity structure, where one class – often held by founders, founding families, and company insiders – is conferred superior voting rights. Those opposed to dual class share structures point out that, when insiders can override majority-held shareholder positions, management may be less accountable and less likely to uphold standards of good governance. Conversely, those defending the practice note that outsized voting power can help founders withstand market short-termism during the crucial growth stages of a company. [3]

Investor scrutiny of dual class share structures has increased in recent years, with several high-profile tech companies adopting this arrangement at their initial public offering (IPO) and some stock exchanges relaxing their stance against this practice. The Council of Institutional Investors’ (CII) semi-annual tracking of IPOs shows an uptick in the proportion of companies in the US going public with differential voting shares since 2019. [4], [5], [6] In 2023, S&P Global reversed its six-year ban on adding new members with dual share class structures to its indices. [7]

The Investor Coalition for Equal Voting Rights, or ICEV, was formed in 2022 to advocate for voting equity. Through the coalition, fiduciaries responsible for more than USD 4 trillion in assets (at the time of writing), are calling for limits on the lifespan of arrangements that deviate from the one share, one vote principle. Many critics of dual class share structures acknowledge that superior voting rights may afford a company’s founders some relief from market short-termism, providing runway for the execution of strategy while still in the early days of being publicly listed. ICEV and its members therefore advocate that, where dual class structures are adopted, they should be accompanied by sunset arrangements. Such arrangements would see the voting classes collapsed into a single share class, no more than seven years after listing on a public market. [8]

Dual Class Share Structures Obscure Proxy Voting Signals

After each proxy season, Morningstar Sustainalytics’ ESG Voting Policy team examines proxy vote outcomes to identify issues shareholders are most concerned about and how companies are responding to these concerns. For companies with dual class share structures, obtaining a more accurate assessment of minority shareholder sentiment entails adjusting for the influence of insiders holding significant voting sway via their superior voting rights. [9]

Our method for doing this is as follows: [10] We identify the proportion of votes controlled by insiders via super-voting share classes. Because companies with super-voting share classes are not required to report vote outcomes per share class, this adjustment requires that we examine beneficial ownership disclosures contained in proxy statements. We then adjust for their influence on the reported vote outcome by assuming the corresponding votes followed the board’s recommended vote on each resolution, on which both classes were entitled to vote.

Digging into the 2024 proxy season’s results, we found that insiders’ super-voting rights skewed corporate proxy vote outcomes. Their votes often significantly underrepresented the level of opposition to management and the board on important corporate governance or sustainability topics.

For this research, we examined the impact of unequal voting rights on three types of resolutions voted at annual shareholders’ meetings, or AGMs, across the 2024 proxy calendar: shareholder advisory votes on executive compensation, sustainability-focused shareholder resolutions, and shareholder resolutions calling on boards to collapse dual class structures. Our analysis shows that when insiders hold disproportionate voting power, outside shareholders are less supportive of management, and that they favor a one share, one vote policy when polled directly.

Unequal Voting Rights Limit Shareholders’ Say on Pay

Say on pay is a regular ballot proposal mandated as a key post-financial crisis reform measure by the 2010 DoddFrank legislation. [11] It asks shareholders to approve CEO and senior C-suite pay and pay practices, applicable to the five highest-paid executive officers. While advisory, it is often considered a vote of confidence in the ability of the board to steer management, by aligning their incentives with those of shareholders. Weak support raises a governance red flag.

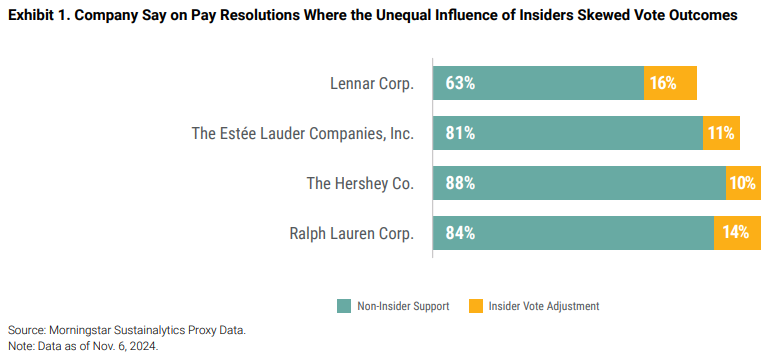

In the 2024 proxy calendar, we counted 22 companies in the S&P 500 that had dual class share structures with significant differential voting rights, of which 15 held a say on pay vote at their 2024 AGMs. Our analysis showed that unequal voting rights overstated shareholder support for executive pay practices and limited shareholders’ opportunities to vote on pay. We identified at least four companies where non-insider-adjusted voting support appeared to be at least 10 percentage points lower than the vote outcome reported by companies.

As shown in Exhibit 1, at Lennar Corp, Executive Chairman and Co-Chief Executive Officer Stuart Miller has voting rights over 65.6% of Class B stock, which carries 10 votes a share, compared to one vote per share of the more widely held Class A stock. This affords him 38% of total voting control, since holders of Class A and Class B shares vote together as a single class. While the company reports that 79% of shareholders [12] supported the advisory approval of named executive officer compensation, we estimate non-affiliated shareholder support to be only 63%.

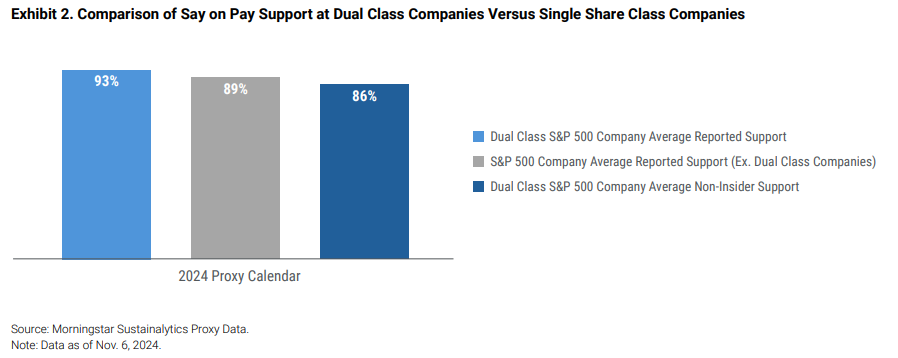

Controlling for insiders’ voting influence, we found that shareholders appear less willing to support pay practices at S&P 500 companies with dual class share structures (Exhibit 2). Companies with dual class share structures reported an average of 92.9% support on say on pay resolutions in the 2024 proxy calendar. However, adjusting for insider super voting influence puts minority shareholder support at 85.6%. Average support for pay arrangements at S&P 500 companies with one share, one vote arrangements was 89.3%.

These numbers reveal a 7.3 percentage point gap between reported and adjusted say on pay support at companies with dual class structures. Put simply, companies with dual class structures faced 35% more opposition from shareholders over their pay practices than did companies with one share, one vote arrangements.

The SEC’s implementation of Dodd-Frank’s say on pay mandate also requires a frequency vote, where companies must poll shareholders at least once every six years to assess whether they would prefer to cast this vote on an annual, biannual or triennial basis.

Whereas broad market investors, including all the largest asset managers, overwhelmingly support annual advisory votes, insiders more frequently prefer a triennial vote cadence. Where insiders control significant voting power, their preference to hold a say on pay vote only once every three years is more likely reflected in the outcome of a say on pay frequency resolution.

In 2023, say on pay’s 12-year anniversary, shareholders of 369 of the 379 S&P 500 companies that held a say on pay frequency vote voted in favor of an annual frequency. Only 10 outcomes favored a triennial vote. Of these, seven were companies with dual class share structures. In the other three cases, an insider owned a significant portion of the company’s single class of shares. In the 2024 proxy calendar, ten companies in the S&P 500 that held AGMs did not hold a say on pay vote. Seven of these companies are dual class companies. In summary, dual class share structures limit shareholders’ opportunities to weigh in on pay practices and, when they do get to vote, this arrangement understates shareholders’ opposition to pay practices.

Unequal Voting Rights May Limit Shareholders’ Right to File Resolutions

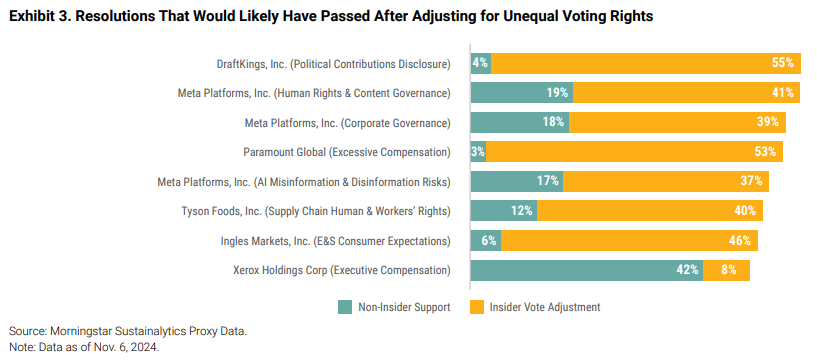

In the 2024 proxy season, shareholder resolutions voted at US companies were significantly impacted by unequal voting rights. Insiders swayed the vote by an estimated 19 percentage points, relative to average estimated noninsider support. This was across 47 shareholder resolutions that came to vote at companies with dual class share structures. [13] We calculate that several more shareholder resolutions might have passed with majority support, were it not for the influence of insiders holding superior voting shares.

Exhibit 3 below shows eight majority-supported resolutions addressing various ESG topics. In the case of Meta Platforms, Mark Zuckerberg holds 99.7% of the company’s Class B Stock, which carries 10 votes per share. The company’s minority shareholders own the more widely traded Class A Stock, which carries one vote per share. Zuckerberg’s shares afford him 61% of total voting power on all items that came to vote at the company’s May 2024 shareholder meeting. As CEO and chairman of the board, we assume his votes followed the board’s recommended position, which was to vote against all shareholder-sponsored resolutions.

In Exhibit 3, Proposal 11 covering human rights and content governance asked the company to begin reporting annually on the effectiveness of its efforts to improve child safety on its platforms. While the company reported 19% shareholder support, we estimate non-affiliated shareholder support to be closer to 60%. [14]

In such cases, the reported vote outcome understates broad market shareholders’ concerns about the ESG issues that are typically raised via the proxy process. Resolutions achieving significant minority shareholder support may be overlooked as a signal of shareholder sentiment.

Unequal voting rights may also limit shareholders’ ability to re-submit shareholder proposals at future annual meetings. Under the SEC’s Shareholder Proposal Rule 14a-8(i)(12), companies may exclude from their ballots re-submitted shareholder proposals that did not previously receive specified thresholds of support. [15]

Consider a resolution voted at Paramount Global’s 2024 AGM, requesting further disclosure of the company’s use and oversight of artificial intelligence. The company reported that less than five percent of voted shares supported this resolution. However, Paramount Global applies a form of unequal voting rights: voting rights attach only to the company’s Class A shares – 77% of which were owned by the founding Redstone family at the time of the company’s 2024 annual shareholder meeting. [16] Class B shares, the class of shares most widely traded and owned by minority shareholders, do not carry any voting rights. Excluding insider holdings, we calculate that the resolution likely received 49% support from outside shareholders. [17] Responsible AI was a new and strongly supported issue on US corporate proxy ballots in 2024, receiving an average 34% adjusted support across 13 resolutions voted during the proxy calendar.

While 2024 is the first year this resolution was filed at Paramount Global, the low reported support level may give the company the option to exclude this request from its proxy ballot for the next five years, as it failed to receive the required 5% support for a first vote. Several other resolutions voted at dual class companies in 2024 are also potentially impacted by this rule.

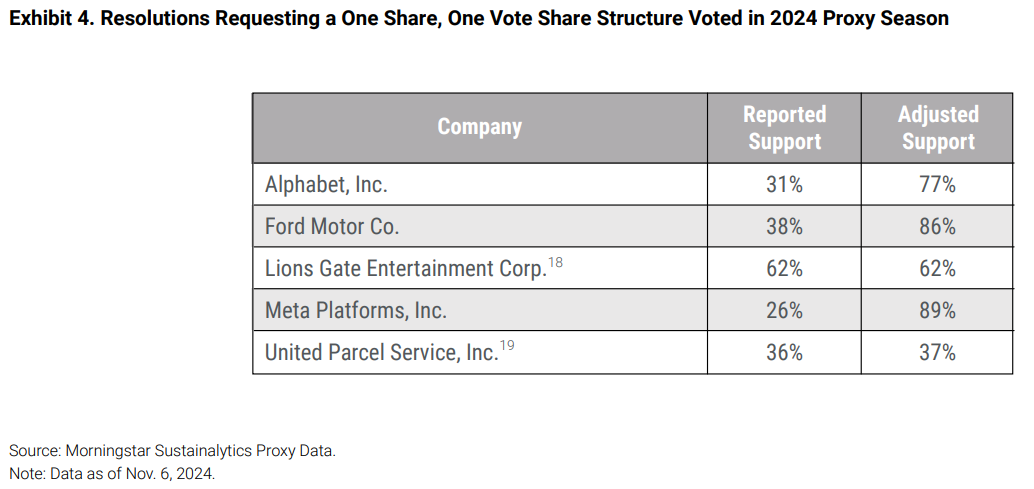

Minority Shareholders Overwhelmingly Opt for One Share, One Vote Arrangements

In the 2024 proxy season, five shareholder resolutions came to a vote asking companies to collapse their dual class share structures (Exhibit 4). Of these, four likely passed with majority support of the shares voted by non-insider shareholders. At UPS, the resolution failed to earn majority support. In this case, the company’s dual class share structure is not typical, in that it does not concentrate power with company insiders. Its Class A shares carry 10 votes for every one vote carried by each Class B share, but they are widely held, having been distributed as incentive pay to current and former employees. Serving directors and executive officers, individually and as a group, held less than 1% of Class A and Class B common stock at the time of the company’s shareholder meeting. The company also explains how it is gradually sunsetting Class A shares through provisions built into their transfer and future use.

The four largest asset managers – BlackRock, Vanguard, State Street and Fidelity – each embed support for the principle of one share, one vote in their proxy voting guidance. For instance, Vanguard highlights that the “alignment of voting and economic interests is a foundation of good governance.” [20] Except for BlackRock, which opposed the resolution at UPS, the four asset management giants unanimously cast their votes in support of shareholder proposals requesting that companies collapse their dual class share structures.

Disaggregated Voting Disclosure Would Strengthen Accountability

Looking ahead, while investor groups strongly favor voting equity, regulators and exchanges are moving towards a more relaxed approach to dual class structures for smaller, earlier stage listed companies. In October 2024, the European Council formally adopted a directive on multiple vote share structures. When it takes effect, it will allow small and medium-sized enterprises (SME) to list multiple share classes on EU financial markets open to the trading of SME shares. [21]

The analyses presented in this paper underscore the ways in which dual class share structures can obscure the true level of broad market shareholder proxy voting support or opposition. These share structures thereby dilute minority shareholder voices on important governance and sustainability issues. We found that reported vote outcomes overstate shareholder support for senior executive compensation arrangements and frequently understate support for shareholder resolutions opposed by the board.

Given the important role of advisory shareholder voting in shaping corporate governance practices, we believe companies with dual class share structures should be required to disclose proxy voting results disaggregated by share class. Presently, SEC rules do not mandate disaggregated vote disclosure. Adjusted support level calculations require additional inspection of the company’s reporting on capital structure and voting rights and beneficial ownership disclosures.

Notably, the International Corporate Governance Network (ICGN) responded to the EU’s directive by recommending that the EU adopt class-by-class vote disclosure to provide the necessary transparency on voting outcomes per agenda item. [22] In a similar vein, at Meta’s 2024 AGM, a shareholder proposal on reporting by share class was voted on and supported by an estimated 55% of independent shareholders.

By focusing on the impact of dual class share structures on proxy vote outcomes, we aimed to highlight the continued relevance and value placed by shareholders on the proxy voting process, as a market-wide poll of shareholder sentiment on material matters. Across the market, entrenched insider control may lead to poor governance practices and impede the ability of shareholders to enact reform. We believe that better reporting of the votes – disaggregating those cast by insider holders of super voting shares from those cast by minority shareholders – would support shareholder democracy and strengthen good governance in markets increasingly shaped by differential voting rights.

1 Ritter, J.R. “Initial Public Offerings: Dual Class Structure of IPOs Through 2023”. Published April 2024: https://site.warrington.ufl.edu/ ritter/files/IPOs-Dual-Class.pdf. (go back)

2 https://www.cbd.int/convention/articles/?a=cbd-02This paper extends Cook, J. and Snyder, G. “Accounting for Insider Influence in the Proxy Process.” Morningstar Whitepaper. Published September 2021. https://www.morningstar.com/sustainable-investing/accountinginsider-influence-proxy-process (go back)

3 “Dual Class Stock: Background and Policy Debate”. Congressional Research Service. Published December 2021. https://crsreports. congress.gov/product/pdf/IF/IF11992/2. (go back)

4 “Dual-Class Stock”. Council of Institutional Investors. Accessed 11 November 2024. https://www.cii.org/dualclass_stock. (go back)

5 Hodgson, P. “Dual Class Share Structures: Is the Sun Setting Too Slowly?” ISS Corporate Solutions. Published December 2022. https://insights.issgovernance.com/posts/dual-class-share-structures-is-the-sun-setting-too-slowly/ (go back)

6 Egan, T.J., Thompson, J., Wong, I., Bell, M. “The revival of dual class shares”. Baker McKenzie. Published March 2020. https://www.bakermckenzie.com/-/media/files/insight/publications/2020/03/the-revival-of-dual-class-shares.pdf (go back)

7 S&P Dow Jones reopens its indices to companies with multiple share classes.” Davis Polk. Published April 2023: https://www.davispolk.com/insights/client-update/sp-dow-jones-reopens-its-indices-companies-multiple-share-classes. (go back)

8 “Investor Statement on Unequal Voting Rights.” Investor Coalition for Equal Voting Rights (ICEV). Published November 2023: https://cdnsuk-railpencom-live-001.azureedge.net/media/media/xtupqlv3/icev-2023-investor-statement-undermining-the-shareholder-voice.pdf. (go back)

9 Lida, O., Zagoroff, D. “Shopify and the Problem of Shareholder ‘Approval’ at Multi-Class Companies”. Harvard Law School Forum on Corporate Governance. Published August 2024. https://corpgov.law.harvard.edu/2024/08/15/shopify-and-the-problem-of-shareholderapproval-at-multi-class-companies/. (go back)

10 See Appendix A for an explanation of how we adjust reported votes to estimate minority shareholder voting. (go back)

11 H.R.4173 – Dodd-Frank Wall Street Reform and Consumer Protection Act. https://www.congress.gov/bill/111th-congress/housebill/4173/text. (go back)

12 See Company 8-K Filing, Item 2: https://www.sec.gov/ix?doc=/Archives/edgar/data/920760/000162828024015846/len-20240410.htm. (go back)

13 Not counting resolutions filed by so-called ‘anti-ESG’ groups. (go back)

14 See Company 8-K Filing, Item 11: https://www.sec.gov/ix?doc=/Archives/edgar/data/1326801/000132680124000057/meta-20240529.htm. (go back)

15 U.S. Securities and Exchange Commission (SEC). Shareholder Proposal Rule 14a-8: https://www.sec.gov/divisions/corpfin/rule-14a-8.pdf. (go back)

16 Via the National Amusements ownership stake. See the Paramount Global’s 2024 proxy statement: https://www.sec.gov/ix?doc=/Archives/edgar/data/813828/000119312524105026/d558817ddef14a.htm (go back)

17 Paramount Global’s 2024 Notice of Annual Stockholder Meeting and Proxy Statement on Form DEF 14a (filed 22 April 2024): https://www.sec.gov/ix?doc=/Archives/edgar/data/813828/000119312524105026/d558817ddef14a.htm (go back)

18 The board made no recommendation, and therefore we did not discount insider voting influence from this outcome. (go back)

19 While UPS has two classes of shares, the superior voting class is widely held and does not have a significant impact on vote outcomes. (go back)

20 “Proxy Voting Policy for U.S. Portfolio Companies” Vanguard. Published March 2022. https://corporate.vanguard.com/content/dam/ corp/advocate/investment-stewardship/pdf/policies-and-reports/US_Proxy_Voting.pdf. (go back)

21 Council of the EU Press Release, “SME financing: Council adopts the multiple-vote share structures directive,” 8 October 2024. https://www.consilium.europa.eu/en/press/press-releases/2024/10/08/sme-financing-council-adopts-the-multiple-vote-sharestructures-directive/. (go back)

22 ICGN Recommendations to the European Institutions on Shareholder Rights, 29 October 2024. https://www.icgn.org/letters/icgnsrecommendations-european-institutions-shareholder-rights. (go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.