Power Purchase Agreement Market Set to Grow at 31.7% CAGR | Top-Growing Players - General Electric, Siemens AG

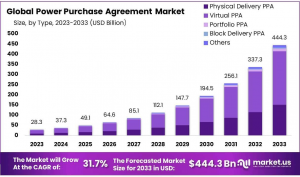

Power Purchase Agreement Market size is expected to be worth around USD 444.3 Bn by 2033, from USD 28.3 Bn in 2023, at a CAGR of 31.7% from 2023 to 2033.

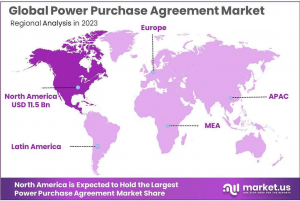

In 2023, North America led the PPA market, with a 40.7% market share.”

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- Power Purchase Agreements (PPAs) Market have emerged as a critical mechanism for ensuring the procurement of electricity, especially in the renewable energy sector. A Power Purchase Agreements is a contractual arrangement between an energy producer and a buyer, typically spanning several years, wherein the buyer agrees to purchase a specified amount of electricity at pre-determined rates. PPAs provide stability to both producers and buyers, with producers securing a steady revenue stream and buyers gaining predictable energy costs. The market for PPAs is gaining momentum globally, driven by the increasing adoption of renewable energy, stringent regulatory frameworks for decarbonization, and growing energy consumption across various sectors.— Tajammul Pangarkar

The Driving Factors of Power Purchase Agreements market is primarily driven by the urgent need to transition to sustainable energy systems. Governments worldwide are enforcing policies to curb greenhouse gas emissions and promote renewable energy adoption. Incentives such as tax credits, feed-in tariffs, and renewable energy certificates have further fueled the deployment of Power Purchase Agreements. Large corporations, particularly those in energy-intensive industries, are actively pursuing Power Purchase Agreements to achieve carbon neutrality and enhance their Environmental, Social, and Governance (ESG) performance.

Corporate demand for Power Purchase Agreements is anticipated to grow significantly as organizations continue to prioritize sustainability and energy security. Industries such as technology, manufacturing, and retail are likely to emerge as key drivers of market demand, given their high energy consumption and focus on green energy initiatives. Additionally, the expansion of energy storage solutions, such as battery storage systems, is expected to complement the renewable energy landscape, further enhancing the feasibility and reliability of Power Purchase Agreements.

Technological advancements are playing a pivotal role in shaping the Power Purchase Agreements market. The integration of smart grid technology, blockchain-based energy trading platforms, and Artificial Intelligence (AI) is enhancing the transparency, efficiency, and reliability of Power Purchase Agreements. Blockchain technology, in particular, enables seamless and secure energy transactions while reducing administrative overheads. Similarly, AI-powered analytics are being employed to forecast energy demand and optimize power distribution, ensuring better alignment between energy producers and buyers.

To Get Moment Access, Buy Report Here: Enjoy Discounts of Up to 30%! https://market.us/purchase-report/?report_id=107225

Key Takeaways

— The global Power Purchase Agreement (PPA) market was valued at USD 28.3 billion in 2023.

— The market is expected to grow at a CAGR of 31.7% between 2024 and 2033.

— Virtual PPAs accounted for a major market share of 59.2% in 2023.

— The off-site segment dominated the global market with an 83.1% share in 2023.

— The corporate segment represented 86.3% of the global market.

— The wholesale segment led the market with a 62.5% share in 2023.

— The 50-100 MW segment dominated the market, holding over 49.6% market share in 2023.

— The wind segment witnessed the fastest growth, with a 51% CAGR during the forecast period.

— The commercial segment dominated with a 50%+ market share in 2023.

— North America held the highest revenue share, accounting for 40.7% of the global market in 2023.

— In 2022, According to the American Public Power Association, 7 gigawatts (GW) of offsite projects were supported by power purchase agreements signed by more than 167 companies.

— Australia’s Renewable Energy Target (RET) influences PPAs by setting targets for electricity generation from renewable sources. For instance, the country has set a national renewable electricity target of 82% by 2030.

Power Purchase Agreements Segments

Based on Type

The Power Purchase Agreement (PPA) market is categorized into physical delivery PPA, virtual PPA, portfolio PPA, block delivery PPA, and others. Among these, the virtual PPA segment emerged as the most lucrative, capturing 59.2% of the global market share in 2023. The growing preference for virtual PPAs is attributed to their flexibility, scalability, and cost-effectiveness, making them an attractive choice for businesses seeking renewable energy solutions without the complexities of physical electricity delivery. As organizations increasingly prioritize sustainability and carbon reduction goals, the adoption of virtual PPAs is expected to continue rising.

Based on Location

The global Power Purchase Agreement (PPA) market is segmented by location into on-site and off-site agreements, with the off-site segment dominating at 83.1% market share in 2023. Off-site PPAs offer businesses and utilities greater flexibility by sourcing renewable energy from locations with optimal generation conditions, enabling large-scale procurement at lower costs. This approach helps overcome challenges associated with on-site renewable energy, such as space limitations, infrastructure constraints, and operational feasibility, making it a preferred choice for organizations aiming for sustainable energy solutions.

Based on Category

The Power Purchase Agreement (PPA) market, categorized by segment into corporate, government, and others, saw the corporate segment lead with an 86.3% market share in 2023. This dominance is driven by businesses increasingly adopting renewable energy to reduce carbon footprints, stabilize long-term energy costs, and hedge against price volatility. Corporate PPAs have become a strategic tool for sustainability commitments, with the segment projected to grow at a CAGR of 32.8%. Notably, in October 2023, corporate PPAs accounted for 30.9 GW of clean power contracts in Europe, reflecting significant growth across multiple industries.

Based on Deal Type

The Power Purchase Agreement (PPA) market, segmented by deal type into wholesale, retail, and others, saw the wholesale segment lead with a 62.5% market share in 2023. The dominance of wholesale PPAs is driven by their scalability, making them an attractive option for large energy buyers and utilities looking to secure significant electricity volumes at predictable rates. These agreements enable direct procurement from large-scale renewable projects, providing cost efficiency and long-term price stability, which further enhances their appeal in the growing renewable energy sector.

Based on Capacity

The Power Purchase Agreement (PPA) market, segmented by capacity into Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW, saw the 50-100 MW segment dominate with a 49.6% market share in 2023. This capacity range offers an ideal balance between scalability and manageability, making it suitable for a wide array of applications. Its ability to achieve economies of scale helps lower the cost per megawatt, enhancing the financial viability of renewable energy projects while ensuring efficient energy procurement for large-scale buyers.

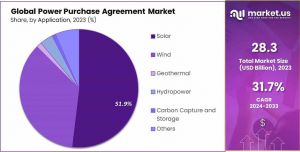

Based on Application

The Power Purchase Agreement (PPA) market, segmented by application into solar, wind, geothermal, hydropower, carbon capture and storage, and others, was led by the solar segment, holding over 51% market share in 2023. The dominance of solar PPAs is driven by their predictable and stable pricing models, making them highly attractive to commercial and industrial buyers seeking to mitigate risks from fluctuating energy costs. With increasing global investments in solar energy and advancements in photovoltaic technology, the demand for solar PPAs is expected to grow steadily.

Based on End-Use

The Power Purchase Agreement (PPA) market, segmented by end-use into residential, commercial, and industrial, was dominated by the commercial segment, accounting for over 50% market share in 2023. Commercial enterprises typically have higher energy demands than residential users, making long-term, stable energy procurement strategies essential. By leveraging PPAs, businesses can secure renewable energy at predictable rates, ensuring cost efficiency and sustainability while reducing exposure to market fluctuations.

For a deeper understanding, click on the sample report link: https://market.us/report/power-purchase-agreement-market/free-sample/

Key Market Segments List

Based on Type

◘ Physical Delivery PPA

◘ Virtual PPA

◘ Portfolio PPA

◘ Block Delivery PPA

◘ Others

Based on Location

◘ On-site

◘ Off-site

Based on Category

◘ Corporate

◘ Government

◘ Others

Based on Deal Type

◘ Wholesale

◘ Retail

◘ Others

Based on Capacity

◘ Up to 20 MW

◘ 20 50 MW

◘ 50 100 MW

◘ Above 100 MW

Based on Application

◘ Solar

◘ Wind

◘ Geothermal

◘ Hydropower

◘ Carbon Capture and

◘ Storage

◘ Others

Based on End-Use

◘ Residential

◘ Commercial

◘ Industrial

Top Emerging Trends

1. Rise of Corporate Renewable PPAs: Corporate renewable PPAs are becoming increasingly popular as businesses of all sizes commit to reducing their carbon footprint. These agreements allow companies to procure renewable energy directly from producers, ensuring price stability and supply security while contributing to corporate sustainability goals. Statistically, the global volume of corporate renewable PPAs has surged, with a reported increase of over 40% in contracted capacity in the last two years alone, highlighting a significant shift towards corporate-driven renewable investments.

2. Digitalization and Technological Integration: The integration of digital technologies such as blockchain and smart contracts into the PPA framework is revolutionizing how agreements are executed and managed. These technologies promise enhanced transparency, reduced transaction costs, and improved compliance monitoring, making PPAs more accessible and efficient. For instance, blockchain-based PPAs can automate the energy procurement process and provide real-time data verification, reducing the need for manual oversight and minimizing the risk of discrepancies.

3. Hybrid and Aggregated PPAs: To cater to smaller entities and diverse energy needs, hybrid and aggregated PPAs are gaining traction. Hybrid PPAs combine multiple renewable energy sources under a single contract, offering energy diversification and optimizing supply according to seasonal variations. Aggregated PPAs, on the other hand, allow multiple smaller buyers to pool their energy demands to leverage collective bargaining power, making renewable energy accessible to smaller companies. These innovative PPA structures are particularly appealing in regions with high renewable potential but fragmented energy markets.

4. Geographical Expansion into Emerging Markets: Emerging markets are witnessing rapid growth in the PPA landscape due to increasing energy demand and governmental support for renewable initiatives. Countries in Africa, Southeast Asia, and Latin America are exploring PPAs as a tool to secure energy supply while promoting sustainable growth. For example, in Southeast Asia, PPAs are projected to grow by 25% annually over the next decade, driven by expanding industrial bases and increasing environmental regulations.

5. Regulatory Evolution and Market Support: Regulatory support is crucial for the expansion of PPAs. Governments are increasingly recognizing the role of PPAs in meeting renewable energy targets and are thus facilitating their adoption through incentives and supportive policies. This regulatory evolution is crucial in established markets as well as in emerging economies where such frameworks can significantly accelerate PPA adoption.

Regulations on Power Purchase Agreements Market

The regulatory environment for PPAs is shaped by national and international policies aimed at promoting renewable energy sources. In the United States, for example, regulations such as the Public Utility Regulatory Policies Act (PURPA) have historically facilitated the development of renewable energy projects by requiring utilities to purchase power from independent producers under PPAs. More recently, the extension of tax credits for renewable energy projects in the U.S. has bolstered the market by making PPAs more financially attractive.

In the European Union, the Renewable Energy Directive sets binding renewable energy targets for each member state, which drives the adoption of renewable PPAs. Additionally, the EU’s state aid rules have been adapted to allow for more flexible support schemes, including corporate PPAs, which are increasingly popular among large energy consumers seeking to reduce their carbon footprint.

Emerging markets also show dynamic regulatory progress. Countries like India and Brazil have implemented specific policies to encourage renewable energy development, often facilitated by government-mediated PPAs. These agreements often benefit from feed-in tariffs or preferential pricing to ensure they are competitive against traditional energy sources.

The global PPA market has seen significant growth in recent years, with an estimated increase in contracted capacity from renewable sources. According to the Renewable Energy Policy Network for the 21st Century (REN21), the global capacity of renewable energy under PPAs increased by 30% year-on-year in 2020. Moreover, Wood Mackenzie forecasts that corporate PPAs are set to add over 20 GW of new renewable capacity annually by 2025.

In terms of regional distribution, North America and Europe are leaders in the adoption of renewable PPAs, largely due to robust regulatory frameworks and corporate sustainability goals. For instance, in 2021, Europe saw a record of over 10 GW of new renewable capacity financed through corporate PPAs, demonstrating a growing trend among businesses to invest in sustainable energy solutions.

Regional Analysis

In 2023, North America led the Power Purchase Agreement (PPA) market with a 40.7% market share. The region’s strong regulatory support for renewable energy has played a key role in its market dominance. Governments in the United States and Canada have introduced incentives and policies that encourage renewable energy adoption, making PPAs an attractive option for both producers and consumers.

According to data from the American Clean Power Association (ACP), commercial and industrial (C&I) companies in the U.S. signed nearly 20 GW of clean power PPAs in 2022, marking a record high in corporate renewable energy purchasing. This surge in agreements highlights the growing commitment of businesses to long-term renewable energy procurement.

North America’s mature and technologically advanced renewable energy sector has further strengthened the PPA market. The presence of large-scale renewable projects and increasing corporate participation in PPAs for cost-effective, long-term renewable energy sourcing continue to drive market growth. Businesses are also responding to rising societal demand for green energy, further accelerating adoption.

Europe is experiencing the fastest growth rate in the PPA market, with a CAGR of 36.6% during the forecast period. Analysts anticipate that Europe will overtake North America in market share in the coming years. This growth is fueled by stringent environmental regulations and the ambitious renewable energy targets set by the European Union, making PPAs a preferred strategy for securing long-term renewable energy.

According to recent reports, 2023 was a record-breaking year for the European PPA market, with over 16.2 GW of contracted renewable power volumes. The European PPA market is projected to exceed 20 GW in 2024, further solidifying the region’s position as a key player in global renewable energy procurement.

Key Players Analysis

Leading companies in the Power Purchase Agreements market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

◘ General Electric

◘ Siemens AG

◘ Shell Plc

◘ Statkraft

◘ Fairdeal Greentech India Pvt. Ltd.

◘ Ameresco

◘ RWE AG

◘ Enel Global Trading

◘ Ecohz

◘ Green sphere Cleantech Services Private Limited

◘ Iberdrola, S.A.

◘ Ørsted A/S

◘ Renew Energy Global PLC

◘ Drax Energy Solutions Limited

◘ Other Key Players

Recent Developments Of Power Purchase Agreement Market

— In August 2024, RWE Supply & Trading entered into a long-term PPA to supply German steelmaker Salzgitter with 64 GWh of green electricity annually from the Boitzenburger Land solar park. This seven-year agreement, starting in 2027, supports Salzgitter's goal to fully cover its power demand with renewable energy by 2030.

— In March 2024, Statkraft signed a long-term PPA with Hydro Energi AS for the delivery of 1.28 terawatt-hours (TWh) of renewable energy from May 2024 to December 2027. This agreement contributes to Hydro's efforts to produce low-carbon aluminum in Norway.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.