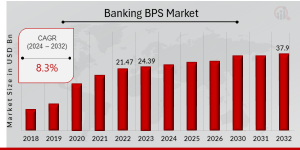

Banking BPS Market is Predicted to Reach USD 37.9 Billion at a CAGR of 8.3% by 2032

Banking BPS Market Research Report By, Service Type, Deployment Model, Industry Vertical, Business Size, Regional

NE, UNITED STATES, January 22, 2025 /EINPresswire.com/ -- The global Banking Business Process Services (BPS) Market has witnessed significant growth in recent years and is expected to expand further in the coming decade. The market size was estimated at USD 21.47 billion in 2022 and is projected to grow from USD 24.39 billion in 2023 to an impressive USD 37.9 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 8.3% during the forecast period (2024–2032). The growth is driven by the increasing adoption of digital banking, cost optimization efforts, and advancements in technology-driven services.Key Drivers of Market Growth

➤ Digital Transformation in Banking

Banks worldwide are increasingly adopting digital solutions to enhance customer experiences, streamline processes, and reduce operational costs. This shift is boosting the demand for Banking BPS solutions.

➤ Focus on Cost Optimization

The rising operational costs in the banking sector have encouraged financial institutions to outsource non-core processes, driving the growth of the BPS market.

➤ Technological Advancements

The integration of artificial intelligence (AI), robotic process automation (RPA), and cloud-based solutions has transformed banking operations, enabling enhanced efficiency and scalability.

➤ Regulatory Compliance

Outsourcing business processes helps banks navigate complex regulatory environments and ensure compliance with international standards, which has further increased market demand.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/23871

Key Companies in the Banking BPS Market Include

• Atos

• Capgemini

• Genpact

• Steria

• HCL Technologies

• TCS

• Infosys

• Wipro

• ExlService

• Cognizant

• WNS

• Syntel

• Accenture

• IBM

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/banking-bps-market-23871

Market Segmentation

To provide a comprehensive analysis, the Banking BPS Market is segmented based on service type, deployment model, application, and region.

1. By Service Type

• Core Banking BPS: Includes loan processing, credit card services, and payment management.

• Customer Interaction Services: Focuses on customer onboarding, help desk services, and complaint resolution.

• Human Resource (HR) Services: Outsourced payroll, recruitment, and training solutions for the banking workforce.

• Finance and Accounting Services: Includes accounts reconciliation, invoice processing, and financial reporting.

2. By Deployment Model

• On-Premises: Preferred by banks with stringent data security requirements.

• Cloud-Based: Witnessing rapid adoption due to scalability, cost-effectiveness, and ease of integration.

3. By Application

• Retail Banking: The largest segment, driven by increased consumer interactions and the need for seamless operations.

• Corporate Banking: Growing demand for efficient treasury, trade finance, and cash management services.

• Investment Banking: Outsourcing complex processes like risk management and compliance to optimize performance.

4. By Region

• North America: Leading the market with advanced banking systems and a focus on technological innovation.

• Europe: Growth driven by digital transformation initiatives and regulatory compliance requirements.

• Asia-Pacific: Fastest-growing region due to rapid financial inclusion and the adoption of banking technologies in emerging economies.

• Rest of the World (RoW): Includes steady growth in Latin America, the Middle East, and Africa due to increasing penetration of banking services.

Procure Complete Research Report Now : https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23871

The global Banking BPS Market is poised for substantial growth, fueled by the need for operational efficiency, enhanced customer experiences, and evolving technologies. As banks increasingly focus on their core functions, the demand for specialized BPS solutions is expected to soar, making the sector a critical component of the banking industry's future landscape.

Related Report :

Agriculture Reinsurance Market

Home Loan Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.