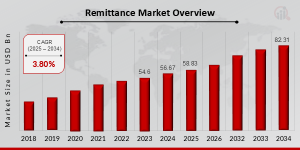

Remittance Market CAGR to be at 3.80% By 2034 | US Remittance Services Enhancing Financial Connectivity and Inclusion

Remittance market has grown exponentially in recent years, driven by globalization and increased migration for work, education, and family reunification.

NEW YORK, NY, UNITED STATES, January 13, 2025 /EINPresswire.com/ -- According to Market Research Future (MRFR), the global Remittance Market valuation will touch 𝗨𝗦𝗗 𝟴𝟮.𝟯𝟭 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 by 2034, growing at a 𝟯.𝟴𝟬% CAGR throughout the review period (2025-2034).The remittance market has grown exponentially in recent years, driven by globalization and increased migration for work, education, and family reunification. Remittance refers to the transfer of money by individuals working abroad to their home countries. This market is a critical component of the global economy, contributing significantly to the GDP of many developing nations. The adoption of digital payment platforms and mobile wallets has transformed the remittance process, making it more accessible, secure, and cost-effective for users worldwide.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗦𝗮𝗺𝗽𝗹𝗲 𝘄𝗶𝘁𝗵 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀:

https://www.marketresearchfuture.com/sample_request/11999

𝗠𝗮𝗿𝗸𝗲𝘁 𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀

The remittance market features several key players, including Western Union, MoneyGram, PayPal, and TransferWise. These companies have established themselves as leaders by providing reliable and efficient money transfer services. Emerging fintech firms like WorldRemit and Remitly have also gained traction by offering innovative solutions tailored to the needs of tech-savvy consumers. Additionally, regional players such as UAE Exchange and Euronet Worldwide cater to specific markets, ensuring competition and diverse service offerings in the industry.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻

The remittance market is segmented based on type, channel, and region. By type, it is divided into inward and outward remittances. Inward remittances dominate, accounting for funds sent to developing countries. Channels include banks, money transfer operators (MTOs), and digital platforms. Banks remain the traditional choice, while digital platforms are rapidly gaining popularity due to their convenience and lower fees. Geographically, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each with unique market dynamics and growth patterns.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗗𝗿𝗶𝘃𝗲𝗿𝘀

Several factors are driving the growth of the remittance market. Increased global migration for employment has led to a higher volume of cross-border money transfers. The rise of digital payment technologies has enhanced transaction speed, security, and transparency. Additionally, favorable government policies in various countries to encourage digital transactions are further supporting the market’s expansion. The need for financial support among families in developing nations also sustains the demand for remittance services, making it a resilient industry.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀

The remittance market presents substantial opportunities for growth, particularly in the adoption of blockchain technology. Blockchain offers improved security, reduced costs, and faster transaction processing, making it an attractive solution for money transfers. The growing penetration of smartphones and internet connectivity in rural areas is also opening up new customer bases. Furthermore, partnerships between financial institutions and fintech companies can enhance service delivery, especially in underserved regions, creating untapped potential for expansion and innovation within the remittance industry.

𝗕𝘂𝘆 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗼𝗳 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝘁𝘂𝗱𝘆 𝗡𝗼𝘄:

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11999

𝗥𝗲𝘀𝘁𝗿𝗮𝗶𝗻𝘁𝘀 𝗮𝗻𝗱 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲𝘀

Despite its growth, the remittance market faces several challenges. High transaction fees, especially for traditional methods, deter many users. Regulatory complexities and compliance requirements across countries add operational hurdles for service providers. Fraud and cybersecurity threats pose significant risks, potentially undermining consumer trust. Additionally, the reliance on cash transactions in certain regions limits the adoption of digital remittance solutions. Addressing these challenges is essential for sustaining the market’s momentum and ensuring its long-term growth.

𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀

The Asia-Pacific region dominates the remittance market, driven by large migrant populations from countries like India, China, and the Philippines. North America and Europe serve as major source regions due to their economic stability and high immigration rates. In Latin America, countries like Mexico benefit significantly from remittance inflows. The Middle East and Africa also see substantial growth, with expatriate workers in Gulf Cooperation Council (GCC) countries sending money back to their home countries. Regional trends highlight the diverse dynamics shaping the global remittance landscape.

𝗩𝗶𝗲𝘄 𝗗𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗙𝗶𝗻𝗱𝗶𝗻𝗴𝘀:

https://www.marketresearchfuture.com/reports/remittance-market-11999

𝗥𝗲𝗰𝗲𝗻𝘁 𝗗𝗲𝘃𝗲𝗹𝗼𝗽𝗺𝗲𝗻𝘁

Recent developments in the remittance market highlight the growing influence of technology. Digital platforms and mobile apps are now widely used for cross-border transactions, providing convenient and cost-effective solutions for users. Companies are increasingly adopting blockchain to streamline operations and enhance security. Governments and regulatory bodies are also playing an active role by implementing policies to support digital payments. Partnerships between financial institutions and technology firms continue to redefine the market, paving the way for innovative products and services to meet evolving consumer demands.

This comprehensive analysis underscores the remittance market's pivotal role in the global economy, driven by technological advancements and the growing need for financial connectivity across borders.

𝗧𝗼𝗽 𝗧𝗿𝗲𝗻𝗱𝗶𝗻𝗴 𝗥𝗲𝗽𝗼𝗿𝘁𝘀:

E-commerce Market Size

Programmatic Advertising Market Analysis

𝗔𝗯𝗼𝘂𝘁 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗙𝘂𝘁𝘂𝗿𝗲:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

𝗖𝗼𝗻𝘁𝗮𝗰𝘁:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

Market Research Future

Market Research Future

+ + 1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.