2024 Annual Stewardship Report

Dimensional advocates for stronger governance practices at the companies in which we invest on behalf of our clients because we believe it can improve returns for investors. [1]

Dimensional manages global equity and fixed income strategies for clients around the world We aim in all areas to be responsible stewards of our clients’ assets, and one way we look to do so is through our stewardship activities. Stewardship activities include engaging with boards and management at portfolio companies, voting on behalf of our clients at shareholder meetings, and advocating for policies that we believe protect and enhance shareholder value.

Our Stewardship Philosophy

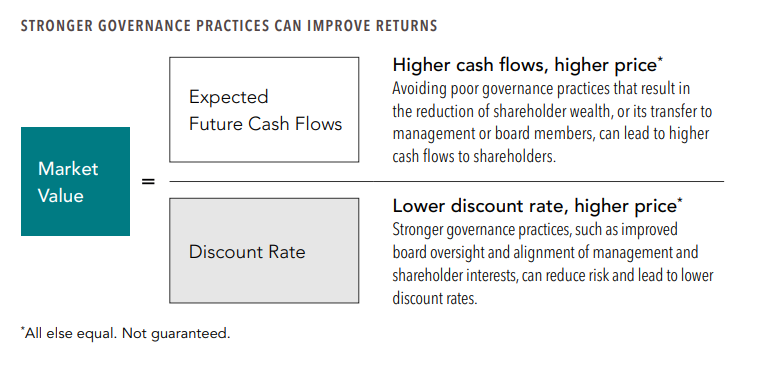

At Dimensional, we believe that security prices reflect the aggregate expectations of market participants, which may include information about a company’s governance practices Improvements in corporate governance may be rewarded with higher market prices if they enhance expected future cash flows or reduce perceived risks, as shown below. [2]

Stewardship activities that promote better governance practices may improve returns to shareholders When there is evidence of poor governance practices at a portfolio company, Dimensional generally believes our clients are better served when we promote improvements in corporate governance through stewardship activities rather than divesting.

A Focus on Good Governance

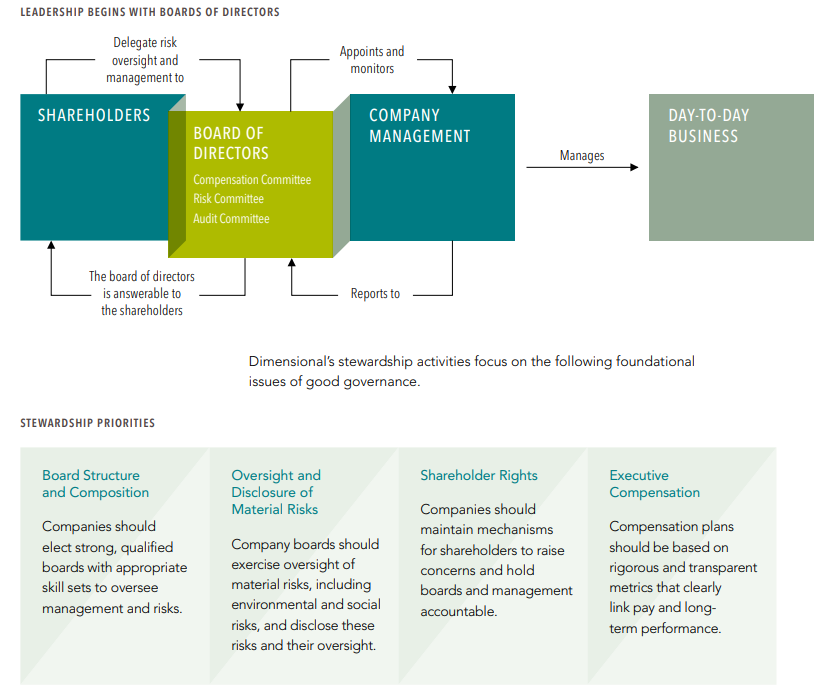

Dimensional believes that stewardship efforts should focus on people, policies, and practices that seek to improve governance at portfolio companies. As illustrated in the graphic below, shareholders delegate leadership and oversight of company management to the board of directors, which is accountable to shareholders. Company management implements day-to-day business matters and is accountable to the board. We believe the goal of good governance is to align boards and management incentives with shareholder interests.

Without strong, foundational governance practices and effective boards, companies may be poorly equipped to address matters of concern to shareholders, including a broad range of environmental, social, and governance (“ESG”) issues.

Implementation Process

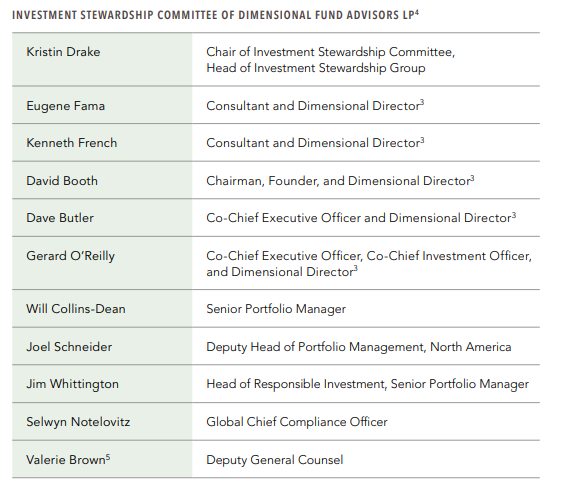

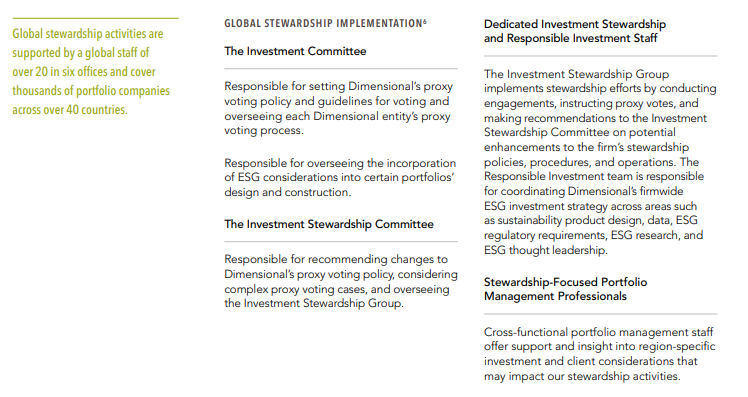

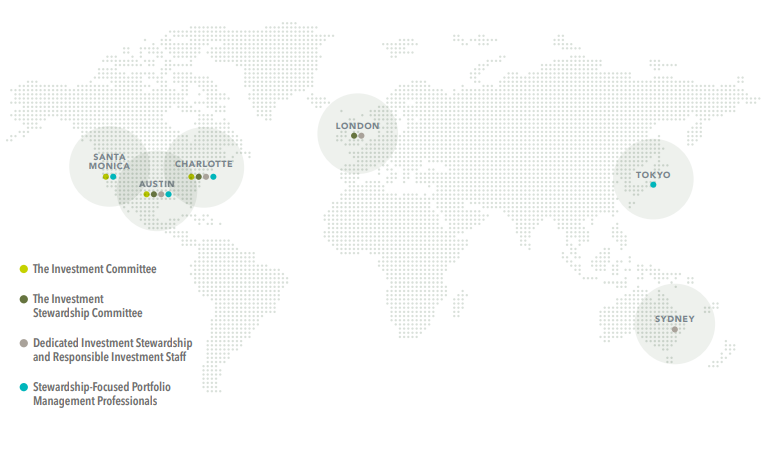

Investment stewardship at Dimensional is a global effort supported by multiple teams Dimensional’s stewardship efforts are overseen by the Investment Stewardship Committee of Dimensional Fund Advisors LP. This group of senior employees and directors, listed below, is chaired by the Head of Investment Stewardship Group and includes members of Dimensional’s Portfolio Management, Executive, and Compliance teams, as well as the Head of Responsible Investment and members of Dimensional’s Board of Directors. [3] The Investment Stewardship Committee, a subcommittee of the Investment Committee of Dimensional Fund Advisors LP, is responsible for developing our policies and approach to investment stewardship, which are then executed by the Investment Stewardship Group in coordination with other groups.

Dimensional’s proxy voting policy is principles-based, setting out our views on certain governance practices and providing the framework by which Dimensional analyzes key proposal types. However, a fund’s or account’s investment strategy can impact voting determinations. For example, in our dedicated social and sustainability strategies, we follow proxy voting guidelines tailored in certain circumstances to consider social and sustainability objectives when evaluating certain proxy votes.

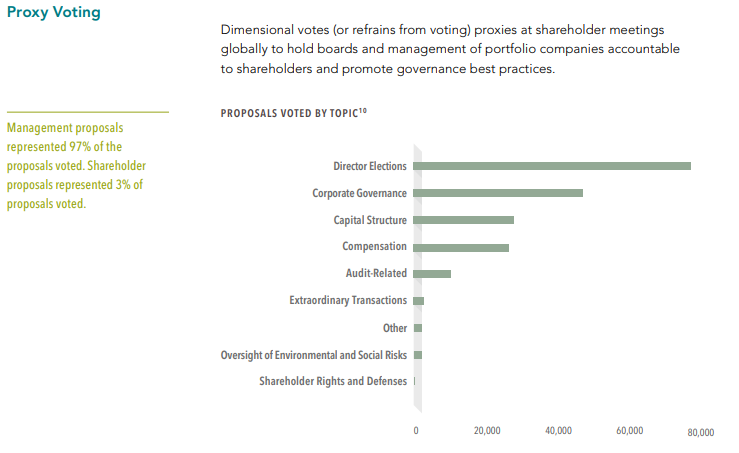

Dimensional seeks to vote (or refrain from voting) proxies on behalf of our clients in a manner that seeks to maximize the value of the client’s investment, subject to any particular investment or voting guidelines of specific funds or accounts. These votes can be on routine business matters raised by management, such as executive compensation plans, or issues raised by other shareholders, such as environmental shareholder proposals.

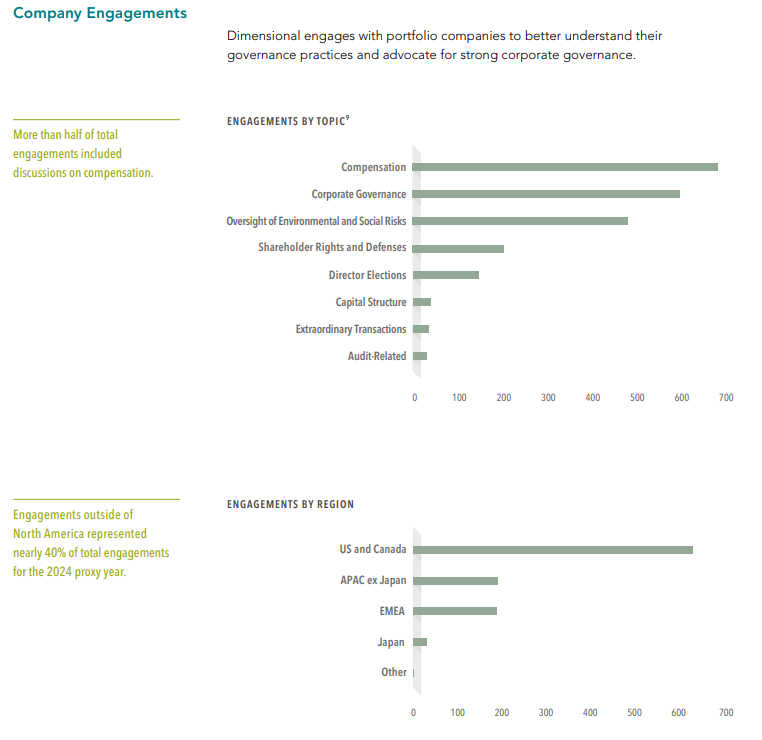

In addition to voting activities, the Investment Stewardship Group may engage with portfolio companies directly to understand their perspective on a particular topic or to provide our point of view. [7] Engagement can take the form of meetings and calls with board directors and company executives or written letters Each year, Dimensional identifies focused stewardship topics and may conduct letter campaigns to engage with a broader set of portfolio companies and pinpoint opportunities for additional engagement on these key issues.

The Investment Stewardship Group may consider news and other developments that might affect portfolio companies when undertaking stewardship activities. As part of our risk management process, we monitor securities in our eligible universe for reports of potential involvement in significant controversies, including ESG-related controversies. If we believe that these controversies are likely to have a material impact on a portfolio company’s financials, we may temporarily exclude the portfolio company from purchase, and the Investment Stewardship Group may follow up on this controversy with engagement.

To keep track of upcoming general meetings and execute votes on behalf of clients, Dimensional retains certain third-party proxy service providers, though we remain responsible for proxy voting decisions. The Investment Stewardship Group may conduct its own independent research, gather additional data, and engage with a company’s board or its management, if needed, before coming to a decision.

Outcomes for Shareholders

The goal of our approach to stewardship is to effectively use engagement and voting to protect and enhance shareholder value Stewardship is an important element of our investment process and commitment to our clients, and the following sections summarize notable activities and examples of stewardship work conducted by Dimensional’s team during the proxy year.

July 1, 2023–June 30, 2024

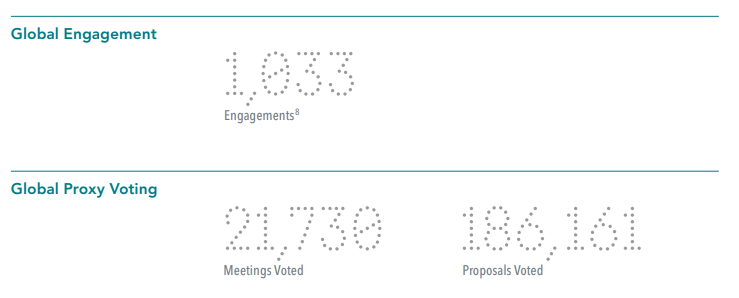

Dimensional’s investment stewardship efforts seek to improve governance practices at portfolio companies in a way that we believe may protect and enhance shareholder value. The following statistics provide a broad overview of Dimensional’s engagement and proxy voting activities during the proxy year.

Link to full report can be found here.

1“Dimensional,” “our,” “us,” or “we” may refer to the Dimensional separate but affiliated entities generally, rather than one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Ireland Limited, and Dimensional Japan Ltd.(go back)

2Dimensional from time to time may discuss governance matters with portfolio companies to represent client interests; however, regardless of such conversations, Dimensional acquires securities on behalf of its clients solely for the purpose of investment and not with the purpose or intended effect of changing or influencing the control of any portfolio company.(go back)

3Board of Directors of the general partner of Dimensional Fund Advisors LP.(go back)

4Committee membership, individual names, and titles as of June 30, 2024.(go back)

5Ex officio.(go back)

6Headcount and locations as of June 30, 2024.(go back)

7Dimensional from time to time discusses governance matters with portfolio companies to represent client interests; however, regardless of such conversations, Dimensional acquires securities on behalf of its clients solely for the purpose of investment and not with the purpose or intended effect of changing or influencing the control of any portfolio company.(go back)

8Includes calls with portfolio companies and dissident and shareholder proponents.(go back)

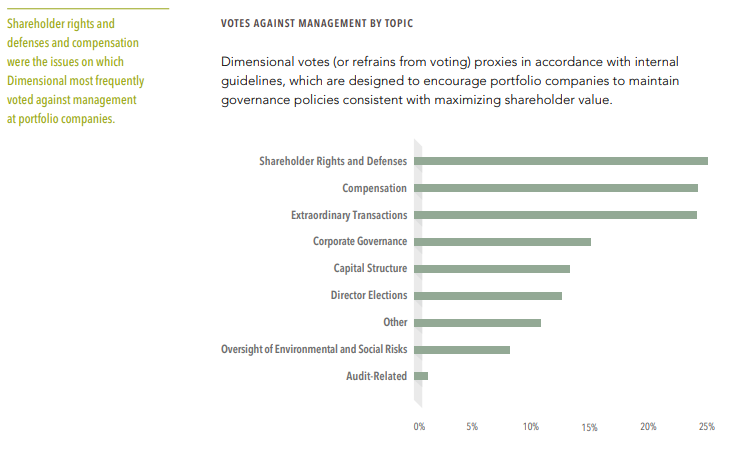

9Engagements may cover multiple topics. Total number of topical discussions will exceed total number of portfolio company discussions due to many discussions covering multiple stewardship topics. Categories based on SEC Form N-PX. See “Appendix: Form N-PX Voting Categories” for additional details. Compensation category includes the following N-PX categories: Compensation; and Section 14A say-on-pay. Oversight of Environmental and Social Risks includes the following N-PX categories: Environment or climate; Other social issues; Diversity, equity, and inclusion; and Human rights or human capital/workforce. Compensation and Oversight of Environmental and Social Risks as represented above remove duplicate engagement counts. Categories without data, such as investment company matters and other, are not included.(go back)

10Categories based on SEC Form N-PX. See “Appendix: Form N-PX Voting Categories” for additional details. Proposals may cover multiple categories. Compensation category includes the following N-PX categories: Compensation; and Section 14A say-on-pay. Oversight of Environmental and Social Risks includes the following N-PX categories: Environment or climate; Other social issues; Diversity, equity, and inclusion; and Human rights or human capital/workforce. Categories with fewer than 10 votes are not represented above.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.