The Outlook for Energy Demand Growth in the MENA Region

The longer research paper on which this policy brief is based can be found here.

Key Points

-

Natural gas by far represents the largest segment of energy demand growth in the Middle East and North Africa region over the course of the current decade, driven significantly by rapid increases in electricity demand growth that are likely to be met by gas-fired generation sources.

-

The fact that many of the region’s largest economies, mostly located in the Gulf Cooperation Council (GCC), are major oil and gas supporters will continue to underpin demand growth in the region to the end of the decade, especially with the development of new resources, particularly unconventional gas assets.

-

Renewable energy growth will also gain considerable momentum, but most new capacity will likely be added in countries where the renewable energy sector is approaching a greater degree of maturity. Countries with little to no renewable capacity have generally experienced difficulty advancing renewable power initiatives and projects.

-

The development of a regional green hydrogen sector represents a significant variable in the growth of renewable power capacity. While it is central to the green hydrogen production process, only one major final investment decision (FID) has taken place on a green hydrogen project, and prospects for the development of a global clean hydrogen market (which would be needed to underpin these investments) remain highly uncertain.

-

North Africa will account for some of the largest growth in demand by sub-region, but it will likely face increasing supply constraints as efforts to develop domestic supplies, both in the form of natural gas and renewables, have either produced disappointing results or been outpaced by demand growth.

-

While population growth is likely to be a key demand driver across the region, a variety of factors, including economic growth, population trends, and government policies, influence the trajectory of energy demand in each country.

Introduction

The MENA region is set to experience substantial growth in demand for energy during the remaining years of the present decade. Factors driving this growth vary enormously by sub-region and individual country, but there are broad similarities in the forms of both primary and final energy demand growth that are expected to materialize by 2030. Additionally, as most regional energy consumption is minimally integrated with global markets due to the availability of local supply, there is often an insufficient amount of attention paid to the granular aspects of demand growth from the region itself, as oil and gas exports from this part of the world, particularly the GCC region as well as Iraq, are major determinants of the global supply and demand balance.

Indeed, the GCC region has largely been able to guarantee energy security for its population via the development of local supply, although there have been some exceptions to this dynamic. For example, strong natural gas demand growth in Kuwait, driven heavily by the power sector, has led the country to become a major importer of liquefied natural gas (LNG).

Additionally, the abundance of local supply does not guarantee that local demand growth can be met. This challenge becomes evident when taking a closer look at the natural gas balances of countries like Egypt and Iran, where local supply is increasingly constrained due to demand growth that has been largely unmanaged on the policy side. This will be a key area to watch in the coming years; major forecasters expect the region’s electricity demand to grow by between 29% and 37% from 2020 to 2030.

Background

The MENA region is set to add an additional 69 million people by 2030, based on population projections from the World Bank. However, the area is also home to some of the most energy-intensive economies in the world, underscoring the role of per-capita energy consumption as a major driver of overall demand. The GCC represents over half of the MENA region’s primary energy consumption, while Iran is the largest consumer on a single-country basis.

Although some of the world’s largest oil and gas exporters are in this region, regional demand has historically received less attention from major forecasters due to the fact that most MENA energy markets are minimally integrated with the wider world.

Where most demand growth is likely to take place before the end of the decade, locally available supply will likely be the primary source that services this demand. Investment in developing new hydrocarbon resources, mostly in the form of unconventional natural gas assets, will enable a major segment of the anticipated demand growth before the end of the current decade.

Renewable power generation is also likely to grow at a rapid pace prior to 2030, although this growth is expected to be concentrated in countries that have already established a renewable generation sector, as countries where development of new renewable capacity either has yet to take place or has been largely dormant for many years generally struggle to accelerate the pace of growth. Still, rapidly growing power demand, particularly in North African countries such as Algeria and Egypt, illustrates the vast potential for renewable power to satisfy new electricity demand.

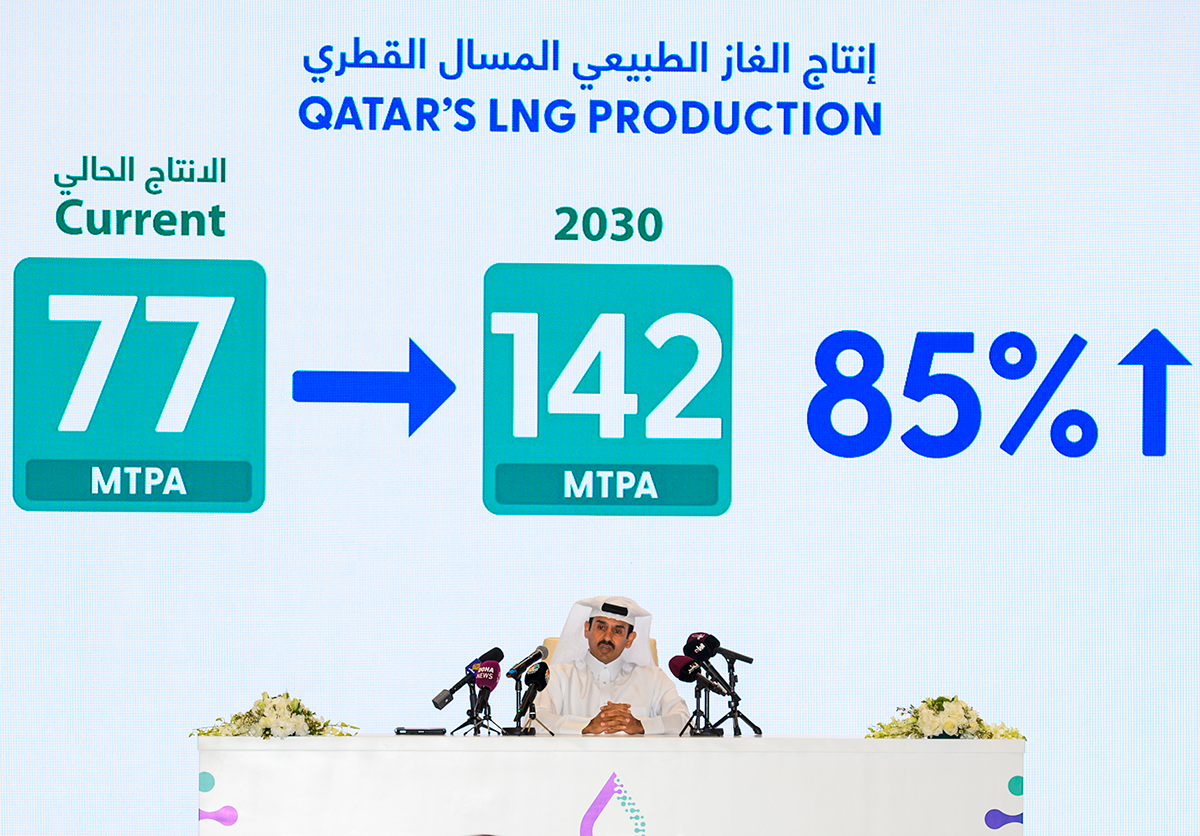

project at QatarEnergy headquarters in Doha on Feb. 25, 2024. Photo by Noushad Thekkayil/NurPhoto via Getty Images.

Analysis

The paper devotes significant attention to consumption patterns in the sub-regions of the GCC and North Africa, as these are home to both the largest energy producers and consumers in the MENA region. While Iran is the largest individual primary energy consumer in the region as well as a major producer, it is something of an outlier as its economy underperforms significantly due to the impact of international sanctions.

GCC

The largest economies in the GCC region have made major investments into the production of oil, natural gas, and increasingly, renewable energy. Ensuring abundant levels of supply, the export of which enables these governments to heavily subsidize energy sales to their populations, essentially guarantees that these economies will drive major portions of the region’s demand growth going forward. Although subsidy policy has been increasingly revisited in some Gulf states like Saudi Arabia and the United Arab Emirates, investment in non-oil industries is a likely indicator of other significant demand growth to come in the near term.

The growing availability of natural gas resources in key countries will have somewhat of an impact in displacing oil demand growth in the power sector, as the GCC is likely to lead the regional trend that points toward a power generation mix that is increasingly made up of natural gas, renewables mostly in the form of solar photovoltaic, and in limited instances, nuclear power. However, investment in expansion of the petrochemical sector as well as other gas-intensive industries will further support gas demand growth. Subsidy reform may moderate the pace of this growth, but regional gas prices are likely to continue providing the Gulf petrochemical sector with a major competitive advantage over other areas of production that also enjoy lower prices, such as the United States Gulf Coast region. Finally, although the growth prospects for clean hydrogen markets (especially prior to 2030) are currently plagued by uncertainty, Saudi Arabia, the UAE, and Qatar all have ambitious blue ammonia production targets or major projects underway, which if successful will represent a major segment of gas demand for years to come.

North Africa

The North African context represents some of the more challenging aspects of energy demand growth in the region. While it is likely to experience similar trends in demand out to 2030, resources in North Africa are less abundant than those in the Gulf. While Egypt has looked to continued growth in its renewable power capacity to offset the impact of electricity demand growth on its strained natural gas resources, the pace of these developments has been insufficient to avoid major shortfalls in both gas and power. Cairo has been overly dependent on the success of continued exploration for natural gas and places significant emphasis on a heavy role for gas well beyond 2030. Despite this, demand has continued to rise while production has declined sharply, and new exploration efforts have failed to add to Egypt’s gas reserves in any meaningful way.

Rising demand in Algeria also looks set to become increasingly risky as its domestic consumption threatens to increase to more than half of its production, the majority of which has previously been reserved for exports. As renewed upstream investment in Algeria has come not as a result of the attractiveness of the country’s resource base or commercial terms but for its proximity to European markets, the lack of any action to manage demand growth may present major issues that increasingly impact the national budget — an issue of particular significance for a country that has all too recently dealt with domestic instability driven by dissatisfaction with socioeconomic conditions.

Conclusion and Recommendations

It is difficult to recommend single policy actions for an entire region where the challenges to managing energy demand are varied and typically dependent upon local factors. However, some key areas for further study that could ostensibly support a more comprehensive approach to policymaking in many parts of the region could be:

-

National authorities making more regular, consistent, and timely disclosures on energy consumption patterns. This type of data is useful to other policymakers in better understanding evolving demand patterns in any given country, and in attempting to forecast how these patterns would be likely to evolve in the future. For instance, finding data that consistently discloses energy consumption by segment (i.e., industrial, commercial, and residential consumption) or that accurately shows a country’s overall energy mix is often challenging when it comes to the MENA region. Some countries are better at releasing said figures than others, while some release very comprehensive data sets that are often lacking in variety.

-

Exploring the potential impacts of limited but greater integration of regional power markets.The power sector is where energy shortages in the MENA are felt most strongly, due to considerable demand growth in almost every part of the region. Some progress has been made in this regard, albeit slowly, and there are doubtlessly numerous political obstacles to accomplishing a much more sophisticated integration of the regional power infrastructure as a whole. However, as larger, wealthier countries build out their generation fleet with new additions of renewable power and limited instances of nuclear capacity, the potential for excess power that could be exported to neighboring states may soon become a more distinct reality, depending on the trajectory of power demand within those states themselves.

Colby Connelly is the director of MEI's Economics and Energy Program. He is also a senior analyst at Energy Intelligence, where he works with the firm’s research and advisory practices.

Photo by Christopher Pike/Bloomberg via Getty Images.

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.