The performance of Eurosystem/ECB staff projections for economic growth since the COVID-19 pandemic

Prepared by Adrian Page

Published as part of the ECB Economic Bulletin, Issue 7/2024.

In the post-pandemic period, Eurosystem/ECB staff projections for growth have performed well over short horizons, despite the large shocks that have occurred. While the performance of inflation projections since the start of the pandemic has been extensively documented in previous issues of the Economic Bulletin, this box looks at how the Eurosystem/ECB staff projections for real GDP growth have fared during this turbulent period.[1] The growth fluctuations in 2020 related to the initial phases of the pandemic could not have been predicted, resulting in historically high forecast errors.[2] This box therefore focuses on the performance of the projections made after the start of the pandemic. During this period, the near-term growth forecasts have been remarkably accurate (Chart A, panel a). With only some exceptions during 2021, when growth continued to be affected by the pandemic’s unpredictable path and the associated containment measures, errors in next-quarter projections for real GDP growth have been even smaller than usual despite large shocks, including those caused by supply chain disruptions and Russia’s war in Ukraine.

However, over one-year horizons, staff projections overestimated growth from mid-2022 onwards. Looking at a longer horizon, the one-year-ahead projections for annual GDP growth have been less accurate and, on several occasions – in 2022 and the first half of 2023, in particular – the absolute projection errors were bigger than the average absolute historical errors over that horizon (Chart A, panel b).[3] The projections between mid-2022 and mid-2023 overestimated growth but underestimated inflation. This is consistent with the fact that the largest shocks during that period related to supply chain bottlenecks and to energy supply shocks caused by the disruptions brought about by Russia’s war in Ukraine. These supply shocks pushed inflation higher while supressing growth. Although the magnitude of the projection errors for growth have diminished over the past year, they have nevertheless remained negative over the one-year horizon, implying a persistent overestimation of the strength of the recovery.

Chart A

Projection errors in real GDP growth since 2021

a) Next quarter ahead |

b) One year ahead |

|---|---|

(percentage points in quarter-on-quarter growth rates) |

(percentage points in year-on-year growth rates) |

| |

Sources: Eurosystem/ECB staff projections and ECB staff calculations.

Notes: Error is the outturn (as published by Eurostat on 6 September 2024) minus the projection. “Next quarter ahead” refers to the projection for the quarter-on-quarter rate of change for the quarter after the one in which the respective projection was published (e.g. the error for the second quarter of 2024 in the March 2024 ECB staff macroeconomic projections). “One year ahead” refers to the projection for the annual rate of change for the same quarter in the year following the respective publication (e.g. the error for the second quarter of 2024 in the June 2023 Eurosystem staff macroeconomic projections). Average absolute real GDP errors refer to the period 1999-2019 and exclude outliers during the global financial crisis.

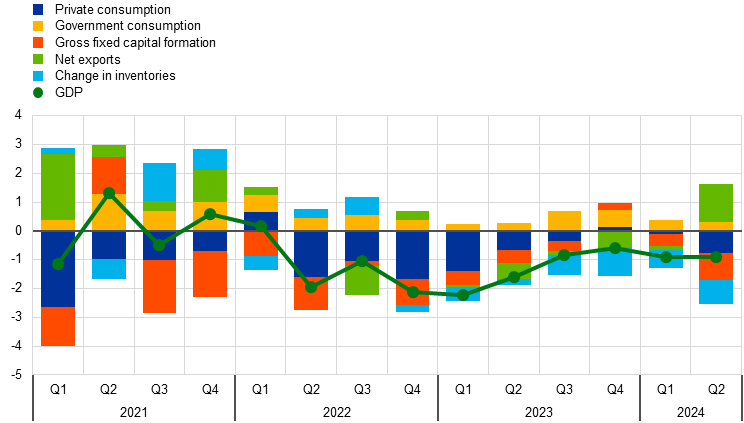

Private consumption and investment have been the main drivers behind one-year-ahead projection errors for most of this period, with net exports and stocks also playing a role more recently. Decomposing the projection errors into the individual demand components of GDP helps explain the source of the errors (Chart B). In 2021, projections made in the course of the previous year (i.e. during the initial phase of the pandemic) were subject to huge uncertainty, resulting in large but partially offsetting errors across the different components. Significant shifts in consumption patterns towards goods during the earlier phases of the pandemic and subsequently back to services led to disruptions in historical economic relationships, thus reducing the predictability of consumption, investment and trade. As the economic impact of the pandemic began to fade, global supply chain disruptions emerged during 2021, followed by Russia’s invasion of Ukraine in early 2022, which disrupted Europe’s energy supply. These shocks pushed up inflation, causing real incomes to fall unexpectedly and private consumption to surprise to the downside up until mid-2023. Since then, private consumption errors have been small, as upside surprises in disposable income have led to higher savings rather than higher consumption. Investment growth has also consistently surprised to the downside throughout the post-pandemic period. This can partly be explained by the high levels of uncertainty, which had been expected to dissipate but which instead persisted in the face of the series of adverse shocks mentioned. Another factor affecting real GDP and several demand components was the ECB’s monetary policy, which was tightened considerably in the face of surging inflation and by more than expected by markets. The contribution of net exports to growth has also tended to surprise to the downside related to a weaker-than-expected recovery in global trade but also to losses in competitiveness, as energy price shocks have been larger in the euro area than for other key trading partners. Over recent quarters, destocking has put an unexpected drag on growth, as reflected in the negative contributions from changes in inventories. The only component to have systematically surprised to the upside over this period is government consumption.[4]

Chart B

Decomposition of one-year-ahead real GDP projection errors into contributions of demand components

(percentage points in the year-on-year rate of change)

Sources: Eurosystem/ECB staff projections and ECB staff calculations.

Notes: See notes to Chart A. In the second quarter of 2024, the large and partially offsetting errors in the net exports and investment components partly relate to volatile and unpredictable developments related to intellectual property products in Ireland.

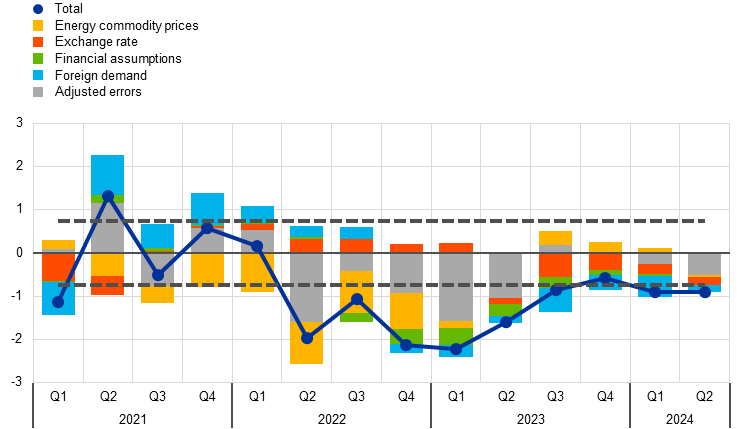

For most of the post-pandemic period, errors in the conditioning assumptions explain a large part of the projection errors. Another way to view the sources of projection errors is to look at the role of the technical assumptions and the projections for euro area foreign demand, both key inputs in the staff projection models.[5] Chart C decomposes the one-year-ahead GDP errors into the impact of errors in these assumptions and an unexplained residual related to other factors. This impact can be estimated using elasticities derived from Eurosystem staff projection models. The sharp, unexpected increases in oil and particularly gas prices from the second half of 2021 onwards played an important role in explaining downside growth surprises up until the end of 2022. From mid-2022 onwards, the financial assumptions also played some role, particularly the stronger-than-assumed increases in interest rates mentioned above. Errors in the exchange rate assumptions had a small, positive offsetting impact during 2022, switching signs to contribute negatively to growth errors from mid-2023 onwards. Lastly, foreign demand surprised mainly to the upside compared with staff expectations in the first half of the post-pandemic period, before contributing to the over-predictions of growth as of late 2022.

Chart C

Decomposition of one-year-ahead real GDP projection errors: the role of errors in conditioning assumptions

(percentage points in the year-on-year rate of change)

Sources: Eurosystem/ECB staff projections and ECB staff calculations.

Notes: See notes to Chart A. The contribution of errors in conditioning assumptions to the errors for real GDP growth are based on elasticities derived from Eurosystem staff macroeconomic models. Energy commodity prices refer to assumptions for oil and gas prices. Exchange rate refers to the nominal effective exchange rate of the euro. Financial assumptions refer to assumptions for short and long-term interest rates and stock market prices. “Adjusted errors” refers to all other sources of error beyond the errors in the conditioning assumptions mentioned. The dashed lines indicate the average absolute errors in the “Adjusted errors” component over the period 2003 (the earliest date for which the decomposition is available) until 2019, excluding outliers during the global financial crisis.

Adjusting for the errors in conditioning assumptions results in smaller errors, which may relate to persistent uncertainty and a possibly stronger-than-expected impact of monetary policy tightening. The conditioning assumptions are mainly based on market pricing and treated as exogenous to the staff projections for the euro area. Adjusting for errors in these assumptions makes it possible to isolate the remaining part of the overall projection error (shown as grey bars in Chart C), which can be attributed to the models used to build the projections and staff judgement.[6] These adjusted errors were notably smaller for most of the sample period, especially since mid-2023. The dashed lines in Chart C show the historical average of the absolute values for these adjusted errors during non-crisis periods. The adjusted errors (grey bars) are larger than these averages in absolute terms in only four quarters, despite large uncertainty during this period. But which factors could be behind these errors? As mentioned above, one extraordinary factor was large under-predictions of the surge in inflation (which went beyond what could be explained by technical assumptions) and the associated hit on disposable income. The energy price shock also led to persistent and unexpected losses in competitiveness beyond what was captured by the exchange rate assumptions. Geopolitical tensions, especially in Ukraine and more recently in the Middle East, have had a significant impact on uncertainty and confidence. Another factor may relate to the impact of monetary policy. While the green bars in Chart C capture the impact of errors in the financial assumptions based on Eurosystem staff projection models, other models suggest stronger impacts.[7] Moreover, non-linearities in the pass-through related to the exceptional speed and intensity of the monetary policy tightening or to the switch from a “low-for-long” to a high interest rate environment, may have had a stronger impact on the economy than suggested by the usual projection models.

In conclusion, despite the series of large shocks which hit the euro area economy in recent years, staff growth projection errors have been comparable to pre-pandemic averages. However, the outlook remains clouded by considerable uncertainty. Staff are continuously looking at ways to improve their forecasting models and make judgemental adjustments where the models systematically miss the mark. Some of the fruits of these efforts can be seen in the projection errors for near-term growth; these have been smaller than the historical average despite the huge shocks we have witnessed. While projection errors over the one-year-ahead horizon have been persistently negative, much of this can be explained by errors in the conditioning assumptions. The remaining errors likely reflect the significant and persistent changes observed in recent years in key economic relationships. It should be noted that the errors presented in this box refer to projections published up until June 2023. Staff have already taken the negative flow of information since then into account: for example, the growth outlook has been revised down from 1.5% in the June 2023 Eurosystem staff macroeconomic projections, to 0.8% for 2024 as recent information suggests a weaker-than-expected recovery. Nevertheless, economic projections remain clouded by considerable uncertainty. To illustrate the potential impact of the most relevant sources of uncertainty on the projections, the staff projections are usually accompanied by alternative scenarios highlighting key risks as well as more generic uncertainty bands.[8]

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.