2024 Director Compensation Report

FW Cook’s 2024 Director Compensation Report studies non-employee director compensation at 300 companies of various sizes and industries to analyze market practices in pay levels and program structure. Approximately 95% of companies overlap between this year’s and last year’s study.

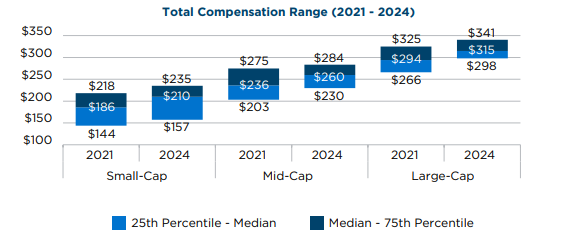

At median, total director compensation saw more muted increases in 2024 as compared to 2023…

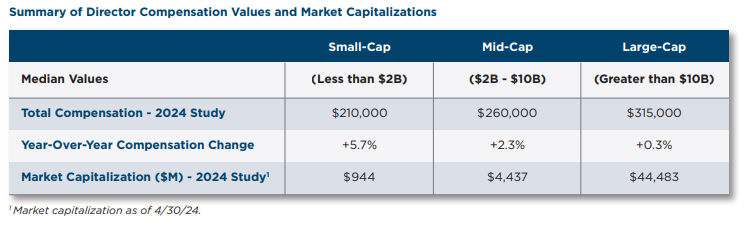

- Large-cap total director compensation remained roughly flat year-over-year at $315,000 (versus a 4.7% increase in 2023)

- The mid-cap segment increased by 2.3% to $260,000 (meaningfully smaller increase than the 6.6% observed in 2023)

- The small-cap segment increased by 5.7% to $210,000 (meaningfully larger increase than the 1.9% observed in 2023).

Director compensation pay ranges continue to narrow for mid-cap and large-cap companies. In 2021, the 75th percentile was 35% higher than the 25th percentile for mid-cap companies and 22% higher for large-cap companies. In 2024, the 75th percentile is 23% higher than the 25th percentile for mid-cap companies and only 14% higher for large-cap companies. For small-cap companies, the pay ranges have remained relatively static.

Narrowing pay ranges are the result of several observed trends:

- More companies are making smaller periodic changes to director compensation, resulting in values coalescing around the median.

- Companies with current pay levels that are at the upper quartile of the market have paused or made smaller increases to minimize the risk of being considered outliers. This could also be influenced by proxy advisory firm policies that criticize companies for outsized director compensation.

- Companies with current pay levels that are at the lower quartile of the market are making larger increases to remain competitive as the demand for qualified and effective directors continues to increase.

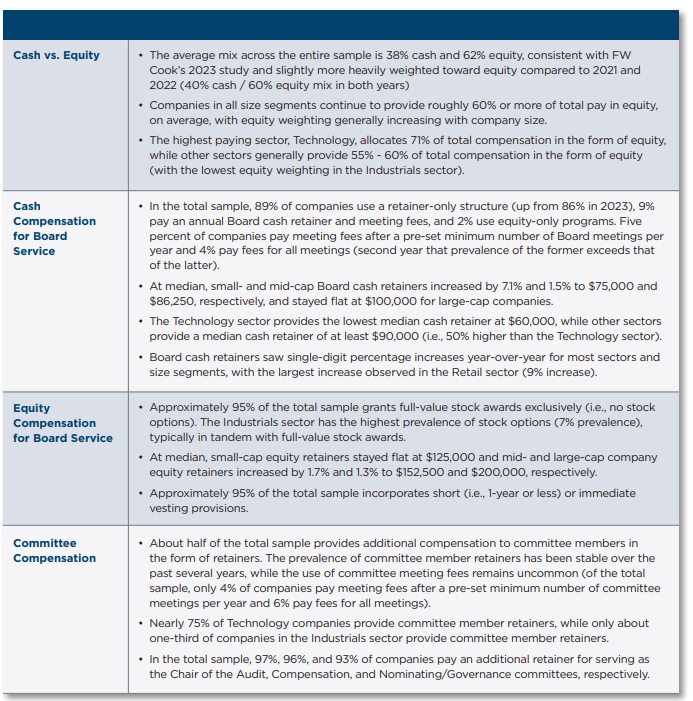

The pay structure of director compensation programs remains relatively consistent with 2023…

- In the total sample, companies have an average mix of 62% equity and 38% cash compensation (same as 2023). Small-cap companies tend to have the highest cash weighting (average of 43%) and large-cap companies tend to have the highest equity weighting (average of 65%).

- Most companies continue to prefer simpler cash retainer programs by providing larger Board annual cash retainers in lieu of meeting fees (only 4% of the total sample pay regular meeting fees, consistent with 3% in 2023).

- Most companies continue to grant fixed-value equity awards (98%) and primarily use full-value stock awards (94%). Annual equity awards most commonly vest after one year (70%), although about one-quarter of companies provide for immediate vesting.

Key findings are summarized below:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.