Activism Vulnerability Report

Introduction & Market Update

As summer wraps up, the landscape of shareholder activism has defied the usual mid-summer slowdown in North America, with plenty of high-profile campaigns. Activist investors have targeted some of the country’s most recognizable companies, after a relatively slow first quarter. The current state of activism is marked by high-profile battles, with influential investors like Elliott Management and Starboard Value launching campaigns against several Fortune 1000 corporations, including Southwest Airlines, Starbucks and Autodesk.

Notable Campaigns

Southwest Airlines

LUV down 3.4% since start of campaign on June 10, 2024

In June, Elliott Investment Management (“Elliott”) disclosed a $1.9 billion stake in the budget airline and called for “enhancing the board, upgrading leadership and a comprehensive business review.” [1], [2] Elliott claimed that years of disappointing shareholder returns were the result of a rigid board and a management team whose stubbornness prevented a turnaround the company desperately needs. [3] Elliott has since advanced a 10-person slate for election on Southwest’s 15-person board. [4] Recently, Southwest announced Executive Chairman Gary Kelly and six other board members will retire from the board by the end of the year. [5]

Starbucks

SBUX up 31.2% since start of campaign on August 1, 2024

Elliott’s presence appears to have spurred change at Starbucks, which successfully fended off a proxy campaign this winter. News reports in July indicated that Elliott, and later Starboard Value, had built stakes in Starbucks. [6] On August 14, Starbucks disclosed that it had replaced its CEO with now former Chipotle CEO Brian Niccol, immediately generating $26 billion of shareholder value as shares jumped 24%. [7], [8]

Texas Instruments

TXN up 0.2% since start of campaign on May 28, 2024

Elliott disclosed a $2.5 billion stake in the semiconductor company in late May, calling for the company to focus on boosting cash flow. [9] Elliott later praised Texas Instruments for positively engaging, with a willingness to improve cash flow initiatives and capital allocation, and to prevent a costly proxy battle. Elliott further commended Texas Instruments after the company raised its guidance for 2026 free cash flow, which is partially attributable to an anticipated rebound in chip demand. [10]

Autodesk

ADSK up 16.9% since start of campaign on June 16, 2024

In June, Starboard Value (“Starboard”) announced a stake worth almost $500 million in software company Autodesk and announced its plan to file a lawsuit to delay its annual general meeting (“AGM”) in order to reopen the nomination window. [11], [12] A Delaware judge dismissed the request, though Starboard has continued to pressure Autodesk, advocating for cost cuts, management change and new compensation policies. [13] This campaign is discussed in more detail below.

Macy’s

M down 27.8% since start of campaign on December 11, 2023

Macy’s rejected Arkhouse Management (“Arkhouse”) and Brigade Capital Management’s final offer in July to purchase Macy’s at a $6.9 billion valuation, following months of negotiations with the struggling retailer. [14] Macy’s had previously opened its books to the investors, and Arkhouse was given two board seats in an earlier settlement. [15]

Vestis

Settled before formal campaign

Corvex in May declared a near 13% stake in uniform and workplace supplies provider Vestis. [16] The two parties reached a settlement in June, giving Corvex Chief Investment Officer Keith Meister a seat on its staggered board following disappointing earnings and a subsequent tumble in share price. [17]

Forward Air

FWRD up 136.1% since start of campaign on May 28, 2024

In late May, Irenic Capital Management built a 5% stake in transport company Forward Air and pushed the company to undertake a strategic review. [18] In mid-August, private equity investor Clearlake Capital (13.8% stake) and activist firm Ancora Advisors (3.6% stake) also sought a strategic review regarding a possible acquisition. [19] This campaign is discussed in more detail below. [20]

Masimo

MASI down 19.4% since start of campaign on September 27, 2022

Politan Capital (“Politan”) announced in March it was preparing for a second campaign at Masimo Corporation (“Masimo”) after securing two board seats at last year’s annual general meeting. [21] To avoid another dispute, Masimo offered to appoint a Politan nominee, but Politan pushed forward with both nominees, seeking a majority. [22] Masimo postponed this year’s AGM from July to September 19. In August, Masimo warned of a possible “mass exodus” of employees if both Politan nominees are elected and subpoenaed proxy advisors Glass Lewis and ISS, both of whom supported Politan’s nominees, for their private investor communications with Politan. [23]

Activism Update

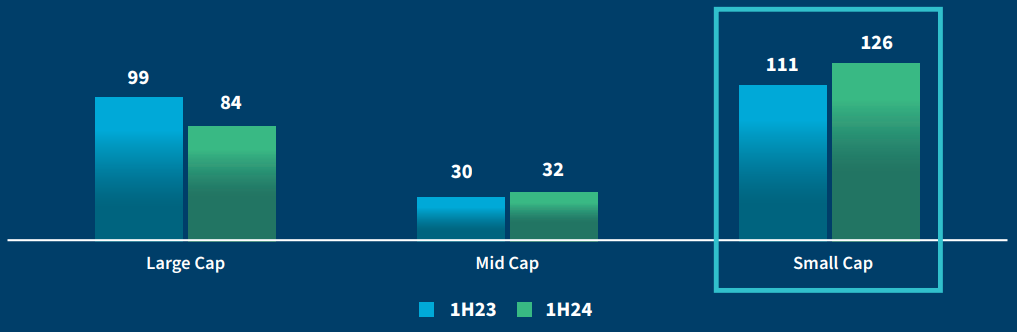

Activist investors continue to focus on small-cap companies, with the number of campaigns initiated at small-cap companies increased from 111 in 1H23 to 126 in 1H24, a 14% jump. [24]

A variety of factors are responsible, one of which continues to be the emergence of first-time activist investors initially aiming at smaller targets. [25] More broadly, with large-cap U.S. equities outperforming small-caps, small-caps present more attractive targets for activist investors, many of whom are valueseekers. [26] Furthermore, activists were at least partially successful in campaigns against large-cap companies 25.4% of the time in all of 2022, versus only 7.9% yearto-date through early August 2024. By contrast, looking at the same period for small-cap companies, the rate at which activists were at least partially successful climbed from 56.7% to 64.7%. [27]

Trian’s campaign at The Walt Disney Company and labor unions’ campaign against Starbucks, both of which were highlighted in previous versions of this report, show that activist campaigns vs. large-caps can be quite expensive and still may not result in success. [28] Targeting small-cap companies often leads to less costly campaigns, and those targets may be less well-equipped to defend against an activist strategy, increasing the chance of success.

With interest rates likely to fall in the coming months, activists have begun to seek M&A more; data shows that from March through late August 2024, activists made 40 demands focused on M&A, a 60% increase from the 25 demands during the same time period in 2023. [29], [30] As the tide continues to turn on interest rates, do not be surprised to see continued attention focused on smaller companies and an uptick in activist engagement, specifically take-private campaigns.

Small-Cap Take-Private Campaigns

Peloton

In January, Blackwells Capital publicized a letter to Peloton Interactive’s (“Peloton”) Board, pushing for the removal of CEO Barry McCarthy, stressing share price underperformance due to management’s lack of action, and for the sale of the fitness equipment manufacturer. [31] On May 2, 2024, Peloton announced the departure of its CEO and appointed Chairperson Karen Boone and Director Chris Bruzzo to act as interim co-CEOs. [32] The company subsequently disclosed plans to cut annual expenses by $200 million by the end of 2025. The cost cutting includes a 15% reduction in workforce and shrinking the retail showroom footprint. [33] Several private equity firms are reportedly interested in taking Peloton private. [34]

Forward Air

In November 2023, Ancora publicized a letter opposing Forward Air’s acquisition of Omni Logistics (“Omni”) and pushed for a CEO transition. [35] In January 2024, the acquisition closed at a lower price than initially proposed, and in April the Board named a new CEO. [36], [37] In May, Irenic Capital Management, believed to hold a stake near 5%, called for the sale of the Company and a Board refresh. [38] Irenic’s letter further criticized the Omni acquisition and claimed a number of private equity firms would be interested in paying a premium for the freight and logistics company. [39] Clearlake Capital, a private equity firm, disclosed a 13.8% stake in a Schedule 13D filed on August 14 and called for a strategic review. [40] Ancora, a 4% holder, penned its support on August 20, stating that the Company should consider a strategic review. [41]

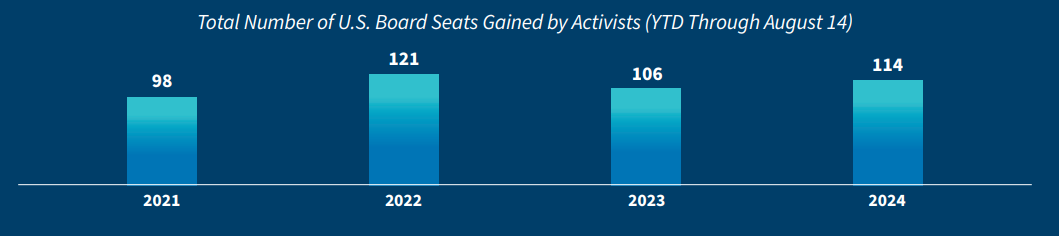

The number of seats gained by activists in the U.S. year-to-date increased from 106 in 2023 to 114 in 2024. The increase in seats can mostly be attributed to an increase in demands in 2024. The number of demands in 2024 is 37% above the average from 2021 through 2023. The same metric for seats gained is just 5% above the average, implying a busy crowd of activist investors experienced lower success rates. [42]

DEI Walk Backs

A noteworthy trend emerged in the second quarter of this year in which activists – who may not even have been shareholders – successfully pressured companies to walk back their diversity, equity and inclusion (“DEI”) initiatives through social media campaigns. In June, conservative groups leveraged X (formerly Twitter) to urge others to boycott Tractor Supply Co. until it removed multiple DEI and ESG programs, which the company ultimately did after its shares fell 5% in the month of June. [43] Shortly after, Deere & Co. experienced similar pressure and announced a comparable step back from such policies. [44] More recently, Lowe’s Companies Inc. also announced changes to its DEI policies, though they stated these decisions had been made without pressure from outside sources. [45] Nonetheless, it is evident that conservative voices have effectively driven change through this unique form of activism, and companies should monitor the extent to which they may be exposed to similar scrutiny, particularly if it could impact revenue.

Shareholder Activism and M&A Activity

A total of 248 campaigns involving U.S.- and Canada-based companies were launched in 1H24, a 2.5% increase compared to 1H23. With a slower 1Q24, the increase in campaigns in 1H24 is thanks to a busy 2Q24 with 133 campaigns, 30% higher than the historical five-year average for second quarter campaign volume. Similar to 1H23, the Financial Institutions sector was the most targeted by shareholder activists in 1H24. The sector notched 77 campaigns, a 43% year-over-year increase, representing 31% of total campaigns for the 1H24. The Technology, Media & Telecommunications (“TMT”) sector accounted for 52 campaigns in 1H24, a 33% increase from 1H23 when the sector reported 39 campaigns. Another prominent sector in 1H24 was the Retail & Consumer Products sector, with 25 campaigns, a slight decrease from 28 campaigns in 1H23. [46]

8Svea Herbst-Bayliss, Granth Vanaik and Waylon Cunningham, “Starbucks taps Chipotle’s Niccol as CEO in surprise move, shares soar”, Reuters, (August 14, 2024), https://www.reuters.com/business/retail-consumer/starbucks-names-chipotles-brian-niccol-ceo-2024-08-13/#:~:text=Aug%2013%20(Reuters)%20%2D%20Starbucks,coffee%20chain’s%20shares%20up%2024%25.(go back)

Financial Institutions

As previously discussed in the June 2024 Activism Vulnerability Report the main target of activists in the Financial Institutions sector continued to be closed-end funds, representing 62% of all financial institution campaigns in 1H24. Karpus Investment Management ran six different campaigns against Blackrock funds, all of which included demands for share repurchases. Saba Capital Management continues to employ campaigns to target closed-end funds, tallying 22 separate campaigns in 1H24. [48]

Technology, Media & Telecommunications

The majority of activist demands toward the TMT sector fell into the category of board representation, operational efficiency or M&A. While the TMT sector’s rate of at least partially successful campaigns of 21% falls short of the overall rate of 27%, it has the largest percentage of ongoing campaigns among all sectors at 47%. [49]

The most notable campaign in the TMT sector was Starboard’s against Autodesk. As highlighted earlier, in June 2024 Starboard disclosed a $500 million stake in Autodesk and announced plans to file a lawsuit in hopes to delay the annual meeting and reopen the nomination window. Starboard argued the company failed to disclose material wrongdoing in the accounting and disclosure practices prior to the nomination deadline, depriving shareholders of rightful clarity. [50] Two months later, after failing to delay Autodesk’s annual meeting, Starboard published a presentation that argued for changes to governance and highlighted lagging operational and financial performance under its current CEO. [51], [52] Starboard asserted that the Board failed to hold management accountable and recommended adjusting compensation practices to incentivize shareholder value creation and reevaluating the CEO. In addition, it asked the design software maker to expand operating margins by optimizing its cost structure and improving budgeting efforts. [53]

M&A Activity

Deal volume in the U.S. in 2Q24 decreased by 6.6% compared to 2Q23, from 3,718 transactions in 2Q23 to 3,471. However, the average transaction size in 2Q24 – $73.2 million – was 6.8% greater than the $68.5 million average size in 2Q23. The TMT sector led in aggregate transaction value, driven by transactions involving such companies as Endeavor, Squarespace and HashiCorp. Meanwhile, the Industrials sector once again topped transaction volume, with 714 deals, representing 20.6% of all U.S. transactions. [54] Despite a reduction in total transactions, the number of campaigns pushing for M&A at North American companies more than doubled quarter-over-quarter. The 28 M&A demands in the second quarter is the highest since 2019. [55]

Screener Results and Relevant Campaigns

Departing from the relative calm that was experienced last quarter when no industries moved 10 or more spots, our results for the second quarter 2024 show four industries moving dramatically in their activism vulnerability industry rankings. The Aviation & Airlines industry claimed the top spot, unseating Real Estate, while Media & Publishing retained second and Biotechnology moved up two spots to the third most vulnerable industry to activism.

Aviation & Airlines

Moved up 3 spots to 1st

While no stranger to the list of the top five industries most vulnerable to activism, this quarter represents that first time since the second quarter of 2022 that the Aviation & Airlines industry has held the top spot. Airlines continue to struggle despite strong demand as they grapple with labor shortages, both at airlines and airports, weather delays, IT glitches and with jet delivery delays and groundings that have forced flight cancellations and route cuts. [57], [58] These disruptions reduced Total Shareholder Returns (“TSR”) and Operating Performance scores compared to 1Q24, pushing Aviation & Airlines to the top of the rankings.

Unsurprisingly, from both activism and M&A perspectives, the industry has experienced a great deal of attention in 2024. In February, Carl Icahn obtained two seats at JetBlue Airways via settlement, one month after a court blocked JetBlue’s acquisition of Spirit Airlines. [59], [60] The very same day, shareholders of Hawaiian Airlines approved the acquisition of the airline by Alaska Air Group, a deal that the U.S. Department of Justice recently declared it would not challenge. [61], [62] Later in June, Elliott announced a ~$2 billion stake in Southwest Airlines, accompanied by a business transformation plan and calls for a new CEO and board members. [63]

We believe further M&A in the industry may be limited given concentration and regulators’ mixed views on further consolidation, as evidenced by the opposite outcomes experienced by JetBlue and Hawaiian. Regulatory uncertainty is likely to force activists to take a different approach in the Aviation & Airlines industry and focus on improving operations to drive shareholder value. Further, Elliott’s campaign at Southwest may encourage other airlines to focus on improving operations to avoid similar engagements with activists.

Agriculture & Chemical Products

Moved up 13 spots to 10th

Compared to 1Q24, weaker results in all four categories measured (Governance, TSR, Balance Sheet and Operating Performance) propelled the Agriculture & Chemical Products industry up 13 spots, the largest move of 2Q24. The industry has had trouble responding to a number of adverse developments, including inflation, geopolitical conflicts, destructive weather conditions such as Hurricane Beryl, and weaker supply and demand dynamics domestically and abroad. [64]

The industry generally had been quiet in 2024 in terms of shareholder activism, but it did witness a notable campaign in the second quarter. Three activists – 22NW, Legion Partners and Wynnefield Capital – all separately sought board seats at Lifecore Biomedical, and 22NW also pushed for the declassification of board of directors. [65] All three activists attained seats via settlement, and the declassification proposal was successful. [66]

Restaurants

Moved up 10 spots to 9th

The Restaurants industry jumped into the top 10 following decreased scores in the TSR, Balance Sheet and Operating Performance categories of our rankings during the past quarter. The industry has been challenged with persistent inflation and a softer consumer environment that has put pressure on margins and share prices. [67] Such pressures have also led to waves of bankruptcies and closures, and a rare profit miss for McDonald’s, its first in two years. [68], [69]

Only a handful of campaigns were launched by activists in the Restaurants industry during 2Q24, the most notable being Hoak & Co.’s campaign at Noodles & Company in June. Hoak & Co. swiftly attained a seat through a support agreement with the company, as the company perhaps was trying to ally with a large shareholder after another shareholder, Headlands Capital Management, disclosed a 5.4% stake this March (raised to 9.5% by July). [70], [71]

Healthcare & Life Sciences Sector

3 of 4 Industries Dropped

— Pharmaceutical – Dropped 7 spots to 14th

— Life Sciences – Dropped 7 spots to 16th

— Healthcare Services – Dropped 10 spots to 23rd

— Biotechnology – Moved up 2 spots to 3rd

The Healthcare & Life Sciences sector improved substantially during the past quarter with three of the four industries in the sector dropping more than seven spots in their vulnerability rankings. For the three industries that moved down the list, the improvements were largely driven by TSR and Balance Sheet strength, while Biotechnology’s advancement up the list was driven by a worsening of those two categories.

Activists have launched multiple campaigns in the sector throughout 2024, particularly in the second quarter. In April, Shah Capital Management initiated a campaign at Novavax, seeking two board seats and operational changes; it withdrew the campaign after Novavax and Sanofi signed a $1.2 billion licensing deal. In May, individual investor Stavros Vizirgianakis won two seats at Apyx Medical after previously calling for a strategic review, Madryn Asset Management called on Standard BioTools to eliminate its classified board, and The Buxton Helmsley Group urged Assertio Holdings shareholders to vote against all company directors and pushed the company to initiate a strategic review of the company. [72], [73], [74]

WHAT HAPPENS WHEN PROXY ADVISORS RECOMMEND FOR ACTIVIST NOMINEES, BUT NOT THE SAME ONES?

The introduction of universal proxy cards (“UPC”) two years ago has had some surprising effects. One unexpected impact surfaced in two separate contests this year: Ancora’s campaign at Norfolk Southern, and Arex Capital’s (“Arex”) campaign at Enhabit. Both times, activists gained fewer board seats than recommended by either of the major proxy advisors, ISS or Glass Lewis, who each backed multiple activist nominees. In a pre-universal proxy world, when both proxy advisors supported the activist, activists were subsequently highly successful in winning shareholder votes. FTI’s research shows that, in the six years leading up to the introduction of UPC, when both proxy advisors recommended the activist card, shareholders elected 67% of activist nominees to the board, across 39 contests.

This spring, Ancora nominated seven directors for 13 seats on Norfolk Southern’s Board of Directors. ISS recommended five nominees, and Glass Lewis supported six. Four activist nominees received the backing of both advisors, with all seven being supported by at least one proxy advisor. In May, shareholders elected only three Ancora nominees.

Arex in May nominated seven candidates to the nine-person board of health care company Enhabit. ISS and Glass Lewis each recommended three Arex candidates. Two Arex candidates received backing from both proxy advisors, with two more receiving backing from one proxy advisor. Shareholders elected only one Arex nominee.

The vote disparity among Ancora’s nominees was greater than among the four Arex nominees supported by at least one proxy advisor. Nevertheless, the results indicate that while shareholders agreed that outside change was needed on the boards of both Norfolk Southern and Enhabit, they disagreed with activists and proxy advisors on the degree of change required. In each case, shareholders seemed wary of granting a majority (or even nearmajority) of board seats to an activist who had sought control of the board. That majority/near-majority would have occurred, had shareholders elected all the activist nominees supported by at least one proxy advisor. One potential explanation could be that some shareholders voted for fewer activist nominees than they actually wanted, but they were concerned that other shareholders would also vote for many nominees and grant the activist more control “undervoted,” choosing fewer activist nominees than they would have preferred, because of their concern that “too many” activist nominees would win seats and effectively control the company.

These results indicate that activists could achieve greater influence by nominating fewer, but higher-quality candidates, who are more likely to gain the backing of proxy advisors and shareholders, rather than trying to gain control through a larger number of nominees.

Industry Expert Insight

“Artificial intelligence (“AI”) has been touted as having the potential to fundamentally transform the way humans live and work, revolutionizing the global economy with increased innovation and efficiency in the process. Through investments, collaborations, acquisitions and their own R&D, companies like Google, Amazon, Microsoft, Meta, Apple and Nvidia (six companies collectively dubbed “GAMMAN”) are poised to participate in the new markets being created by AI technologies and across the full scope of the AI supply stack. Global antitrust enforcers, however, have expressed concerns that these companies’ built-in advantages will lead to a stifling of competition in these new markets, harming consumers.

Antitrust scrutiny is not new for Big Tech. In the United States, the Federal Trade Commission (“FTC”) sued Facebook in 2020, claiming it illegally monopolized social networking. [75] More recently, the FTC and 18 state attorneys general brought a case against Amazon, alleging Amazon is illegally maintaining its monopoly power in the “U.S. online superstore market.” [76] Similarly, the U.S. Department of Justice (“DOJ”) sued Apple in March of this year with more than a dozen state attorneys general. [77] The DOJ also is prosecuting Google for monopolizing digital advertising, having recently won a victory in a separate case against the company wherein Google was found to have violated antitrust law by creating an illegal monopoly over internet search. [78] Appeals in the latter case are ongoing, and remedies to the illegal conduct are yet to be determined. The UK Competition and Markets Authority (“CMA”) and the European Commission (“EC”) have similarly conducted more than a dozen investigations of Big Tech companies in the last 10 years.

The rise of AI has only increased these enforcers’ interest in the GAMMAN companies. The CMA published initial findings on markets related to AI models, identifying what it felt were three key risks to competition: (1) restricted access to key inputs for developing AI, such as data, computing power and labor talent; (2) distortion of consumer choices by incumbent firms; and (3) reinforced or extended market power through partnerships between GAMMAN companies and new entrants. [79] In the U.S., the FTC launched an inquiry into AI investments and partnerships in January, and in June it was reported that the DOJ would investigate Nvidia, and the FTC would examine the conduct of OpenAI (maker of ChatGPT) and Microsoft. [80] The DOJ reportedly subpoenaed Nvidia this month as part of their antitrust investigation. [81] The two agencies joined the CMA and EC in issuing a joint statement on competition in AI foundation models and AI products, reiterating the three risks previously identified by the CMA and reaffirming their intent to monitor activity in these markets. [82]

We can expect tech firms, both incumbent Big Tech firms and new entrants, to continue in their significant efforts to innovate through AI. We can also expect regulators around the world will continue to scrutinize these firms. The outcomes of the reported investigations by the FTC and DOJ will be a leading indicator for whether, and to what extent, regulators will attempt to intervene in the trajectory of AI markets. The remedies imposed in the DOJ’s Google internet search litigation may also provide insight into judicial appetite for making structural changes to the Big Tech landscape. Investors in public tech companies can draw upon nearly a decade of experience navigating antitrust news stories, investigations and lawsuits. Whether Big Tech companies will remain insulated from activist investors as they balance the competing uncertainties of innovation and antitrust regulation remains to be seen.”

Bryan Perry, Senior Managing Director,

FTI Consulting’s Center for Healthcare

Economics and Policy

AI, Antitrust and Activists

Through the end of last year and the first half of this year, some the largest tech firms, such as Meta, Alphabet, Microsoft and Amazon, have invested billions of dollars to build out AI technology and infrastructure. [83] Further, these firms have committed to spending billions more through 2024 and beyond, reflecting a belief in AI as a transformative force. [84] Using capital expenditures as a proxy for AI investment, these four firms have already spent nearly $100 billion in the first half of 2024, a massive sum, but just a fraction of the $1 trillion of future investment that is expected to flood the industry in the coming years. [85], [86]

AI has been heralded by many of the world’s leading figures, with some comparing today to the early days of the Industrial Revolution or the rise of the Internet. [88] CEOs Jamie Dimon (J.P. Morgan Chase), Elon Musk (Tesla) and Mark Zuckerberg (Meta) have all echoed this sentiment, emphasizing the profound impact AI could have on society. [89], [90], [91] However, skepticism remains, with some arguing that the technology’s real benefits and revenues are still far off, while near-term costs continue to mount. [92]

The Big Tech companies leading this AI charge are among the most profitable in the world and have significant cash reserves and financial resources that will enable them to pursue such ambitious projects without immediate concerns regarding fiscal health. However, significant risks lie ahead: currently, four of the five companies are facing litigation aimed at curbing their power and influence. [93] Such litigation could potentially threaten the substantial revenues and growth they have enjoyed for so long, and which have powered investment in longer-term focused AI projects that may be non-viable without a cash cow as a backstop. However, the future of this symbiotic relationship that has worked so well is now more uncertain than ever before.

Despite the risks, these companies may feel they have no choice but to forge ahead. They have a fiduciary duty to their shareholders to maximize shareholder value, and investing billions in AI infrastructure and intellectual property appears to be what the boards believe are in shareholders’ best interests. Both Sundar Pichai (Alphabet) and Zuckerberg expressed similar thoughts on their most recent earnings calls. Pichai stated, “[T]he risk of underinvesting is dramatically greater than the risk of over-investing,” while Zuckerberg declared, “At this point I’d rather risk building capacity before it is needed, rather than too late.” [94] Time will tell whether or not these approaches are sound.

For now, Big Tech seems insulated from any potential second guessing by activist investors. AI technology certainly may have tremendous commercial potential; however, if these capital expenditures do not yield revenue and ultimately returns in the coming years, the door may open for activists to question the underlying capital allocation strategies. The massive outlays will impact income statements in the years to come and will compress margins if revenues do not sufficiently materialize. Investors seem to be struggling to determine whether these investments will be fruitful and may be questioning whether they want to stick around to find out.

The anticipation surrounding Nvidia’s recent earnings underscores the intense focus on the AI sector. Leading up to the release, nearly every major financial news outlet prominently featured commentary on Nvidia, signaling its pivotal role as a bellwether for the AI industry and broader equity markets. [96] Despite delivering strong earnings, raising its third-quarter revenue forecast, and unveiling a $50 billion share buyback program, in after-hours trading, Nvidia’s shares sold off, as investors demanded even more. [97] The reaction was so pronounced that all three major indices dipped, only to recover modestly the next day – further emphasizing the AI sector’s significant influence on market movements. [98]

Interestingly, Apple’s shares have remained relatively stable throughout this AI frenzy, possibly because it is not dumping tens of billions into its own AI projects, but instead is leveraging the technology of other major players to reap the benefits with a much smaller bill. [99] For instance, Apple is currently in talks to buy a stake in OpenAI in its latest funding round, valuing the company above $100 billion. [100] This strategy could prove to be prescient, allowing Apple to conserve capital and wait for others to work out any flaws in the technology.

Shareholders and activists may soon begin to push other companies to adopt a similar approach, advocating for smaller AI firms like OpenAI and Anthropic to take the lead. This strategy could benefit Big Tech in a number of ways such as potentially reducing antitrust scrutiny while allowing them to invest capital through partnerships with these smaller firms or in other projects that may be more profitable. However, at the moment, both the benefits and costs of developing this technology are uncertain, and that is exactly why these companies may become targets for activists. Where there is uncertainty, there are often many paths to take or levers to pull, and where there are levers to pull, there is often an activist ready to pull them.

What This Means

As 2024 progresses, shareholder activists have been active on both ends of the size spectrum, initiating high-profile campaigns against large-caps and increasingly targeting smaller companies, with a focus on M&A and board representation. The shift to targeting small-caps reflects strategic adjustments due to lower success rates against large-cap firms, yet some of the largest activists aren’t shying away from a fight with heavyweight firms. This underscores that companies of all sizes must stay vigilant. Activism may further intersect with broader trends like AI investments and antitrust scrutiny, adding complexity to the market landscape. Additionally, the ramifications of the UPC continue to reverberate throughout the activism arena, forcing both sides to adapt to new angles of approach or defense. Such dynamics are sure to make for an interesting conclusion to the year.

1Leslie Josephs and Rohan Goswami, “Elliott takes $1.9 billion stake in Southwest Airlines, seeks to oust CEO and chair”, CNBC, (June 10, 2024), https://www.cnbc.com/2024/06/10/southwest-luv-activist-elliott-stake.html.(go back)

2“New Leadership is Long Overdue at Southwest”, Elliott Investment Management L.P., https://strongersouthwest.com/southwest-slate/?gad_source=1&gclid=Cj0KCQjw28W2BhC7ARIsAPerrcKmrr7oD4FZxjRYkadGWiWM6ulrP034aQZ2Ku1v313kQyW4z0dkCkEaAvC7EALw_wcB.(go back)

3Elliott Investment Management L.P., “Elliott Sends Letter to the Board of Southwest Airlines”, PR Newswire, (July 8, 2024), https://www.prnewswire.com/news-releases/elliott-sends-letter-to-the-board-of-southwest-airlines-302190893.html.(go back)

4Rohan Goswami and Leslie Josephs, “Elliott readies Southwest proxy fight, will nominate 10 directors”, CNBC, (August 13, 2024), https://www.cnbc.com/2024/08/13/elliott-southwest-proxy-fight.html.(go back)

5Alison Sider, “Southwest Airlines Overhauls Board Amid Activist Pressure”, The Wall Street Journal, (September 10, 2024), https://www.wsj.com/business/airlines/southwest-airlines-executive-chairman-to-retire-amid-activist-pressure-4b314802?mod=hp_lead_pos6.(go back)

6Lauren Thomas, “Activist Elliott Takes Big Stake in Starbucks”, The Wall Street Journal, (July 19, 2024), https://www.wsj.com/finance/activist-elliott-takes-big-stake-in-starbucks-259837e4.(go back)

7“Starbucks names Brian Niccol as Chairman and Chief Executive Officer”, Starbucks, (August 13, 2024), https://stories.starbucks.com/press/2024/starbucks-names-brian-niccol-as-chairman-and-chief-executive-officer/.(go back)

10Elliott Investment Management L.P., “Elliott Statement on Texas Instruments’ Capital Management Event”, PR Newswire, (August 20, 2024), https://www.prnewswire.com/news-releases/elliott-statement-on-texas-instruments-capital-management-event-302226696.html.(go back)

11Lauren Thomas, “Activist Starboard Value Has Stake in Autodesk”, The Wall Street Journal, (June 17, 2024), https://www.wsj.com/finance/activist-starboard-value-has-stake-in-autodesk-2b764e01.(go back)

12Priyanka G., Shivani Tanna and Leroy Leo, “Starboard Value reveals Autodesk stake, files lawsuit to delay annual meeting”, Reuters, (June 17, 2024), https://www.reuters.com/markets/us/starboard-value-discloses-autodesk-stake-plans-lawsuit-delay-annual-meeting-2024-06-17/.(go back)

13Jef Feely, “Starboard Loses Bid to Block Autodesk Director Vote in July”, Bloomberg, (June 20, 2024), https://www.bloomberg.com/news/articles/2024-06-20/starboard-loses-bid-to-block-autodesk-director-vote-in-july.(go back)

14“Macy’s, inc. Terminates Discussions with Arkhouse and Brigade”, Macy’s, Inc. Newsroom, (July 15, 2024), https://www.macysinc.com/newsroom/news/news-details/2024/Macys-Inc.-Terminates-Discussions-with-Arkhouse-and-Brigade/default.aspx.(go back)

15Abigail Summerville and Svea Herbst-Bayliss, “Exclusive: Macy’s opens its books in company sale talks”, Reuters, (March 19, 2024), https://www.reuters.com/business/retail-consumer/macys-opens-its-books-company-sale-talks-sources-say-2024-03-19/.(go back)

16“Corvex management buys $34.3m in Vestis Corp shares”, Investing.com, (May 8, 2024), https://www.investing.com/news/company-news/corvex-management-buys-343m-in-vestis-corp-shares-93CH-3430326.(go back)

17“Vestis Appoints Keith Meister to the Board of Directors”, Vestis Investor Relations, (June 20, 2024), https://ir.vestis.com/news-media/press-releases/detail/110/vestis-appoints-keith-meister-to-the-board-of-directors.(go back)

18Lauren Thomas, “Activist Investor Irenic Builds Stake in Forward Air”, The Wall Street Journal, (May 28, 2024), https://www.wsj.com/business/logistics/activist-investor-irenic-builds-stake-in-forward-air-f2d213de.(go back)

19“Ancora Issues Letter to Forward Air Corporation’s Board of Directors Regarding the Need to Initiate a Strategic Review Based on Acquirer Interest”, Business Wire, (August 20, 2024), https://finance.yahoo.com/news/ancora-issues-letter-forward-air-130000872.html.(go back)

20Rohan Goswami, “Activist investor Politan plans second fight at Masimo”, CNBC, (March 25, 2024), https://www.cnbc.com/2024/03/25/activist-investor-plans-second-fight-at-masimo-sending-shares-up-12percent.html.(go back)

21Susan Kelly, “Masimo offers Politan a concession to avoid second proxy fight”, MedTech Dive, (May 10, 2024), https://www.medtechdive.com/news/masimo-politan-proxy-fight-offers-concession/715855/#:~:text=Activist%20investor%20Politan%20immediately%20snubbed,at%20the%20pulse%20oximetry%20specialist.&text=This%20audio%20is%20auto%2Dgenerated.(go back)

22Rohan Goswami, “Masimo, under activist pressure, subpoenaed two top proxy advisors for private investor communications”, CNBC, (August 28, 2024), https://www.nbcdfw.com/news/business/money-report/masimo-under-activist-pressure-subpoenaed-two-top-proxy-advisors-for-private-investor-communications/3631884/.(go back)

23FTI Consulting analysis of Diligent data as of August 28, 2024.(go back)

24“Review of Shareholder Activism – H1 2024”, Lazard, (July 2, 2024), https://www.lazard.com/research-insights/review-of-shareholder-activism-h1-2024/.(go back)

25FTI Consulting analysis of FactSet market data as of August 28, 2024.(go back)

26FTI Consulting analysis of Diligent data as of August 28, 2024.(go back)

27“June 2024 Activism Vulnerability Report”, FTI Consulting Activism and M&A Solutions, (June 17, 2024), https://www.fticonsulting.com/-/media/files/insights/reports/2024/jun/june-2024-activism-vulnerability-report.pdf.(go back)

28Emese Bartha and Paulo Trevisani, “Fed Rate Cuts Are Coming, but Investors Disagree on the Path Forward”, The Wall Street Journal, (August 27, 2024), https://www.wsj.com/articles/fed-rate-cuts-are-coming-but-investors-disagree-on-the-path-forward-648e2864.(go back)

29FTI Consulting analysis of Diligent data as of August 28, 2024.(go back)

30FTI Consulting analysis of Diligent data as of August 28, 2024.(go back)

31Lauren Thomas and Dean Seal, “Peloton CEO Barry McCarthy to Step Down Amid Fresh Layoffs”, The Wall Street Journal, (May 2, 2024), https://www.wsj.com/business/peloton-ceo-barry-mccarthy-to-step-down-amid-job-cuts-c65f922f.(go back)

32Gabrielle Fonrouge, “Peloton CEO Barry McCarthy to step down, company to lay off 15% of staff as it looks to refinance debt”, CNBC, (May 2, 2024), https://www.cnbc.com/2024/05/02/peloton-ceo-barry-mccarthy-steps-down-15percent-of-staff-laid-off.html.(go back)

34Gabrielle Fonrouge and Lillian Rizzo, “Private equity firms circle Peloton for potential buyout”, CNBC, (May 7, 2024), https://www.cnbc.com/2024/05/07/private-equity-firms-circle-peloton-for-potential-buyout.html?&qsearchterm=peloton.(go back)

35“Ancora Sends Open Letter to Omni Logistics Regarding Apparent Efforts to Suppress Opposition to the Transaction with Forward Air”, Business Wire, (November 16, 2023), https://www.businesswire.com/news/home/20231116670067/en/Ancora-Sends-Open-Letter-to-Omni-Logistics-Regarding-Apparent-Efforts-to-Suppress-Opposition-to-the-Transaction-with-Forward-Air.(go back)

36“Forward Air Announces Closing of Omni Logistics Transaction”, Forward Air Corp, (January 25, 2024), https://ir.forwardaircorp.com/news-events/press-releases/detail/367/forward-air-announces-closing-of-omni-logistics-transaction.(go back)

37“Forward Air Announces Leadership Transition”, Forward Air Corp, (April 23, 2024), https://ir.forwardaircorp.com/news-events/press-releases/detail/374/forward-air-announces-leadership-transition.(go back)

38Lauren Thomas, “Activist Investor Irenic Builds Stake in Forward Air”, The Wall Street Journal, (May 28, 2024), https://www.wsj.com/business/logistics/activist-investor-irenic-builds-stake-in-forward-air-f2d213de.(go back)

40Forward Air Corporation Schedule 13D, EDGAR, (August 14, 2024), https://www.sec.gov/Archives/edgar/data/912728/000114036124037374/ef20032426_sc13d.htm.(go back)

41“Ancora Issues Letter to Forward Air Corporation’s Board of Directors Regarding the Need to Initiate a Strategic Review Based on Acquirer Interest”, Business Wire, (August 20, 2024), https://www.businesswire.com/news/home/20240820689918/en/Ancora-Issues-Letter-to-Forward-Air-Corporation%E2%80%99s-Board-of-Directors-Regarding-the-Need-to-Initiate-a-Strategic-Review-Based-on-Acquirer-Interest.(go back)

43Rachel Treisman, “Tractor Supply slashes its DEI and climate goals after a right-wing pressure campaign“, NPR, (June 28, 2024), https://www.npr.org/2024/06/28/nx-s1-5022816/tractor-supply-dei-climate-backlash.(go back)

44Wyatte Grantham-Philips, Claire Savage, “John Deere ends support of ‘social or cultural awareness’ events, distances from inclusion efforts”, AP News, (July 17, 2024), https://apnews.com/article/john-deere-tractor-supply-dei-backlash-21eb1ea49701d1fd7b0b59aeb48b480d.(go back)

45Haleluya Hadero, Wyatte Grantham-Philips, “Lowe’s changes some DEI policies amid legal attacks on diversity programs and activist pressure”, AP News, (August 28, 2024), https://apnews.com/article/lowes-dei-robby-starbuck-conservative-522fef16cf0dc77450524542d21016ef.(go back)

47FTI Consulting analysis of Diligent data as of August 28, 2024.(go back)

50“Starboard Value Issues Letter to Autodesk Shareholders Regarding Opportunities for Improved Corporate Governance and Enhanced Value Creation”, Business Wire, (June 17, 2024), https://www.businesswire.com/news/home/20240617451283/en/Starboard-Value-Issues-Letter-to-Autodesk-Shareholders-Regarding-Opportunities-for-Improved-Corporate-Governance-and-Enhanced-Value-Creation.(go back)

51“Autodesk Confirms Annual Meeting of Stockholders Will Be Held on July 16, 2024”, PR Newswire, (June 20, 2024), https://www.prnewswire.com/news-releases/autodesk-confirms-annual-meeting-of-stockholders-will-be-held-on-july-16-2024-302178573.html.(go back)

52“AutoDesk”, Starboard Value, (August 2024), https://www.starboardvalue.com/presentations/.(go back)

54Joe Mantone, Brian Scheid, Umer Khan, “Q2’24 M&A Equity Offerings Market Report”, S&P Global Market Intelligence, (July 2024), https://pages.marketintelligence.spglobal.com/Quarterly-MnA-Equity-Report-Q224-Content-Download.html.(go back)

55FTI Consulting analysis of FactSet market data as of August 28, 2024.(go back)

57“Why The Travel Industry Is Struggling Despite Growing Demand”, Gant Travel Management, https://www.ganttravel.com/travel-industry-struggling/.(go back)

58Rajesh Kumar Singh, “Airlines struggle with lack of planes as summer travel set to hit record levels”, Reuters, (April 9, 2024), https://www.reuters.com/business/aerospace-defense/airlines-struggle-with-lack-planes-summer-travel-set-hit-record-levels-2024-04-09/.(go back)

59Cara Lombardo, “Icahn Strikes Deal for JetBlue Board Seats”, The Wall Street Journal, (February 16, 2024), https://www.wsj.com/business/deals/icahn-nears-deal-for-jetblue-board-seats-49fac2cb?mod=article_inline.(go back)

60David Koenig, “JetBlue’s $3.8 billion buyout of Spirit Airlines is blocked by judge citing threat to competition”, AP News, (January 16, 2024), https://apnews.com/article/jetblue-spirit-antitrust-acquisition-45568e98f87b549ba2c66ac89821812d.(go back)

61“Hawaiian Holdings Stockholders Approve Acquisition by Alaska Air Group”, Hawaiian Airlines, (February 16, 2024), https://newsroom.hawaiianairlines.com/releases/hawaiian-holdings-stockholders-approve-acquisition-by-alaska-air-group.(go back)

62Michelle Chapman, “Alaska Air clears a big hurdle in its proposed merger with Hawaiian Airlines”, AP News, (August 20, 2024), https://apnews.com/article/alaska-air-hawaiian-air-merger-2a11bab552ccdda0a002cb6bcc9db0f2.(go back)

63Lauren Thomas and Alison Sider, “Elliott Takes Big Stake in Southwest Airlines”, The Wall Street Journal, (June 10, 2024), https://www.wsj.com/finance/elliott-takes-big-stake-in-southwest-airlines-bce80796.(go back)

64“How commodity prices can impact markets and inflation”, US Bank, (July 12, 2024), https://www.usbank.com/investing/financial-perspectives/market-news/commodity-prices-impact-on-the-market.html.(go back)

65“Lifecore Biomedical Announces Cooperation Agreement with 22NW”, Lifecore Biomedical, (July 1, 2024), https://ir.lifecore.com/news-releases/news-release-details/lifecore-biomedical-announces-cooperation-agreement-22nw.(go back)

67Alicia Kelso, “Mid-2024 report: The ‘restaurant renaissance’ hangover kicks in”, Nation’s Restaurant News, (July 1, 2024), https://www.nrn.com/quick-service/mid-2024-report-restaurant-renaissance-hangover-kicks.(go back)

69Savyata Mishra, “McDonald’s posts rare profit miss as customers turn picky”, Reuters, (April 30, 2024), https://www.reuters.com/business/retail-consumer/mcdonalds-sales-misses-estimates-customers-cut-back-spending-2024-04-30/.(go back)

70“Noodles & Company Appoints Britain Peakes to its Board of Directors”, GlobeNewswire, (June 10, 2024), https://www.globenewswire.com/news-release/2024/06/10/2896380/26260/en/Noodles-Company-Appoints-Britain-Peakes-to-its-Board-of-Directors.html.(go back)

71Noodles & Company Schedule 13D filed with the SEC on March 22, 2024. https://www.sec.gov/Archives/edgar/data/1275158/000114036124014882/ef20024888_sc13d.htm.(go back)

72“Apyx Medical Corporation Announces Board Leadership Transition”, Apyx Medical (May 9, 2024), https://apyxmedical.com/apyx-medical-corporation-announces-board-leadership-transition/.(go back)

73Standard BioTools Inc. Schedule 14A filed with the SEC on May 21, 2024. https://www.sec.gov/Archives/edgar/data/1162194/000114036124027068/ny20016518x3_defc14a.htm.(go back)

74“Buxton Helmsley Urges Assertio Stockholders To Vote ‘Against’ Directors After Disclosure Failures, Inappropriate Boardroom Activity, Strategic Blunders”, PR Newswire (May 13, 2024), https://www.prnewswire.com/news-releases/buxton-helmsley-urges-assertio-stockholders-to-vote-against-directors-after-disclosure-failures-inappropriate-boardroom-activity-strategic-blunders-302144012.html.(go back)

75“Facebook, Inc., FTC v.”, Federal Trade Commission, (November 17, 2021), https://www.ftc.gov/legal-library/browse/cases-proceedings/191-0134-facebook-inc-ftc-v.(go back)

76“Amazon.com, Inc. (Amazon eCommerce)”, Federal Trade Commission, (March 15, 2024), https://www.ftc.gov/legal-library/browse/cases-proceedings/1910129-1910130-amazoncom-inc-amazon-ecommerce.(go back)

77“U.S. and Plaintiff States v. Apple Inc.”, U.S. Department of Justice, (March 21, 2024), https://www.justice.gov/atr/case/us-and-plaintiff-states-v-apple-inc.(go back)

78“Justice Department Sues Google for Monopolizing Digital Advertising Technologies”, U.S. Department of Justice, (January 24, 2023), https://www.justice.gov/opa/pr/justice-department-sues-google-monopolizing-digital-advertising-technologies.(go back)

79“AI Foundation Models: update paper”, Competition & Markets Authority, (April 11, 2024), https://assets.publishing.service.gov.uk/media/661941a6c1d297c6ad1dfeed/Update_Paper__1_.pdf.(go back)

80“FTC Launches Inquiry into Generative AI Investments and Partnerships”, Federal Trade Commission, (January 25, 2024), https://www.ftc.gov/news-events/news/press-releases/2024/01/ftc-launches-inquiry-generative-ai-investments-partnerships.(go back)

81Ian King and Leah Nylen, “Nvidia Gets DOJ Subpoena in Escalating Antitrust Probe”, Yahoo! Finance, (September 3, 2024), https://finance.yahoo.com/news/nvidia-gets-doj-subpoena-escalating-210038371.html?guccounter=1.(go back)

82Margrethe Vestager, Sarah Cardell, Jonathan Kanter and Lina M. Khan, “Joint Statement on Competition in Generative AI Foundation Models and AI Products”, European Commission, Competition & Markets Authority, U.S. Department of Justice, U.S. Federal Trade Commission, https://www.ftc.gov/system/files/ftc_gov/pdf/ai-joint-statement.pdf.(go back)

83Nate Rattner, “Breaking Down the Tech Giants’ AI Spending Surge”, The Wall Street Journal, (August 3, 2024), https://www.wsj.com/finance/stocks/breaking-down-the-tech-giants-ai-spending-surge-e282ca24.(go back)

84Dan Gallagher, “Big Tech’s AI Race Has One Main Winner: Nvidia”, The Wall Street Journal, (August 2, 2024), https://www.wsj.com/business/telecom/amazon-apple-earnings-63314b6c?mod=article_inline.(go back)

85FTI Consulting analysis of FactSet market data as of August 19, 2024.(go back)

86Allison Nathan, Jenny Grimberg and Ashley Rhodes, “Gen AI: Too Much Spend, Too Little Benefit?”, Goldman Sachs Global Macro Research, (June 25, 2024), https://www.goldmansachs.com/insights/top-of-mind/gen-ai-too-much-spend-too-little-benefit.(go back)

87FTI Consulting analysis of FactSet market data as of August 20, 2024.(go back)

88Parmy Olson, “AI’s Advances Will Echo the Internet, Not the Steam Engine”, Bloomberg, (April 9, 2024), https://www.bloomberg.com/opinion/articles/2024-04-09/no-jamie-dimon-ai-won-t-be-just-like-the-steam-engine?sref=p5QwRxCz.(go back)

89Hannah Levitt, “Dimon Likens AI’s Transformational Impact to Steam Engine”, Bloomberg, (April 8, 2024), https://www.bloomberg.com/news/articles/2024-04-08/dimon-says-ai-could-be-as-transformational-as-the-steam-engine?sref=p5QwRxCz.(go back)

90Breck Dumas, “Elon Musk expects AI will replace all human jobs, lead to ‘universal high income’”, Fox Business, (May 24, 2024), https://www.foxbusiness.com/technology/elon-musk-expects-ai-replace-all-human-jobs-universal-high-income.(go back)

91Mark Zuckerberg, “Open Source AI is the Path Forward”, Meta, (July 23, 2024), https://about.fb.com/news/2024/07/open-source-ai-is-the-path-forward/.(go back)

92Allison Nathan, Jenny Grimberg, Ashley Rhodes, “Gen AI: Too Much Spend, Too Little Benefit?”, Goldman Sachs Global Macro Research, (June 25, 2024), https://www.goldmansachs.com/insights/top-of-mind/gen-ai-too-much-spend-too-little-benefit.(go back)

93Daniel A. Crane, “Ranking the Big Tech Monopolization Cases”, Yale Journal on Regulation, (March 26, 2024), https://www.yalejreg.com/nc/ranking-the-big-tech-monopolization-cases-by-daniel-a-crane/.(go back)

94Nate Rattner, “Breaking Down the Tech Giants’ AI Spending Surge”, The Wall Street Journal, (August 3, 2024), https://www.wsj.com/finance/stocks/breaking-down-the-tech-giants-ai-spending-surge-e282ca24.(go back)

95FTI Consulting analysis of FactSet market data as of August 19, 2024.(go back)

96Carmen Reinicke, Jeran Wittenstein and Ryan Vlastelica, “Nvidia Pays Price of Lofty Expectations, Stoking Fear for Rivals”, Bloomberg, (August 29, 2024), https://www.bloomberg.com/news/articles/2024-08-29/nvidia-pays-price-of-lofty-expectations-as-ai-trade-shaken?srnd=homepage-americas&sref=p5QwRxCz.(go back)

98FTI Consulting analysis of FactSet market data as of August 30, 2024.(go back)

99Max A. Cherney, “How Apple used Google’s help to train its AI models”, Reuters, (June 11, 2024), https://www.reuters.com/technology/artificial-intelligence/how-apple-used-googles-help-train-its-ai-models-2024-06-11/.(go back)

100Tom Dotan and Aaron Tilley, “Apple, Nvidia Are in Talks to Invest in OpenAI”, The Wall Street Journal, (August 29, 2024), https://www.wsj.com/tech/ai/openai-apple-funding-chatgpt-50754cd6?mod=hp_lead_pos3.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.