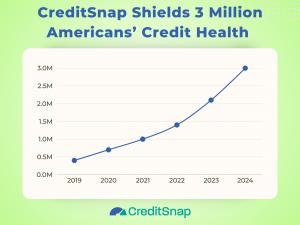

CreditSnap Shields 3 Million Americans' Credit Health; Unveils New Business Solutions

CreditSnap safeguards credit health of more than 3 million Americans and launches advanced business lending and deposit solutions.

SAN ANTONIO, TX, UNITED STATES, September 23, 2024 /EINPresswire.com/ -- CreditSnap, a pioneer in fintech solutions for Banks and Credit Unions, announces that more than 3 Million Americans have benefited from the Soft Inquiry tech it developed and deployed for its Bank and Credit Union customers. Achieving this landmark milestone in less than five years firmly demonstrates our commitment to safeguard credit health across the nation. By partnering with financial institutions across the US, CreditSnap's cutting-edge technology has prevented countless unnecessary hard inquiries, helping Americans maintain stronger credit profiles and access better financial opportunities.More Innovation: Building on this foundation of customer-centric ideology, CreditSnap has delivered industry leading Lending and Deposit Account Opening automation in 2023 - including the recent launch of full Deposit automation for Service Credit Union. Now, in 2024, it has launched Business Lending and Business Deposit solutions - to deliver innovation in the business category also. And in doing so, it has become the ONLY one stop solution for all originations needs of a Credit Union or a Bank.

Business Lending: CreditSnap's latest Business Lending Software empowers Banks and Credit Unions to transform their commercial lending services. This advanced platform accelerates the loan process with a journey that automates very complex Data and Document collection journeys. Fully automated from start to finish, it can include ID verification, fraud detection, eContracting and more. Designed to outpace both traditional and fintech lenders, this solution enables Credit Unions and Community Banks to deliver fast and efficient lending experiences to their business customers.

Business Deposit Account Opening: In a parallel advancement, CreditSnap introduced an innovative online Deposit Account Opening Solution for the business customers of Banks and Credit Unions. This software is engineered to automate the entire application process - all the way to booking the new deposit account in core and funding the brand new deposit account instantly. This allows for faster account openings and also higher active rates in both online and in branch channels.

"By introducing these cutting-edge solutions, we want Credit Unions and Community Banks to have access to affordable but best-in-class solutions, and allow them to pass the savings along to their customers," said Deepak Polamarasetty, CEO of CreditSnap. He added "We are convinced that every Bank and Credit Union can now deliver the same digital experience, automation and awesomeness that consumers have not experienced outside of Neo Banks."

About CreditSnap: At the forefront of financial technology innovation, CreditSnap is transforming traditional banking processes. The company's comprehensive suite of products enhances operational efficiency and customer experience across loan and deposit origination. With a history of safeguarding millions of credit scores and enhancing banking operations, CreditSnap continues to drive significant advancements in the fintech industry. Learn more about how CreditSnap is shaping the future of finance at www.creditsnap.com or reach out at community@creditsnap.com.

For all other inquiries, contact our Media Relations team at

contact@creditsnap.com

13333 Blanco Rd, Ste 206

San Antonio TX 78216

Deepak Polamarasetty

CreditSnap Inc.

+1 520-333-7252

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.