Loan Brokers Global Market 2024 To Reach $487.24 Billion By 2028 At Rate Of 14.1%

Loan Brokers Global Market Report 2024 – Market Size, Trends, And Forecast 2024-2033

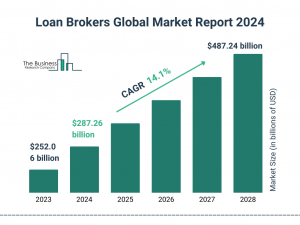

LONDON, GREATER LONDON, UNITED KINGDOM, September 6, 2024 /EINPresswire.com/ -- The loan brokers market has experienced robust growth in recent years, expanding from $252.06 billion in 2023 to $287.26 billion in 2024 at a compound annual growth rate (CAGR) of 14.0%. The growth in the historic period can be attributed to rising demand for homeownership, growth in the housing market, introduced significant changes in financial regulations, increasing transparency in lending practices, and fluctuations in housing prices.

What Is The Estimated Market Size Of The Global Loan Brokers Market And Its Annual Growth Rate?

The loan brokers market is projected to continue its strong growth, reaching $487.24 billion in 2028 at a compound annual growth rate (CAGR) of 14.1%. The growth in the forecast period can be attributed to changes in lending regulations, taxes, and subsidies, new laws affecting loan approval processes and broker operations, fluctuations in property values, changes in consumer credit scores and borrowing behavior, business expansions, and capital expenditures.

Explore Comprehensive Insights Into The Global Loan Brokers Market With A Detailed Sample Report:

https://www.thebusinessresearchcompany.com/sample_request?id=17188&type=smp

Growth Driver Of The Loan Brokers Market

Rising demand for homeownership is expected to propel the growth of the loan broker market going forward. Homeownership refers to the status of possessing a residential property, such as a house or apartment, either through direct purchase or mortgage financing. The demand for homeownership is rising due to several reasons, including low mortgage rates, the increase in remote work opportunities, the desire for stability, and rising rental costs. Loan brokers play a crucial role in facilitating homeownership by helping prospective buyers navigate the complex mortgage market.

Make Your Report Purchase Here And Explore The Whole Industry's Data As Well:

https://www.thebusinessresearchcompany.com/report/loan-brokers-global-market-report

Who Are The Key Players Shaping The Loan Brokers Market Trends?

Key players in the loan brokers market include Macquarie Group Limited, Social Finance Inc.(SoFi), Credit Karma Inc., Quicken Loans LLC, United Wholesale Mortgage, Guild Mortgage, American Pacific Mortgage Corp., LendingTree Inc., Lendio Inc., BlueVine Inc., Balboa Capital Corp., Funding Circle Ltd., Avant LLC, OnDeck Capital Inc., Rapid Finance Pvt. Ltd., Fundbox Inc., Credibly LLC, National Business Capital & Services, Fundera Inc., LendStreet Financial Inc., QuarterSpot Inc.

What Are The Dominant Trends In Loan Brokers Market Growth?

Major companies operating in the loan broker market are focused on developing advanced solutions, such as the digital verification process, to streamline and expedite the loan approval process for homebuyers. Digital verification processes refer to the use of technology to verify a borrower's financial information and identity electronically, speeding up and simplifying the loan approval process.

How Is The Global Loan Brokers Market Segmented?

1) By Component: Products, Services

2) By Enterprise Size: Large Enterprise, Small And Medium-Sized Enterprises

3) By Application: Home Loans, Commercial And Industrial Loans, Vehicle Loans, Loans To Governments, Other Applications

4) By End User: Businesses, Individuals

Geographical Insights: Asia-Pacific Leading The Loan Brokers Market

Asia-Pacific was the largest region in the loan brokers market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the loan brokers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Loan Brokers Market Definition

Loan brokers are intermediaries who connect borrowers with lenders, facilitating the process of obtaining loans. They assess the financial needs of borrowers and help find suitable loan products from various financial institutions. Loan brokers earn commissions from lenders for successfully brokered loans and sometimes charge fees to borrowers.

Loan Brokers Global Market Report 2024 from TBRC covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global loan brokers market report covering trends, opportunities, strategies, and more

The Loan Brokers Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on loan brokers market size, loan brokers market drivers and trends, loan brokers market major players, loan brokers competitors' revenues, loan brokers market positioning, and loan brokers market growth across geographies. The loan brokers market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Insurance (Providers, Brokers and Re-Insurers) Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/insurance-providers-brokers-and-re-insurers-global-market-report

Insurance Brokers & Agents Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/insurance-brokers-and-agents-global-market-report

Insurance Brokers Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/insurance-brokers-global-market-report

What Does The Business Research Company?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.