Why 49% of Self-Employed Mortgage Applications Are Denied—and What to Do About It

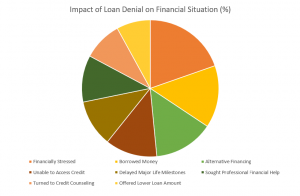

A breakdown of how individuals are affected when denied loans, including increased financial stress, reliance on alternative financing, and delays in major life milestones.

Learn why self-employed individuals face higher mortgage rejection rates and how to improve approval chances to get a loan while self-employed.

LADERA RANCH, CALIFORNIA, USA, August 31, 2024 /EINPresswire.com/ -- With rising interest rates and increasingly stringent lending criteria, securing a mortgage has become more challenging for self-employed individuals. Truss Financial Group has explored recent trends and data to uncover increased mortgage rejections among self-employed Americans. Our findings highlight the connection between existing data, the difficulties faced by this group of individuals and a possible set of solutions that will help them make their problems go away.

Understanding the Challenges for Self-Employed Workers:

Self-employed borrowers face a significantly higher rate of mortgage rejections compared to traditionally employed individuals. Here are some prime reasons behind it:

1. Income Fluctuations: Self-employed people often deal with inconsistent income, a factor that complicates mortgage approval. Data from the Bureau of Labor Statistics (BLS) shows considerable variability in the number of incorporated self-employed individuals over the years. For instance, the number reached 6,666,000 in January 2024, demonstrating a trend of income instability that lenders find challenging to assess. (Source: U.S. Bureau of Labor Statistics)

2. Documentation Difficulties: Unlike traditional employees who use standard pay stubs and W-2 forms, self-employed individuals must rely on alternative documentation. Most lenders, especially the traditional ones like banks find such documents less reliable.

3. Increased Risk Perception: The perception of higher risk associated with self-employed borrowers leads to stricter credit score requirements. Self-employed mortgage applications undergo closer scrutiny, often resulting in higher rejection rates.

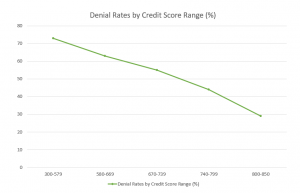

Credit Scores: A Major Barrier:

Maintaining a strong credit score is essential for mortgage approval, but self-employed individuals face distinct challenges:

I. Credit Score Impacts: Data shows that 73% of self-employed borrowers with credit scores below 700 are denied loans, compared to 45% of traditionally employed applicants with similar scores. (Source: Bankrate)

II. Income Variability: The fluctuating nature of income among unincorporated self-employed workers, as highlighted by BLS data, adds complexity to credit assessments. For example, the employment level among unincorporated self-employed workers in January 2024 was 9,492,000, reflecting a pattern of income variability that can affect credit stability.

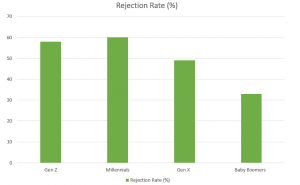

Younger Self-Employed Individuals Facing Greater Challenges:

Our findings revealed that younger self-employed individuals experience higher rejection rates:

I. Generational Differences: 58% of Gen Z self-employed and 60% of Millennials report loan denials, a stark contrast to 42% of Gen X and 37% of Baby Boomers.

II. Economic Impact: The difficulty in securing mortgages restricts younger self-employed individuals from investing in property and expanding their businesses, contributing to broader economic slowdowns.

Strategies to Enhance Mortgage Approval Chances:

1. Maintain Detailed Financial Records: Keeping accurate profit and loss statements, balance sheets, and tax returns can significantly improve approval chances.

2. Improve Credit Scores: Regularly monitoring and enhancing credit scores through timely payments, debt reduction, and correcting inaccuracies can boost approval chances by 30%.

3. Increase Down Payments: Providing a down payment of 20% or more can lower lender risk perception. Such down payments make borrowers 40% more likely to be approved.

4. Seek Professional Guidance: Working with mortgage brokers or financial advisors who specialize in self-employed loans can improve application success rate. Plus, it makes your life easier as it helps you make an informed and educated decision.

5. Explore Alternative Lenders: Considering non-traditional lenders with more flexible criteria can increase approval rates. Alternative lenders tend to approve more self-employed mortgage applications than traditional banks.

Conclusion:

Nearly half of self-employed people are having their mortgage applications denied. This is due to factors like unstable income and tougher credit checks. But there are ways to improve the chances of getting approved: keep good financial records, boost your credit score, make a bigger down payment, get expert advice, and look into alternative lenders. Following these tips can help self-employed individuals get the mortgage they need.

About Truss Financial Group:

Truss Financial Group is a leading independent mortgage lender specializing in helping real estate investors and self-employed business owners secure financing. With over 20 years of experience, TFG offers personalized attention and creative loan solutions, backed by strong relationships with well-capitalized banking partners.

Jason Nichols

Truss Financial Group

+1 888-878-7715

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

TikTok

Self Employed Mortgage Overview

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.