Mark Gilbert, CEO of ATN, Comments on the Evolving U.S. Auto Loan Trends

SCOTTSDALE, ARIZONA, US, August 20, 2024 /EINPresswire.com/ -- As U.S. auto loan rates continue to rise, Mark Gilbert, esteemed CEO of Automotive Training Network, offers a nuanced perspective on what these trends mean for the future of car ownership in America. Following a comprehensive report published by Statista, he shares his insights on the recent trends in U.S. auto loan rates.

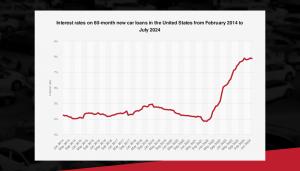

According to the Statista report, car loan interest rates slightly increased in May and June 2024, following a period of rapid escalation, when rates rose from under 4% in February 2022 to 7.9% by early 2024.

Understanding the Implications of Rising Rates

Gilbert acknowledges that the rapid rise in interest rates has posed a challenge for consumers and the auto industry. He says, “The sharp increase in rates over the past two years has undoubtedly impacted consumer purchasing power and has led to a more cautious approach to financing, especially among buyers of new vehicles.”

He further explains that the Federal Reserve’s influence on interest rates has been critical in driving these fluctuations. Gilbert adds, "The Fed’s interest rate policy is closely tied to inflation control. While it aims to curb inflation, it also directly impacts the affordability of auto loans. As inflation has stabilized, we expect to see a reduction in rates, lowering the cost of car loans. This will be a much-needed relief for consumers and a boon for the auto industry, likely expected by September 2024.”

The Critical Role of Car Financing in the U.S. Market

Gilbert emphasizes the importance of car financing in the U.S. market. He claims, “In a country where car ownership is often essential, particularly outside major urban centers, financing enables access to vehicles for the average consumer. The fact that most new vehicles in 2023 were financed underlines the necessity of maintaining favorable loan conditions.”

Looking Forward

Despite the current challenges, Gilbert remains optimistic about the future of auto financing in the U.S. He says, “As the market stabilizes, we expect to see more balanced interest rates, which will support both consumers and the broader automotive industry. In the meantime, there are some pretty attractive lease programs out there for consumers to really consider.”

According to the Statista report, car loan interest rates slightly increased in May and June 2024, following a period of rapid escalation, when rates rose from under 4% in February 2022 to 7.9% by early 2024.

Understanding the Implications of Rising Rates

Gilbert acknowledges that the rapid rise in interest rates has posed a challenge for consumers and the auto industry. He says, “The sharp increase in rates over the past two years has undoubtedly impacted consumer purchasing power and has led to a more cautious approach to financing, especially among buyers of new vehicles.”

He further explains that the Federal Reserve’s influence on interest rates has been critical in driving these fluctuations. Gilbert adds, "The Fed’s interest rate policy is closely tied to inflation control. While it aims to curb inflation, it also directly impacts the affordability of auto loans. As inflation has stabilized, we expect to see a reduction in rates, lowering the cost of car loans. This will be a much-needed relief for consumers and a boon for the auto industry, likely expected by September 2024.”

The Critical Role of Car Financing in the U.S. Market

Gilbert emphasizes the importance of car financing in the U.S. market. He claims, “In a country where car ownership is often essential, particularly outside major urban centers, financing enables access to vehicles for the average consumer. The fact that most new vehicles in 2023 were financed underlines the necessity of maintaining favorable loan conditions.”

Looking Forward

Despite the current challenges, Gilbert remains optimistic about the future of auto financing in the U.S. He says, “As the market stabilizes, we expect to see more balanced interest rates, which will support both consumers and the broader automotive industry. In the meantime, there are some pretty attractive lease programs out there for consumers to really consider.”

Mark Gilbert

ATN

+1 480-999-5055

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.