2024 Proxy Season Review: Five takeaways

In 2024 companies secured strong support on key voting items despite increasing complexity. This year’s proxy season included a busier year for activism amid a demanding economic context, a recalibrated shareholder proposal landscape, and emerging topics of focus such as artificial intelligence (AI). It also included growing political and regulatory uncertainty in a pivotal election year, and more scrutiny of both companies and investors from diverse stakeholders related to the impacts of business and stewardship decisions on societal challenges and financial performance.

Proxy season trends

During this proxy season, directors received more support despite investors’ increased focus on board effectiveness and director accountability. Say-on-pay support also increased this season despite growing stakeholder scrutiny of executive compensation. Still, binary votes may not reflect the nuance behind investors’ voting decisions, or the engagement and enhanced communications companies undertook to secure that support. Such efforts remain paramount: opposition votes on the re-election of directors in certain leadership roles signal investor willingness to use director elections as a lever to escalate governance concerns and hold board members accountable.

At the same time, a higher cost of capital combined with universal proxy cards created new vulnerabilities for companies this year and drove changes to activist campaigns. Support also surged for governance-focused shareholder proposals and stabilized for environmental and social proposals following a two-year decline. Both investors and companies have recalibrated to a shareholder proposal landscape marked by more robust company sustainability disclosures and narrower, more prescriptive proposal requests

To help directors understand the evolving proxy landscape and changing stakeholder expectations, as inputs to making informed decisions that support long-term value creation, we examine five takeaways from the 2024 proxy season and actions for boards to consider.[1]

Board and committee leaders faced more opposition than peers but still secured strong support.

Investor focus on director accountability and individual director qualifications and performance has increased in recent years. This is particularly true in the wake of universal proxy rules that allow investors to mix and match candidates from different slates in a proxy contest.

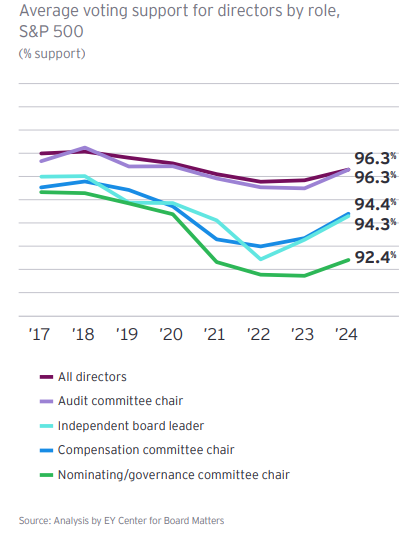

Despite the increased scrutiny, support for directors increased this year. S&P 500 directors averaged 96.3% support compared with 95.8% in 2023. Similarly, S&P 1500 directors averaged 96% support versus 95.4% in 2023.

Still, subtle shifts in voting outcomes in recent years demonstrate investors’ increased willingness to hold board members — particularly those holding board and committee leadership positions — accountable when expectations are not met.

Nominating and governance committee chairs continued to draw the least support

Where a committee is charged with specific governance responsibilities, investors typically hold that committee chair or members accountable for related performance and may vote against the board chair or lead director where the line of accountability is not clear.

Nominating and governance committee chairs have been impacted the most by the shift in investor voting. This likely reflects their responsibilities related to board composition, governance practices and (for an increasing number of nominating and governance committees) oversight of sustainability. Notably, among S&P 500 directors who received more than 15% opposition votes this year, 34% are nominating and governance committee chairs.

Understanding the rationale behind investor voting on directors is important

Investors’ multi-layered director voting decisions are occurring within a broader context of heightened shareholder activism. Growing opposition to directors could be an important signal of potential vulnerabilities to activist campaigns. Boards should monitor and address rising opposition early to mitigate activism risk and avoid being caught off guard by investor discontent.

Even though investors have shown a growing willingness to vote against directors, most still set a high bar for taking that action, and the largest investors face growing scrutiny on their director voting decisions from a range of stakeholders. This is especially true in contentious and high-profile votes. Companies should recognize votes against directors as a powerful signal of investor discontent and seek to understand the drivers behind those decisions, which may reflect multiple areas of concern.

KEY ACTIONS FOR BOARDS TO CONSIDER

- Ask management to monitor changes to the voting policies and director election practices of the company’s major shareholders and keep the board informed where vulnerabilities may be uncovered. Monitor significant or rising opposition to individual directors and engage shareholders to better understand the specific rationale underlying the negative vote.

- Use rigorous board evaluations to strengthen board effectiveness, and use the proxy statement as a strategic communication channel to make the case that the board is fit for purpose and proactively address investor concerns.

A higher cost of capital and universal proxy rules are driving changes to the activism landscape.

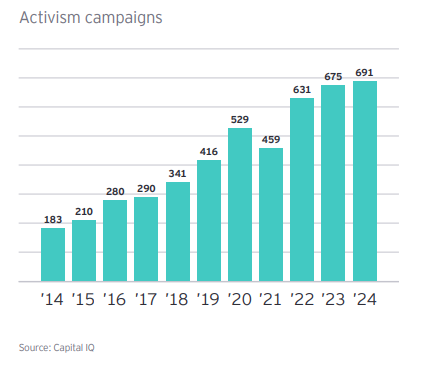

In 2024, the US saw a sustained uptick in activist endeavors, with the number of campaigns advancing by 2.4% from the previous year. Reflecting on the decade, activism campaigns have surged at a compound annual growth rate (CAGR) of 14.2%. The consumer sector remained the prime focus for activists, hosting 230 campaigns in 2024, marking an increase from 183 in 2023. The financials and technology, media, and telecommunications (TMT) sectors were also prominent arenas for activism, experiencing 162 campaigns (up 6.6% year over year) and 153 campaigns (up 15.9% year over year) in 2024, respectively. In this heightened activism environment, there are several themes boards should consider.

In a high interest rate environment, scrutiny of past acquisitions has intensified

With capital markets recalibrating to the realities of increased capital costs, following a prolonged period of historically low interest rates, activist investors are seizing the opportunity to question management’s past capital allocation choices, particularly mergers and acquisitions (M&A) deals perceived as detrimental to shareholder value. This scrutiny is anticipated to continue as corporations navigate a demanding economic landscape marked by elevated interest rates, above-average inflation, and economic slowdown. In anticipation of potential critiques, numerous prominent firms are taking the initiative to remedy business underperformance by shedding suboptimal divisions. The April 2024 EY CEO Outlook Pulse survey underscores this trend, revealing that 70% of Americas CEOs expect to actively pursue divestments, spin-offs or initial public offerings (IPOs) over the next 12 months.

Investors’ corporate governance expectations have moved beyond structural issues to board quality and performance

Effective governance and board composition continue to be critical concerns for institutional investors. As most companies have addressed structural issues such as having a staggered board, investor focus has shifted to board quality and performance. We saw in the 2024 season continued focus on lack of industry knowledge or experience among board members, succession planning, and independence as factors that can raise questions about a board’s ability to hold management accountable and its effectiveness in strategic decisions.

Universal proxy cards are starting to drive changes to activism campaigns

The universal proxy card, which allows shareholders to vote for any combination of director nominees from competing slates, has significantly altered the mechanics of proxy fights. Prior to its advent, having multiple activists nominating directors for the board was practically a guarantee of a lost vote for the activists. Traditionally, we observed one of the activists withdrawing their campaign and putting their weight behind the alternate slate of proposed directors to avoid this situation. However, the initiation of the universal proxy has complicated this scenario, as institutional investors can now significantly restructure a board without granting excessive influence to a single shareholder. While a 2024 proxy contest was the inaugural high-profile vote where this kind of decision was in play, it certainly won’t be the last.

Another development related to the introduction of universal proxy cards is single-issue environmental, social and governance (ESG) campaigns. As universal proxy lowered the cost of running a proxy fight and the risk of unintended consequences, it was expected that sustainability-focused activists could start to go beyond shareholder proposals or vote-no campaigns. This year saw the first single issue ESG campaign in the era of universal proxy cards. The campaign was focused on addressing perceived labor issues and may serve as a blueprint for upcoming proxy seasons. Key to this strategy is pinpointing a singular issue affecting a company’s financial prospects and nominating independent directors with expertise on that matter.

In the spotlight

Increased scrutiny on succession planningIn the wake of major companies’ struggles with CEO succession, as well as numerous high-profile proxy contests that have made the issue a primary point of attack, succession planning is coming under increased investor scrutiny and activist attention. This is occurring as CEO tenure rates are declining: the median tenure among S&P 500 companies has decreased 20% from 6 years in 2013 to 4.8 years in 2022, according to Equilar.[2] Further, increasing turnover across the senior management level may also be disrupting the internal CEO pipeline and related candidate development. Investors tell us they want assurance that companies are planning for both longer-term and emergency CEO successions, and that boards are planning for related board leadership changes that avoid former CEOs staying on the board beyond a temporary transition period. Disclosures about the board’s role in CEO succession planning (without revealing sensitive or confidential information) may assure investors that the process is planned instead of reactive. A 2023 EY examination of the charters of Fortune 100 compensation committees found that 66% are charged with succession planning responsibilities, making those committee leaders most accountable on this topic. Equally important is how directors are thinking about succession for the board itself, including from a committee and board leadership perspective — especially since for about a quarter (26%) of S&P 1500 companies, 20% or more of the board is 70 years or older and has served for a decade or more. |

KEY ACTIONS FOR BOARDS TO CONSIDER

- Get ahead of the activist threat by thinking like an activist and challenging management to optimize or exit business lines. In overseeing strategic portfolio reviews, press management on how they have evaluated underperforming business units, non-strategic assets or business units that simply aren’t deserving of additional capital. Consider additional ways to guide optimal capital strategy in the current environment.

- Evaluate the board’s composition to ensure that it includes members with relevant industry knowledge, financial expertise, and independence. Implement a robust succession planning process for both board members and executive management to address any potential concerns about the board’s effectiveness and accountability.

- Develop a shareholder engagement strategy that takes into account the new dynamics introduced by universal proxy cards. Ensure that the board understands investors’ priorities and communicate how the board has the right skillset and is taking appropriate actions to address investors’ key financial and sustainability concerns. Prepare for activism campaigns involving multiple activists with divergent views about how to drive value creation.

A recalibrated shareholder proposal landscape

Support rose for governance proposals and stabilized for environmental and social proposals, with increased complexity on the horizon.

In some ways the 2024 shareholder proposal landscape is a continuation of trends we observed in 2023. Environmental and social topics continue to dominate proposal categories, representing 63% of all shareholder proposals voted at S&P 1500 companies through June 18, 2024, but average support for those proposals has fallen from a peak in 2021, driven by enhanced company disclosures, narrower and more prescriptive proposal requests, the perceived agendas of certain proponents and various other considerations. What is new this year was a surge in support for governance-focused proposals.

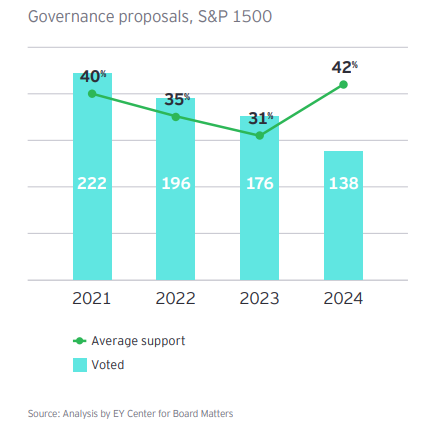

Governance proposals made a comeback in terms of support

While the number of governance-focused shareholder proposals voted at S&P 1500 companies continued to decline this year, average support for those proposals jumped from 31% in 2023 to 42% this year. Further, two-thirds of the proposals exceeded 30% support — the level at which most boards take notice.

These changes were driven largely by an increase in proposals to eliminate supermajority votes, which averaged 72% support, up from 54% in 2023. These proposals request that each supermajority voting requirement in the charter and bylaws be replaced by a simple majority voting requirement. Thirty-eight such proposals went to a vote this year with 28 securing majority support, vs. less than half (just 12) last year with seven securing majority support.

Other governance proposals that stood out in support this year include ones to eliminate classified boards (averaged 60% support), allow shareholders to call a special meeting (43%), allow shareholders to act by written consent (37%), eliminate unequal voting rights (33%), and appoint an independent board chair (31%). Notably, support for proposals to appoint an independent board chair varied widely, from 13% to 49%, demonstrating the company‑specific circumstances investors take into account in voting on those proposals.

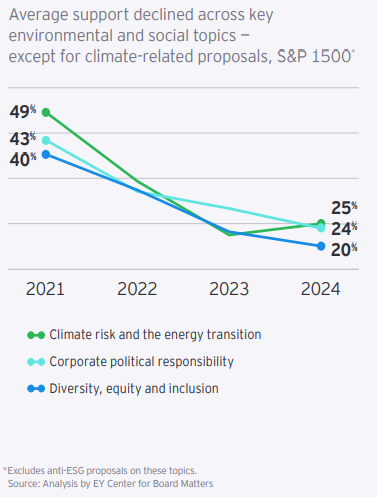

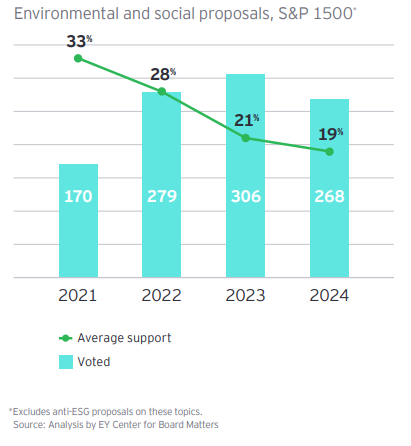

Support for environmental and social proposals stabilized

Average support for environmental and social proposals leveled off after a two-year decline, ticking down to 19% average support from 21% last year. Just 17% of those proposals secured more than 30% support, down from a high of 55% of environmental and social proposals that reached that support level in 2021.

This decline in support in recent years has been driven by a confluence of factors. For one, companies continue to disclose more about their environmental and social initiatives, related progress and board oversight, which has left large investors perceiving many proposals as redundant.

Additionally, proposals have become narrower and more prescriptive in nature, in some cases seeking strategic and operational changes that large asset managers believe should be left to management’s discretion. While this year proponents generally took a less aggressive approach compared to 2023 in terms of what the proposals requested, proposals receiving the highest support tend to be the least prescriptive and focused on disclosure.

That formula for strong voting support for environmental and social shareholder proposals (i.e., flexible and disclosure-focused) may be reaching its limits. There are fewer laggards left as company disclosures become more robust. In addition, investors may think some topics are better addressed through engagement or director votes than through seeking additional company reporting in an expansive and expanding reporting landscape. A third of investors told us that in the current environment, all other things being equal, they are more likely to vote against specific directors than to vote for a related shareholder proposal if they have concerns about the board’s oversight of material risks and opportunities.

In the spotlight

A closer look at the top three environmental and social shareholder proposal topicsIn this election year, proposals relating to corporate political and lobbying expenditures were the most voted of all shareholder proposal topics, followed by proposals related to diversity, equity and inclusion and proposals related to climate risk and the energy transition. Average support continued to decline across these categories, except for climate-related proposals, where support ticked up slightly from last year.

|

Companies must remember that investors are weighing multiple factors in these voting decisions, including:

- whether a proposal is financially material to the business and would provide investment-decision relevant information where gaps exist;

- whether a proposal is too prescriptive in nature;

- the feasibility, costs and potential risks to the company if the proposal is implemented as prescribed;

- management’s progress addressing the proposal’s underlying concern; • who the proponent is and their perceived purpose, and

- the investor’s experience engaging with the company.

Underscoring the nuance involved, an increase of anti‑ESG shareholder proposals this year (70 that went to a vote versus 40 last year) continued to garner just 2% support on average. This continued, strong opposition to anti-ESG proposals resonates with what investors have shared with us regarding their continued commitment to ESG: 98% of investors said their stewardship in 2024 would focus as much or more on material environmental and social matters as in 2023.

In the spotlight

Various political, regulatory and market developments may compound the growing complexitySeveral developments in process or on the horizon stand to heighten the complexity of today’s shareholder proposal landscape.

Companies will need to follow these developments and adapt accordingly, keeping materiality, business value, and the interests of key long-term shareholders as their guiding principles for navigating the complexity. |

KEY ACTIONS FOR BOARDS TO CONSIDER

- Encourage management to engage with major shareholders outside of proxy season to understand their views on the company’s strategy, performance, disclosures and governance and have a director join those conversations where appropriate. These engagements should include both portfolio managers and stewardship leaders to gain a full perspective of investor views. Seek to understand their rationale behind voting decisions and identify and address where the company could be vulnerable to opposition.

- Monitor how the company’s governance and disclosure practices compare with peers, particularly related to areas that the company’s top shareholders are raising in engagement. Ask management whether they have done any scenario planning around shareholder proposal topics that are getting increasing support.

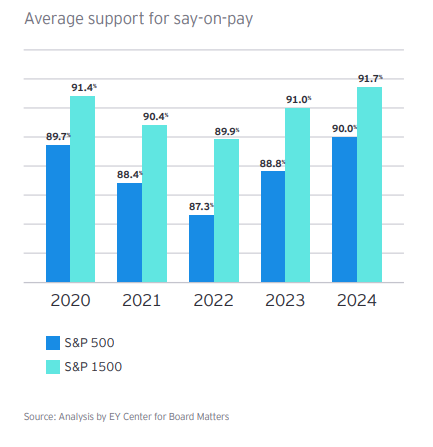

Companies secured strong support, continuing a new upward trend from 2023.

This season investor support for say-on-pay proposals climbed to its highest levels in years. That came on the heels of a new upward trend in support that emerged in 2023, when companies got a boost after years of decline. This year companies managed to increase those support levels further, with average support ticking up to 90% for S&P 500 say‑on‑pay votes.

Further, 4.5% of S&P 1500 companies this year received less than 70% support on their say-on-pay votes, down from 5.4% in 2023, and 1% received less than 50% support, down from 1.7% in 2023. Overall, just 12 say-on-pay proposals failed across the S&P 1500, versus 25 in 2023.

Investors highlighted several pay topics where they planned to pay closer attention this year

While say-on-pay voting trends are informative in terms of broader investor sentiment, ultimately say‑on‑pay votes reflect investor views on the company’s specific executive pay program. In our recent investor outreach, we asked investors what pay practices they would be paying closer attention to in 2024. The following four topics were the specific pay issues raised by the most investors and provide a helpful lens for companies to consider where their pay programs may be vulnerable to investor opposition and where engagement and enhanced disclosures may be beneficial.

- Performance stock units (PSUs). Twenty-one percent of investors raised concerns about companies’ use of PSUs, which they contended are overly complex, associated with underperformance, lack rigor and artificially inflate pay. See our 2024 proxy season preview for more details.

- One-time special awards. Fifteen percent of investors said any pay awards outside the normal pay plan are red flags where they would delve deeper. Some said such awards call into question the viability of the pay plan if the committee is constantly needing to add one-time awards or reset metrics. Some also expressed strong views that they will no longer tolerate mega retention grants made because the company’s long-term incentive plans had lost value.

- Pay magnitude and equity. Seventeen percent of investors said they would focus more on the magnitude of CEO pay and were grappling with the question: even if pay seems aligned with performance, when is it simply too much? Investors raised particular concerns about outsized CEO pay where the broader workforce has very low pay, with some focused more on the pay ratio disclosures (the required disclosure comparing the CEO’s compensation to that of the median employee). Still, high-profile pay votes this year underscored that for most investors, magnitude does not outweigh performance.

- ESG pay metrics. Thirteen percent of investors said they would be paying closer attention to ESG metrics in pay plans, but the views they expressed vary. Some are asking companies to incorporate ESG metrics into their pay plans and see that as a sign that the company is taking its ESG goals seriously. Others are concerned that ESG metrics may be used to artificially inflate pay and want to better understand how those metrics tie to operational performance. Some are broadly supportive but are scrutinizing disclosures to understand why those metrics were chosen and how they align to the strategy.

For companies facing challenges related to say-on-pay, constructive engagement discussions with investors focused on company-specific decisions (not proxy advisory firm views) and including compensation committee members or the chair in shareholder discussions where appropriate can provide both the company and investors with valuable insight. Clear disclosures that illuminate the reasoning behind pay decisions and discuss how the committee is responding to shareholder feedback may also help secure support.

KEY ACTIONS FOR BOARDS TO CONSIDER

- Use off-season engagement discussions with investors’ governance stewardship teams — directly involving compensation committee members as appropriate — as an opportunity to gain insight into the pay practices and decisions that are most important to these shareholders, and to demonstrate the compensation committee’s authority and engagement on pay structure and decisions.

- Proactively address potential vulnerabilities through clear proxy statement disclosures that explain the rationale behind pay decisions and make clear how investor feedback is considered and addressed.

Investors seek more information on AI governance, and companies are starting to address that interest with enhanced disclosure.

Our recent institutional investor outreach revealed an emerging focus on “responsible AI,” which allows leaders to take advantage of AI’s transformative potential while mitigating risks. Nineteen percent of investors said they planned to prioritize responsible AI in their engagements with companies in 2024, with most expecting AI to be a subject of discussion with their portfolio companies.

Investors want to understand how companies are using and governing AI

While the questions investors told us they may raise cover many dimensions, including how companies are using AI across the business and identifying and mitigating a variety of risks, by far their most-cited topic of interest (42% of investors) was governance and the role of the board in overseeing AI risks and opportunities. Investors emphasized a particular interest in related board training and education to build director competence.

A variety of new shareholder proposals also emerged this year on AI. Eleven companies (mostly in the telecommunication services sector) received those proposals. The most submitted proposal sought transparency regarding the use of AI in business operations and any ethical guidelines the company has adopted regarding its use of AI technology; it averaged 27% support (ranging from 2% to 43% support). Other AI-focused proposals averaged 15% support and included requests for board committee oversight, reporting on how the company will manage AI-generated misinformation, and an assessment of negative human impacts from AI.

Companies are starting to heed the call for more AI governance transparency

Some of the largest companies are beginning to meet investors’ interest with enhanced voluntary disclosures on how their boards are overseeing AI. An analysis of AI-related disclosures in the proxy statements and Form 10-K filings of Fortune 100 companies found[3] that:

- Companies are disclosing AI-related director experience and training. Over a quarter (26%) of companies cited AI in at least one director biography or in the board skills matrix. Those directors’ backgrounds include experience overseeing AI initiatives, board roles at AI-centric companies, and AI software development experience. Eight percent of companies disclosed that AI has been a recent subject of board education or training.

Based on what we’re hearing, investors are likely to be more focused on how boards are building their competence through ongoing education via help from external experts, and less focused on boards’ recruitment of specialists from a limited pool of candidates in a nascent area. This is consistent with views investors shared with us in our most recent outreach: 81% of investors said boards should demonstrate their expertise in areas like cybersecurity and climate by disclosing board training and education, vs. 48% who said boards should add a member with specific skills or expertise.

- Committees are starting to mention AI among their oversight responsibilities. Eleven percent of companies disclosed that a board committee has some level of AI oversight responsibilities. For now, most assign related responsibilities to the audit committee. Other committees citing AI include compliance, technology and risk.

- AI is being cited as a material risk and an area of board risk oversight. Nearly 70% of companies addressed AI in their 10-K risk factor disclosures, up from about 20% last year. The degree of explicit focus on AI varied; only 14% focused on AI as a standalone risk factor, and all were added this year. Many noted evolving legal and regulatory risks, reputational risks, and the increased threat of AI-driven cybersecurity risks. Additionally, 16% of companies explicitly cited AI in the board risk oversight section of their proxy statements, with a couple including an AI-specific subsection to provide further detail on how AI risks are governed.

- Some companies are highlighting responsible AI frameworks. Eleven percent of companies disclosed the use of AI frameworks, principles or guidelines aimed at promoting responsible and ethical design, development and application of AI technologies.

While most of these percentages are small, the findings show that Fortune 100 companies are starting to enhance their disclosures in this area and are a strong signal that more disclosures around AI governance are likely to follow. Such disclosures provide a window into new leading practices such as regular AI board briefings, the integration of AI into enterprise resource management (ERM), and the use of responsible AI frameworks.

Companies enhancing their disclosures around AI governance and risk management should be aware that SEC Chair Gary Gensler has signaled that SEC staff will scrutinize the accuracy of company disclosures relating to AI use and has warned companies not to “AI wash” by making untrue claims about their use of AI to raise their profiles. See the EY article Five key SEC priorities in 2024 for more information.

Finally, in addition to concerns regarding AI governance, some investors are raising questions on the return on invested capital around AI given the significant and growing level of investment in this space, including questions around how companies are using AI to reduce costs. As winners and losers emerge, AI may become a target for criticism in terms of capital allocation decisions.

KEY ACTIONS FOR BOARDS TO CONSIDER

- Evaluate, enhance and communicate the effectiveness of the board’s oversight of AI. This should include how AI oversight is structured at the committee level and how the board is building and maintaining the competency needed in the boardroom to oversee AI and other emerging technologies.

- Ask management what role AI played in the company’s investor outreach conversations this year, including any key themes and areas of interest revealed by investors’ questions. Challenge whether the company’s disclosures effectively address those topics and help build investor confidence in the company’s use and governance of AI.

When it comes to the proxy landscape, a new equilibrium is being negotiated. Investors are refocusing on fundamental shareholder rights and accountability mechanisms such as electing directors. The limits of sustainability-focused shareholder proposals as a tool for change are being tested as companies meet core disclosure expectations. Universal proxy rules are slowly changing the calculus in terms of activist campaigns, and new risks and opportunities are emerging related to technology, particularly AI.

These developments, along with continuing transformational changes in the business environment, are driving increased focus on board quality and performance. While the stakes for directors (particularly those in board and committee leadership roles) are increasing as a result, those changes are happening gradually. Leading companies will continue to monitor and adapt to this changing landscape by engaging their shareholders and refocusing strategic investor communications to effectively tell their story. In an era where governance and board effectiveness are under increasing scrutiny, a strategic proxy statement combined with targeted engagement can be powerful instruments to earn shareholder confidence and support.

- How well does the board understand the perspectives shared by investors (governance teams as well as portfolio managers) during the company’s shareholder engagement activities? Do select directors ever participate directly in discussions on board oversight-related topics when appropriate?

- How does the company’s governance and disclosure practices align with peers and with shareholder proposals that are securing majority support? How would the company respond if it were to receive one of those proposals?

- How is the board’s engagement on areas of investor focus communicated to stakeholders? Does the proxy statement make clear that the board is giving sufficient, meaningful attention to material topics for the business, including hearing external perspectives and supporting ongoing director training and education?

- How are the company’s top shareholders’ proxy voting policies and practices evolving regarding director elections, and what are those shareholders communicating about those changes in investor engagement discussions? Are new vulnerabilities emerging for certain board or committee leaders?

- How robust is the board’s CEO and management succession planning process? Has the company disclosed enough about that process and how it is governed by the board to give investors assurance that the company is actively planning for leadership changes?

- What is the board’s current director succession plan, and how does it align with the strategic direction of the company and investor perspectives? How is the board identifying and addressing gaps in skills and experience on the board?

- What executive pay practices or outcomes are investors raising in engagement discussions with management? Are members of the compensation committee ever involved in those discussions as appropriate?

- How does the proxy statement proactively address potential areas of shareholder concern related to the company’s executive pay decisions, including how shareholder feedback is considered?

- How is the board structuring its oversight of AI and building AI competency among all board members? What options (e.g., chartering a new committee focused on technology, creating an ad hoc committee centered on a particular AI challenge, creating an advisory board of AI experts) has the board considered?

1All vote results and shareholder proposal data for 2024 are based on a universe of S&P 1500 companies with meetings through June 18.(go back)

2CEO Tenure Rates, Equilar Inc., August 4, 2023.(go back)

3Based on a review of 80 Fortune 100 companies whose 2024 proxy statements and 10-K filings were available as of 31 May 2024.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.