Fort Bend Central Appraisal District 2024 Reappraisal For Property Taxes

O'Connor has finished a analysis for Fort Bend Central Appraisal District 2024 Reappraisal for Property Taxes.

FORT BEND COUNTY, TEXAS, UNITED STATES, May 1, 2024 /EINPresswire.com/ -- Fort Bend Central Appraisal District appears to have overvalued 61% of homes in Fort Bend County during the 2024 property tax reassessment. The increase for a typical home was 7%. Further, they increased the value of commercial properties by about 50%. This mind-boggling increase in commercial property values occurs as the commercial property market is suffering its worst downturn in at least a decade.Fort Bend Central Appraisal District Facts

There is an appraisal district in each Texas county, except for Potter and Randall Counties which have one appraisal district. The annual budget for Fort Bend Central Appraisal District was $18.2 million for 2022, the latest period for which data is available. A team of 63 appraiser's values over 343,000 property tax parcels, again for 2022.

Fort Bend County Home Tax Reappraisals Increase Almost 7%

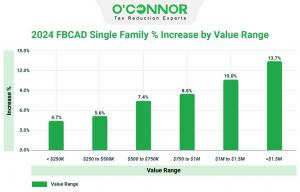

Fort Bend Central Appraisal District increased the assessed value homes by 6.9% versus a 2.1 to 2.7% increase in home prices in the Houston metro area, is reported by the Houston Association of Realtors. Property tax assessments increased in Fort Bend for all value strata with the smallest increases being for homes value that’s less than $250,000 (4.7%) and the largest increases for homes valued at more than $1.5 million (13 .7%).

The Houston Association of Realtors reported that the average sales price for Houston area homes increased by 2.7% in January 2024. They also reported the median home price increase from by 2.1% during the same.

Fort Bend County specific reports for home price increases from 2023 to 2024 varied as reported below:

Redfin 6.1%

Orchard -1.5%

The Rogers Index +8.3%

Zillow 1.1%

The tax assessment increases for 2024 are within the range reported by these sources, albeit at the upper end of the range.

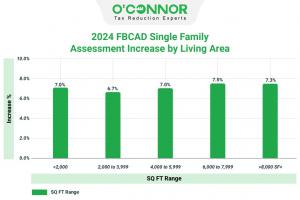

Property value increases in Fort Bend County were similar regardless of the size of home. While there was a sharp correlation for higher-value homes to have larger increases in property tax assessment the property tax assessment increase was roughly the same, at about 7%, regardless of home size.

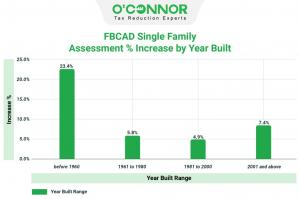

Fort Bend County Tax Assessments Based on Year Built

The 2024 property tax reappraisals for homes built prior to 1960 were higher than for any other age range of Fort Bend County homes, based on the valuations by Fort Bend Central Appraisal District in 2024. This may be because older homes are in prime locations. Homes built before 1960 increased by a whopping 23.4%. Homes built between 1981 and 2000 had the smallest increase in property tax reassessment in Fort Bend County at 4.9%. Fort Bend County market values for homes, as estimated by Fort Bend Central Appraisal District increased by just under 7%.

Fort Bend Central Appraisal District has overvalued 61% of homes in the county in 2024. This analysis is based on a comparison of the sales price for home sold during 2023 versus the 2024 property tax reassessment value. Conversely, 39% of the homes sold during 2023 were valued at less than the 2024 sales price.

Fort Bend Commercial Owners Face Shocking Tax Revaluations!

Fort Bend County commercial property owners are going to be shocked and dismayed at the massive increases in commercial property values set for tax year 2024. Commercial property values in Fort Bend County were increased overall by 47.4% in 2024. The total assessed value of commercial property in Fort Bend County increase from $12.9 billion in 2023 to $19.1 billion in 2024. Apartments incurred the largest increase from a value of $765 million to a value of $1.365 billion, a 79% increase in just one year. Office buildings, considered a semi-toxic asset by many debt and equity investors, incurred an increase of 30%. The value of retail buildings in Fort Bend County increased from $3.0 billion to $4.4 billion, 46.3% increase. Warehouses received the least amount of increase. The Fort Bend warehouse buildings increased in value from $1.94 billion to $2.16 billion, and 11.6% increase. The value of Fort Bend County hotels increased by a shocking 66.4%. Property tax assessments for Fort Bend hotels rose from $291 million in 2023 to $483 million in 2024. The value of Fort Bend land increased by almost two-thirds. The tax value of Fort Bend County land increased from $4.9 billion in 2023 to $7.95 billion in 2024, a 63.8% increase.

Record Property Tax Protests Expected for Commercial Property in Fort Bend in 2024

Given the massive size of the increases and their unprecedented nature it is expected that virtually every Fort Bend County commercial property owner will be protesting their property taxes in 2024. Commercial property valued at less than $5 million in 2024 will be subject to a 20% cap. The cap was instituted by the Texas Legislature in 2023 and is affective for tax years 2024, 2025, and 2026. The cap can be extended if approved by the legislature and the voters.

Commercial property assessments use set for 2024 by the Fort Bend central appraisal district soared regardless of year built. Commercial property built between 1961 and 1980 in Fort Bend incurred a 72.5% increase. In the 2024 property tax revaluation, prepared by Fort Bend Central Appraisal District. Properties built in 2001 and later saw the smallest increase in their 2024 property tax reassessment with a 29.4% increase in value.

Disconnect Between FBCAD Values and Wall Street Bankers

The 2024 commercial property tax reassessment established by Fort Bend Central Appraisal District is substantially different and directionally inconsistent with analysis by Wall Street firm Green Street Real Estate Advisors. Green Street advisers that values are off 7% in the last year and down 21% from the peak in 2022. Conversely, Fort Bend Central Appraisal District advises that commercial property values are up over 47% in just the last year. There is a 54% gap between Green Streets’ -7% and FBCAD’s +47%.

Property not Protected by Property Tax Circuit Breaker Have Largest Increases

Commercial property assessments in Fort Bend County vary widely depending on the assessed value strata. The property values under $5 million are subject to a 20% cap, or circuit breaker, for tax years 2024, 2025, and 2026. Properties valued under $1 million rose by about 15.4%. Conversely, properties valued over $5 million rose an average of 42.5% and do not receive the benefit of the 20% circuit breaker cap. The data in this table only includes commercial improved properties compared to the first commercial analysis which includes land and commercial improved properties.

FBCAD Retail Tax Assessments Up Almost 50%

Property tax assessments for office buildings in Fort Bend County surged regardless of year built. It is difficult to discern a meaningful trend underlying the increases. Retail buildings built between 1961 and 1980 had the largest increase; from a total value of $109 million in 2023 to $242 million in 2024, a 121% increase. Retail buildings built in 2001 and later increased in value from $1.9 billion to $2.6 billion, a 34% increase.

Fort Bend County warehouse building owners saw an average increase of 12% in their property tax assessment from 2023 to 2024. There is an anomaly with warehouse buildings in Fort Bend County built before 1960. These buildings rose from $1.5 million to $3.8 million, a 150% increase. However, the colossal increase may be tied to just one or two buildings. Warehouse buildings built in 2001 and later account for 81% of the total value of office buildings in Fort Bend County, according to Fort Bend Central Appraisal District.

Office Building 2024 Reassessment by Type

Property tax assessments rose for all types of office buildings in Fort Bend County in 2024. Low-rise office buildings had the highest level of increase clocking in at 32.4% versus high-rise office buildings incurring an increase of 8.5%.

2024 Retail Property Tax Revaluation by Type

Property tax assessments rose for all categories of retail properties in Fort Bend County in 2024. The smallest increase was for malls which rose from $321,000,000 to $398 million, a 24% increase. The largest increase was for neighborhood shopping centers which increased from $1.9 billion to $2.9 billion a 54% increase. The increases for each of these categories is surprising in light of the difficult environment in the commercial real estate market due to higher interest rates, casualty insurance and operating cost and relatively flat revenue.

FBCAD Warehouse Revaluations by Type

Fort Bend central appraisal district calculates market values for four types of warehouse properties: mini-warehouse low-rise; mini-warehouse high-rise; mega-warehouse; and warehouse. Those termed mega-warehouse, also called distribution centers, increase from $656 million to $708 million, a 7.9% increase. Plain warehouse values rose from $773 million to $855 million, a 10.6% increase. The highest levels of increase were for mini-warehouse low-rise (19.4%) and mini-warehouse high-rise (14.9%).

Summary for FBCAD 2024 Property Tax Revaluation

Fort Bend County property owners face substantial increases for both residential and commercial properties. Increases for homes are above the level reported by the Houston Association of Realtors for the Houston metro area but within a range reported by various sources for Fort Bend County only. The increases for commercial properties are massive and almost certain to catch owners unaware. Trends in the commercial property market have been challenging for some down to outright ugly for others. Commercial owners would likely privately agree that commercial property values have fallen over the past several years. This is due in part to the increase of interest rates from 1.71% in January 2022 to 4.05% in January 2024. It is also due to large and continuing increases in casualty insurance and other operating expenses compounded by largely flat revenue trends.

Appeal Your Property Values Each and Every Year

Property owners in Texas, and specifically in Fort Bend County have the right and are well advised to contest the assessed value of their property. The appeal process offers both commercial and residential property owners the opportunity to present evidence supporting their claim that the assessed value is overstated. The majority of property tax protests are successful, so owners should strongly consider filing an appeal or securing the services of a property tax consulting firm. With 50 years of experience, O’Connor understands how to protest commercial and residential property values and has the resources to support their core focus of enriching the lives of property owners through cost-effective tax reduction.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.