Cryptocurrency Market Driven by Increased Adoption of Cryptocurrencies and Major Institutional Investments

Rising investor interest and adoption drive growth in the Cryptocurrency Market, offering decentralized and borderless financial transactions.

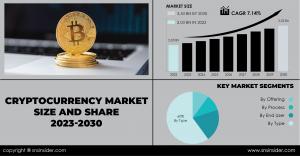

“According to SNS Insider, the Cryptocurrency Market size was estimated at USD 2.03 Bn in 2022, and is expected to reach USD 3.53 Bn by 2030, with a growing healthy CAGR of 7.14% over the forecast period 2023-2030.”

Cryptocurrency has emerged as a revolutionary force in the financial landscape, fundamentally transforming the way we perceive and engage in transactions. Rooted in blockchain technology, cryptocurrencies like Bitcoin, Ethereum, and Ripple offer a decentralized and secure alternative to traditional monetary systems. Blockchain, the underlying technology, is a distributed ledger that records transactions across a network of computers, ensuring transparency, immutability, and resistance to fraud. The scope of cryptocurrency market extends beyond traditional banking, providing financial inclusion to the unbanked and underbanked populations globally. Moreover, the decentralized nature of cryptocurrencies eliminates the need for intermediaries, reducing transaction costs and enhancing efficiency.

The overview of cryptocurrency market encompasses not only its role as a digital currency but also its potential as a store of value and a medium for executing smart contracts. Bitcoin, the pioneer cryptocurrency, has paved the way for a myriad of alternative coins (altcoins) and tokens, each designed with specific functionalities. Ethereum, for instance, introduced the concept of smart contracts, self-executing contracts with coded terms, facilitating trustless and automated transactions. The cryptocurrency market, known for its volatility, attracts investors seeking high returns, while blockchain technology continues to be embraced by enterprises for its security and efficiency. Regulatory developments and mainstream adoption further shape the cryptocurrency landscape, influencing its acceptance and integration into traditional financial systems.

Get a Report Sample of Cryptocurrency Market @ https://www.snsinsider.com/sample-request/1245

Some of the Major Key Players Studied are:

➤ Bitmain

➤ NVIDIA

➤ Xilinx

➤ Intel

➤ Advanced Micro Devices

➤ Ripple Labs

➤ Ethereum Foundation

➤ Bitfury Group

➤ Coinbase

➤ BitGo

➤ Binance Holdings

➤ Canaan Creative

➤ Bitstamp

➤ Others

Cryptocurrency Market Set for Robust Expansion Fueled by Mainstream Acceptance and Increasing Awareness of Blockchain Technology

The cryptocurrency market is poised for dynamic growth, driven by several key factors that shape its trajectory. One of the primary growth drivers is the increasing acceptance of cryptocurrencies as a legitimate and mainstream form of financial asset. As traditional financial institutions and major corporations continue to integrate blockchain technology into their operations, confidence in cryptocurrencies as a reliable investment option is bolstered. Moreover, the rising awareness and understanding of blockchain's decentralized nature contribute to the market's expansion. Strategic partnerships between traditional financial institutions and blockchain projects also present opportunities for synergy and mutual growth.

However, despite the positive momentum, certain restraints pose challenges to the cryptocurrency market's evolution. Regulatory uncertainty remains a significant hurdle, as governments around the world grapple with how to effectively oversee and regulate this rapidly evolving sector. Additionally, concerns regarding security and the prevalence of cyber threats have been a deterrent to widespread adoption. Overcoming these obstacles necessitates collaborative efforts between industry stakeholders and regulatory bodies to establish a comprehensive framework that fosters innovation while safeguarding investor interests.

Strengths of the Cryptocurrency Market

The Cryptocurrency Market exhibits several strengths that have propelled its growth and resilience in the global financial landscape:

➤ Decentralization and Security: Cryptocurrencies operate on decentralized blockchain networks, enhancing security by eliminating the need for a central authority to oversee transactions. This decentralized structure minimizes the risk of fraud, manipulation, and censorship, instilling trust among users.

➤ Accessibility and Inclusivity: Cryptocurrencies offer financial inclusion to individuals who lack access to traditional banking services, enabling them to participate in global financial transactions. With a smartphone and internet connection, anyone can access and use cryptocurrencies, democratizing access to financial services worldwide.

➤ Borderless Transactions: Cryptocurrencies facilitate fast and borderless transactions, enabling seamless peer-to-peer transfers across geographical boundaries. This feature eliminates the need for intermediaries such as banks or payment processors, reducing transaction costs and enhancing efficiency, particularly for international remittances and cross-border trade.

➤ Innovation and Technological Advancements: The cryptocurrency market fosters innovation in financial technology (fintech) and blockchain technology. As a hotbed for technological advancements, it drives research and development in areas such as blockchain scalability, privacy, and interoperability, paving the way for transformative solutions in various industries beyond finance.

➤ Investment Opportunities: Cryptocurrencies offer investment opportunities for individuals seeking alternative assets with high growth potential. With a diverse range of cryptocurrencies available for investment, investors can diversify their portfolios and potentially generate substantial returns, albeit with accompanying risks.

➤ Financial Sovereignty: Cryptocurrencies empower individuals to have full control over their financial assets, providing financial sovereignty and autonomy. Users can manage their funds independently without relying on intermediaries or government authorities, preserving privacy and freedom in financial transactions.

➤ Disruptive Potential: The cryptocurrency market has disruptive potential to revolutionize traditional financial systems, payment infrastructures, and business models. By challenging conventional norms and fostering innovation, cryptocurrencies pave the way for a decentralized, transparent, and inclusive financial ecosystem.

Overall, the strengths of the Cryptocurrency Market lie in its decentralized nature, accessibility, borderless transactions, technological innovation, investment opportunities, financial sovereignty, and disruptive potential, positioning it as a transformative force in the global economy.

Market Segmentation and Sub-Segmentation Included are:

➤ By Offering: The market divides offerings into hardware and software, catering to the distinct needs of investors and enthusiasts seeking either tangible hardware wallets or software-based solutions for managing cryptocurrencies securely.

➤ By Process: Segmentation based on processes delineates the core functions within the cryptocurrency ecosystem, distinguishing between mining, the process of validating transactions and adding them to the blockchain, and transaction, which involves the exchange of cryptocurrencies between parties.

➤ By Type: The market encompasses various cryptocurrency types, including Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dash, and others, reflecting the broad spectrum of digital currencies available for investment, trading, and transactional purposes.

➤ By End User: End-user segmentation categorizes participants into distinct groups such as trading, retail and e-commerce, banking, and others, reflecting the wide array of use cases and applications within the cryptocurrency ecosystem, from speculative trading to retail transactions and financial services.

Growth Opportunities for the Cryptocurrency Market

The Cryptocurrency Market presents a myriad of growth opportunities driven by several factors:

➤ Increasing Adoption: As cryptocurrencies gain wider acceptance among consumers, merchants, and institutional investors, the market witnesses growing adoption across various industries. This adoption is fueled by factors such as increasing awareness, regulatory clarity, and technological advancements, creating a fertile ground for market expansion.

➤ Institutional Participation: The entry of institutional investors, including hedge funds, asset managers, and corporations, into the cryptocurrency space presents significant growth opportunities. Institutional adoption brings increased liquidity, stability, and credibility to the market, attracting further investment and fostering mainstream acceptance.

➤ Technological Advancements: Ongoing innovations in blockchain technology and cryptocurrency infrastructure unlock new growth avenues for the market. Advancements such as scalability solutions, interoperability protocols, and decentralized finance (DeFi) platforms enhance the functionality, security, and usability of cryptocurrencies, driving wider adoption and market growth.

➤ Regulatory Developments: Regulatory clarity and supportive frameworks play a crucial role in fostering confidence and investment in the cryptocurrency market. Positive regulatory developments, such as clear guidelines on cryptocurrency taxation, licensing, and compliance, provide a conducive environment for market expansion and institutional participation.

➤ Global Financial Uncertainty: Heightened economic volatility, currency devaluation, and geopolitical tensions drive demand for alternative stores of value, such as cryptocurrencies. As investors seek hedging strategies against inflation and economic uncertainty, cryptocurrencies emerge as viable investment options, fueling market growth.

➤ Emerging Use Cases: Cryptocurrencies are increasingly being utilized beyond speculative trading, with applications in areas such as cross-border payments, remittances, decentralized finance (DeFi), non-fungible tokens (NFTs), and digital identity. The emergence of new use cases expands the utility and relevance of cryptocurrencies, attracting new users and driving market growth.

➤ Financial Inclusion: Cryptocurrencies hold the potential to promote financial inclusion by providing access to financial services for the unbanked and underbanked populations worldwide. By offering low-cost, borderless transactions and decentralized financial services, cryptocurrencies can bridge the gap between traditional banking systems and underserved communities, unlocking new markets and growth opportunities.

Overall, the Cryptocurrency Market is poised for robust growth driven by increasing adoption, institutional participation, technological advancements, regulatory developments, global financial uncertainty, emerging use cases, and the potential for financial inclusion. These growth opportunities position the market as a dynamic and transformative force in the global economy.

Impact of Recession

The ongoing recession has had a multifaceted impact on the cryptocurrency market. On one hand, the economic uncertainty has led investors to seek alternative assets like cryptocurrencies as a hedge against inflation and economic downturns. This has fueled increased interest and investment in the market. On the other hand, the recession has heightened regulatory scrutiny as authorities aim to mitigate risks associated with speculative trading and potential market manipulation. The cryptocurrency market, often seen as a barometer for economic sentiment, experiences fluctuations influenced by macroeconomic factors, making it susceptible to both positive and negative impacts during recessionary periods.

Impact of Russia-Ukraine War

The Russia-Ukraine war has introduced new dynamics to the cryptocurrency market. While the traditional financial systems face disruptions due to geopolitical tensions, cryptocurrencies, with their decentralized nature, offer a potential refuge for investors seeking stability. On the negative side, increased regulatory scrutiny and concerns about illicit use may arise. Additionally, the war's impact on global energy markets could influence the environmental discourse surrounding cryptocurrency mining. The evolving situation necessitates a careful examination of the market's resilience and adaptability in the face of geopolitical challenges.

Regional Analysis

North America stands as a frontrunner in cryptocurrency adoption, with the United States and Canada leading the way. The region has witnessed significant institutional interest, with major financial institutions integrating blockchain technology. In Europe, the cryptocurrency market is characterized by a collaborative approach between traditional financial systems and emerging blockchain technologies. Countries like Switzerland and Germany have emerged as hubs for blockchain innovation, while regulatory clarity varies across the continent. The Asia-Pacific region showcases a diverse cryptocurrency landscape. While countries like Japan and South Korea have embraced digital currencies, others, such as China, have implemented stringent regulations. Technological innovation, particularly in blockchain development, remains a focal point, with numerous startups and projects emerging across the region.

Buy the Latest Version of this Report @ https://www.snsinsider.com/checkout/1245

Conclusion

In the latest report by SNS Insider on the cryptocurrency market, a comprehensive analysis reveals dynamic trends and noteworthy developments within the digital asset landscape. The report delves into the evolving regulatory environment, shedding light on the impact of governmental policies on major cryptocurrencies like Bitcoin and Ethereum. SNS Insider also examines the growing influence of decentralized finance Furthermore, the report highlights the emergence of new blockchain technologies and their potential applications beyond currency, emphasizing the transformative potential of non-fungible tokens (NFTs) in various industries.

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. COVID-19 Impact Analysis

4.2. Impact of Ukraine- Russia war

4.3. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter’s 5 Forces Model

7. PEST Analysis

8. Cryptocurrency Market Segmentation, By Offering

8.1. Hardware

8.2. Software

9. Cryptocurrency Market, By Process

9.1. Mining

9.2. Transaction

10. Cryptocurrency Market, By Type

10.1. Bitcoin

10.2. Ethereum

10.3. Bitcoin Cash

10.4. Ripple

10.5. Litecoin

10.6. Dash

10.7. Others

11. Cryptocurrency Market, By End User

11.1. Trading

11.2. Retail and E-commerce

11.3. Banking

11.4. Others

12. Regional Analysis

12.1. Introduction

12.2. North America

12.3. Europe

12.4. Asia-Pacific

12.5. The Middle East & Africa

12.6. Latin America

13. Company Profile

14. Competitive Landscape

14.1. Competitive Benchmarking

14.2. Market Share Analysis

14.3. Recent Developments

15. USE Cases and Best Practices

16. Conclusion

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.