IRS Releases Updated Schedule SE Tax Form and Instructions for 2023 and 2024 Announced by Harbor Financial

Schedule SE Tax Form

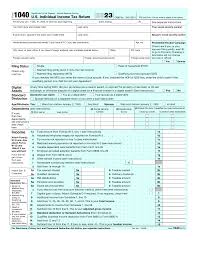

IRS Tax Form Instructions

Printable IRS Tax Forms

The Internal Revenue Service (IRS) has released updated Schedule SE tax form and instructions for the tax years 2023 and 2024.

TRAVERSE CITY, MI, US, January 12, 2024 /EINPresswire.com/ -- The Internal Revenue Service (IRS) has released updated Schedule SE tax form and instructions for the tax years 2023 and 2024. The Schedule SE is used by self-employed individuals to calculate and report their self-employment tax.

The updated Schedule SE form and instructions include a number of changes that aim to simplify the process of reporting self-employment income and calculating self-employment tax. These changes include:

1. New tax rates: The self-employment tax rate for 2023 and 2024 is 15.3%. This rate consists of two parts, i.e., 12.4% for Social Security and 2.9% for Medicare. The Social Security wage base limit for 2023 is $147,000, up from $142,800 in 2022. There is no limit on earnings subject to the 2.9% Medicare tax.

2. New worksheet: The updated Schedule SE instructions include a new worksheet that makes it easier for self-employed individuals to calculate their self-employment tax liability. The worksheet includes separate sections for Social Security and Medicare taxes, and it includes clear instructions on how to calculate the tax due.

3. Simplified reporting: The updated Schedule SE form now includes a simplified reporting method for self-employed individuals who earn less than $400 in net earnings. These individuals can now report their self-employment income and pay their self-employment tax on their personal tax return, instead of filing a separate Schedule SE form.

4. New electronic filing options: The IRS has introduced new electronic filing options for Schedule SE, including the ability to file the form electronically using tax preparation software.

Overall, the updated Schedule SE tax form and instructions for 2023 and 2024 aim to make it easier for self-employed individuals to report their income and pay their self-employment tax. These changes should help to reduce the administrative burden on self-employed individuals and encourage compliance with tax obligations.

For more information on the updated Schedule SE tax form and instructions, please visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.