IRS Releases Schedule H Tax Form and Instructions for 2023 and 2024 Announced by Harbor Financial

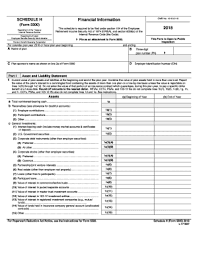

Schedule H Tax Form

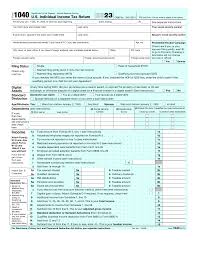

IRS Tax Form Instructions

Printable IRS Tax Forms

The Internal Revenue Service (IRS) has released the Schedule H tax form and instructions for 2023 and 2024.

TRAVERSE CITY, MI, US, January 11, 2024 /EINPresswire.com/ -- The Internal Revenue Service (IRS) has released the Schedule H tax form and instructions for 2023 and 2024. This form is used to report household employment taxes, which are taxes that employers are required to pay when they hire domestic workers such as nannies, caregivers, and housekeepers.

Here are some key highlights of the IRS Schedule H tax form and instructions for 2023 and 2024:

1. Threshold for Household Employees: The threshold for household employees has been increased to $2,600 for 2023 and 2024. This means that if a household employee is paid less than $2,600 in a year, household employment taxes do not have to be paid.

2. Social Security and Medicare Taxes: Schedule H cover the same three taxes that are withheld from all employment wages: the 12.4 percent Social Security tax, a 2.9 percent Medicare tax and the 6 percent federal unemployment tax, or FUTA.

3. Filing Deadline: The deadline for filing Schedule H tax form for 2023 and 2024 is April 15th of the following year. However, if one pays household employment taxes of $1,000 or more in a quarter, quarterly estimated tax payments must be made.

4. Record Keeping: It is important to keep accurate records of all household employment taxes paid, including the employee's name, address, and Social Security number, as well as the dates and amounts of payments made.

5. Penalties: Failure to pay household employment taxes can result in penalties and interest charges. Additionally, if one fails to file Schedule H tax form or provide incorrect or incomplete information, they may be subject to penalties.

In conclusion, with a household employee, it is important to understand the tax obligations and file the Schedule H tax form and instructions for 2023 and 2024 accurately and on time. To get the form, visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

American Tax Service

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.