IRS Schedule EIC, Earned Income Credit Tax Form and Instructions for 2023 and 2024 Announced by Harbor Financial

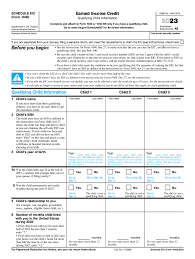

The IRS has released updated instructions and printable forms for the Schedule EIC and Earned Income Credit (EIC) tax forms for 2023 and 2024.

TRAVERSE CITY, MI, US, January 9, 2024 /EINPresswire.com/ -- As tax season approaches, the Internal Revenue Service (IRS) has released updated instructions and printable forms for the Schedule EIC and Earned Income Credit (EIC) tax forms for 2023 and 2024.

The EIC is a tax credit for low to moderate-income individuals and families, and the Schedule EIC is used to determine and claim the credit.

The updated instructions provide comprehensive guidance on how to fill out the Schedule EIC and claim the EIC tax credit.

Taxpayers can use the instructions to accurately calculate their credit, which is based on their earned income and the number of qualifying children they have.

The instructions also outline the eligibility requirements for the credit, such as income limits and filing status.

In addition to the instructions, the IRS has also released printable forms for the Schedule EIC and the EIC tax credit. These forms can be downloaded and printed from the IRS website, making it easier for taxpayers to file their taxes. The forms are available in both English and Spanish.

Taxpayers who qualify for the EIC tax credit can receive a significant refund, which can help them pay for essential expenses such as housing, food, and childcare.

According to the IRS, the average EIC tax credit amount for tax year 2022 was $2,650. This amount can vary based on a taxpayer's income, number of qualifying children, and filing status.

To claim the EIC tax credit, taxpayers must file their taxes using Form 1040 or Form 1040-SR and attach Schedule EIC to their return. The credit is refundable, which means that taxpayers can receive a refund even if they don't owe any taxes.

In conclusion, the IRS has released updated instructions and printable forms for the Schedule EIC and EIC tax credit for 2023 and 2024.

Taxpayers who qualify for the credit should take advantage of these resources to ensure that they accurately claim their credit and receive the maximum refund possible.

For more information on the EIC tax credit form, visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.