New IRS Schedule E Tax Form Instructions and Printable Forms for 2023 and 2024 Announced by Harbor Financial

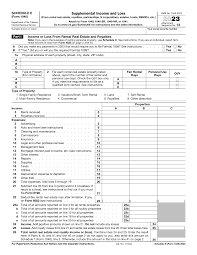

New IRS Schedule E Tax Form Instructions and Printable Forms for 2023 and 2024 are now available to report rental property income and expenses.

TRAVERSE CITY, MI, US, January 9, 2024 /EINPresswire.com/ -- New IRS Schedule E Tax Form Instructions and Printable Forms for 2023 and 2024 are now available to help taxpayers understand and report their rental property income and expenses accurately.

The IRS Schedule E is a supplementary form that must be filed with Form 1040 by taxpayers who have rental property income.

The IRS Schedule E is one of the most challenging tax forms to complete, and many taxpayers struggle with it. To make things easier, the IRS has released detailed tax form instructions and printable forms for 2023 and 2024.

The new instructions provide step-by-step guidance on how to fill out the form correctly, ensuring that taxpayers report their rental property income and expenses accurately.

The IRS Schedule E Form is not only for property owners but also for anyone who rents out property, including landlords, property managers, and real estate professionals. The form requires taxpayers to report their rental income, expenses, and depreciation.

Rental income includes any payments received for the use of property, such as rent, security deposits, and advance rent.

Expenses include any costs related to the property, such as mortgage interest, property tax, insurance, repairs, and maintenance. Depreciation is the loss of value over time, which can be claimed as a tax deduction.

The IRS encourages taxpayers to file their taxes online, as this is the fastest and most secure way to file. Taxpayers who file electronically can also receive their refunds more quickly than those who file on paper.

In conclusion, the new Schedule E tax form instructions and printable forms for 2023 and 2024 provide taxpayers with a valuable resource to help them report their rental property income and expenses accurately.

By following the step-by-step instructions, taxpayers can avoid errors.

For more information on IRS tax forms and instructions, visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.