IRS Tax Form 3903 Instructions and Printable Forms for 2023 and 2024 Announced by Harbor Financial

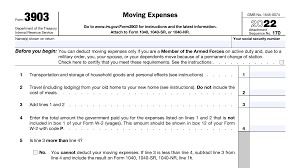

The Internal Revenue Service (IRS) has announced the release of the Tax Form 3903 instructions and printable forms for the years 2023 and 2024.

TRAVERSE CITY, MI, US, December 27, 2023 /EINPresswire.com/ -- The Internal Revenue Service (IRS) has announced the release of the Tax Form 3903 instructions and printable forms for the years 2023 and 2024.

Taxpayers who are eligible to claim moving expenses can now access the updated forms and instructions to prepare their returns.

The Tax Form 3903 is required to claim moving expenses for a job-related move. The eligible taxpayers can deduct the reasonable expenses incurred for moving their household goods and personal effects, as well as travel expenses, including lodging, but not meals.

The IRS has released the updated instructions and forms to make it easier for taxpayers to claim their allowable moving expenses.

The new forms and instructions reflect the changes made by the Tax Cuts and Jobs Act (TCJA) of 2017, which eliminated the deduction for most job-related moving expenses for tax years 2018 through 2025.

However, the deduction is still available for members of the Armed Forces on active duty who move pursuant to a military order.

Taxpayers can download the Tax Form 3903 and its instructions from the IRS website or pick up a printed copy at their local IRS office. The form is available in both English and Spanish.

To claim moving expenses, taxpayers must meet certain requirements, such as the distance test and the time test. The distance test requires that the new workplace must be at least 50 miles farther from the taxpayer's former home than the old workplace was.

The time test requires that the taxpayer work full-time for at least 39 weeks during the first 12 months after arriving in the general area of the new workplace.

The IRS reminds taxpayers that they must keep adequate records to support their deduction and should retain all receipts and documentation related to their moving expenses.

The records should include the cost of packing, shipping, and insuring household goods and personal effects, as well as the expenses incurred for travel and lodging.

Taxpayers can access Tax Form 3903 here, https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.