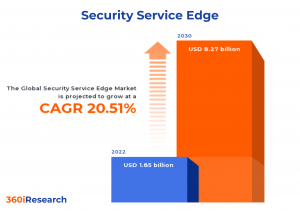

Security Service Edge Market worth $8.27 billion by 2030, growing at a CAGR of 20.51% - Exclusive Report by 360iResearch

The Global Security Service Edge Market to grow from USD 1.85 billion in 2022 to USD 8.27 billion by 2030, at a CAGR of 20.51%.

PUNE, MAHARASHTRA, INDIA , December 8, 2023 /EINPresswire.com/ -- The "Security Service Edge Market by Offering (Cloud Access Security Broker (CASB), Cloud Secure Web Gateway (SWG), Firewall-as-a-service (FWaaS)), Enterprise Size (Large Enterprises, Small & Medium Enterprises(SMEs)), Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Security Service Edge Market to grow from USD 1.85 billion in 2022 to USD 8.27 billion by 2030, at a CAGR of 20.51%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/security-service-edge?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The security service edge (SSE) combines wide area networking capabilities and network security services into a single, cloud-based service model. This convergence is the convergence of network security services delivered from a purpose-built cloud platform. Security service edge spans multiple sectors such as IT, telecom, BFSI, and healthcare, providing secure internet access, threat prevention, data loss prevention, and firewall provisions. The rise in digital processes, data security needs, and digital transformation strategies have fueled the security service edge market growth. Growing IT infrastructure and the presence of stringent global data privacy regulations have propelled the adoption of security service edge solutions. However, factors such as unstructured data security gaps, the high initial cost, and issues associated with security service edge deployment impair market growth. Besides these challenges, the security service edge market presents opportunities through innovation to enhance its offerings and overcome shortcomings. Additionally, robust R&D in cloud-native architectures, zero-trust frameworks, and AI-powered self-learning systems present promising development opportunities for the adoption of security service edge.

Enterprise Size: SMEs prefer security service edge solutions that are easy to manage and implement

Large enterprises prefer comprehensive security service edge solutions to safeguard their intricate networks, regardless of the expenditure. Conversely, affordability and scalability are the prerogatives of small & medium enterprises (SMEs) when selecting security service edge solutions. Given the limited resources and potential lack of in-house IT proficiency, SMEs prefer manageable and implementable solutions. While large enterprises and SMEs perceive the importance of security service edge, their preferences and requirements differ drastically. Large enterprises are more likely to invest in extensive security solutions, focusing on total protection, regardless of cost. SMEs prefer affordable and scalable solutions, as these businesses work with limited resources and budgets.

Offering: Growing adoption of zero trust network access (ZTNA) by remote workers

Cloud access security broker (CASB) provides policy enforcement points for cloud service access, placed between cloud service customers and providers to combine and implement security, compliance, and governance policies. As enterprises continue to embrace cloud platforms, CASBs have become crucial for businesses needing to secure their cloud-based resources. Cloud secure web gateway (SWG) services provide a solution to protect against web-based threats and enforce corporate and regulatory policy compliance. They are intermediaries that filter out unwanted software or malware from user-initiated web/internet connections. Firewall-as-a-service (FWaaS) offers a cloud-based solution for firewall and other network security functions. This service provides the control and visibility of a traditional firewall setup without the associated hardware and maintenance costs. Zero trust network access (ZTNA) is an IT security model that mandates that no one within or outside the network is trusted by default. It reduces the attack surface by masking applications from unauthorized users. Comparatively, cloud access security broker (CASB) is indispensable for enterprises utilizing many cloud-based applications. It focuses on securing data and enforcing policies in the cloud. Cloud secure web gateways (SWGs) mainly focus on securing web-based communications and protecting against web-based threats. Firewall-as-a-service (FWaaS) replaces traditional firewall hardware with a cloud-based solution, thus reducing maintenance complexity and cost. Zero trust network access (ZTNA) provides not just controlled network access but also the visibility of its usage, which becomes essential for organizations with a significant remote workforce.

Vertical: Significant demand for security service edge in BFSI arena to protect sensitive data and secure transactions

The automotive industry capitalizes on the security service edge for advanced vehicular communication systems and IoT integrations. Due to the sensitive nature of their operations, the BFSI sector emphasizes stringent security service edge. In BFSI, network security stands at the forefront, ensuring data protection and secure financial transactions. The government sector relies on the security service edge for safeguarding its extensive e-governance platforms and public infrastructure. The healthcare sector is leveraging security service edge to securely handle sensitive patient data and telemedicine services. Security service edge is necessary for the IT and telecommunication industry, considering the potential risk of cyber threats to their vast data networks. The retail and eCommerce industry uses security service edge to safeguard customer data and secure online transactions. Security service edge, depending on the unique requirements of each sector, offers a plethora of benefits ranging from securing sensitive data to protecting online transactions and infrastructure.

Regional Insights:

The Americas region has been at the forefront of the security service edge market, showing a steady growth curve, largely attributed to the advanced technological infrastructure, widespread acceptance of BYOD (Bring Your Own Device) culture, and high cyber-security investment. Multinational companies in the region are increasingly focusing on state-of-the-art cyber security solutions, contributing significantly to the market's expansion. The EMEA region, with the EU's General Data Protection Regulation (GDPR) is driving the market demand for security service edge solutions. The Middle East and Africa, though developing at a slower pace, are showing promising potential with increasing awareness about data security, robust telecommunications growth, and a surge in digital transformation initiatives. The Asia-Pacific region is witnessing a substantial growth rate in the security service edge market owing to rapid urbanization and the swift expansion of IT sectors in countries including India, China, and South Korea are the primary driving factors. This growth is further fuelled by proactive government policies regarding cyber security, the adoption of cloud technologies, and the escalating penetration of internet services.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Security Service Edge Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Security Service Edge Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Security Service Edge Market, highlighting leading vendors and their innovative profiles. These include Barracuda Networks, Inc., Broadcom Inc., Cato Networks Ltd., Check Point Software Technologies Ltd., Cisco Systems, Inc., Citrix by Cloud Software Group, Inc., Cloudflare, Inc., Ericom Software Ltd., Fortinet, Inc., Hewlett Packard Enterprise Company, iboss, Inc., Infoblox Inc., InterVision Systems, LLC, Island Technology, Inc., Juniper Networks, Inc., Lookout, Inc., Microsoft Corporation, Netskope, Inc., Nord Security Inc., Open Systems, Palo Alto Networks, Inc., Skyhigh Security, LLC, Trellix, Versa Networks, Inc., and Zscaler, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/security-service-edge?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Security Service Edge Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Cloud Access Security Broker (CASB), Cloud Secure Web Gateway (SWG), Firewall-as-a-service (FWaaS), and Zero Trust Network Access (ZTNA). The Cloud Secure Web Gateway (SWG) is projected to witness significant market share during forecast period.

Based on Enterprise Size, market is studied across Large Enterprises and Small & Medium Enterprises(SMEs). The Small & Medium Enterprises(SMEs) is projected to witness significant market share during forecast period.

Based on Vertical, market is studied across Automotive, BFSI, Government, Healthcare, IT & Telecommunication, and Retail & eCommerce. The Healthcare is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 37.52% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Security Service Edge Market, by Offering

7. Security Service Edge Market, by Enterprise Size

8. Security Service Edge Market, by Vertical

9. Americas Security Service Edge Market

10. Asia-Pacific Security Service Edge Market

11. Europe, Middle East & Africa Security Service Edge Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Security Service Edge Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Security Service Edge Market?

3. What is the competitive strategic window for opportunities in the Security Service Edge Market?

4. What are the technology trends and regulatory frameworks in the Security Service Edge Market?

5. What is the market share of the leading vendors in the Security Service Edge Market?

6. What modes and strategic moves are considered suitable for entering the Security Service Edge Market?

Read More @ https://www.360iresearch.com/library/intelligence/security-service-edge?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.