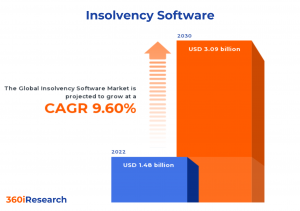

Insolvency Software Market worth $3.09 billion by 2030, growing at a CAGR of 9.60% - Exclusive Report by 360iResearch

The Global Insolvency Software Market to grow from USD 1.48 billion in 2022 to USD 3.09 billion by 2030, at a CAGR of 9.60%.

PUNE, MAHARASHTRA, INDIA , December 8, 2023 /EINPresswire.com/ -- The "Insolvency Software Market by Offering (Services, Solutions), Organization Size (Large Enterprises, Small & Medium Enterprises), Application, Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Insolvency Software Market to grow from USD 1.48 billion in 2022 to USD 3.09 billion by 2030, at a CAGR of 9.60%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/insolvency-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Insolvency software, commonly used in financial and business environments, is a specialized software that automates the administrative processes associated with insolvency management. It is designed to simplify, streamline, and expedite various aspects of managing insolvency cases. Insolvency software comprises multiple functionalities, including case creation, case management, statutory report creation, communication tracking, task scheduling, deadline monitoring, and financial transaction recording. These features facilitate a reduced workload by improving efficiency and promoting accuracy in handling insolvency cases. The increasing number of insolvencies worldwide, driven by economic downturns, spikes in unemployment, and business crises, is a significant growth propeller for this market. However, legal complexities associated with insolvency proceedings could pose a considerable challenge in developing software that comprehensively addresses these intricacies. Nevertheless, technological advancements and the increasing acceptance of cloud-based technologies provide substantial growth opportunities.

Vertical: Significant adoption of insolvency software in the IT & telecommunication sector

Banking, Financial Services, and Insurance (BFSI) vertical is a primary consumer of insolvency software due to the nature of operations that include managing bad debts and bankruptcies. The energy & utilities sector, being capital intensive, significantly relies on insolvency software to manage its defaults and liquidations. The government sector employs insolvency software to manage the defaults of public accounts. In the IT & telecommunication sector, insolvency software is used to manage bankruptcies and credit risks. Manufacturing industries also employ insolvency software for business risk management, secured transactions, and addressing the issues of bankruptcies. In retail, insolvency software helps manage possible liquidation and bankruptcy.

Offering: Proliferating use of insolvency software services for companies with less technical competence

The services offered within the domain of insolvency software include auxiliary aids such as consulting, implementation, and support services in utilizing the software. These services also involve providing required training to the users for understanding and efficiently using the software for resolving insolvency processes. The solutions segment encapsulates a series of comprehensive software products aiming to simplify and automate the insolvency processes. This includes asset management, case management, document management, reporting, and analytics tools. The teams from service providers guide, train, and assist the users throughout the software utilization phase. Conversely, solutions may be well-suited for tech-savvy firms who require a hands-on toolkit for managing insolvency proceedings.

Organization Size: Growing application of insolvency software in large enterprises

Large enterprises often require complex procedures for insolvency due to the number of assets, creditors, stakeholders, and transactions involved. Thus, robust and comprehensive insolvency software is critical. For small & medium enterprises (SMEs), every resource allocation decision matters; hence, financial software tailored to handle insolvency situations is of considerable value. SMEs might not manage enormous amounts of financial data or intricate legal cases compared to larger counter-part organizations. However, they still need to navigate the complexities of insolvency in an efficient, legally compliant, and strategic manner.

Application: Burgeoning usage of insolvency software in compliance management

In the insolvency domain, keeping up with legal compliance is critical and complex due to frequently changing regulations and laws. The software ensures adherence to all compliance rules and regulations. It manages, automates, and streamlines real-time alerts, compliance monitoring, and mapping of regulatory changes. It reduces non-compliance risk and facilitates robust, legally sound financial decisions. The insolvency software comes with dynamic creditor management features that offer a simple and efficient process for handling and prioritizing creditors. It allows to manage all interactions with creditors, including communications, claims, distributions, and votes, thus facilitating the seamless execution of insolvency procedures. Document management becomes significantly streamlined with a centralized repository offered by the insolvency software. It empowers firms with fully searchable, secure, and instantly accessible document storage. The insolvency solution's financial transaction management feature allows easy tracking, recording, and organization of all financial transactions related to the insolvency process. This includes automated calculation of interests, debts, credits, and payments. The software provides comprehensive reporting tools that deliver insightful, real-time reports and analysis. These data-driven insights foster strategic decision-making and aid in monitoring the entire insolvency process.

Regional Insights:

The insolvency software market is evolving in the Americas owing to the efficiency and transparency of these processes and the consumer need for robust, simple-to-navigate software with high security. In the Asia Pacific region, a strong inclination toward insolvency software is primarily driven by a surge in digitalization and strict bankruptcy legislation. In Europe, particularly the European Union (EU) countries, insolvency software has gained popularity due to the complex legislative framework around insolvency. In the Middle East, although the insolvency software market is relatively nascent, it shows promising future potential due to the complex business environment and advancements in technology leading to an increased consumer need for this software. In Africa, the insolvency software market has shown gradual growth due to the need to simplify complex insolvency processes and recent modernization efforts across businesses. Besides, the integration of innovative features and breakthrough technologies is anticipated to propel the use of insolvency software by the end-use sectors globally.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Insolvency Software Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Insolvency Software Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Insolvency Software Market, highlighting leading vendors and their innovative profiles. These include Altisource S.à r.l., Aryza Ltd., Begbies Traynor Group plc, Caseware International Inc., CINcompass, Clio by Themis Solutions Inc., CLOUDLEX, INC., Epiq Systems, Inc., Ernst & Young Global Limited, Farsoft Infotech Pvt Ltd, Fastcase Inc., Fileassure, Grant Thornton UK LLP, Kroll, LLC, LegalPRO Systems, Inc., Litera Corp., National e-Governance Services Limited, Panther Software, LLC, QwikFile, Smokeball, Inc., Stephenson Harwood LLP, stp.one, Stretto, Inc., tandard Legal Network LLC, and Turnkey Computer Technology Ltd..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/insolvency-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Insolvency Software Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Services and Solutions. The Services is projected to witness significant market share during forecast period.

Based on Organization Size, market is studied across Large Enterprises and Small & Medium Enterprises. The Small & Medium Enterprises is projected to witness significant market share during forecast period.

Based on Application, market is studied across Compliance, Creditor Management, Document Management, Financial Transaction Management, and Reporting. The Financial Transaction Management is projected to witness significant market share during forecast period.

Based on Vertical, market is studied across BFSI, Energy & Utilities, Government, IT & Telecommunication, Manufacturing, and Retail. The Retail is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 37.69% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Insolvency Software Market, by Offering

7. Insolvency Software Market, by Organization Size

8. Insolvency Software Market, by Application

9. Insolvency Software Market, by Vertical

10. Americas Insolvency Software Market

11. Asia-Pacific Insolvency Software Market

12. Europe, Middle East & Africa Insolvency Software Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Insolvency Software Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Insolvency Software Market?

3. What is the competitive strategic window for opportunities in the Insolvency Software Market?

4. What are the technology trends and regulatory frameworks in the Insolvency Software Market?

5. What is the market share of the leading vendors in the Insolvency Software Market?

6. What modes and strategic moves are considered suitable for entering the Insolvency Software Market?

Read More @ https://www.360iresearch.com/library/intelligence/insolvency-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.