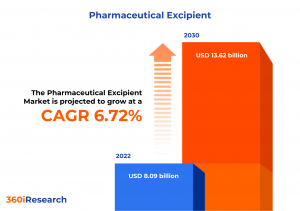

Pharmaceutical Excipient Market worth $13.62 billion by 2030- Exclusive Report by 360iResearch

The Global Pharmaceutical Excipient Market to grow from USD 8.09 billion in 2022 to USD 13.62 billion by 2030, at a CAGR of 6.72%.

PUNE, MAHARASHTRA, INDIA , December 6, 2023 /EINPresswire.com/ -- The "Pharmaceutical Excipient Market by Type (Inorganic, Organic), Formulation (Oral Formulations, Parenteral Formulations, Topical Formulations), Function - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Pharmaceutical Excipient Market to grow from USD 8.09 billion in 2022 to USD 13.62 billion by 2030, at a CAGR of 6.72%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/pharmaceutical-excipient?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Pharmaceutical excipients are added to pharmaceutical products for various purposes, including improving the manufacturing process, enhancing stability, ensuring the bioavailability of the drug, and facilitating the administration and dosing of the final product. Excipients are essentially inactive components that support the overall formulation and delivery of the active ingredient. The market for pharmaceutical excipients is primarily driven by the increasing demand for pharmaceutical products due to the rising global population and chronic diseases. Technological advancements in drug formulation and developing novel excipients also contribute to market growth. Furthermore, the expansion of the generic pharmaceuticals sector and the trend toward self-medication for minor health issues provide a strong impetus for the excipient market. However, stringent regulatory requirements leading to lengthy approval processes can impede the introduction of new excipients, and the high cost associated with developing and producing advanced excipients hamper its market growth. The shift toward multifunctional and co-processed excipients and ongoing advancements and research activities for developing biobased excipients opens significant opportunities for market players, offering benefits such as improved product performance and production efficiency.

Type: Potential demand and utilization of organic excipients

Inorganic excipients are substances not of organic origin and are included in pharmaceutical formulations to serve various functions. These excipients include calcium carbonate, widely used as a filler or diluent, and a source of calcium in pharmaceutical tablets. It is favored for its high purity, non-toxic nature, and cost-effectiveness. Calcium phosphate excipients, including dicalcium phosphate and tricalcium phosphate, are utilized for their excellent compressibility and flow properties, making them ideal for tableting operations. Calcium sulfate is used in pharmaceuticals as a tablet excipient and a co-processed excipient to improve the mechanical strength of tablets. Halites, especially sodium chloride, create isotonic solutions and are used as stabilizers and taste-masking agents in oral medications. In pharmaceutical formulations, metal oxides such as magnesium and zinc oxide function as pH adjusters, colorants, and nutrient supplements. Organic excipients refer to substances of organic (carbon-based) origin that are included in pharmaceutical formulations. Carbohydrates are fillers, binders, and stabilizers in oral solid dose formulations. Cellulose derivatives, including microcrystalline cellulose, are prolific in the excipient market, valued for their binding, disintegrating, and film-forming properties. Starch and its derivatives are used as disintegrants, binders, and fillers in tablets, providing good mechanical properties to pharmaceutical forms. Sugars such as sucrose are often used in syrups and lozenges as sweeteners and crystalline bases for water-soluble drugs. Fatty alcohols are non-ionic surfactants and emollients in topical formulations, aiding in skin penetration of APIs. Glycerin is used as a solvent, humectant, and preservative in various pharmaceutical preparations, including oral, topical, and parenteral formulations. Mineral stearates such as magnesium are predominantly used as lubricants in tablet manufacture, ensuring the efficient running of tablet presses. In tablet formulations, petrochemicals such as acrylic polymers, including polymethyl methacrylate, serve as film coatings, binders, and sustained-release matrix formers. Glycols such as propylene glycol are versatile solvents for APIs and are used in many pharmaceutical preparations, including injectables, topical formulations, and syrups. Mineral hydrocarbons such as paraffin are used for their lubricating properties in capsules and as bases in various ointments and creams. Furthermore, povidones are used as binders in tablet formulations, as solubilizers in liquids, and as bioadhesives for buccal applications. Proteins such as gelatin and collagen are used to form drug capsules and as film-forming agents. Their biodegradability and compatibility with the human body make them vital for specific pharmaceutical applications.

Formulation: Significant demand for oral formulations owing to its convenient drug delivery

Oral formulations are dosage forms administered through the oral route, one of the most convenient and commonly used drug delivery methods. This segment includes a variety of excipients designed to aid the active pharmaceutical ingredient's stability, release, and bioavailability (API). Hard gelatin capsules are solid dosage forms in which one or more drug substances and excipients are enclosed within a small shell. They also offer advantages such as dose precision and good stability. Soft gelatin capsules (soft gels) are an oral dosage form for medicine similar to capsules; however, they consist of a gelatin-based shell surrounding a liquid fill. They are favored for their ease of swallowing and ability to enhance the bioavailability of poorly soluble APIs. Liquid formulations include solutions, suspensions, and emulsions that are taken orally. The choice of excipients in these formulations is critical to ensure stability, palatability, and proper absorption of the API. Tablets are a popular oral dosage form, and the excipient market for tablets remains robust. The ingredients used in tablet manufacturing bind the compound, aid in disintegration, and enhance stability. Parenteral formulations are sterile preparations intended to be administered directly into the body tissues. Topical formulations are applied to the skin or mucous membranes to deliver active ingredients directly to the site of action or systemic circulation.

Function: Coating agents provide physical and chemical protection for the drug

Binders are adhesive materials used in tablet formulations to agglomerate and hold the powder particles together, enhancing the strength and integrity of the tablet. Coating agents are applied to the exterior of various dosage forms to mask unpleasant tastes, provide physical and chemical protection for the drug, and control the release of the drug substance. Colorants are added to pharmaceuticals to facilitate product identification and enhance aesthetic appeal. Disintegrants are critical excipients that promote the breakup of a tablet in the digestive tract after administration, permitting the rapid release and absorption of the active pharmaceutical ingredient. Their functionality ensures the tablet disintegrates efficiently into smaller fragments when it enters a fluid environment. Emulsifying agents assist in the formation and stabilization of emulsions by reducing surface tension at the interface between the immiscible liquids. They are crucial for formulations such as creams, ointments, and suspension-based systems and facilitate the homogeneous distribution of the drug substance within the system. Fillers and diluents are inert additives that increase a tablet or capsule's bulk volume, making it practical to produce and easy to handle. Flavoring agents and sweeteners improve the palatability of oral medications, masking any unpleasant flavors and odors from the active drug or other excipients. Lubricants are added to formulation blends to prevent ingredients from clumping and to ensure a smooth ejection of the tablet from the die during compression. Preservatives contain the growth of microbes in pharmaceutical products, extending their shelf life and ensuring safety during use. Suspending and viscosity agents help maintain a uniformly dispersed state of insoluble particles in a liquid dosage form and can modulate liquid preparations' flow properties (viscosity). This ensures a uniform dose of medication with each administration and improves the stability of the practice.

Regional Insights:

The Americas region has a significant landscape in the pharmaceutical excipient market as countries exhibit a high demand for excipients, directed by stringent regulatory environments, advanced healthcare systems, and strong intellectual property frameworks. Having a significant landscape in pharmaceutical innovation, the countries in the region strongly focus on advanced and novel excipients for drug formulations. The EMEA region, which encompasses Europe, the Middle East, and Africa, shows diverse market characteristics. The stringent regulatory environment in the European Union drives the demand for compliant and high-quality excipients, whereas markets in the Middle East and Africa are burgeoning, with increasing investment in pharmaceutical manufacturing infrastructure and regulation. The EU market demonstrates a high need for cutting-edge pharmaceutical excipients that cater to complex drugs and sophisticated drug delivery systems. Moreover, the EU's investment in biopharmaceuticals and biosimilars is complemented by the growing demand for novel excipients in these areas. Countries in the Asia-Pacific region are key players in the pharmaceutical excipient sector experiencing substantial growth due to a large patient pool, increasing healthcare expenditures, and supportive government initiatives. The region focuses on innovating high-functional excipients with ongoing research and development, reducing its historical reliance on imports.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Pharmaceutical Excipient Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Pharmaceutical Excipient Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Pharmaceutical Excipient Market, highlighting leading vendors and their innovative profiles. These include ABITEC Corporation, Aceto Corp., Archer Daniels Midland Company, ARMOR PROTEINES S.A.S., Asahi Kasei Corporation, Ashland Inc., BASF SE, BIOGRUND GmbH, Chemische Fabrik Budenheim KG, Clariant AG, Colorcon Inc., Corel Pharma Chem Private Limited, Croda International Plc, Darling Ingredients, Inc., DFE Pharma GmbH & Co KG, DuPont de Nemours, Inc., Evonik Industries AG, Fuji Chemical Industries Co., Ltd., GATTEFOSSE SAS, Innophos Holdings, Inc., International Flavors & Fragrances Inc., JRS PHARMA GmbH + Co. KG, Kerry Group P.L.C., Lipoid GmbH, Lubrizol Corporation, L’AIR LIQUIDE S.A., Mallinckrodt plc, MEGGLE GmbH & Co. KG, Merck KGaA, Nagase & Co., Ltd., Nipon Soda Co., Ltd., NOF Corporation, Omya International AG, Peter Greven GmbH & Co. KG, R.T. Vanderbilt Holding Company, Inc., Resonac Holdings Corporation, Roquette Frères S.A., Shin-Etsu Chemical Co., Ltd., Solvay S.A., SPI Pharma, Inc., and Thermo Fisher Scientific Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/pharmaceutical-excipient?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Pharmaceutical Excipient Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Inorganic and Organic. The Inorganic is further studied across Calcium Carbonate, Calcium Phosphate, Calcium Sulfate, Halites, and Metal Oxides. The Organic is further studied across Carbohydrates, Oleochemicals, Petrochemicals, and Proteins. The Carbohydrates is further studied across Cellulose, Starch, and Sugars. The Oleochemicals is further studied across Fatty Alcohols, Glycerin, and Mineral Stearates. The Petrochemicals is further studied across Acrylic Polymers, Glycols, Mineral Hydrocarbons, and Povidones. The Inorganic is projected to witness significant market share during forecast period.

Based on Formulation, market is studied across Oral Formulations, Parenteral Formulations, and Topical Formulations. The Oral Formulations is further studied across Capsules, Liquid Formulations, and Tablets. The Capsules is further studied across Hard Gelatin Capsules and Soft Gelatin Capsules. The Oral Formulations is projected to witness significant market share during forecast period.

Based on Function, market is studied across Binders, Coating Agents, Colorants, Disintegrants, Emulsifying Agents, Fillers & Diluents, Flavoring Agents & Sweeteners, Lubricants & Glidants, Preservatives, and Suspending & Viscosity Agents. The Suspending & Viscosity Agents is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.75% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Pharmaceutical Excipient Market, by Type

7. Pharmaceutical Excipient Market, by Formulation

8. Pharmaceutical Excipient Market, by Function

9. Americas Pharmaceutical Excipient Market

10. Asia-Pacific Pharmaceutical Excipient Market

11. Europe, Middle East & Africa Pharmaceutical Excipient Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Pharmaceutical Excipient Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Pharmaceutical Excipient Market?

3. What is the competitive strategic window for opportunities in the Pharmaceutical Excipient Market?

4. What are the technology trends and regulatory frameworks in the Pharmaceutical Excipient Market?

5. What is the market share of the leading vendors in the Pharmaceutical Excipient Market?

6. What modes and strategic moves are considered suitable for entering the Pharmaceutical Excipient Market?

Read More @ https://www.360iresearch.com/library/intelligence/pharmaceutical-excipient?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.