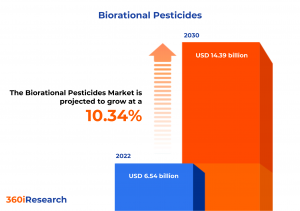

Biorational Pesticides Market worth $14.39 billion by 2030- Exclusive Report by 360iResearch

The Global Biorational Pesticides Market to grow from USD 6.54 billion in 2022 to USD 14.39 billion by 2030, at a CAGR of 10.34%.

PUNE, MAHARASHTRA, INDIA , December 6, 2023 /EINPresswire.com/ -- The "Biorational Pesticides Market by Type (Biorational Fungicides, Biorational Insecticides, Biorational Nematicides), Formulation (Dry, Liquid), Source, Mode of Application, Crop - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Biorational Pesticides Market to grow from USD 6.54 billion in 2022 to USD 14.39 billion by 2030, at a CAGR of 10.34%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/biorational-pesticides?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Biorational pesticides are a class of pest control substances derived from natural or biological origins. Unlike conventional chemical pesticides, biorational pesticides are typically more targeted in their action, affect only their intended pests, and are generally considered environmentally friendly with minimal non-target consequences. These substances include various products such as microbial pesticides, plant growth regulators, pheromones, and natural insecticides that work by exploiting naturally occurring compounds or organisms. Rising demand for residue-free organic crops and products across economies and increasing investments and expansion of the agriculture sector are fuelling demand in the market. Low shelf life, limited availability of biorational pesticides, limited consumer awareness, and higher product costs than conventional pesticides pose significant hurdles. Improvements in biorational pesticide formulations and the introduction of new products, along with government initiatives to promote biorational pesticides, are creating substantial growth prospects in the market. Market players are focusing on research and development to diversify their product portfolios and improve the efficacy and cost-effectiveness of biorational products.

Formulation: Significant adoption of dry biorational pesticides for longer shelf life

Dry formulations include wettable powders (WP), dusts (D), granules (GR), and water-dispersible granules (WDG). These are typically applied in solid form or require mixing with water before application. The advantages of dry formulations stem from their stability. They have a longer shelf life than liquid formulations and are less susceptible to temperature extremes. Moreover, they are less hazardous to transport and present reduced risks of spillage. Liquid formulations, such as emulsifiable concentrates (EC), solutions (S), and suspensions (SC), are either ready-to-use or require dilution with water. These formulations are characterized by ease of application and uniform distribution, which allows for more precise dosing and immediate biological impact. The choice between dry and liquid biorational pesticides largely depends on the pest control scenario and the end-user's preferences. Dry formulations may suit products requiring long-term storage or transport through varying climates. Conversely, liquid formulations are often preferred for immediate pest management needs and ease of application.

Type: Significant use of insecticides and nematicides, which targets specific pest insects and nematodes

Biorational fungicides are substances of natural origin or synthetic products similar to naturally occurring products used to control or suppress fungal pathogens in agriculture. These products have a specific mode of action and are often considered environmentally friendly due to their low toxicity to non-target organisms and rapid environmental decomposition. They include bacterial or fungal-derived products, botanical extracts, and minerals. Biorational insecticides are specialized products that target specific insect pests while posing minimal risks to non-target organisms, including humans and beneficial insects. They often have unique modes of action, such as insect growth regulators (IGRs), which disrupt the normal development of insects, or microbial products, such as Bacillus thuringiensis (Bt), which produces toxins lethal to certain insect larval stages. Addressing nematode pests in agriculture, biorational nematicides offer less harmful solutions to non-target organisms than conventional nematicides. They are often derived from natural sources such as plant extracts, microbial products, or other biological materials. For instance, various species of the fungus Paecilomyces lilacinus and the bacterium Pasteuria penetrans are used to attack and parasitize nematodes. Biorational nematicides tend to be more specific in action and degrade quickly in the environment, minimizing long-term detrimental effects. The primary similarities between biorational fungicides, insecticides, and nematicides are their environmentally friendly profiles, low non-target toxicity, and integration within Integrated pest management strategies. Each type offers a targeted approach to pest management with a reduced environmental footprint compared to conventional pesticides.

Source: Considerable use of non-organic biorational pesticides, as they are effective and more cost-efficient

Botanical pesticides are derived from plants known for their natural insecticidal properties. They manage to break down quickly in the environment, reducing the risk of long-term residue, and are generally safer for non-target organisms, including humans. Botanicals include Azadirachtin and neem oil, Pyrethrin, and Rotenone. Azadirachtin and neem oil are derived from the seeds of the neem tree, and they are prominent botanical pesticides known for their effectiveness in controlling various pests. They disrupt the life cycle of insects by inhibiting molting and deterring feeding, thus proving to be an eco-friendly option. Pyrethrin is extracted from chrysanthemum flowers and has a fast knockdown effect on many insects. It affects the nervous system of insects, leading to paralysis and death. Rotenone is a potent insecticide derived from the roots of certain tropical plants. It has been used to target a broad spectrum of pests but is known for its environmental persistence and toxicity to fish and other aquatic life. Microbial pesticides consist of microorganisms such as bacteria, fungi, viruses that target and control specific pests. Bacillus thuringiensis (Bt) is a soil-dwelling bacterium whose spores contain crystalline proteins with insecticidal properties. When ingested by susceptible insects, these proteins disrupt digestive processes, leading to the pest's death. Beauveria bassiana is a naturally emerging fungus that parasites on various insect species. Once the spores come into contact with the insect's cuticle, they germinate and penetrate, ultimately killing the host, which exhibits a broader host range than Bt and is environmentally friendly. Non-organic and synthetic pesticides are chemically engineered for efficient pest control and can respond rapidly to pest infestations. They tend to have a broader spectrum of activity and longer-lasting effects than their organic counterparts. Botanical and microbial pesticides are valued for their environmental safety and specificity but may require more frequent applications and entail higher costs. Conversely, non-organic pesticides are effective and cost-efficient but pose significant environmental and health risks, emphasizing the need for careful and responsible use.

Crop: Enhance the adoption rate of biorational pesticides in cereals & grains

Cereals and grains such as corn, rice, and wheat are staple food crops with substantial global importance. Biorational pesticides play a vital role in managing pests while minimizing environmental impact. A wide range of pests often targets corn, and applying biorational products helps preserve beneficial insects. Rice grown in flooded conditions is susceptible to unique pests such as rice borers, for which biorational solutions offer targeted control without harming aquatic ecosystems. Wheat, affected by pests such as aphids and rust, can benefit from biorational pesticides to reduce the resistance build-up often seen with traditional chemicals. High-value crops such as fruits and vegetables require stringent pest control measures to ensure quality and yield. Biorational pesticides are particularly important in these crops due to their lower residue levels, essential for meeting regulatory standards and consumer preferences for minimally processed foods. Oilseeds such as soybean, sunflower, and various pulses are susceptible to numerous pests that can significantly affect yield and oil quality. Biorational pesticides provide a sustainable pest management option, improving soil health and preserving beneficial insect populations in these crops. For soybeans, which face threats from pests such as soybean aphids and armyworms, biorational solutions ensure effective control aligned with integrated pest management practices. Sunflower crops can also benefit from these environmentally softer options, especially in managing specialist pests such as the sunflower moth. Cotton seed is a fundamental crop in the textile industry, and its seed is vulnerable to a host of pests, such as bollworms and thrips. Applying biorational pesticides in cotton has increased as resistance to traditional pesticides grows, and concerns about environmental health escalate. Biorational pesticides are a promising alternative to traditional pesticides, with diverse products tailored to pests and crops. However, their efficacy, cost, and best-use practices vary among cereals, fruits, vegetables, oilseeds, pulses, and cotton seeds. There is a common trend toward increased use of these products as part of integrated pest management strategies to reduce environmental impact, safeguard human health, and maintain crop productivity and quality.

Regional Insights:

In the Americas, the United States and Brazil are leading in adopting biorational pesticides, underpinned by stringent environmental regulations and a growing organic food industry. North America is witnessing a significant shift toward sustainable agriculture, enhancing the demand for biorational products. Latin America, conversely, is experiencing a gradual rise in the uptake of biorational pesticides, with an improved focus on integrated pest management (IPM) practices. Europe has established itself as a frontrunner in the biorational pesticides market, largely due to the stringent regulations about chemical pesticide usage and a robust organic farming sector. The European Union's Common Agricultural Policy (CAP) pushes for greener agricultural practices, thus propelling the market for biorational pesticides. Conversely, the Middle East and Africa are emerging markets with significant growth potential, particularly as these regions become more aware of the health and environmental benefits of biorational products. Adoption rates are expected to increase with improving education and regulation. The Asia-Pacific region presents a diverse and rapidly expanding market for biorational pesticides. Countries such as China, India, and Australia are increasingly adopting these products to cater to domestic demands for sustainable agriculture and to comply with export standards for agricultural produce. The region's large agrarian economies are trailblazers in the production and usage of biological and botanical pesticides, fueled by government initiatives and the necessity to improve crop yields while minimizing environmental impact.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Biorational Pesticides Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Biorational Pesticides Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Biorational Pesticides Market, highlighting leading vendors and their innovative profiles. These include AgriLife (India) Private Limited, Andermatt Group AG, BASF SE, Bayer AG, Biobest Group NV, Bionema Limited, BioSafe Systems, LLC, Certis Biologicals by Mitsui & Co., Ltd., Corteva, Inc., Emery Oleochemicals LLC, FMC Corporation, Gowan Company, LLC, Green Vision Life Sciences Pvt Ltd., Hexa Agro Industries, Innatrix Inc., Koppert B.V., Novozymes A/S, Nufarm Limited, Pro Farm Group Inc. by Bioceres Crop Solutions Corp., Russell IPM Ltd., SEIPASA, SA, Solvay SA, STK bio-ag technologies, Sumitomo Chemical Co., Ltd., Suterra by The Wonderful Company LLC, Syngenta AG, Vegalab SA, and Vestaron Corporation.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/biorational-pesticides?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Biorational Pesticides Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Biorational Fungicides, Biorational Insecticides, and Biorational Nematicides. The Biorational Insecticides commanded largest market share of 37.43% in 2022, followed by Biorational Fungicides.

Based on Formulation, market is studied across Dry and Liquid. The Liquid commanded largest market share of 53.20% in 2022, followed by Dry.

Based on Source, market is studied across Botanical, Microbial, and Non-Organic. The Botanical commanded largest market share of 56.27% in 2022, followed by Microbial.

Based on Mode of Application, market is studied across Foliar Spray, Seed Treatment, and Soil Treatment. The Foliar Spray commanded largest market share of 40.44% in 2022, followed by Soil Treatment.

Based on Crop, market is studied across Cereals & Grains, Fruits & Vegetables, and Oilseeds & Pulses. The Cereals & Grains commanded largest market share of 39.22% in 2022, followed by Oilseeds & Pulses.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 38.43% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Biorational Pesticides Market, by Type

7. Biorational Pesticides Market, by Formulation

8. Biorational Pesticides Market, by Source

9. Biorational Pesticides Market, by Mode of Application

10. Biorational Pesticides Market, by Crop

11. Americas Biorational Pesticides Market

12. Asia-Pacific Biorational Pesticides Market

13. Europe, Middle East & Africa Biorational Pesticides Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Biorational Pesticides Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Biorational Pesticides Market?

3. What is the competitive strategic window for opportunities in the Biorational Pesticides Market?

4. What are the technology trends and regulatory frameworks in the Biorational Pesticides Market?

5. What is the market share of the leading vendors in the Biorational Pesticides Market?

6. What modes and strategic moves are considered suitable for entering the Biorational Pesticides Market?

Read More @ https://www.360iresearch.com/library/intelligence/biorational-pesticides?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.