Understanding IRS Form 8812 for Child Tax Credit in 2023 and 2024

The Internal Revenue Service (IRS) introduces Form 8812, a valuable tool designed to help families maximize their benefits through the Child Tax Credit.

TRAVERSE CITY, MI, US, November 27, 2023 /EINPresswire.com/ -- As taxpayers prepare for the upcoming tax seasons, the Internal Revenue Service (IRS) introduces Form 8812, a valuable tool designed to help families maximize their benefits through the Child Tax Credit.

Understanding the intricacies of this form is key for eligible individuals seeking to optimize their tax returns in 2023 and 2024.

Key Highlights for Understanding IRS Form 8812 for Child Tax Credit in 2023 and 2024

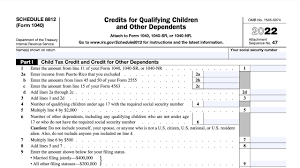

Purpose of Form 8812: Form 8812, officially titled "Additional Child Tax Credit," serves the purpose of determining the additional amount of Child Tax Credit that eligible taxpayers can claim beyond the regular Child Tax Credit amount. This form is particularly relevant for families with three or more qualifying children.

Eligibility Criteria: Taxpayers must meet specific eligibility criteria outlined by the IRS to claim the Additional Child Tax Credit. This includes having three or more qualifying children and having earned income greater than a certain threshold. Form 8812 assists in calculating the additional credit based on these criteria.

Enhanced Child Tax Credit in 2023 and 2024: The tax year 2023 and 2024 sees an enhanced Child Tax Credit, providing eligible families with increased financial support. Form 8812 helps eligible taxpayers navigate these changes and determine the additional credit they may be entitled to claim.

Completing Form 8812: Taxpayers using Form 8812 will find it essential to carefully follow the instructions provided by the IRS. The form guides taxpayers through the process of calculating the additional credit, ensuring accuracy and compliance with IRS guidelines.

Electronic Filing Options: Form 8812 is compatible with electronic filing, offering taxpayers the convenience of submitting their tax returns electronically. This option expedites the processing of returns and ensures a faster turnaround for potential refunds.

The IRS emphasized the importance of understanding Form 8812, stating, "Form 8812 is a valuable resource for families with three or more qualifying children, allowing them to maximize their benefits through the Child Tax Credit. We encourage eligible taxpayers to explore this option as they prepare their tax returns for 2023 and 2024."

As taxpayers delve into the tax preparation process, the IRS encourages them to familiarize themselves with Form 8812 and leverage its benefits to optimize their Child Tax Credit. Early awareness of these opportunities ensures that eligible families can make informed decisions to enhance their financial well-being.

For more information about Form 8812 and the Child Tax Credit in 2023 and 2024, please visit https://americantaxservice.org/child-tax-credit-additional/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.