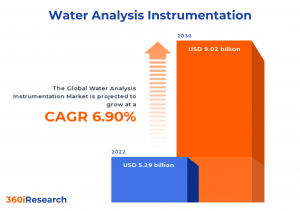

Water Analysis Instrumentation Market worth $9.02 billion by 2030 - Exclusive Report by 360iResearch

The Global Water Analysis Instrumentation Market to grow from USD 5.29 billion in 2022 to USD 9.02 billion by 2030, at a CAGR of 6.90%.

PUNE, MAHARASHTRA, INDIA , November 20, 2023 /EINPresswire.com/ -- The "Water Analysis Instrumentation Market by Product (Instrument, Software), Category (Benchtop, Handheld, Portable), Application, End-use - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Water Analysis Instrumentation Market to grow from USD 5.29 billion in 2022 to USD 9.02 billion by 2030, at a CAGR of 6.90%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/water-analysis-instrumentation?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Water analysis instrumentation measures physical, chemical, and biological components in various water resources such as groundwater, surface water, wastewater, and municipal water to ensure safety, regulatory compliance, and optimization of industrial processes involving water usage. Water analysis instrumentation is essential for environmental monitoring agencies, municipalities, wastewater treatment facilities, utility companies, food and beverage processors, pharmaceutical manufacturers, power generation firms, and more. Water analysis instruments include a comprehensive array of equipment and tools such as photometers, digital thermostats, turbidimeters, and electrochemical analysis (pH meters, conductometers, multimeters, and electrodes). Water quality parameters often monitored include pH, conductivity, dissolved oxygen, chlorine, salinity, and corrosion rate. Increased population and urbanization leading to higher demand for clean drinking water, rising environmental conservation awareness promoting stricter wastewater discharge regulations, and emerging IoT-based smart sensor technologies for efficient management systems within various industries are generating a need for water analyzing instrumentation. Additionally, growing emphasis on recycling and reuse practices due to diminishing freshwater sources further increases reliance on treated wastewater as an alternative source in agricultural irrigation or industrial processes. Furthermore, complex regulatory frameworks across different regions create uncertainties for international players seeking market entry or expansion strategies. Businesses need to invest in R&D initiatives aimed at introducing innovative products catering to specific customer needs, and customization services tailored to unique end-user demands can make businesses more agile and adaptable to changing end-user dynamics.

Category: Preference for benchtop instruments owing to their high-precision measurements

Benchtop water analysis instruments, including spectrophotometers, turbidimeters, and total organic carbon (TOC) analyzers, are used in laboratory settings requiring precision measurements. These devices offer higher accuracy, sensitivity, and advanced data management features compared to portable or handheld options. Handheld water analysis instruments provide rapid on-site testing capabilities suitable for field technicians who need quick results while working in remote locations or conducting routine site inspections. These pocket-sized devices offer portability without compromising accuracy and are preferred for applications requiring minimal sample preparation and immediate results. Portable water analysis instruments strike a balance between benchtop and handheld devices in terms of accuracy, user-friendliness, and portability. They are suitable for on-site testing in various industries, such as wastewater treatment plants, environmental monitoring agencies, and food processing facilities.

Product: Use of different water analysis instruments depending on the application's requirements and sensitivity levels

Instrumentation in water analysis involves various analytical devices that measure parameters such as pH, conductivity, dissolved oxygen (DO), turbidity, total organic carbon (TOC), and trace elements. These measurements are crucial in determining the quality of water samples and detecting potential contamination. The preference for specific instruments depends on the application's requirements and sensitivity levels. Software in water analysis instrumentation consists of applications designed for data management, analysis, and reporting purposes. As modern instruments generate large volumes of data, software solutions are necessary for streamlined processing and interpretation to support informed decision-making.

End-use: Introduction of an advanced range of water analysis instrumentation for diverse industrial settings, particularly chemical and beverage manufacturing facilities

Water analysis instruments are employed to monitor water quality at different production levels to ensure that manufacturing processes comply with industry environmental regulations and standards. Water analysis instruments play a crucial role in maintaining the quality and taste of beverages. Water quality in breweries, wine, and spirit manufacturing companies heavily influences the flavor, consistency, and overall quality of the alcoholic beverage. Soft drink manufacturers utilize instruments such as TOC analyzers and conductivity meters to examine water quality. The chemical and biological standards of water used in soft drinks must be maintained thoroughly to ensure the final product's flavor, color, and texture. The mineral water industry heavily relies on water testing instrumentation due to the direct consumption of its product, mandating the need to meet the highest standards of safety and quality. Industries such as bottling plants and mineral water production exhibit high utilization, while wine and spirits manufacturing reveal comparatively lower usage. Ensuring microbiological safety and chemical balance of the water is crucial in food products. In the dairy industry, water is used extensively for cleaning and pasteurization processes, as well as a component in a plethora of products, including milk, cheese, and yogurts. Water is integral to the cultivation, cleaning, and processing stages for fruits, vegetables, grain and oilseed, and bakery products. Water analysis instruments help determine the presence of pesticides, heavy metals, or other hazardous substances that might affect the crop or fruit's growth and safety. In bakery products, the hardness of the water can change the properties of the dough; hence, measuring this parameter is key to ensuring product consistency. Grain and oilseed mills use water in the cleaning and processing stages to remove dirt, bacteria, and pesticides. Water analysis instruments in the metals industry serve as an environmental safeguard. They measure heavy metals and potentially toxic substances, unlike most other industries. In pharmaceuticals, water analysis instruments offer critical regulations compliance. Water purity is paramount to drug safety and efficacy and is thus monitored with stringent parameters. In many ways, the pharmaceuticals sector can be compared to the electronics and semiconductors sector in terms of the necessity for purity and quality of the product. The chemical and refined petroleum industry utilizes water analysis instrumentation predominantly for process control, wastewater treatment, and environmental compliance. Consistent with the diverse chemical and biochemical reactions occurring in the industry, the accuracy and precision of these analysis devices are crucial. Water analysis instruments are used to measure the water content in petroleum and test the effluent water for hydrocarbons and other potentially harmful chemicals. Within coal power plants, water analysis instrumentation is primarily used to monitor the quality of water in boilers and cooling systems. Gas power plants utilize these instruments to closely monitor the water used in cooling systems and certain natural gas processes. In nuclear power plants, meticulous water analysis is of paramount importance due to the potential magnified impacts of corrosion, contamination, and other radioactive component issues. Waste incineration plants leverage these instruments to monitor water quality in flue gas cleaning systems. Water analysis instrumentation plays a pivotal role in maintaining optimum product standards in the graphic paper and paper packaging industry. To yield high-grade pulp for paper production, consistent water quality monitoring spanning several stages, such as pulp washing, black liquor recovery, and bleaching, is crucial. High-tech water analysis instruments such as turbidity meters and spectrometers are largely deployed in the water filtration processes to ensure the efficacy of de-inking and bleaching stages for producing recycled papers. The sanitary paper and tissue paper industry gives utmost importance to water quality, given the final products' utilization in hygiene-focused applications. Water analysis instrumentation plays a critical role in enabling municipalities to maintain optimal water quality. These local government bodies use various analytic devices to monitor and control contaminant levels, water temperature, turbidity, and other essential parameters in the water supply, particularly municipal drinking water. Regular use of analysis tools helps avoid groundwater contamination and allows municipalities to reuse or dispose of treated wastewater safely. Third-party laboratories often support municipalities and industries with independent water quality testing. These entities employ water analysis instrumentation to conduct advanced and specialized analyses, such as trace metal determination, organic compound detection, and microbiological assessments. Third-party laboratories, therefore, offer a higher level of scrutiny on water quality and complement the water analysis initiatives of municipalities.

Regional Insights:

In the Americas, strict regulatory standards for water quality monitoring in the United States and Canada fuel the demand for advanced water analysis instruments. The vendors in this region invest heavily in R&D activities to develop innovative solutions across the region. The EMEA region experiences increased adoption of water analysis instrumentation due to stringent EU regulations on water quality under the Water Framework Directive (WFD). However, the Middle East and Africa face challenges with limited freshwater resources and inadequate infrastructure for effective water management, leading to an increased demand for reliable testing equipment. Rapid urbanization and industrialization have made the Asia-Pacific a significant consumer of water analysis instrumentation. Countries such as China, Japan, and India confront increasing levels of water pollution, necessitating enhanced monitoring and treatment efforts. Global initiatives such as the World Bank's Water Global Practice aim to provide financial and technical support for improving access to clean water. Therefore, innovations in this sector are evident through several patents filed worldwide. Significant investments from the public and private sectors have also strengthened the global water analysis instrumentation landscape.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Water Analysis Instrumentation Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Water Analysis Instrumentation Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Water Analysis Instrumentation Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Acustrip Company, Inc., Agilent Technologies, Inc., Alpha MOS, AMETEK, Inc., Apera Instruments, LLC, Apure by Shanghai GL Environmental Technology Co., Ltd., Emerson Electric Co., Endress+Hauser Group Services AG, General Electric Company, Hach Company by Danaher Corporation, Hanna Instruments Inc., Honeywell International Inc., HORIBA Ltd., In-Situ Inc., Istek, Inc., Jenco Instruments, Johnson Controls International PLC, Mettler-Toledo International Inc., Myron L Company, OMEGA Engineering inc., Owlstone Inc., Panomex Inc., PCE Holding GmbH, PerkinElmer Inc., Sato Keiryoki Mfg. Co., Ltd, Shimadzu Corporation, Sper Scientific Direct, Taylor Water Technologies LLC by Fluidra S.A., Teledyne Monitor Labs by Teledyne Technologies Incorporated, Texas Instruments Incorporated, Thermo Fisher Scientific Inc., and Xylem Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/water-analysis-instrumentation?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Water Analysis Instrumentation Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Instrument and Software. The Instrument is further studied across Conductivity Meter, Dissolved Oxygen Meter, Multipara Meter, PH Meter, Spectrophotometer, Total Organic Carbon (TOC) Analyzer, and Turbidity Meter. The Instrument commanded largest market share of 91.79% in 2022, followed by Software.

Based on Category, market is studied across Benchtop, Handheld, and Portable. The Benchtop commanded largest market share of 53.65% in 2022, followed by Handheld.

Based on Application, market is studied across Biological Analysis, Chemical Analysis, and Physical Analysis. The Chemical Analysis commanded largest market share of 56.21% in 2022, followed by Biological Analysis.

Based on End-use, market is studied across Industrial End-users, Maritime, Municipal End-users, and Third-party Laboratories. The Industrial End-users is further studied across Automobile, Beverage, Chemical & Refining, Electronics & Semiconductors, Food, Metals, Oil & Gas, Pharmaceuticals, Power Plants, and Pulp & Paper. The Beverage is further studied across Bottling Plants, Manufacture of Beer, Manufacture of Soft Drinks, Manufacture of Spirits, Manufacture of Wine, and Production of Mineral Water. The Chemical & Refining is further studied across Chemicals & Chemical Products and Refined Petroleum Products. The Food is further studied across Aquaculture, Dairy, Fruits, Vegetables, Grain & oilseed & Bakery Products, Meat & Poultry, and Sugar. The Fruits, Vegetables, Grain & oilseed & Bakery Products is further studied across Bakeries Manufacturing, Grain & Oilseed Mills, and Processing of Fruits & Vegetables. The Metals is further studied across Mining and Treatment & Coating of Metals. The Power Plants is further studied across Coal Power Plants, Gas Power Plants, Nuclear Power Plants, and Waste Incineration Plants. The Pulp & Paper is further studied across Graphic Paper, Manufacture of Pulp, Paper for Packaging, Recycled Paper, and Sanitary Paper/tissue Paper. The Municipal End-users is further studied across Municipal Drinking Water and Municipal Wastewater. The Third-party Laboratories is further studied across Government Laboratories and Private Laboratories. The Industrial End-users commanded largest market share of 54.22% in 2022, followed by Third-party Laboratories.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 45.09% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Water Analysis Instrumentation Market, by Product

7. Water Analysis Instrumentation Market, by Category

8. Water Analysis Instrumentation Market, by Application

9. Water Analysis Instrumentation Market, by End-use

10. Americas Water Analysis Instrumentation Market

11. Asia-Pacific Water Analysis Instrumentation Market

12. Europe, Middle East & Africa Water Analysis Instrumentation Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Water Analysis Instrumentation Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Water Analysis Instrumentation Market?

3. What is the competitive strategic window for opportunities in the Water Analysis Instrumentation Market?

4. What are the technology trends and regulatory frameworks in the Water Analysis Instrumentation Market?

5. What is the market share of the leading vendors in the Water Analysis Instrumentation Market?

6. What modes and strategic moves are considered suitable for entering the Water Analysis Instrumentation Market?

Read More @ https://www.360iresearch.com/library/intelligence/water-analysis-instrumentation?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.