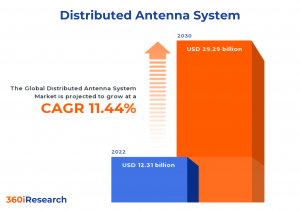

Distributed Antenna System Market worth $29.29 billion by 2030 - Exclusive Report by 360iResearch

The Global Distributed Antenna System Market to grow from USD 12.31 billion in 2022 to USD 29.29 billion by 2030, at a CAGR of 11.44%.

PUNE, MAHARASHTRA, INDIA , November 20, 2023 /EINPresswire.com/ -- The "Distributed Antenna System Market by Offering (Components, Services), Coverage (Indoor, Outdoor), Ownership, User Facility, Frequency Protocol, Signal Source, Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Distributed Antenna System Market to grow from USD 12.31 billion in 2022 to USD 29.29 billion by 2030, at a CAGR of 11.44%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/distributed-antenna-system?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

A distributed antenna system (DAS) is a grid of spatially isolated antenna nodes linked to a common source that provides wireless or radio coverage to a specific area. A DAS aims to enhance and extend the wireless communication infrastructure, especially in areas with high user density or challenging radio frequency (RF) environments. The distributed antenna system (DAS) comprises various hardware components such as antenna, head-end units, radio units, and others that offer great efficiency and improved network coverage and connectivity performance. The rise in smartphone users and mobile internet penetration drives the adoption of distributed antenna systems across end-use sectors. Growing utilization of the Bring Your Own Device (BYOD) trend, edge computing, and the Internet of Things (IoT) ecosystem is boosting the market's growth. The high cost of installation associated with distributed antenna systems hampers the market growth. Integration of advanced technologies in a distributed antenna system is expected to provide opportunities for market growth.

Ownership: Carrier-based DAS improve customer coverage and capacity

Carrier-based DAS is owned and operated by a specific wireless carrier that helps improve customer coverage and capacity within a specific location, such as a sports stadium or airport. Enterprise-owned DAS are owned and operated by a particular enterprise, such as a university, hospital, or corporate campus. Enterprise-owned DAS is to provide better in-building wireless coverage and capacity for their employees, customers, and guests. Neutral-Host DAS is owned and operated by a neutral third-party company and provides wireless coverage and capacity to multiple carriers and enterprises within a specific location. This type of DAS is often used in public venues, such as hotels, shopping malls, and convention centers, where multiple carriers and enterprises need to provide wireless service to their customers.

Vertical: Potential use of DAS system in commercial sector for smooth operations

Distributed antenna systems (DAS) in the commercial segment encompass various industries, from large-scale corporations to up-and-coming startups. The key driving need here is providing reliable and efficient indoor and outdoor wireless coverage, acting as the backbone of the business's communication network. In hospitals and healthcare facilities, reliable wireless connectivity is essential for critical communication, patient monitoring, and medical devices. DAS ensures seamless connectivity for healthcare professionals, facilitating efficient care delivery and improved patient outcomes. Airports, train stations, and other transportation hubs rely on DAS to provide reliable wireless connectivity for travelers. It enables efficient communication, real-time updates, and passenger convenience. DAS is used in schools, colleges, and universities to provide seamless wireless connectivity to students, faculties, and staff. DAS provides a way to efficiently distribute wireless connections inside buildings or other structures where steel columns and coatings of concrete can interfere with wireless signals. The usage of DAS in industrial settings, such as manufacturing plants and warehouses, is driven by the need for dedicated and efficient wireless communication. DAS) plays a crucial role in providing reliable and efficient wireless communication in the government sector. DAS is crucial in stadiums, arenas, convention centers, and other public venues and provides reliable coverage for large crowds, enabling uninterrupted communication and enhancing the overall fan and attendee experience. DAS enhances wireless coverage in concert halls and theaters, allowing performers, production staff, and audience members to have reliable connectivity for communication and mobile applications. DAS provides priority access to public safety personnel during emergencies, ensuring that they have access to the network. The installation of DAS systems in public safety environments, such as fire departments, police stations, and rescue centers, promotes excellent coverage, thereby enhancing the overall effectiveness of the services offered.

Offering: High adoption of antenna nodes or radio nodes for maxim performence

The distributed antenna system (DAS) 's antenna nodes or radio nodes are the devices that transmit and receive wireless signals. They are placed in strategic locations to ensure maximum coverage and performance. Bidirectional amplifiers amplify the wireless signal to ensure it can reach all parts of the structure or area. The donor antenna receives the wireless signal from the carrier's network and distributes it to the DAS network. Head-end units control the entire DAS network as they receive and distribute the wireless signals to the appropriate antenna nodes. In a distributed antenna system (DAS), a radio unit (RU) is the component that transmits and accepts radio signals to and from mobile devices within the coverage area. The DAS system's installation services include antennas, cables, amplifiers, and other equipment. Post-installation services include maintenance and support services to ensure that DAS continues to function properly. Pre-sales services in DAS refer to the activities and support provided by a vendor or service provider before the actual sale of the DAS solution.

Coverage: Significant utilization of DAS system for outdoor coverage

An indoor DAS system is designed to improve wireless coverage in large indoor spaces, such as office buildings, hospitals, and stadiums. This type of DAS system uses a network of antennas installed throughout the building to distribute wireless signals evenly. An active DAS system uses a network of small cells or remote radio units (RRUs) connected to a central hub. A passive DAS system uses a network of antennas connected to a central hub via cables and amplifiers. Passive DAS systems are normally used in smaller indoor spaces, such as offices and hotels, where the coverage area is relatively small. An outdoor DAS system is designed to improve wireless coverage in outdoor areas, such as campuses, parking lots, and stadiums. This type of DAS system uses a network of antennas that are installed on light poles, building roofs, and other structures.

Regional Insights:

The Americas account for a substantial market landscape in the distributed antenna systems (DAS) industry attributed to the extensive deployment of DAS by telecommunication giants in response to the growing mobile data traffic and demand for seamless connectivity. The countries with an ambitious mobile network infrastructure enhancement strategy to improve signal strength predominantly in urban areas and large public venues further fueled the market growth in the region. Europe is at the forefront with an escalating demand due to rapid urbanization, increasing data-centric applications, and modernization of communication infrastructure. Countries in the region are showing increased investment in DAS technology. The Middle East leads with advanced network infrastructure, while in Africa, South Africa has been spearheading the adoption of DAS due to its fast-emerging telecom industry. The increasing construction of high-rise residential buildings and commercial spaces is driving the usage of the distributed antenna system in Asia-Pacific. The increasing multiple government initiatives, such as Smart Nation Singapore and Smart Cities Mission India, with a growing volume of 4G & 5G smartphones, are expected to create a platform for the growth of the distributed antenna system in Asia-Pacific.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Distributed Antenna System Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Distributed Antenna System Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Distributed Antenna System Market, highlighting leading vendors and their innovative profiles. These include Activo Inc., Advanced RF Technologies, Inc., Alliance Corporation, American Tower Corporation, Amphenol Procom, Anixter, Inc. by Wesco Distribution, Inc., AT&T Inc., Audiolink Limited, Betacom, Inc., Bird Technologies Group, Inc., Boingo Wireless, Inc., Boost Pro Systems Ltd., BTI Wireless by Star Solutions Inc., Cartel Communications, CenRF Communications Limited, Cobham Limited by Advent International, Comba Telecom Systems Holdings Limited, CommScope, Inc., Comtex Group Pty. Ltd., Connect 8, Connectivity Wireless, Corning Incorporated, Dali Wireless, Decypher Technologies, LLC, EMTS Telecom Services Ltd., Exchange Communications Group Ltd., Fixtel Pty Ltd., Galtronics by Baylin Technologies Inc., Grimard, HALO Networks, HUBER+SUHNER AG, John Mezzalingua Associates, LLC, Mantis Systems Limited, McGill Microwave Systems Limited, Newbridge Wireless, Powertec Telecommunications, PPM Systems, Pyott-Boone Electronics, Inc., Qypsys, LLC, RF Industries, Inc., Rigstar Industrial Telecom, SOLiD Gear, Inc., Symphony Technology Solutions, Inc., Teleco Inc., The Siemon Company, Total Communications by Paragon Care Limited, Waveform/RSRF, Westcan ACS, Whoop Wireless, and Zinwave Limited by Wilson Electronics, LLC.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/distributed-antenna-system?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Distributed Antenna System Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Components and Services. The Components is further studied across Antenna Nodes or Radio Nodes, Bidirectional Amplifiers, Donor Antenna, Head-End Units, and Radio Units. The Services is further studied across Installation Services, Post-Installation Services, and Pre-Sales Services. The Services is projected to witness significant market share during forecast period.

Based on Coverage, market is studied across Indoor and Outdoor. The Indoor is further studied across Active and Passive. The Outdoor is projected to witness significant market share during forecast period.

Based on Ownership, market is studied across Carrier, Enterprise, and Neutral-Host. The Enterprise is projected to witness significant market share during forecast period.

Based on User Facility, market is studied across 200k–500k Ft2, <200k Ft2, and >500k Ft2. The >500k Ft2 is projected to witness significant market share during forecast period.

Based on Frequency Protocol, market is studied across Cellular and VHF/UHF. The Cellular is projected to witness significant market share during forecast period.

Based on Signal Source, market is studied across Off-Air Antennas and On-Site Base Transceiver Station. The Off-Air Antennas is projected to witness significant market share during forecast period.

Based on Vertical, market is studied across Commercial and Public Safety. The Commercial is further studied across Airports & Transportation, Education, Enterprises, Government, Healthcare, Hospitality, Industrial, Public Venues, and Retail. The Public Safety is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 37.82% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Distributed Antenna System Market, by Offering

7. Distributed Antenna System Market, by Coverage

8. Distributed Antenna System Market, by Ownership

9. Distributed Antenna System Market, by User Facility

10. Distributed Antenna System Market, by Frequency Protocol

11. Distributed Antenna System Market, by Signal Source

12. Distributed Antenna System Market, by Vertical

13. Americas Distributed Antenna System Market

14. Asia-Pacific Distributed Antenna System Market

15. Europe, Middle East & Africa Distributed Antenna System Market

16. Competitive Landscape

17. Competitive Portfolio

18. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Distributed Antenna System Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Distributed Antenna System Market?

3. What is the competitive strategic window for opportunities in the Distributed Antenna System Market?

4. What are the technology trends and regulatory frameworks in the Distributed Antenna System Market?

5. What is the market share of the leading vendors in the Distributed Antenna System Market?

6. What modes and strategic moves are considered suitable for entering the Distributed Antenna System Market?

Read More @ https://www.360iresearch.com/library/intelligence/distributed-antenna-system?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.